The US Inflation Data: How Markets Will React to It

The inflation data from the United States will be the main focus this week. Traders and investors expect the data to provide some clarity on whether the Federal Open Market Committee is ready to make another easing step this year or stick to its wait-and-see approach.

Economists expect monthly inflation to slow down to 0.2% from 0.3% in October, while core monthly inflation is expected to accelerate by 0.1% from the previous reading and make a 0.3% growth in total. When it comes to yearly inflation, it is expected to remain at 3.0%, which may be considered as a good sign for the Fed as the central bank may cut rates by 25 bps again this year.

Recent comments from the Fed Chair Jerome Powell suggest that the central bank is going to keep rates high until next year. This may support the US dollar in the mid-term. On the other hand, the latest FOMC voting members’ comments suggest that the Fed is still considering the possibility of a rate cut, especially after disappointing UoM Consumer Sentiment, which declined to 50.3.

The US government shutdown is nearing its end. The parties have agreed on reopening the government institutions, which adds some risk sentiment to the markets. However, once more data is available, market participants will reassess it, and this may also add volatility to the financial markets.

Contents

EUR/USD: Market Participants Eyeing US Inflation and Lagarde Comments

The currency pair has got some support from the ECB’s latest comments. According to central bank officials’ speeches, the financial institution is likely to maintain rates at their current levels until 2026. The Fed is still hawkish, which, on the other hand, puts pressure on the currency pair. The US infflation data may provide some guidance this week.

From the technical analysis perspective, EUR/USD is trading close to the upper band of the Bollinger Bands indicator, with the lines moving sideways and close to each other, suggesting that the volatility is low. On the upside, traders can watch 1.1580, 1.1630, and 1.1670. On the downside, market participants can consider 1.1540, 1.1510, and 1.1470.

GBP/USD: The British Pound Dipped on the Labor Market Data

The UK labor market data released today was disappointing. The unemployment rate increased by 5.0% in October, while the number of new unemployed increased by 29,000 during the same period. Moreover, quarterly wage growth decelerated by 4.8% in October, which puts pressure on the British pound. However, the currency pair managed to gain back some positions on expectations of the US shutdown ending in the upcoming days.

From the technical analysis perspective, the currency pair just rejected the lower band of the Bollinger Band indicator, with lines being close to each other, which means that the volatility is narrow. On the upside, if GBP/USD breaks above 1.3160, then traders can hold long positions targeting 1.3200 and 1.3250. On the downside, short positions are possible from 1.3110 targeting 1.3050 and 1.3010

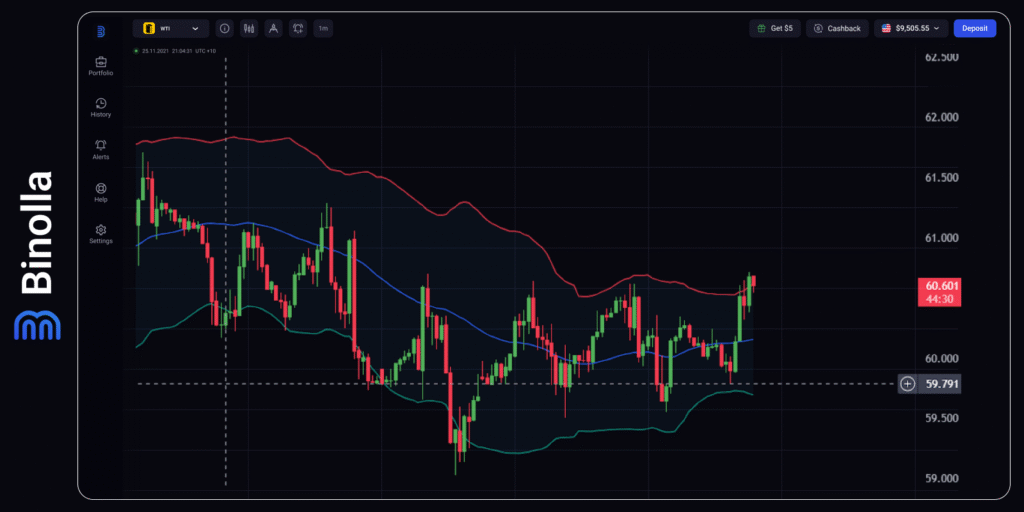

WTI: Oil Traders Watch for Inflation Data

Crude oil is trading within a wide range due to the upcoming shutdown end and expectations that the Fed may cut rates during its December meeting. Additionally, oil prices are supported by the output increase pause that OPEC+ has announced for Q1 in 2026.

From a technical analysis perspective, oil is trading close to the upper band of the Bollinger Bands indicator, with the price making attempts to make a breakout. On the upside, traders can buy if a breakout occurs and the price goes beyond 60.70, targeting 61.50 and 62.00. On the downside, short positions are preferable below 60.10, targeting 59.30 and 59.00.

XAU/USD: Gold Is Supported by the Expectations of the Fed Rate Cut in December

The Fed rate cut in December is already partially priced in as gold receives support from another easing move by the FOMC. Also, the upcoming shutdown ending supports the precious metal as market participants expect more data to be released. The latest UoM Consumer Sentiment data showed that the economic situation is worsening, which means that the central bank may cut the rate by 25 bps in the last month of 2025.

From the technical analysis perspective, gold is trading close to the upper band of the Bollinger Bands indicator but failed to set new local highs today. Sellers can engage below 4,120, targeting 4,100 and 4,070. Buyers can step in if the price breaks above 4,150 targeting 4,180 and 4,200.