Binolla Platform: How to Trade

The Binolla platform offers a very simple and user-friendly interface, which is great news for both newcomers and professional digital options traders. Moreover, it can boast all those important features that allow you not only to make deals but also to conduct deep technical analysis and use any type of strategy.

After you complete all the procedure that include registration and depositing funds, you are free to place your first trade.

Contents

- 1 Binolla Platform: A Step-By-Step Guide on How to Trade

- 2 Choosing Financial Instruments and Underlying Assets

- 3 Conduct Market Analysis

- 4 Pick the Amount of Investment

- 5 Set Expiration

- 6 Choose the Direction

- 7 Try trading with the Binolla platform now!

- 8 Waiting for the Expiration to Occur

- 9 Binolla Platform: Types of Contracts

- 10 Binolla Trading Tips for Beginners

- 11 Conclusion

- 12 FAQ

Binolla Platform: A Step-By-Step Guide on How to Trade

Demo Mode

The platform allows you to trade using two modes: demo and real money. The demo is designed for you to practice trading with virtual money and hone some of your own strategies. This mode is also useful for traders to familiarize themselves with the platform.

The demo mode is limited to $10,000. However, you can always refresh the balance if you need some more training.

To do that, you need to go to the balance menu and choose the settings (three vertical dots). Here, you need to click Refresh Balance. After you do it, another $10,000 of virtual money will be available right away.

Keep in mind that the demo is fully functional and 100% similar to the real account. Once you think you are ready to end your practice, you can switch to a real account.

To switch between the two, you need to click the button with the balance at the top of the screen and choose a real or demo account.

Real Account

To buy Higher or Lower options, you need to do the following:

- Choose your financial instrument and/or underlying asset;

- Conduct market analysis to see how the underlying asset is going to perform;

- Pick the amount of investment;

- Set expiration;

- Click on Higher/Lower according to your forecasts;

- Wait for the expiration to take place to see whether your forecasts were right or wrong.

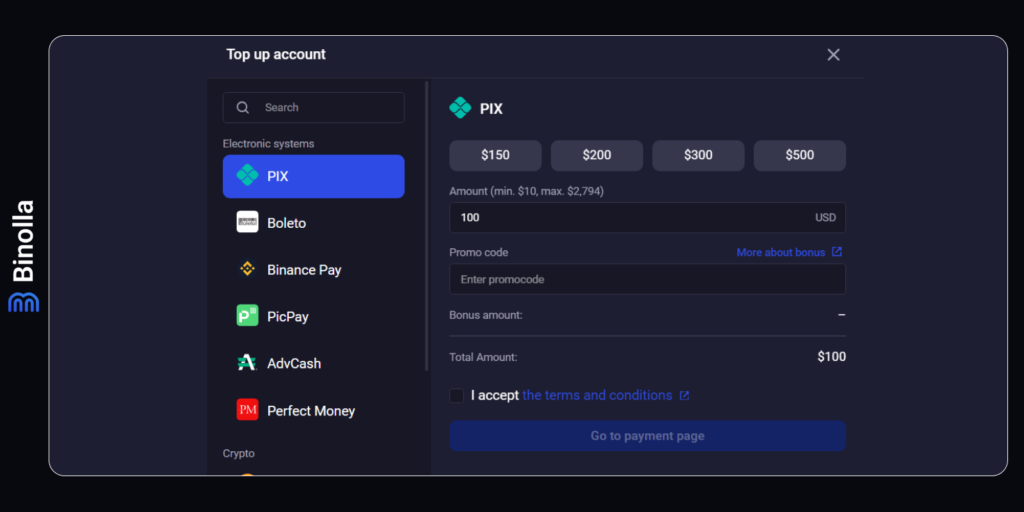

Traders can also receive additional money during the deposit process that they can use when trading on their real accounts. If you have a valid promocode, you can paste it into the Promo code field. Once the deposit procedure is done, you will be able to use the bonus together with your own money for trading

Choosing Financial Instruments and Underlying Assets

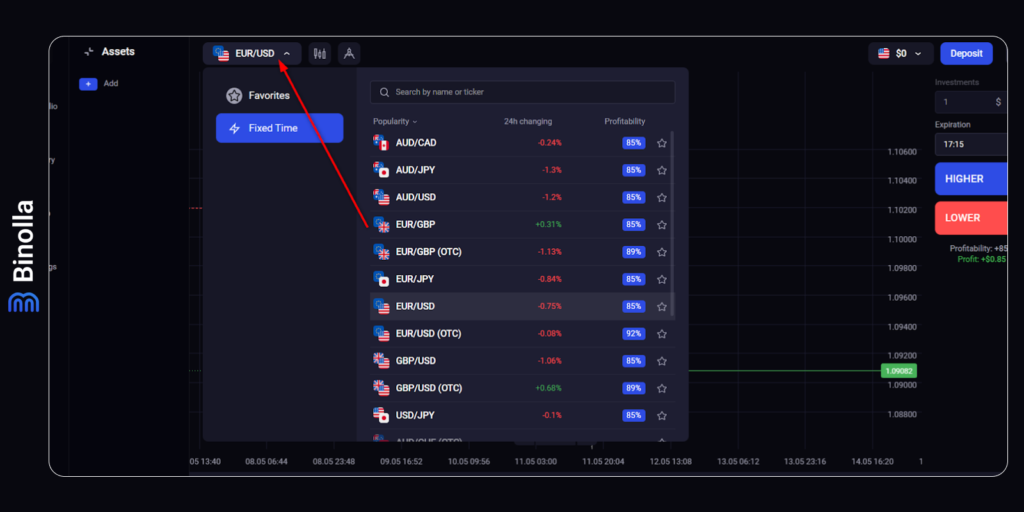

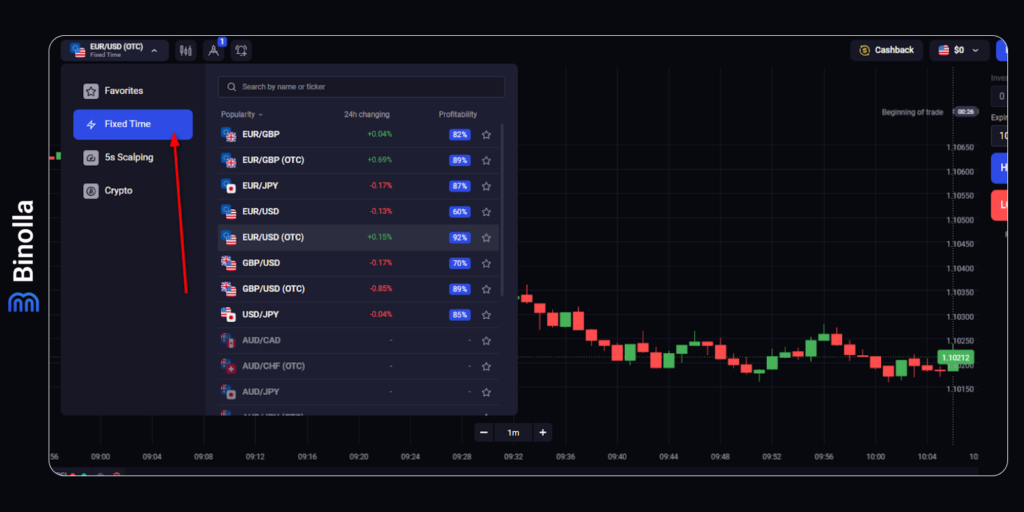

To choose a financial instrument and/or an underlying asset, you should click the button with a currency pair at the top of the screen. By doing this, you will open a special window where you can pick any type of financial instrument and select underlying assets.

Each underlying asset has its own profitability that you can watch to the right of its name. Keep in mind that it impacts your eventual profits. Moreover, there is another column that shows the underlying asset’s performance for the past 24 hours.

You can also add any of the available underlying assets to your list of favorites and pick them later, in a matter of seconds, so that they are on time if they show great performance.

Binolla Tip

Choose underlying assets wisely. Make sure that you understand what events may affect its fluctuations and cause trends. Read more about how to choose underlying assets here (link How to Choose an Underlying Asset for Trading).

Conduct Market Analysis

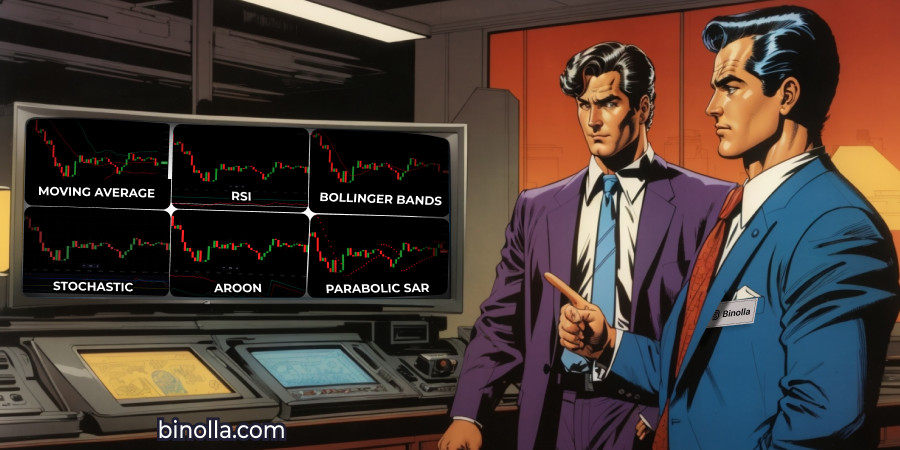

This is a very important part of trading, as you need to understand the current trend and the direction of the price movement before the expiration occurs. With Binolla, you can use the following analysis methods and tools:

- Japanese Candlestick price action system;

- Price patterns like Triangles, Double bottom/top, and others;

- Trend following technical indicators;

- Oscillator indicators;

- Basic drawing tools.

To use Binolla analysis tools, you need to click a button at the top of the screen as shown in the image, and choose whatever tool you want.

You can learn more about how to use drawing tools and technical indicators by reading these guides:

- Binolla Platform: How to Use Indicators;

- Binolla Platform: How to Draw Support, Resistance, and Trend Lines;

- Binolla Platform: Charts.

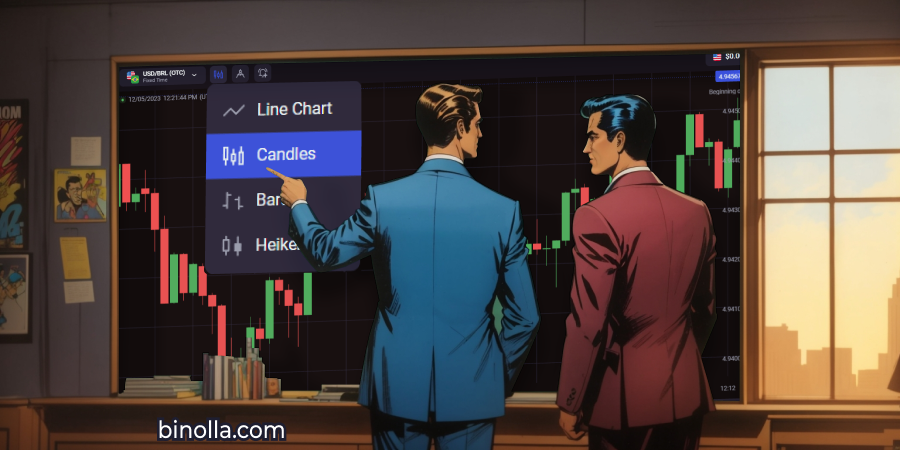

Many traders conduct multi-timeframe analysis, which involves switching between different timeframes to see major and local trends, as well as corrections. To change timeframes, traders can click on the icon at the top of the screen. The window that pops up will allow you to change a timeframe at any moment.

Traders can choose how their chart will look like with the Binolla platform. By clicking the icon at the bottom of the chart, they will be able to set colors of candlesticks as well as choose their style.

Pick the Amount of Investment

The next thing you should do before your trade is placed is to choose the amount that you are going to invest in a trade. You can set the sum manually or use “+” and “-” to increase and decrease it.

Binolla Tip

When thinking about how much to invest in a trade, you can simply stick to the rule of 1-2%. This means that you shouldn’t put at risk more than 1-2% of your total balance per contract. If you are looking for more information on how to manage your money in fixed-time contract trading, read Money Management for Beginners.

Set Expiration

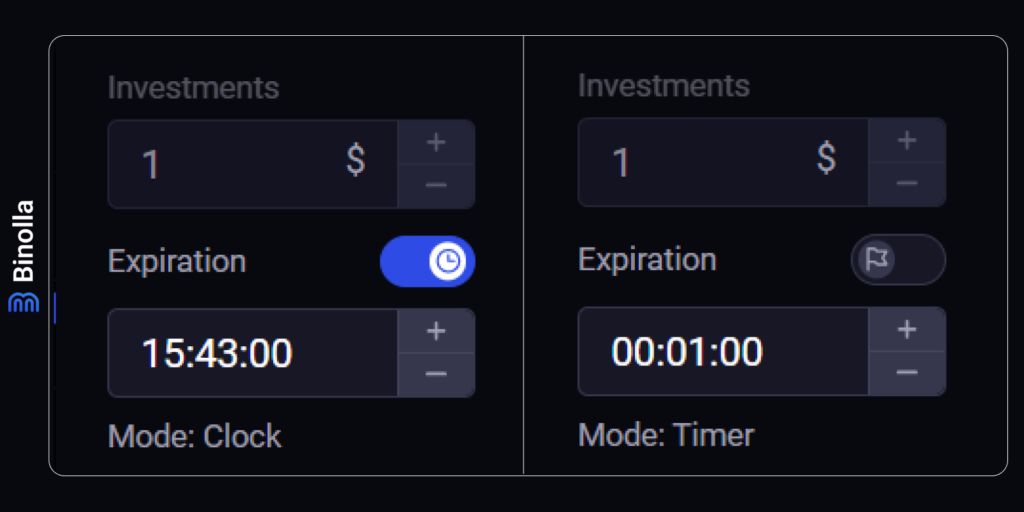

Each digital option contract is limited in time and has its expiration. Therefore, before buying one, you need to think about how long your fixed-time instrument will be active. With Binolla, you can choose between 15 seconds and 4 hours. To set expiration, you need to use a special “Expiration” field at the right part of the platform. To do it, you have two options. You can either use “+” and “-” to increase or decrease time or simply set it manually.

The Binolla platform offers a special feature known as Expiration mode. Here you have two options. The timer allows you to set minutes or hours before expiration. When it comes to a clock, you can choose the exact time when the contract expires.

Binolla Tip

Setting expiration is a kind of art for traders. This is less about guessing and more about thinking of what exact market situation is currently developing on the chart. Keep in mind that smaller expiration requires you to have enough skills and better timing. To find out more about how to choose expiration, read this article (link How to Choose Expiration in Time-Fixed Contracts).

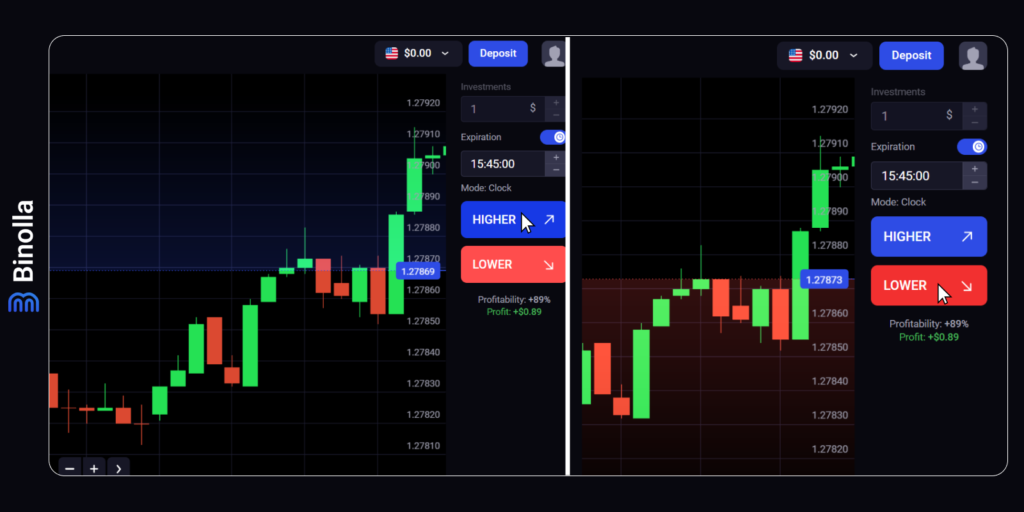

Choose the Direction

The last step before you buy a fixed-time contract is to choose the direction. Picking between Higher or Lower depends on your previous underlying asset analysis. If you think that the price of a currency pair, for instance, is going to increase before expiration, you can press Higher. In case your strategy tells you that the currency pair is going to decline, then you should click the Lower button.

When choosing a particular contract button, you will see the strike price level. The area above or below it will be colored according to the contract you are going to buy. For instance, by hovering over the Higher button, you will see a blue arrow and the area above the strike price will be colored blue. When it comes to the Lower button, you will see a red arrow and the area below the strike price will be painted red.

Waiting for the Expiration to Occur

Now that everything is prepared and you have chosen the direction, the digital contact appears in your portfolio. You can track it right below the chart. Here, you can find the following information:

- Underlying asset;

- Expiration;

- Investment;

- Opening;

- Current Price;

- Expected P/L.

What is important here is the difference between the opening price and the current price. If you have chosen Higher, then the current price should be higher than the opening price for the contract to expire with a profit. Otherwise, you will lose your money.

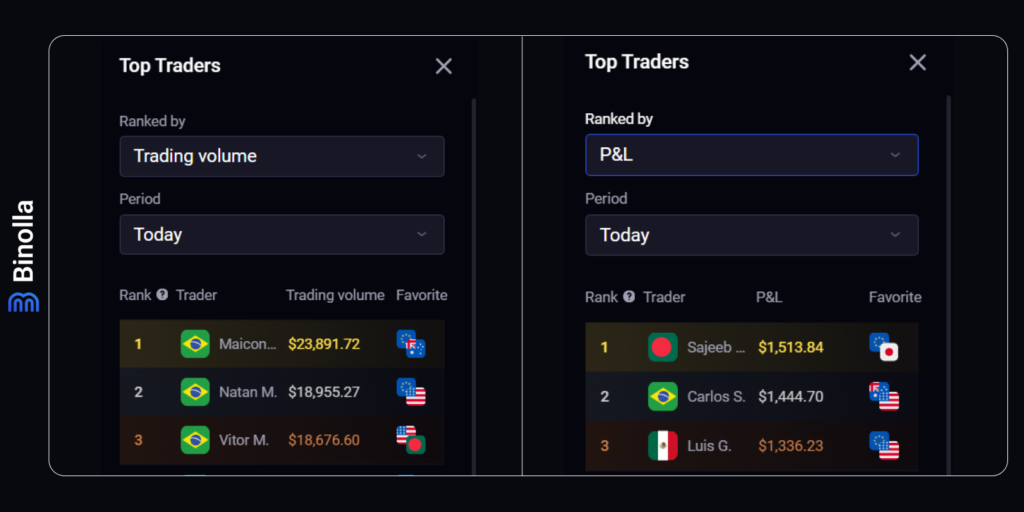

There are two options inside. You can switch between traders rated according to their profit and loss results as well as see how they perform according to their volume turnover. You can also check which assets they use.

Binolla Platform: Types of Contracts

When trading at Binolla, you can choose between Fixed-Time and 5s Scalping contracts. The first is a classic digital option derivative that allows you to predict the direction of price movement over a given time interval.

For instance, if you think that EUR/USD is likely to grow in the following minutes, you can buy a Higher contract with a 5-minute expiration to profit from this situation. On the other hand, if you expect the currency pair to move lower, you can buy a Lower contract with the same or another expiry time to make money on the downtrend.

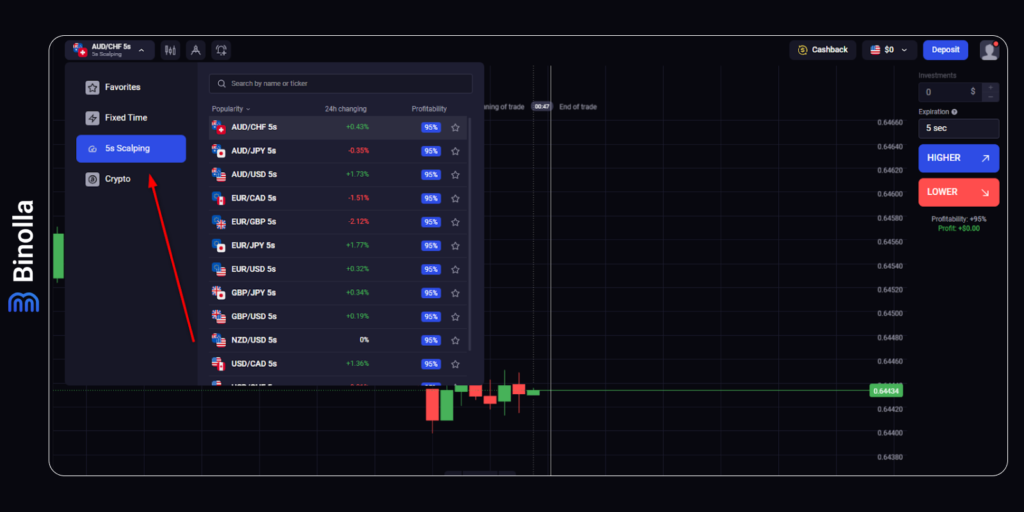

Another type of contract that is available at Binolla is 5s Scalping. This is a special digital option with a 5-second expiration. Such a derivative is a great opportunity to make money on the smallest price deviations.

As an example, you can imagine a situation when XBT/USD is trading at 29,000. You think that the currency pair is going to move higher within the next few seconds. To benefit from this situation, you can buy a Higher 5s Scalping contract. If XBT/USD even changes by a single pip upwards, you will receive up to a 95% payout of your investment amount.

How to Trade 5s Scalping on the Binolla Platform

To trade 5s Scalping contracts, you need to:

- Log in to your Binolla account.

- Go to the menu with assets.

- Choose 5s Scalping there and pick one of the available underlying assets.

- indicate the amount you want to invest.

- Pick the direction of your trade (Higher or Lower).

- Wait for 5 seconds to see whether your forecasts were right or wrong.

Binolla Trading Tips for Beginners

Now that you know how to trade with the Binolla platform, we are going to provide you with some general tips on how to succeed in this profession:

- Use a systemized approach. You should treat trading as your business and systematize your trading routine by calculating your eventual profits in advance, using a particular strategy to find entry points, thinking about expiration, etc;

- Learn how to apply various technical analysis tools and build your strategy. One of the essential criteria for succeeding in trading is being able to build your own strategy. You can use one single indicator or even a combination of them, drawing tools, or Japanese candlesticks to pave your way to success;

- Don’t go beyond your financial possibilities. Think about how much you can invest in trading and stick to this sum, as this will be the amount that you are comfortable with. Do not put at risk than you can afford, as you will have a lot more of additional psychological pressure on you;

- Plan your per-trade amount in advance. Along with planning your whole trading balance, you should think about how much you can risk in a single deal. It is recommended to avoid risking more than 5% in a single trade. Try to stick to this rule throughout your trading career;

- Don’t forget about market news, even if you don’t use news trading strategies. One of the biggest mistakes that many novice traders make is that they try to stay out of the technical analysis vacuum. While the technical method is independent and you can rely solely on it when making trading decisions, it is worth knowing the current macroeconomic environment, especially when you are trading fiat currencies. One unexpected data release may ruin technical signals, which, in turn, may lead to losses;

- Control your emotions and don’t let them control your trading. Emotions should be put down and caged during the times of trading. Don’t let them burst outside and dominate your trading solutions. Greed and fear may bring you even more harm than any other mistakes in trading.

Conclusion

That’s all about how to trade fixed-time contracts on the Binolla Platform. If you are looking for some more information about our trading terminal, you might be interested in reading the articles below:

Binolla Platform General Guide

Discover the basics of our trading platform.

Binolla Platform: How to Register and Deposit Funds

Find out more about how to create an account at Binolla and start trading on the platform.

Binolla Platform: How to Use Indicators

Learn about trading indicators and how to use them on our platform.

Binolla Platform: How to Draw Support, Resistance, and Trend Lines

Start drawing your own support, resistance, trend lines, and others with our well-designed platform.

Learn more about how to switch between charts and read them on the Binolla platform.

Binolla Platform: How to Place a First Trade Video Guide

FAQ

What Is Better, Standard Fixed-Time Contracts or 5s Scalping?

It is up to you to decide what to choose. When it comes to standard contracts, you have a variety of expiration choices, which allow you to apply a set of strategies. Those who choose 5s Scalping, use special strategies that allow them to predict minor price fluctuations. Moreover, when trading scalping contracts, you should be prepared to have a lightning-fast reaction to what is happening in the market.

Can I Try Trading with Binolla for Free?

Yes, you can. Binolla offers an unlimited demo mode, where you can trade with $10,000 of virtual money. This is a great opportunity to get familiar with the interface, as well as work on your strategies.

For How Long Can I Trade for Free on a Demo Mode?

It is not limited by the platform, but you should keep in mind that the more you trade on a demo account, the more difficult it will be for you to switch to the real money mode in the future. In general, average traders use demos for a week or near.

How Much Should I Invest to Make Money?

It depends on your skills and appetite. You should also think about how much you can afford to lose so that this amount is comfortable for you when trading.