US GDP Data and US Core PCE Price Index are in Focus

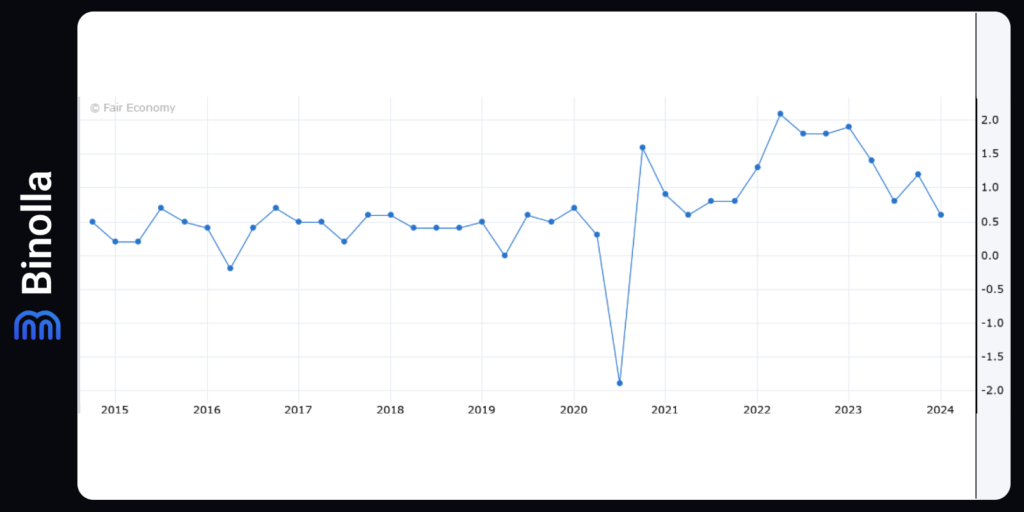

This week, market attention is expected to focus on the initial GDP estimate for Q1, set for Thursday, and the core PCE index for March, which will be released on Friday. The U.S. economy, the world’s largest, expanded by 3.4% quarter-on-quarter at a seasonally adjusted annual rate (SAAR) in the final quarter of 2023. According to the Atlanta Fed GDPNow model, growth remained robust in Q1, reaching 2.9%. Regarding the core PCE index, the Federal Reserve’s preferred inflation measure, the resilience in consumer prices suggests a potential upward risk. On Tuesday, preliminary S&P Global PMIs for April will provide insight into the U.S. economy’s performance as it enters Q2.

A week filled with strong U.S. data may diminish expectations for Fed rate cuts, potentially shifting focus from the magnitude of cuts to the possibility of no cuts at all this year. Such a scenario is likely to support further appreciation of the U.S. dollar.

Comerica Bank economists Bill Adams and Waran Bhahirethan suggested on Monday that the advance estimate for Q1 likely indicates a slowdown in real GDP growth following a 3.4% annualized increase in Q4 2023. They anticipate a decline in residential investment, particularly in multifamily homebuilding, while consumer spending and government expenditures are expected to contribute positively to growth. Additionally, businesses’ investments in nonresidential fixed assets and inventories are likely to bolster real GDP for the quarter.

On Friday, the release of the personal consumption expenditures index for March is anticipated to show a 0.3% monthly inflation increase. The core index, excluding food and energy costs, favored by the Fed, is expected to reflect a 2.7% annual rate of increase, surpassing the central bank’s 2% target.

Sam Bullard, managing director and senior economist at Wells Fargo’s corporate and investment banking unit, noted that firmer inflation at the beginning of the year has prolonged the journey toward the Fed’s 2% target. He anticipates inflation to gradually decrease, though challenges such as rising prices of food and energy-related commodities could impede progress.

Market expectations align with the forecast that the Fed will likely abstain from interest rate cuts at the end-of-month meeting and might even consider raising rates later in the year.

The impact of the highest interest rates in two decades is evident in reduced demand for new mortgages, influencing March’s new home sales data. Tuesday’s data is expected to show a slight increase due to favorable weather conditions. Pending home sales, indicating homebuyer demand, are projected to decline on Thursday.

On Friday, the University of Michigan’s final April consumer sentiment reading is expected to remain relatively unchanged, reflecting a generally stable but positive trend over recent months.

Contents

EUR/USD Past-PMI Situation

In the early European session, EUR/USD showed signs of strength, edging above 1.0650 and turning positive for the day. The pair’s short-term technical analysis indicates a growing momentum towards recovery.

Data released from Germany on Tuesday revealed that business activity in the private sector experienced a modest expansion in early April. The HCOB Composite PMI climbed to 50.5 from 47.7 in March. Additionally, the Eurozone’s HCOB Composite PMI increased to 51.4 from 50.3 during the same period.

Dr. Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, commented on the survey results, stating that “the Eurozone has made a promising start to the second quarter. The Composite HCOB Flash PMI has notably entered expansionary territory.” He added, “This growth was primarily driven by the services sector, which has seen further acceleration. Taking into account various factors, including the HCOB PMIs, our GDP forecast suggests a 0.3% expansion.”

Australian Inflation Expectations

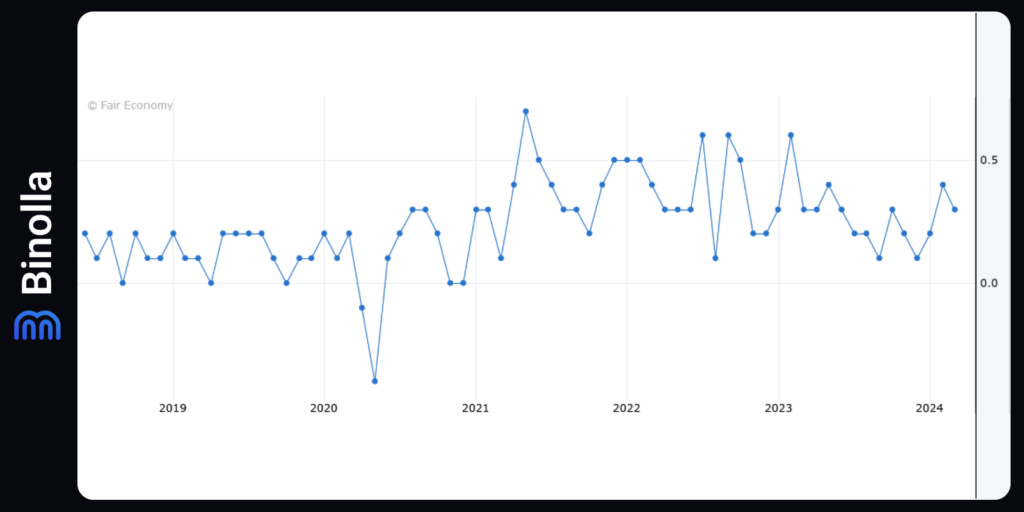

In the December 2023 quarter (Q4), inflation saw a modest increase of 0.6%, resulting in an annual rate of 4.1% year-on-year (YoY). This figure fell below the expected 4.3% and was notably lower than the 5.4% recorded in the September quarter. The Reserve Bank of Australia (RBA)’s preferred gauge of inflation, the trimmed mean inflation, experienced a quarterly rise of 0.8%, leading to a YoY measure of 4.2%, marking a significant decrease from the 5.2% recorded in the September quarter.

According to Michelle Marquardt, ABS head of prices statistics, “The CPI rose by 0.6 per cent in the December quarter, representing a decrease from the 1.2 per cent rise in the September 2023 quarter. This marks the smallest quarterly increase since the March 2021 quarter.” Projections for the March 2024 quarter (Q1) anticipate headline inflation to increase by 0.8% quarter-on-quarter (QoQ), yielding an annual rate of 3.5%. The trimmed mean is forecasted to also rise by 0.8% QoQ, leading to an annual trimmed mean of 3.8% YoY.

If realized, this would represent the slowest rate of trimmed mean inflation since March 2022, aligning closely with the RBA’s implied forecast. However, the rate remains elevated, indicating that the RBA is unlikely to consider rate cuts before August at the earliest.

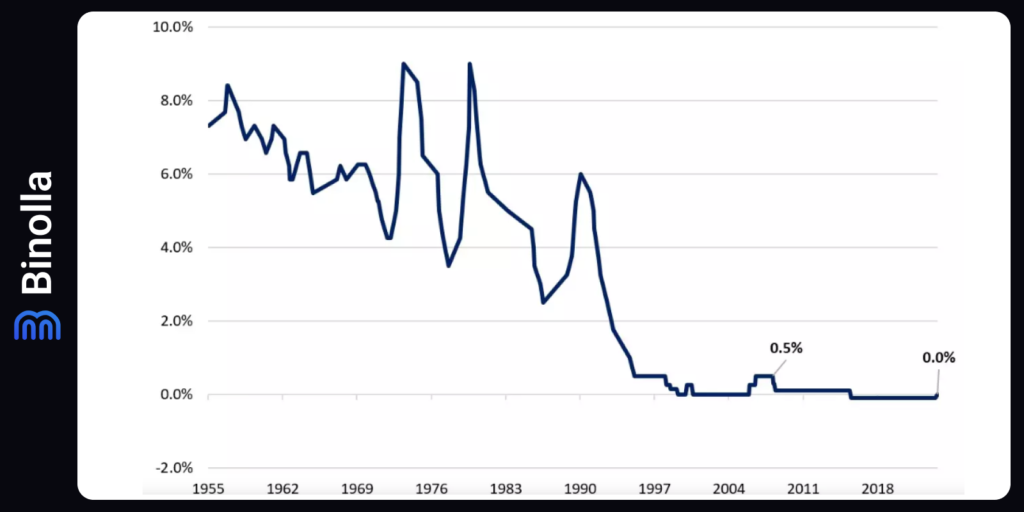

The BoJ Meeting: What to Expect from This Event

The Bank of Japan (BoJ) is scheduled to convene for its monetary meeting on April 25-26, 2024. In the preceding meeting, the BoJ implemented its first key short-term interest rate hike in 17 years, adjusting it from -0.1% to a range of 0% to 0.1%. Additionally, the central bank ceased its yield curve control (YCC) policy and scaled back its asset purchases, discontinuing acquisitions of equity exchange-traded funds (ETFs) and J-REITs while maintaining the purchase of Japanese Government Bonds (JGBs) at a similar scale as before.

This policy transition was prompted by a robust outcome in this year’s annual wage negotiations (shunto), which suggested the potential for a sustainable wage-price spiral, aligning with the BoJ’s target of achieving “sustainable and stable 2% inflation.” Japan’s major corporations agreed to increase wages by 5.28% for 2024, marking the highest raise in 33 years.

However, markets reacted to the BoJ’s dovish language regarding further tightening, signaling an expectation for a more gradual pace of policy normalization. Despite acknowledging economic risks, the central bank indicated its intention to maintain accommodative financial conditions for the foreseeable future.

What to Anticipate at the Upcoming BoJ Meeting?

The forthcoming meeting is widely anticipated to maintain current policy settings, reflecting the BoJ’s patience in assessing future policy adjustments. Expectations lean towards further rate adjustments possibly occurring in the July or September meetings.

The focus of the upcoming meeting will be on the BoJ’s quarterly outlook report. Analysts will closely examine how recent developments, such as a weaker yen and surging oil prices, impact the central bank’s inflation outlook, setting the stage for potential future rate movements.

Market speculation suggests that the forecast for FY2025 core inflation may be raised from 1.8% to 2.0%, with the unveiling of the first forecast for FY2026 expected to hover around 2%.

While Japan’s inflation slightly moderated in March, pricing pressures persist above the BoJ’s 2% target for the second consecutive year, potentially supporting further normalization efforts.

Recent statements from BoJ Governor Kazuo Ueda indicate a likelihood of interest rate hikes if underlying inflation continues to rise, along with eventual reductions in bond purchases.

The press conference following the meeting will also be closely monitored for any shifts in the Governor’s statements, particularly regarding inflation expectations and the continued need for accommodative monetary conditions.

Bitcoin’s Past-Halving Situation

Bitcoin’s price remains a focal point of uncertainty, irrespective of significant events like the halving, macroeconomic shifts, or other developments. Researches suggest that the halving is at least partially priced in.

What might happen to Bitcoin’s price post-halving?

The Bitcoin halving is characterized as a retail-driven event, with retail investors perceiving the negative supply shock as beneficial for Bitcoin’s price. Consequently, there is typically a notable increase in the number of addresses holding BTC after a halving event.

Approximately 150 days after previous halvings, the number of retail addresses holding up to 1,000 BTC surged by 52%, 37%, and 3% in 2012, 2016, and 2020, respectively. This trend underscores the retail-driven nature of halving effects on Bitcoin’s ecosystem.

Currently, there are 53.3 million addresses of retail investors holding up to 1,000 BTC, compared to 2,121 addresses held by whale/institutional investors holding over 1,000 BTC. If history repeats itself, these numbers are expected to rise significantly post-halving, likely exerting a positive influence on Bitcoin’s price.

From a historical perspective, Bitcoin’s price typically reaches an all-time high approximately 410 days after a halving. The first, second, and third halving events saw Bitcoin’s price reach ATHs roughly 378 days, 518 days, and 336 days afterwards, respectively.

If history mirrors or echoes itself, there’s a high likelihood of Bitcoin continuing its upward trajectory.

On the flip side, a sharp correction in Bitcoin’s price, breaking through the psychological $50,000 level and transforming it into a resistance level, could invalidate the bullish outlook. In such a scenario, BTC might retreat to the next key weekly support level at $45,000.