Tag: trading

4 min read

Fed Minutes in the Spotlight as Global Markets Digest Mixed Macro Signals

Markets will be watching the FOMC meeting minutes release, which will be published on Wednesday. Traders and investors will see whether policymakers are ready to make another rate cut or whether they will stick to their wait-and-see approach for longer....

13 min read

Handling Losses: Why Accepting Losses Is the Price of Winning in Trading

Traders always think about profits when they place trades. While this is normal, understanding that losses are also part of the game is crucial. Read this article to learn more about how to handle losses and avoid mistakes in trading...

4 min read

French Political Crisis and US Shutdown: Two Key Drivers This Week

Global markets are in turmoil as the US shutdown and France's political crisis shake investor confidence. From the euro to crude oil, political instability is casting a shadow over financial assets. In the midst of the chaos, gold is emerging as a safe haven, reaching new highs....

12 min read

Recommended

20 min read

8 min read

Binolla Platform: How to Draw Support, Resistance, and Trendlines

Learn how to draw support and resistance lines and adjust them. Find out where to find drawing tools on the platform and how to apply them to charts. Explore some useful tips and tricks. Delve into the details of the drawing tools on the Binolla platform....

13 min read

6 min read

Trading

Trading involves buying and selling financial instruments such as stocks, currencies, commodities, and derivatives with the aim of profiting from price movements. Here are key points to consider when engaging in trading:

- Market Analysis: Conduct thorough analysis of market trends, economic indicators, and news events to identify potential trading opportunities.

- Risk Management: Implement risk management strategies to protect capital, including setting stop-loss orders and diversifying investments.

- Trading Plan: Develop a trading plan outlining entry and exit criteria, position sizing, and risk tolerance to guide decision-making.

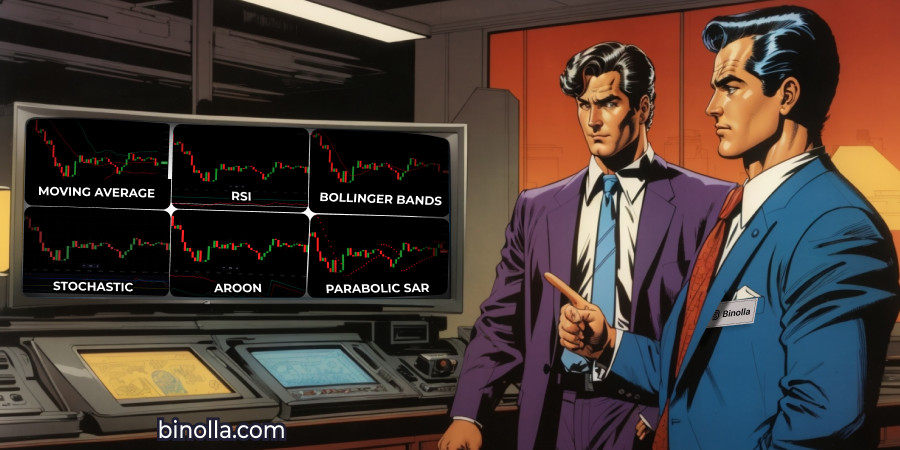

- Technical Analysis: Utilize technical analysis tools such as charts, patterns, and indicators to identify trends and potential entry and exit points.

- Fundamental Analysis: Evaluate the fundamental factors influencing asset prices, such as earnings reports, economic data, and company news.

- Trading Platforms: Choose a reliable trading platform that offers access to a wide range of financial instruments, advanced charting tools, and order execution capabilities.

- Leverage: Understand the risks associated with leverage and use it judiciously to amplify returns while managing potential losses.

- Psychology: Develop emotional discipline and avoid letting emotions such as fear and greed influence trading decisions.

- Continuous Learning: Stay informed about market developments, learn from both successes and failures, and continuously refine trading strategies.

- Monitoring and Review: Regularly monitor trades, review performance metrics, and make adjustments to trading strategies as needed.

- Compliance: Adhere to regulatory requirements, trading rules, and ethical standards to ensure legal and ethical trading practices.

By incorporating these principles into your trading approach, you can enhance your chances of success and navigate the complexities of financial markets effectively.