Trump Tariffs Weigh Over Markets Again: What To Expect from Major Assets This Week

The recent comments from the US president underline that the White House is ready to renew its tariff threats. Donald Trump has mentioned, in particular, that the duties on steel and aluminium will be raised from 25% to 50%, which adds uncertainty to the financial markets.

A new cycle of tariff war brings more fear to the financial markets. Analysts believe that this summer the US economy may face stagflation with lower economic growth and higher inflation, which can make the Fed’s life even harder as they will have to make difficult decisions and sacrifice something to stimulate economic growth.

Taking all these factors into consideration, the US dollar is going through tough times. However, the DXY index has recovered a bit.

Contents

EUR/USD: Eurozone’s Inflation in Focus

The currency pair is trading with moderate losses amid weaker-than-expected inflation data in the Eurozone. Yearly core inflation plunged to 2.3% while yearly consumer price index posted moderate growth by 1.9% in May.

These figures will allow the European Central Bank to continue its dovish monetary policy as the central bank is expected to cut rates for the eighth consecutive time during its June meeting. However, the ECB head, Christine Lagarde, has mentioned that the central bank is likely to stick to the neutral strategy and wait for more data before making any further decisions.

The US dollar, in turn, is under pressure due to updated tariff rhetoric from Donald Trump. The upcoming duties on metals may put additional pressure to the US currency due to uncertainty about the future of the US economic growth.

From a technical analysis perspective, the currency pair is trading above the SMA50, but it is likely to test the moving average in the coming hours. Short positions are preferable below 1.1400, while if the SMA50 holds the price pressure, traders can buy from there, targeting 1.1455 and then 1.1500.

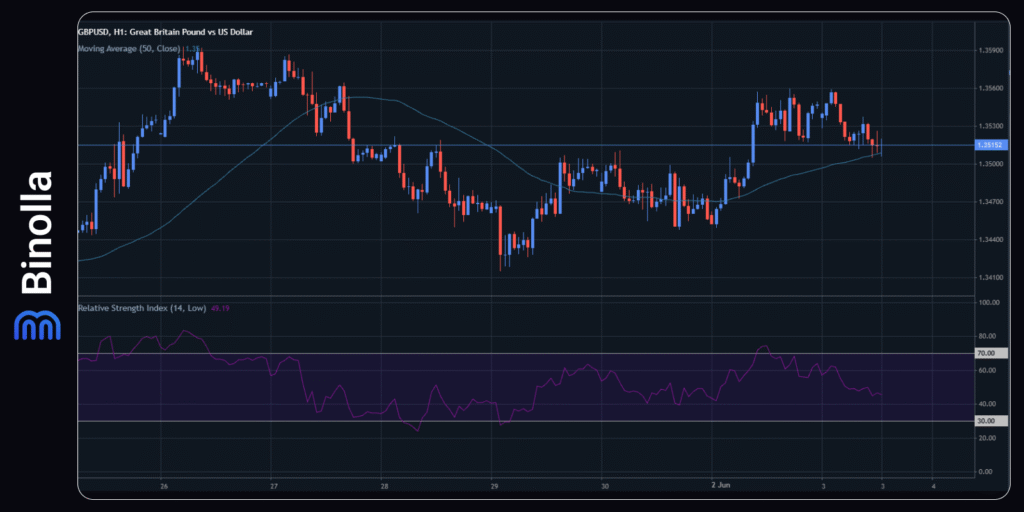

GBP/USD: Pound is Moving Down on Bailey’s Comments

The Bank of England’s head, Andrew Bailey, mentioned that the inflationary pressure is not a big concern anymore, which means that the BoE is likely to resume its dovish strategy this year. The chief of the central bank has also warned about economic uncertainties that may delay investment decisions by UK businesses.

The US manufacturing activity is hurt by the tariff wars, which is confirmed by the ISM manufacturing data in the United States. The indicator has lost almost 1 point and remains below 50, which means that the manufacturing sector is in the contraction zone. This adds pressure to the US dollar, but in the short term, the currency pair may plunge.

From the technical analysis perspective, the currency pair is trading above the SMA50, but is testing the moving average at the moment. Fundamentals and comments from the BoE officials stimulate the downside pressure, which means that there is a probability of breaking below the dynamic support. Traders can place short orders below 1.3500, while long positions are relevant if the price stays above this level. For buyers, targets can be at 1.3560 and 1.3600.

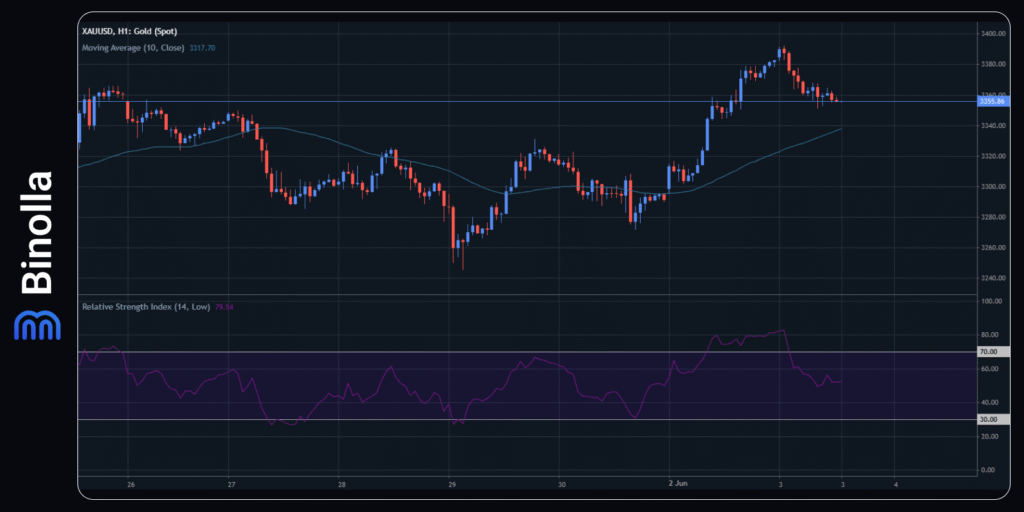

XAU/USD: Gold Is Supported by Trade Uncertainties

Renewed trade tensions between the US and its main peers support gold prices. China accuses the US of violating recent trade agreements. It is to mentioning that the US president made the same accusations last week. Moreover, Donald Trump has announced 50% tariffs on steel and aluminum. Retaliatory measures from Canada and the EU are expected.

One more point of concern is the situation between the US and Iran. While the US officials were convinced that the deal is almost done, Tegeran is unlikely to sign the document and agree to the conditions and requirements from the US, which means that the situation will remain unchanged.

Gold is trading above the SMA50 on the hourly chart, which means that buyers are controlling the market. If the price moves above 3360, then gold will become more attractive for short-term buyers. The next target will be at 3400. When it comes to downside, short positions are preferable below 3350.

WTI: Downside Pressure is Looming Over Oil

Oil prices attempted to grow on Monday after the OPEC+ decision to increase oil production by 411,000 barrels in July. However, the OECD report puts pressure on the WTI quotes. According to the document, the global GDP growth forecast is cut down to 2.9%, which means that the demand for crude oil can be lower in the future. Moreover, dollar-denominated commodities may become expensive, which, in turn, will put pressure on the energy.

On the other hand, oil quotes are supported by the fears that the US-Iran negotiations will lead to nothing. Moreover, talks between Russia and Ukraine brought no significant progress, which is also a supportive factor for WTI.

WTI stays above the SMA50, marking the bullish domination in the market. Buyers can join if the price breaks above 62.40, with the closest target at 63.00. On the downside, short positions can be preferable if WTI breaks below 61.80.