Central Bank Decisions: How They Affect Financial Markets

Like any motorized vehicle that has an engine under the hood that drives it, financial markets have their own drivers that push prices higher or lower. One of the key aspects that often gives birth to significant trends is central bank meetings and decisions. Traders often try to get the most out of these events and even mark them as important in their own trading schedules so as not to miss them. By reading this article, you will discover the effect of the central bank’s decisions on markets and understand the reason for such reactions. Start trading on the Binolla platform after creating an account there.

Contents

- 1 Monetary Policy Basics

- 2 Make use of this information on the Binolla platform

- 3 How Does Monetary Policy Affect Currencies and Stocks?

- 4 How Digital Options Traders Can Use Central Bank’s Decisions Forex in Their Strategies

- 5 Central Banks Decisions and Forex/Stocks Trading

- 6 Trading Central Banks’ Decisions Pitfalls

- 7 Conclusion

- 8 FAQ

Monetary Policy Basics

Before delving deeper into the impacts of central banks on financial markets, it is important to understand the basics of monetary policy. In general, monetary policy is a tool that is used by financial authorities to regulate the total volume of currencies in circulation. The main goal of implementing decisions is to control inflation, employment, and, through them, economic growth.

Each particular central bank is responsible for its own currency. For instance, the Federal Reserve Bank regulates the amount of US dollars in circulation, while the European Central Bank controls the volume of euros.

There are two main types of monetary policy that you should know before trading in financial markets.

Restrictive Monetary Policy

As it comes from the name, this type of monetary policy is implemented by central banks to limit the amount of currency in circulation. Financial authorities raise the benchmark interest rate to implement this strategy.

By doing this, central banks limit the currency supply. Borrowings become more expensive, which, in turn, makes them less attractive. Restrictive monetary policy normally aims at curbing inflation rates while they are above the target levels.

On the other hand, higher interest rates deter economic growth as businesses scale down their operations. Moreover, consumers prefer saving over spending, which cools down retail sales. As a matter of fact, inflation rates go down as well, but at the cost of an economic slowdown.

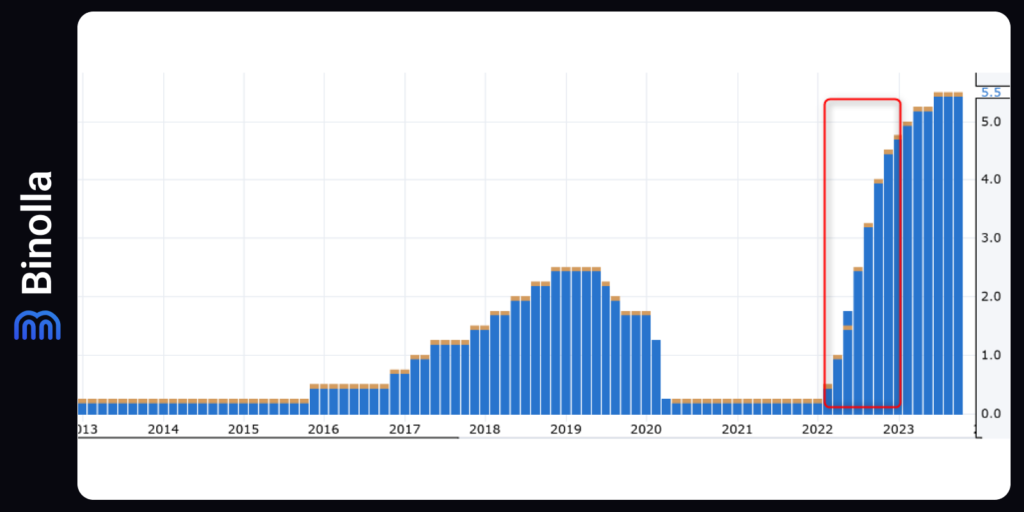

The latest interest rate hikes across major central banks can be taken as examples of restrictive monetary policy. Financial authorities were forced to undertake these measures in response to growing inflation rates in the post-COVID era.

Expansionary Monetary Policy

The idea behind this policy is to add liquidity to markets, which, in turn, supports economic growth. Borrowings become cheaper, which stimulates business activity. Moreover, households are not interested in saving money anymore, as it is deflated by the increasing inflation rate. The result of this policy is an increase in demand, which in turn supports the growth of the gross domestic product (GDP).

However, all these benefits come with a rise in inflation rates. If they are below the targeted levels, central banks may continue their expansionary monetary policy until they see evidence of inflation jumping over the red line. Once this happens, central bankers are likely to change their policy.

Central banks were compelled to cut rates during the COVID-19 pandemic. Restrictive measures that most governments had undertaken led to the freeze of business activities. In order to support economic growth, or at least to prevent it from further falling, financial authorities took unprecedented measures and cut rates to zero or close to this level in a matter of a couple of months.

How Does Monetary Policy Affect Currencies and Stocks?

Now that you know the basics about monetary policies and their types, it is time to move further and watch how a particular decision may affect currencies, stocks, and other assets. Here, it is important to get back to the main principles of price changes that are based on the supply/demand ratio.

When demand rises, the price normally goes higher until the temporary deficit of the product/asset is covered by higher supply. When it comes to restrictive monetary policy, it cuts the supply, which, in turn, leads to increasing demand. Thus, if a central bank decides to hike rates, you can expect a currency to grow.

When it comes to stocks, higher rates are likely to influence them in the opposite direction. Lower liquidity means lower interest on investments. Moreover, restrictive monetary policy leads to lower consumer activity, which, in turn, is likely to cool down sales. Companies’ reports show worse earnings figures, which push shares further down.

Starting in January 2022, Apple stocks had a massive decline. That was the reaction of the stock market to the restrictive monetary policy of the Fed.

The period of rate hikes started in 2022 and ended in 2023. However, even now, the Fed still holds rates at their extreme levels and remains hawkish.

The US dollar index, in turn, had impressive growth in the same period due to FOMC monetary policy decisions.

Lower rates, in turn, cut demand and increase supply, which leads to currency devaluation. The stock market, on the other hand, reacts to this event with a general uptrend. This is due to the fact that more liquidity stimulates demand, companies’ sales are improving, their earnings reports become more attractive for eventual investors, and, more importantly, huge hedge funds and banks have access to cheaper money that they can and often invest in stocks.

The US dollar index plunged starting at the beginning of 2020 and was down until mid-2021. It was due to the fact that the Fed had cut rates to 0 and held them at these levels for so long.

On the other hand, Apple stock was in an uptrend for the whole period of low rates during the COVID-19 pandemic active phase, which was due to the unprecedented volumes of liquidity that were thrown into markets by the central bank.

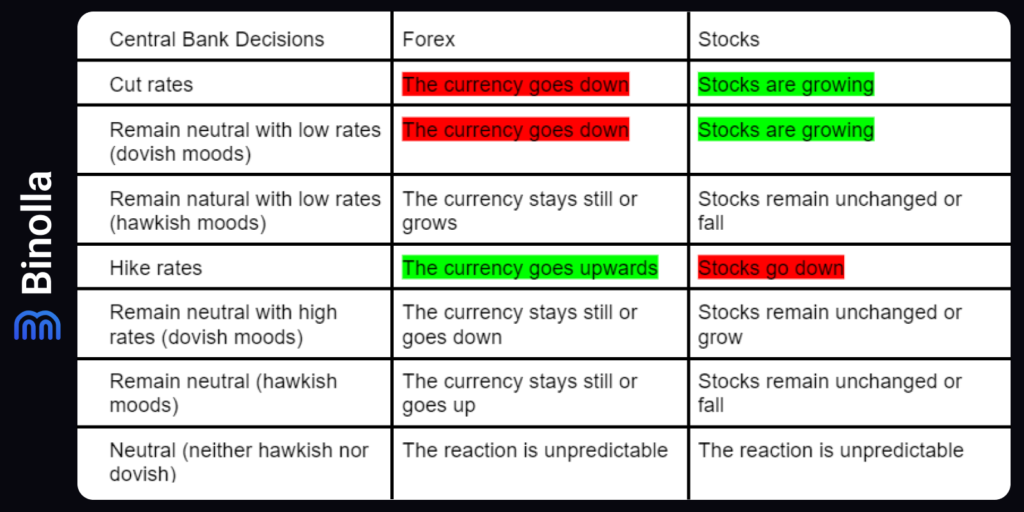

To make it clear, we have prepared a table with possible central bankers’ decisions and the reactions that they may provoke.

How Digital Options Traders Can Use Central Bank’s Decisions Forex in Their Strategies

While fundamental analysis is almost useless when it comes to such short-term trading contracts as digital options, you can still use central banks’ monetary policy decisions in your trading routine. The idea is to be right on time to trade at the moment when an interest rate is announced.

The image above displays how EUR/USD reacted to the Fed’s decision to leave the rates unchanged. The head of the central bank remained neutral, which means that he is ready to maintain rates at the same level for some time but with no further interest rate hikes in the future. If you go back to our table to see the possible reaction, you will see that the reaction to this event may be unpredictable. Therefore, you can use a simple momentum strategy to buy a contract.

In this particular case, you can buy a contract if the price is rising. During such important releases, the market chooses the direction and follows it for a while.

Central Banks Decisions and Forex/Stocks Trading

The example below shows the market reaction to one of the most interesting events in the world of finances when the Fed cut rates from 1.25% to less than 0.25%. What happened next wasn’t predictable if we took this situation separately from what was going on in the entire world at that exact period.

The piquancy of this particular case is that this was the time of serious monetary policy expansion from all major central banks, as it was the time before shutdowns. Therefore, traders and investors picked USD as a safe haven currency (as they always do in times of uncertainty). Therefore, selling EUR/USD instead of buying it was the right decision.

To trade central banks’ decisions when you are dealing with Forex CFDs or stocks, it goes far beyond simply looking at the final rate level. You need to be aware of the general financial and economic conditions both in the world and in a particular region. If a European Central Bank cuts rates, for instance, you should also look at the rates of other central banks, analyze the current economic and financial situation, and keep an eye on what the officials are saying about their further steps.

In the example above, USD was in favor because traders and investors often chose it as an asset to buy during hard times. When the situation stabilized a bit, the interest in this currency lowered, and the EUR managed to start a local uptrend.

Trading Central Banks’ Decisions Pitfalls

While it may seem evident when to buy a particular contract or buy/sell currencies/stocks, central banks’ trading has several pitfalls. We have put together some of the most crucial ones:

- There may be no reaction at all. Even if you were right about a particular decision made by central bankers, there is no guarantee that the market is going to have a strong reaction to it. In some cases, such decisions were expected or known in advance and already included in price;

- The reaction may be unpredictable. As we have demonstrated in one of our examples, the reaction to the interest rates cut by the Fed was the opposite, as there were other important fundamentals to consider;

- You never know for how long a particular central banker’s decision will last. It may be a short-term momentum or, on the opposite, a long-term trend.

Conclusion

Central banks have a serious impact on price fluctuations, whether it is Forex currencies, stocks, metals, or others. Knowing them allows you to keep things clear and understand where the price is likely to go in the future. Even if you are not using news trading strategies or fundamental analysis, this information may be useful to you, whatever financial instruments you are trading.

FAQ

What are central bank decisions?

Central bank decisions are the actions taken by the monetary authorities of a country or region to influence the supply and cost of money and credit in the economy. These actions include setting interest rates, adjusting reserve requirements, conducting open market operations, and providing guidance on future policy.

How do central bank decisions affect Forex?

Central bank decisions affect Forex by influencing the demand and supply of a currency relative to other currencies. For example, if a central bank raises interest rates, it makes its currency more attractive to investors who seek higher returns, thus increasing the demand and value of that currency. Conversely, if a central bank lowers interest rates, it makes its currency less appealing to investors who look for lower costs, thus decreasing the demand and value of that currency.

What are some examples of central bank decisions that have impacted Forex?

Some examples of central bank decisions that have impacted Forex are:

- The European Central Bank’s (ECB) announcement of quantitative easing (QE) in 2015, involved buying large amounts of government bonds and other assets to stimulate the economy and combat deflation. This decision lowered the value of the euro against other major currencies, as it increased the supply of euros and reduced the interest rate differential with other regions.

- The Federal Reserve’s (Fed) decision to taper its QE program in 2013, signaled a gradual reduction of its bond purchases and a possible increase in interest rates in the future. This decision boosted the value of the US dollar against other major currencies, as it decreased the supply of dollars and increased the interest rate differential with other regions.

- The Bank of Japan’s (BoJ) introduction of negative interest rates in 2016 meant that commercial banks had to pay a fee to deposit excess reserves at the central bank. This decision weakened the value of the yen against other major currencies, as it reduced the cost of borrowing yen and encouraged more lending and spending in the economy.

How can traders benefit from central bank decisions?

Traders can benefit from central bank decisions by anticipating how they will affect the exchange rates of different currencies and taking positions accordingly. For example, if a trader expects a central bank to raise interest rates, they can buy that currency and sell another currency with lower interest rates, thus profiting from the appreciation of the former and the depreciation of the latter. Alternatively, if a trader expects a central bank to lower interest rates, they can sell that currency and buy another currency with higher interest rates, thus profiting from the depreciation of the former and the appreciation of the latter.