News Trading Strategies: How to Trade Fundamentals

Traders often limit their trading analysis tools to technical research. They prefer to focus on trends, indicators, support, and resistance and completely ignore outside price movers like inflation, changes to interest rates, companies’ earnings releases, etc. While technical analysis is a self-sufficient and independent method that, even taken alone, brings you a lot of useful data about the current price and its prospects, ignoring fundamentals may cost you an arm and a leg when it comes to trading. By reading this article, you will find out more about the news trading strategy and discover its pros and cons.

How to Read Fundamentals

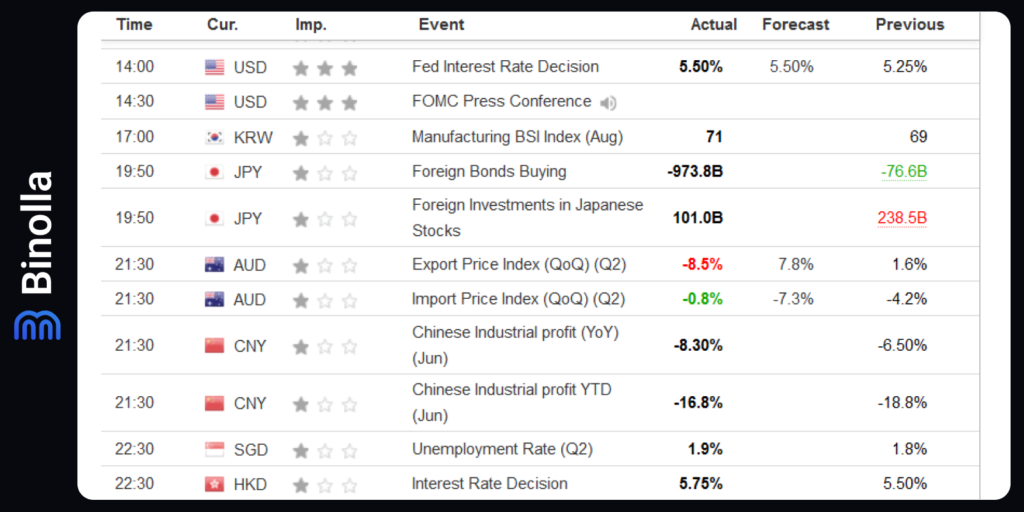

The first and the most important tool that you have at hand when trading news is a macroeconomic calendar. It contains information about the upcoming events as well as some key figures that will be useful to you once you decide to trade news.

The economic calendar provides you with a lot of useful information. First, you can see the exact date and time of a news release. Therefore, you can plan your news trading strategy in advance. When it comes to Forex, for instance, you can also watch which country and currency is affected by a particular data release.

Apart from the abovementioned, macroeconomic calendars provide traders with information about previous readings, forecasts by Bloomberg and other experts, and the current meaning once particular data is released. To start trading using the fundamental analysis, open an account at Binolla.

Key Data Releases to Watch When Trading News

Before describing the main strategies for trading news, it is important to put together the most important data releases and events that may have a serious impact on price fluctuations.

Central Banks Decisions

Those financial institutions regulate monetary policy and have several mandates, including keeping inflation at certain levels, maintaining steady economic growth, supporting employment growth, etc. Central banks use interest rates to control the money supply, and, therefore, they can reach their goals by increasing or decreasing the money flow.

By cutting rates, central banks increase the cash supply, which goes directly to the economy to support its growth. Rates are normally cut when economic growth is slowing down and sliding into recession. The money goes to the economy via commercial banks in the form of loans that, in turn, provide further economic growth. However, there is a flip side, as inflation speeds up in this case.

By hiking rates, central bankers aim at curbing inflation, which goes beyond the set limits. This decision is great to hold prices from further growth, but in return, higher rates hold down economic growth, which means that central bankers are always on guard and double-think before taking any further steps.

Another tool that central banks have at their disposal is a so-called QE, or quantitative easing, when the Fed or other banks buy securities in the open market, which, in turn, provides banks with more liquidity.

Officials Commentaries

Along with interest rate decisions, traders should also pay attention to what central bankers say about further economic growth, inflation, and monetary policy. If you see one of the central bank heads making comments throughout the week, then you can focus on this event and even trade it, as markets may react to it. For instance, if Jerome Powell (current Fed head) says that economic growth is going to slow down while inflation is below the targeted level, you can expect the Fed to cut rates in order to spice up economic growth.

Inflation

The inflation rate is crucial when it comes to its impact on financial markets. Most central banks tend to maintain it at 2-3% y/y. When it goes beyond these limits, central banks hike rates and keep them from going higher, while when inflation is below 2-3%, financial institutions cut rates in order to stimulate demand.

When it comes to trading, inflation data like the consumer price index (CPI) and personal consumption expenditures (PCE) are crucial. If you are using one of those news trading strategies, then you should pay particular attention to these data releases.

Employment

One of the indicators of economic health is employment. The more residents are employed, the better. Therefore, if the unemployment rate meets the central bank’s targets, it is good for currency as the central bankers are going to support steady growth and hold the rates at higher levels.

Trade Balance

This is another important indicator that you should focus on, especially for economies that severely depend on exports, like Japan or Australia. If the trade balance is positive, it means that a country exports more than it imports. This is good for the currency.

Purchase Manager Index (PMI)

Those indicators are crucial as they show economic activities in both industrial and service sectors. PMIs are sometimes used by traders as indicators of future economic growth. If they are above 50, this means that the economy is expanding, while below 50, this index indicates some problems with economic growth.

An Example of How to Trade News

Now that you know more about the key macroeconomic indicators that can be the reason for huge market price movements, it is time to look at how news trading basically works.

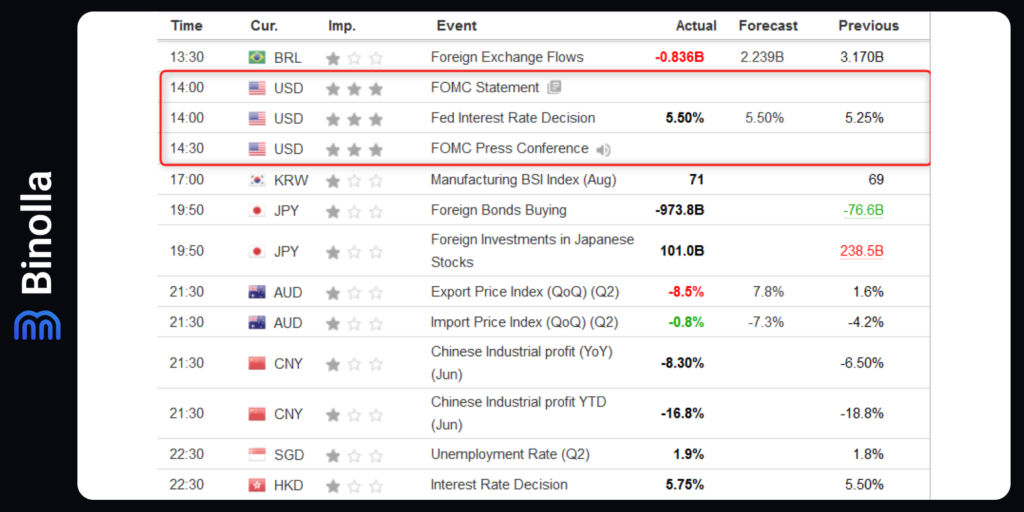

We have taken the FOMC meeting as an example. The Fed has made a decision to hike rates from 5.25% to 5.50% on July 26, 2023. As was already mentioned, hike rates mean less liquidity to markets and lower supply for the currency.

The market reaction to this wasn’t predictable for news traders, as this decision was expected to support USD. However, EUR/USD moved upward instead, which means that USD lost its position against some majors. While for news traders this may be a failure, those who use fundamentals and understand the situation on a larger scale can say that they knew everything in advance.

Inflation in the United States continues to slow down, while economic growth is held by the recent FOMC decisions. Therefore, the Fed does not have much space for further monetary policy hiking, while the Eurozone still struggles with higher inflation rates and is likely to hike rates several times in the future. This means that markets play this situation in advance, knowing that when the Fed is going to stay neutral, the ECB will likely hike rates again.

Anyway, if you were using one of those news trading strategies, you could make money in this particular situation if you joined the uptrend right after the news release.

News Trading Strategies

Now it is time to dive deeper and see what kind of strategies you can use to trade the news. However, some additional parts of the theory should come first. When trading news, traders should keep their eyes on the following things:

- News importance. There are plenty of data releases on economic calendars, but not all of them are worth looking at when you are trying to trade news. Pick only those having two or three stars (or bull heads, depending on how they are outlined in a particular calendar);

- Country/currency. Each news release that you can see in such macroeconomic calendars refers to a certain country and currency. With this in mind, when you use a news trading strategy, you should focus on this particular currency and trade it;

- Readings. Each news item in the macroeconomic calendar has three figures: previous, forecast, and current. Previous forecasts are known in advance, while current forecasts become live once the data is released.

Straight News Trading Strategy

This approach is one of those basic strategies when you are trying to trade macroeconomic news. You need to look through a calendar and pick an event with the maximum importance. Further on, you are also required to watch the figures and figure out whether the forecast is better than the previous reading or not.

If, for instance, you are going to trade inflation data and the CPI rate is going to grow, you can expect the market to react positively to this event, as higher inflation means hawkish moods within the central bank board. Therefore, if the CPI is expected to grow, you can buy a currency pair or a Higher contract when it comes to digital options.

On the other hand, when Bloomberg experts expect the inflation rate to go down (and it is currently below 2-3%), the central bank board is likely to be dovish and think about stimulating inflation and demand in general. Therefore, you can sell a currency pair or buy a Lower contract when it comes to fixed-time contracts.

This basic strategy has a lot of benefits, but when using it you should be careful, as it can lead to losses. In our example above, with the Fed’s new rates and the EUR/USD reaction to this event, you can see that if you were using this exact method, you would lose money. The Fed hiked rates, but the USD went down.

Both-Direction News Trading Strategy

This is one of those classic FX strategies where you need to open two positions in different directions. It should be mentioned that such an approach can be applied to Forex trading and is not relevant to digital options (we will tell you why after its description).

When you use this particular strategy, you don’t need to think about the previous reading and the forecast, as you are going to catch volatility instead of guessing whether the current figure will match or mismatch the forecast.

Assume that you are going to trade US Core PCE data. You can open both Buy and sell orders at the same time and wait until the data is released. Once it happens, you simply watch the direction of the price and close the losing one.

Imagine that the PCE was above expectations and EUR/USD went down as USD was supported by the data release. Therefore, you leave your sell order in place and close a buy one. The idea is to stay in the market until your losses from the buy order are covered by the earnings from the sell order and wait for further profits.

As we have mentioned, this method is not relevant for digital options as your eventual profit for one trade is less than your eventual losses. Even with a 95% contract, you still lose 100% in one of your trades, which makes a 5% loss in total for both deals.

After-Data-Release Strategy

This is another volatility strategy that allows you to join the movement once the data is released. You don’t need to watch the results, as the goal here is to be in time to catch the movement instead of trying to predict the figures. However, you should still keep an eye on the macroeconomic indicators that you trade to avoid a false market reaction.

Say you are going to trade on the US employment change data, which is also known as Non-Farm employment change. Once the indicator is released (below expectations), the price unpredictably goes upwards. You can join this movement by buying a currency pair or a Higher contract.

The trick here is that you should be on guard, as unpredicted movements may lead to losses. Market participants’ first reaction may be irrelevant, and if you join this movement, you may lose.

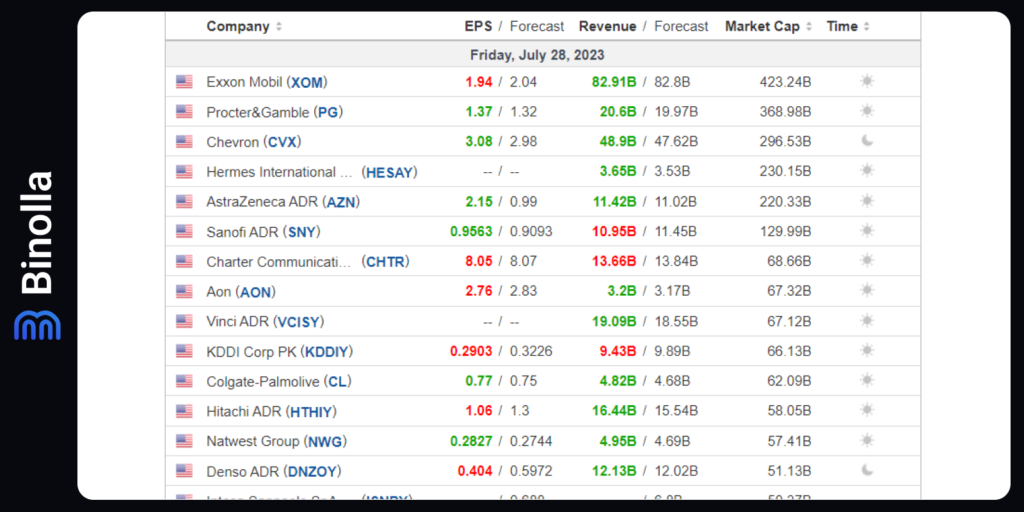

Earnings Data Trading Strategy

If you are trading stocks, you can use a very simple news trading strategy that involves earnings reports. They are released each quarter, meaning you can’t use this strategy frequently. However, you can pick a huge variety of stocks and, therefore, apply such tactics almost every day.

The idea is to buy an asset prior to or right after the release of the report. If earnings are better than forecasted, then you can expect a stock to become more expensive, while if the report is below expectations, the price is likely to plunge.

News Trading Strategies: Pros and Cons

While news trading strategies seem like a great idea to make a lot of money, they have both positive and negative sides. Here are the advantages of using such an approach:

- Important fundamentals may cause significant price movements and fluctuations, allowing you to make huge profits when trading FX CFDs. When it comes to digital options, you can simply profit from strong price movements to make sure you have chosen the right direction;

- For those who are interested in fundamentals, news trading may be a way to know in advance the main trends that can arise from key macroeconomic data releases.

When it comes to disadvantages, they are the following:

- One of the biggest drawbacks of news trading strategies is that sometimes prices may go in both directions and confuse traders. You may think that the uptrend is around the corner, but the price reverses and goes down;

- To use some of the news trading strategies, you should be good in fundamentals and at least understand what they mean and how the market may react to them.

Conclusion

News trading strategies are widely used by traders, but you should be careful with them. They offer a lot of opportunities, but the risks are also high. It is recommended to learn all the fundamentals that you are going to trade before placing your first order. Moreover, you should also use a proper money management approach in order to succeed.

FAQ

What is the Bet News Trading Strategy?

Like with technical analysis strategies, no one method can be called the best in this case. You should try various approaches and find which one suits you best.

What Is the Meaning of News Trading?

News trading is a special method that involves buying or selling assets on the eve or right after the release of key macroeconomic data.

Can I Use News to Trade Different Types of Assets?

Yes, you can. All types of assets are driven by news, which makes this method universal for all financial instruments.