ECB Meeting and US Inflation Data in Focus: Traders and Investors Are Anticipating the Key Events of This Week

The most important events of this week are the US inflation data and the ECB meeting, which both will take place on Thursday. Moreover, today, the yearly US labor market for NFP will also be revised. Analysts expect the NFP to be 800,000 less than it was previously calculated from April 2024 to March 2025, which may put additional pressure on the US dollar.

When it comes to the inflation data, the annual consumer price index is expected to reach 2.9% in August, which is 0.2% higher than July’s reading. At the same time, 2.9% is still within the Fed’s target range of 2-3%, but the accelerating inflation may make the officials think twice before making any further monetary policy decisions, even if the US labor market demonstrates disastrous figures.

Contents

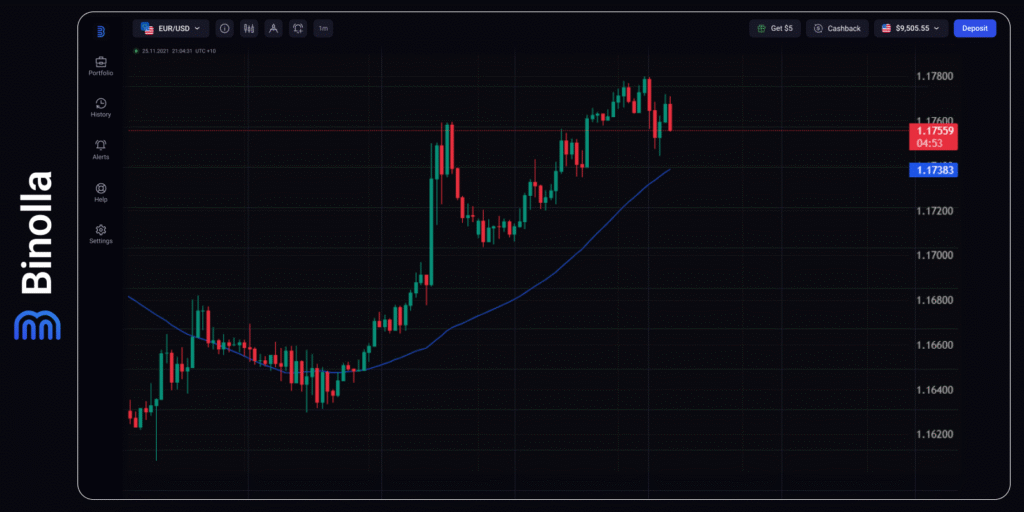

EUR/USD: Euro Benefits from the Upcoming ECB Decision

The European Central Bank is holding the meeting this week, with the market participants expecting no changes in the key rate. Moreover, the ECB is unlikely to change its tone and move to a more dovish stance as the rate is low currently and inflation is elevated.

With this support for the Euro coming from the European Central Bank meeting, the currency pair may develop its uptrend, but market participants should watch closely the outcomes of the US inflation data release and the revision of the NFP data.

From a technical analysis perspective, EUR/USD is trading above the simple moving average of 50, demonstrating a strong upside potential. However, the downside correction to the SMA50 may be a bit longer. Buyings are preferable from 1.1780 targeting 1.1850. On the downside, traders can sell if the NFP and inflation data are higher than expected, from 1.1740 targeting 1.1670.

GBP/USD: The British Pound Makes Some Further Gains

The British pound has gained support on Tuesday and continues to climb higher as the US dollar suffers from the upcoming yearly NFP revision and the expectations of the Fed rate cut that may take place during the meeting in September.

It is expected that the NFP figures will be disappointing, and this may put some more pressure on the US dollar. On the British side, GDP data will be released on Friday. According to expectations, monthly economic growth in the United Kingdom may slow down to 0.0% from 0.4% in July, which may put some pressure on the pound as well. However, the Bank of England is expected to stick to its current wair-and-see approach for longer.

From a technical analysis perspective, the currency pair is trading above the dynamic support level (SMA50), with buyers controlling the market now. Traders can consider long positions above 1.3590, targeting 1.3650-1.3680. On the downside, selling from 1.3550, the SMA50 will move above this level, which will be a great solution.

WTI: Oil Is Getting Support from the OPEC+ Decisions

The meeting on Sunday revealed that the cartel+Russia is ready to increase the output at a slower pace as compared to the September production boost. This has added some additional support to oil, along with the sliding DXY, which is reacting to the anticipation of the rate cut by the Federal Reserve. Moreover, the situation around secondary sanctions against those who buy oil from Russia may stimulate further growth of demand.

The pressure on the US dollar will support WTI, but global trade uncertainty along with expectations of a weaker demand may prevent the energy from developing further uptrend.

On the technical analysis side, WTI is trading slightly above the SMA50, which confirms buyers’ domination in the financial markets. Long positions will be preferable above 62.90 with targets at 64. On the downside, if oil breaks below the SMA50, traders can go short below 62.10, targeting 61.

XAU/USD: Gold Remains Bullish, But a Correction May Occur

The bullish march in gold continues as the precious metal sets new highs on Tuesday. However, while the upside remains the top priority, the uptrend is almost exhausted, which means that some correction may be needed to refresh bullish pressure.

Gold is benefiting from the DXY weakness as the US dollar suffers from expectations of the Fed rate cut. The question now is whether the Federal Reserve will cut rates by 25 or 50 bps the next week.

From the technical analysis perspective, Gold is trading above the moving average, which is the dynamic support now, showing bullish dominance. Long positions will be relevant from 3,660, targeting 3,700. Sellers can engage approximately 3,620, targeting 3,580.