A New Tariffs Deadline and Risks of Rising Inflation Fuel the US Dollar Growth

The US President decided to postpone import tariffs, with the new deadline set to August 1. However, along with this statement, Donald Trump threatened many countries with 25% tariffs if they were unable to conclude a deal with the United States.

The recent US labor market data supported the US dollar and brought positive market sentiment back as the Fed may still stick to its wait-and-see approach and not make any aggressive steps in cutting rates. Moreover, rising inflation risks support the US currency as well.

However, the US dollar’s growth is limited due to several factors. First, Donald Trump threatened countries to raise tariffs further if they decide to introduce retaliatory measures. We have seen the same with China when Trump imposed 145% tariffs and lifted them after successful negotiations.

Second, while the Fed is not in a rush to cut rates, it will have to ease its monetary policy this year, which puts pressure on the US currency. Previously, the Fed was expected to cut rates in September and during one of the concluding meetings in 2025. Currently, market participants still expect the central bank to engage in September. However, market participants doubt the second rate cut this year.

Contents

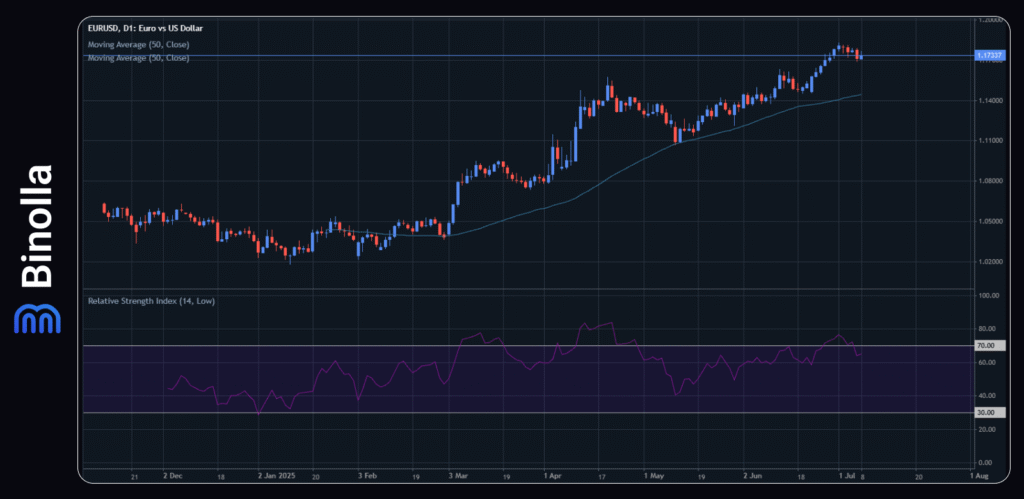

EUR/USD: Hopes on US-EU Deal Provide Support to the Currency Pair

Negotiations between the US and EU continue, and the deal might be announced on Wednesday. This supports the positive mood and helps the euro outperform the dollar in the short term. However, fears of no deal are looming over the financial markets, putting pressure on the currency pair.

The main event for the dollar will be the FOMC meeting this week. If Fed officials continue their cautious rhetoric, the US currency may regain support and move higher.

On the technical analysis front, the currency pair remains above the SMA50, which is a good sign for buyers. Long positions will be preferable above 1.1850. On the downside, sellers can engage if EUR/USD breaks below the SMA50. Sell stop orders can be placed below 1.1400.

GBP/USD: Pound Is Under Pressure Amid Tariffs and Fiscal Risks

The Trump administration announced renewed 25% tariffs on many countries. When it comes to the UK, there is still no deal between the two countries, which puts pressure on the pound. While there is still time before the new deadline (tariffs will take place after August 1), market participants have doubts that the negotiations will succeed.

An additional factor of pressure is the rising fears about fiscal risks in the United Kingdom. The likelihood of the autumn tax increase pushed the UK currency down. Therefore, the Bank of England may cut rates again this year.

From the technical analysis perspective, the currency pair is trading below the SMA50, outlining the sellers’ pressure. With the recent news from the US and the UK, the pound may continue its decline, and short positions will be preferable at 1.3560 in this case. When it comes to long positions, traders can consider them above 1.3650.

WTI: Oil is Under Pressure

While oil prices still attempt to rise, the global sentiment is shifting towards the downside, which will put pressure on WTI in the near future. The main reasons for this probable downtrend lie in the Middle East de-escalation, risks of a global economic slowdown, as well as the recent OPEC+ decision to review output for August.

The situation in the Middle East is becoming quieter, while some conflicts are still taking place. However, global risks of supply chain disruptions are at their lowest levels since the beginning of the Iran-Israel conflict.

New Trump tariffs may hit the global economy even harder, which, in turn, will lead to a slowdown and cut the demand even more severely. Last but not least, the OPEC+ cartel has decided to increase the output for August by 548,000 barrels per day from 411,000 barrels per day as expected previously. All these factors together will exert pressure on WTI in the near future.

On the technical analysis side, WTI remains above the SMA50, with attempts to break above 67.50. If oil manages to pass this level, buy orders will be preferable. On the downside, the SMA50 acts as a dynamic support, and traders can place sell stop orders below 66.00.

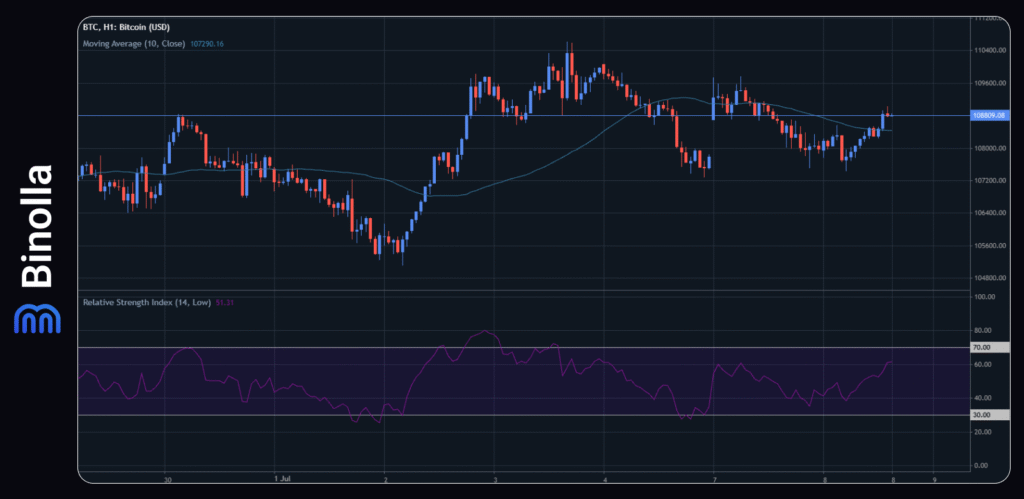

BTC/USD: Uncertainty Prevailing

Bitcoin is trading sideways amid the global uncertainty. The upcoming tariffs from the US administration put pressure on cryptocurrency as a global slowdown may wipe funds from this industry. As for supportive factors, they are not effective enough currently to push Bitcoin higher.

From a technical analysis perspective, Bitcoin is trading slightly above the SMA50, which means that buyers are trying to regain control. Long positions will be preferable above 110,000. As for the downside, traders can place sell stop orders below 107,000.