AI and Machine Learning in Trading

The evolution in the fintech industry made it possible to create so called trading advisors, special software that is designed to automate trading routines. Nowadays, various solutions are applied to digital options, Forex, stock and cryptocurrency trading. AI and machine learning is expected to open new horizons and provide traders with even more opportunities in the future.

Cutting-edge technologies may be applied to various trading styles. However, intraday traders are likely to benefit from them the most as a lot of routine will be transferred to virtual assistants of this type. By reading this article, you will learn more about AI and machine learning in trading as their contribution to the decision-making process. If you are ready to start trading, create an account at Binolla.

Digital Options Trading Bots

Digital options traders can have access to trading bots via different platforms. Most brokerage companies offer proprietary trading terminals that, in turn, don’t have open code languages. This means that bots can be provided only by such companies.

Trading bots by digital options brokers come in two variations. Some of them are free, while others are available by subscription only. Most expert advisors of this type have several settings inside allowing digital options traders to set them according to their preferences.

All digital options trading bots, designed by brokerage companies can be divided into two main groups: copy trading and trading robots. The first one is an automated platform where traders can copy trading signals from other traders. The second is a pure robot that is based on various technical analysis tools. Moreover, most brokers offer both copy trading and expert advisor services to cater for all types of customers.

When it comes to the filling, such bots are designed with technical indicators mostly. In particular, they can include separate technical tools such as moving averages, MACD, RSI, or others. Some more sophisticated automated trading systems may include a combination of such indicators in order to provide better signals to traders. It is important to mention that digital options are simplified contracts without the necessity of placing stop losses and take profit orders. Therefore, such digital options trading bots do not include this risk management part.

Can One Trust Digital Options Trader Bots?

To answer this question, one should consider two things. First is the provider. Only trustworthy platforms offer reliable software solutions. They are mostly open and transparent as traders know what is under the hood and they can choose between various expert advisers for digital options that they think suit their trading styles the best.

Along with digital options platforms, trading bots are provided by third-party developers. However, they shouldn’t be considered as their reliability and transparency is under question.

Second, before using a trading bot for digital options, one should look at what is inside to see whether a set of indicators is good for a particular strategy. Knowing how a digital options trading bot works is crucial for its successful application in the future.

When using digital options trading bots, one should review their trading sessions from time to time to see the overall performance and effectiveness of the robot.

In general, one can trust robots, but should check them and get more information about the expert advisor’s background. Moreover, it is worth looking at the software provider to see whether it is a reliable company or not.

Forex Trading Bots

Unlike digital options trading bots, their Forex counterparts are designed mostly for the most popular MetaTrader platforms using MQL language. Moreover, with the rising popularity of TradingView online services, some newest trading robots have been created there. The biggest difference between Forex bots created for MetaTrader or TradingView and digital options robots is both Forex platforms allow users to create their own bots, while digital options terminals have a limited set of experts developed by the company itself.

Most trading bots for Forex are based on technical analysis tools. Some of them use popular indicators such as moving averages or RSI. Some Forex trading bots even work with drawing tools to provide signals from support and resistance levels and are even capable of reading basic chart patterns. However, the latter is less popular as such expert advisors make many mistakes.

The Most Widely Known Forex and Crypto Bots

The next part of the article is devoted to trading bots that are widely known in the community. Keep in mind that we do not promote any of these, nor do we have any proven information about their profitability or other statistics.

Harmonizer EA

The Harmonizer EA is a complex solution designed to improve trading performance through the usage of various technical indicators and strategies. Such expert advisor is compatible with both MT 4 and MT 5, which are among the most popular trading platforms nowadays. Harmonizer EA allows traders to delegate part of their routines to the machine while focusing on the strategic aspect.

The expert advisor is based on RSI, MACD and Bollinger Bands. Together, they provide precise trading signals and aim at maximizing profits in various market situations. One of the advantages of this advisor is that it has flexible risk management setting allowing traders to protect their balances from excessive risks.

The expert advisor is suitable for all types of traders, including even those with no previous trading experience. By utilizing this robot, traders can focus on other aspects, including their money management planning instead of finding entry and exit points.

EA Cicada

This innovative robotized trading solution is designed for automating various trading processes. EA Cicada was developed by a team of professional traders who understand all the aspects that may be crucial in decisiokn-making process.

The advisor is designed to capitalize on significant directional price movements. To find entry points, the robot uses various trend-following and momentum indicators. Apart from analyzing the price direction, EA Cicada relies on volume data.

One of the key benefits of the robot is its flexibility. One can set up the advisor to maximize its effectiveness. Moreover, the abundance of settings provides traders with the opportunity to capitalize on price fluctuations in different market conditions.

EA Cicada incorporates various useful features including stop losses and position sizing to optimize any money and risk management approach. When using it on the MetaTrader platform, traders can backtest the robot to see its performance over time and adjust its settings to make it even more effective.

AGI EA

AGI EA is an innovative trading solution that was designed by the team of enthusiasts. It offers advanced algorithms that are able to react in different market conditions. This, in turn, increases the chances for boosting profits over time.

While there is no information about the exact indicators that are used in this algorithm, traders can watch backtesting results to decide whether to use it or not. One of the greatest advantages of this advisor is that it allows performing quick and accurate trades to maximize your profits. The robot analyzes market data and includes it in calculations.

Diversified AST RoboFX

The robot automates trades under various market conditions. It boasts high accuracy and great speed. The EA includes several indicators (which are not disclosed, by the way). Before using it in real-time trading, you can backtest it on the MetaTrader platform.

The advisor is designed to adapt to various market conditions. Moreover, it has several settings allowing traders to adjust the software to their needs. One can change the period of indicators, set the distance for stop losses and take profits, adjust position sizing, etc.

What Are the Strategies that Are Used in Trading Bots?

Most trading bots are based on simple trading strategies, which include the most popular trading indicators. Therefore, their profitability depends on the performance of a particular indicator. We are going to provide two example of how a trading bot for digital options or Forex can perform with the RSI indicator.

One of the most popular signals that a lot of trading bots use is when the price leaves the overbought and oversold areas. In the first example, a bot could buy a Higher contract simply because the RSI indicator line leaves the oversold area (below 30).

However, the next signal that the indicator provides leads to losses. A trading bot would suggest buying Lower contracts or selling a currency pair, stock or cryptocurrency based on the reversal signal from the RSI indicator. However, this signal would lead to a loss as the price stays sideways. A human trader could easily recognize the range and avoid trading, while the bot would sell as it is unable to use additional graphic tools.

The next mistake that a trading bot would make is in the case that is illustrated above. While there is a signal for buying a Higher contract or buying an asset, the movement is descending, which means that purchasing Higher contracts or buying would be a mistake. While a trading bot can’t recognize such failures, a human trader would never trade in this case.

As you can see, a standard trading bot based on the RSI indicator would bring one profit against two losses. This is relevant for most existing trading bots as they are also based on such simple methods.

The situation may change in future with the adoption of AI technologies and the development of Artificial Intelligence. However, currently, most indicators work they way it is with a lot of mistakes that cost money to both digital options and Forex traders!

How to Choose a Trading Bot

Picking a robot to trade digital options or Forex assets is an important decision that requires assessment. Nowadays, plenty of options are available and traders should weigh all the crucial factors to make the final decision. Some of them are listed below:

1. Think About Your Trading Goals

Traders should consider various factors, including their profit expectations when selecting a particular trading bot. Moreover, they should think about their risk tolerance and market they are going to capitalize on. Before making the final choice, you should understand which trading style suits best to your goals.

2. Check Various Available Robots

Even if you have found one robot that you think is reliable and may be useful to you, you should consider several once to be able to compare them. When making a selection, analyze various factors including the markets that work in, customer support and community.

3. Types of Assets and Customization

The best trading bots allow traders to make various adjustments. In particular, they offer functionality to change indicators settings, adjust money and risk management parameters, as well as set stop loss levels. The more options you have, the more flexible the trading system will be.

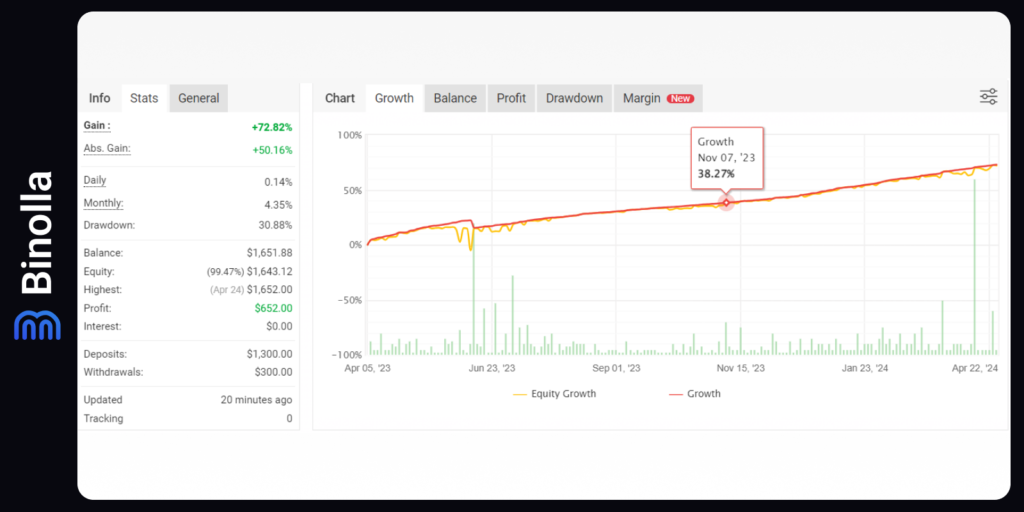

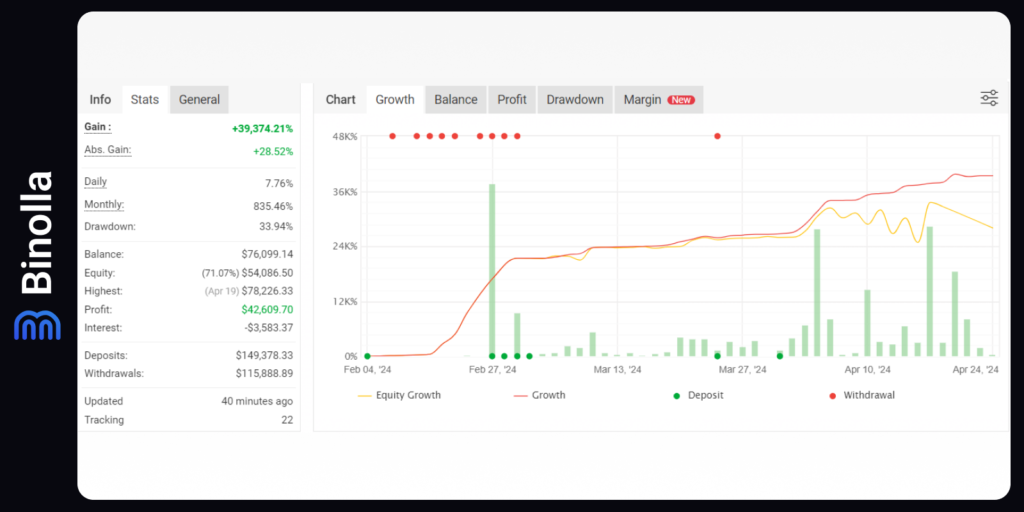

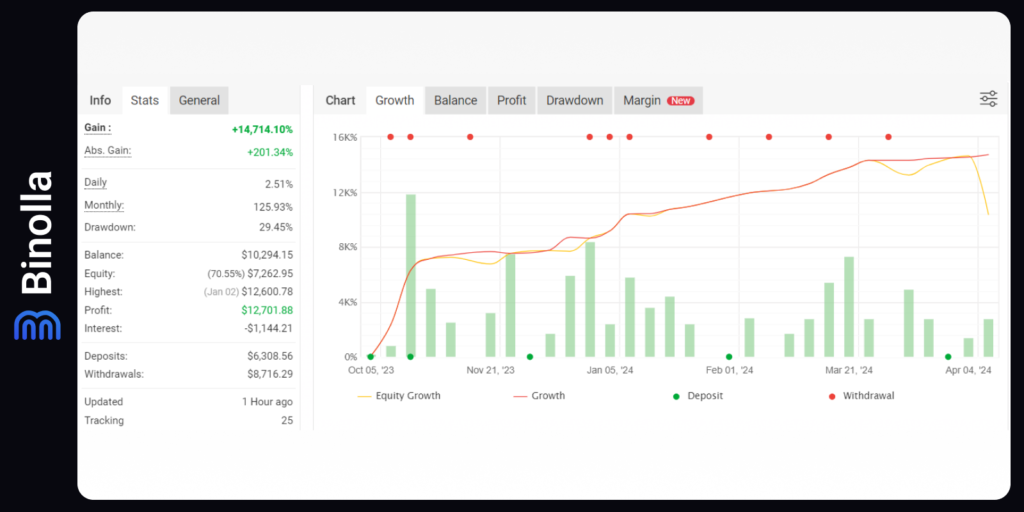

4. Evaluate Performance

Choose only those trading robots with the sustainable performance. Check their historical data and evaluate performance to understand whether a particular one is suitable to you. Also, analyze drawdowns, which are important to understand how risky a robot is.

5. Evaluate Pricing and Costs

For paid bots, one should evaluate their costs in order to understand how much they should pay and how this will impact their profits in future. Compare tariffs of different bots to choose the right one.

6. Test the Bot

Most trading bots are available in the demo mode, which allows you to test them before buying or using in your trading routines. Test the robot before giving them your own money. Also, you can test the interface, ease of use and other important things.

7. Seek Support and Community

Ask questions about a particular trading bot in any trading community you can find. Also, choose only those trading bots with reliable support service having various communication methods, including chats, emails, and forums.

8. Consider Regulatory Compliance

Make sure that a trading bot you choose meets the regulatory requirements. This may not apply for most jurisdictions, but in some, such requirements are mandatory.

9. Start Small and Monitor Performance

After choosing a trading bot, it is worth trading with smaller amount and check it even if you have tested a robot previously. Increase your investments gradually by watching the performance. Make adjustments to the strategy if needed. Moreover, it would be better to stay informed about market changes and trade manually if necessary.

10. Stay Informed and Adapt

Traders should follow the latest trends in this niche and check for innovations. You should continuously evaluate the performance of your trading bot to see whether it still meets your trading goals or not. If a trading bot makes more mistakes than you expect then you can substitute it with another one.

Paid vs. Unpaid Trading Robots

When choosing a particular trading bot, traders have two options. They can select an unpaid one, which comes for free or a paid one, which requires additional investments. Paid bots are developed by professionals and they have some advantages that make them more attractive in some cases. Sometimes, they use more sophisticated algorithms.

Paid robots can be bought, but some of them come through subscription. By buying them, traders can expect higher performance and reliability. Moreover, teams behind such bots often spend more time testing them before selling to retail traders and investors.

Free trading robots are available at no cost, allowing market participants to start using them right away. They are often produced by individuals and may be developed for a single platform or be cross-platform.

While both paid and free trading bots may have even the same functionality, the latter sometimes lack this sophisticated feature, which makes paid robots more attractive. Moreover, those who want to employ free robots should be careful as they may not meet their expectations in trading, contain bugs and even security vulnerabilities.

Choosing between both types of trading robots depends on your preferences. If you are looking more complex solutions with higher eventual performance, and better support, then you can buy a robot or subscribe to it.

On the other hand, you can also try free robots and even become successful with them. The thing is that it is up to a trader to see what is insight and evaluate the performance. Even free bots can be great, while not all unpaid once may show better results.

What a Trader Should Know Before Using Any of Current Trading Bots?

Within the trading robots industry, traders often encounter deceptive practices and unreliable products that overstate their capabilities or fail to meet expectations. These offerings can vary from paid robots marketed as high-performance trading systems to unpaid alternatives promising substantial returns without upfront costs. While not all trading robots are problematic, it’s crucial for traders to exercise caution and recognize the potential risks associated with misleading marketing and inadequate performance.

A common strategy utilized by less reputable actors in the trading robots sector involves exaggerated claims and inflated performance metrics to entice unsuspecting traders. These robots may advertise extraordinary returns with minimal risk, employing aggressive marketing tactics to instil a sense of urgency and capitalize on traders’ fear of missing out. However, such claims often lack substantiation and can result in significant financial losses for traders who invest based on these misleading representations.

Moreover, certain trading robot creators may resort to deceptive tactics such as fabricating user testimonials, manipulating performance data, or presenting misleading information to create an illusion of profitability. These strategies aim to foster trust and credibility in the product, enticing traders to invest without conducting thorough due diligence. Unfortunately, once traders realize the disparity between the promised results and the actual performance, they may find themselves unable to recover their losses.

In addition to paid robots, unpaid options like free trading robots or downloadable software can also pose risks of deceptive practices and fraudulent activities. Despite the allure of no initial costs, traders should remain cautious when engaging with free trading robots, as they may conceal hidden fees, undisclosed risks, or even malicious intentions. Some free robots could serve as conduits for phishing schemes or malware distribution, posing significant threats to traders’ financial security and personal information.

The trading robots industry presents various risks, ranging from exaggerated claims in paid products to undisclosed risks in unpaid alternatives. Traders must approach any trading robot with scepticism and conduct thorough research before committing to any investment. By remaining vigilant and informed, traders can safeguard themselves against falling victim to deceptive practices and ensure they select reputable and reliable trading solutions aligned with their financial objectives and risk tolerance.

AI and Machine Learning Basics

Conversations surrounding artificial intelligence (AI) and machine learning (ML) in digital options and Forex trading have become increasingly prevalent in recent years, reflecting the growing interest and adoption of advanced technologies in financial markets. These discussions encompass a wide range of topics, from the potential benefits of AI and ML in enhancing trading strategies to the ethical and regulatory considerations surrounding their use.

One key area of focus in these discussions is the role of AI and ML in predictive analytics. Traders and analysts are exploring how machine learning algorithms can analyze vast amounts of historical market data to identify patterns, trends, and correlations that human traders may overlook. By leveraging these insights, traders can make more informed decisions about when to buy, sell, or hold assets, potentially improving their trading performance and profitability.

Artificial Intelligence (AI) and Machine Learning have emerged as transformative technologies across various industries, revolutionizing the way tasks are performed, decisions are made, and systems are optimized. At their core, AI and Machine Learning entail the development of computer systems that can simulate human intelligence, enabling them to learn from data, recognize patterns, and make predictions or decisions without explicit programming. This ability to analyze vast amounts of data and extract meaningful insights has led to a wide range of applications, from virtual assistants and recommendation systems to autonomous vehicles and medical diagnostics.

In the financial sector, AI and Machine Learning have garnered significant attention for their potential to enhance trading strategies, risk management, and portfolio optimization. Algorithmic trading, which relies on complex algorithms to execute trades automatically, has become increasingly prevalent in today’s markets. These algorithms leverage AI and Machine Learning techniques to analyze market data, identify trading opportunities, and execute trades at lightning speed, often surpassing the capabilities of human traders. By leveraging AI-driven insights and predictive modeling, algorithmic trading systems can make informed decisions based on real-time market conditions, leading to improved trading performance and profitability.

Moreover, AI and Machine Learning have transformed the landscape of investment management and portfolio optimization. Hedge funds and asset managers are increasingly turning to AI-powered algorithms to analyze market trends, identify investment opportunities, and manage risk more effectively. These algorithms can process vast amounts of financial data, news articles, social media sentiment, and other relevant information to identify patterns and correlations that may impact asset prices. By incorporating AI-driven insights into their investment strategies, fund managers can make more informed decisions, reduce portfolio volatility, and enhance returns for their investors.

How AI Can Change the Trading and Investment Landscape

Artificial Intelligence (AI) and Machine Learning (ML) have ushered in a new era of transformation in trading practices, revolutionizing how traders approach the markets. Let’s explore and expand upon each aspect of their impact:

- Predictive Analytics. ML algorithms may empower traders with the ability to analyze vast troves of historical market data to discern patterns and trends that were previously inaccessible. By leveraging these insights, traders can now make more informed decisions about future market movements, effectively foreseeing potential opportunities and risks before they unfold. This predictive capability not only enhances trading strategies but also enables traders to stay ahead of the curve in dynamic market environments, ultimately leading to more profitable outcomes.

- Algorithmic Trading. AI-driven algorithms fundamentally alter the landscape of trading by enabling lightning-fast execution of trades at speeds beyond human capacity. These algorithms continuously scan the market for inefficiencies and discrepancies, swiftly capitalizing on lucrative opportunities in real time. What’s more, they possess the remarkable ability to adapt to changing market conditions, ensuring that trading strategies remain optimized and effective even in the face of volatility and uncertainty. As a result, algorithmic trading has become an indispensable tool for traders seeking to gain a competitive edge in today’s fast-paced markets.

- Risk Management. AI tools revolutionize risk management practices by providing traders with sophisticated analytical capabilities to assess and predict potential risks. By analyzing a myriad of factors including market conditions, geopolitical events, and economic indicators, AI algorithms offer traders a comprehensive understanding of the risks inherent in their trading decisions. Armed with this information, traders can make more informed choices, mitigating potential losses and safeguarding their investment capital effectively.

- Sentiment Analysis. AI algorithms transform the way traders gauge market sentiment by scanning an array of digital content including news articles, social media posts, and online forums. This sentiment analysis provides valuable insights into public perception and sentiment towards specific assets or markets, helping traders anticipate and navigate market movements more effectively. By incorporating sentiment analysis into their trading strategies, traders can gain a deeper understanding of market dynamics and make more strategic trading decisions based on prevailing market sentiment.

- Portfolio Management. AI-powered robo-advisors democratize access to personalized investment advice and portfolio management services. These intelligent algorithms analyze an individual’s financial situation, goals, and risk tolerance to offer tailored investment strategies that optimize returns while minimizing risk. By leveraging AI-driven portfolio management solutions, traders can benefit from a more hands-off approach to managing their investments, freeing up time and resources to focus on other aspects of their trading journey.

FAQ

What is trading with bots?

Trading with bots refers to the practice of using automated software programs or algorithms to execute trades in financial markets. These bots are programmed to follow specific trading strategies and can operate without human intervention, executing trades based on pre-defined criteria such as price movements, technical indicators, or news events.

How does AI contribute to trading?

Artificial intelligence (AI) plays a significant role in trading by enabling more advanced and sophisticated trading strategies. AI algorithms can analyze vast amounts of data at speeds far beyond human capabilities, allowing traders to uncover patterns, trends, and market inefficiencies that may not be apparent through traditional analysis methods.

What are the advantages of using bots and AI in trading?

Using bots and AI in trading offers several advantages, including the ability to execute trades with speed and precision, the capacity to analyze large datasets and identify complex patterns, and the potential to automate routine tasks, freeing up traders to focus on higher-level decision-making and strategy development.

What are some common trading strategies employed by bots and AI?

Bots and AI can be programmed to execute a wide range of trading strategies, including trend following, mean reversion, arbitrage, sentiment analysis, and machine learning-based strategies. These strategies vary in complexity and suitability for different market conditions and asset classes.

What are the risks associated with trading with bots and AI?

While trading with bots and AI offers numerous benefits, it also carries inherent risks. These risks include the potential for programming errors or bugs leading to unintended trades, susceptibility to market anomalies or sudden changes in market conditions, and the risk of over-reliance on technology without proper risk management protocols in place.

How can traders mitigate the risks of using bots and AI in trading?

Traders can mitigate the risks of trading with bots and AI by thoroughly testing and validating their algorithms before deploying them in live markets, implementing robust risk management protocols, monitoring bot performance closely, and being prepared to intervene manually if necessary.

How is the landscape of trading evolving with the advancement of AI and automation?

The advancement of AI and automation is transforming the trading landscape, leading to increased efficiency, liquidity, and accessibility in financial markets. It’s also reshaping the role of human traders, who are now leveraging AI tools to augment their decision-making processes and stay competitive in an increasingly digitized and data-driven trading environment.

Can I Become Rich When Using Trading Bots?

No, you can’t. None of the existing trading bots are good enough to make you rich. Traders can partially unload their routines with trading bots. However, they should monitor how robots make trades and stay on guards all the time.