Will the Labor Market Data Support USD Again?

The upcoming US labor market data is likely to provide insight into the future monetary policy as the FOMC meeting is approaching. While most traders and investors expect the Fed to cut rates by 25 bps in September, some expect the Federal Reserve to be more proactive and cut rates by 50 bps in the first month of autumn. Moreover, there are expectations that the Fed is likely to make easing steps more than once this year.

Inflation is slowing down, which is another confirmation that Jerome Powell and other voting members are likely to reconsider the monetary policy in the US. Moreover, according to the latest Fed official’s comments, the Federal Reserve does not want the labor market to cool down.

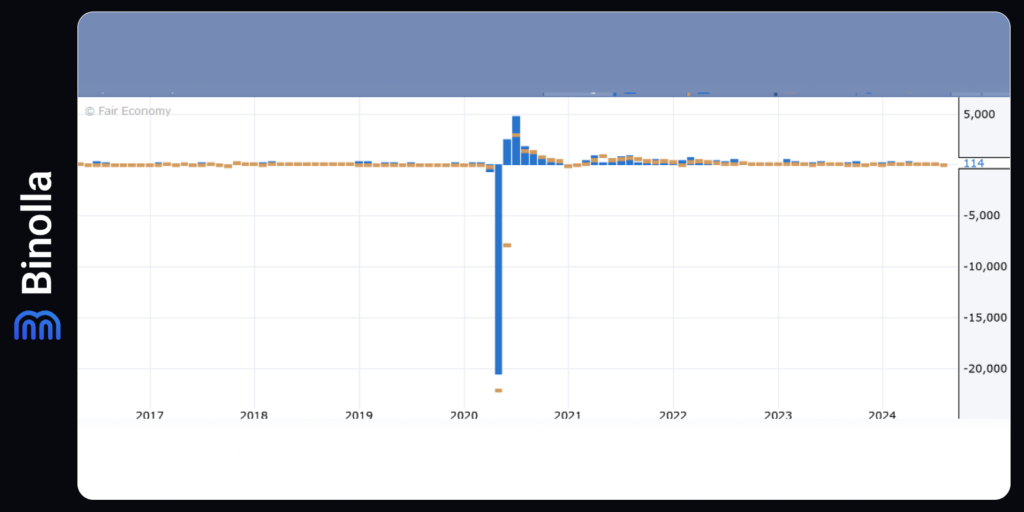

Friday’s report is expected to demonstrate payrolls to increase by 165K, which is above 114K that the US labor showed in July. As for the unemployment rate, it is expected to decrease from 4.3% in July to 4.2% in August.

When it comes to the number of vacancies per unemployed worker, this ratio stands at 1.2, which is close to pre-pandemic levels. In 2022, this ratio was 2 to 1.

Contents

The Bank of Canada Considers More Cutting Rates in 2025

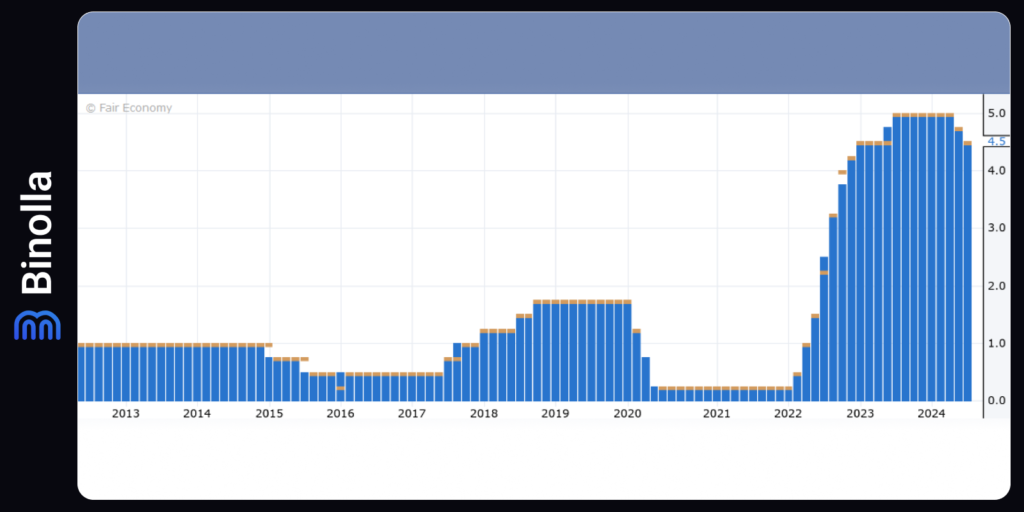

The BoC officials are likely to make a third round of interest rate cuts during the meeting that will take place this week. While the inflation is cooling down, the Bank of Canada has more opportunities when it comes to monetary policy.

The BoC governor Tiff Macklem Is expected to announce another cut this week as the benchmark is expected to be at 4.25%. Economists also expect more and deeper cuts in 2025 and forecast the Bank of Canada to stop at approximately 3%. When it comes to 2026, the interest rate is expected to be settled at 2.75%.

According to the latest outlook, financial markets expect a gradual monetary policy normalization by the BoC. The monetary policy easing that is planned for 2025 goes in confluence with the economic growth of 1.7%, which is expected over the next year. The Bank of Canada expects inflation not to surpass 2% yearly and slow down to this level from 2.5% yearly in 2024.

These shifts in outlooks come amid the changing bets for the Fed as the Federal Reserve is expected to join this expansionary trend. The US labor market data affected bets on the BoC overnight cuts.

Both economies are intertwined, which means that if one country makes some steps, the other will definitely react to them. With the Fed set to cut rates, Macklem has no worries about normalizing the monetary policy.

The Rising Inflation and Weak GDP Make the RBA’s Life Even Harder

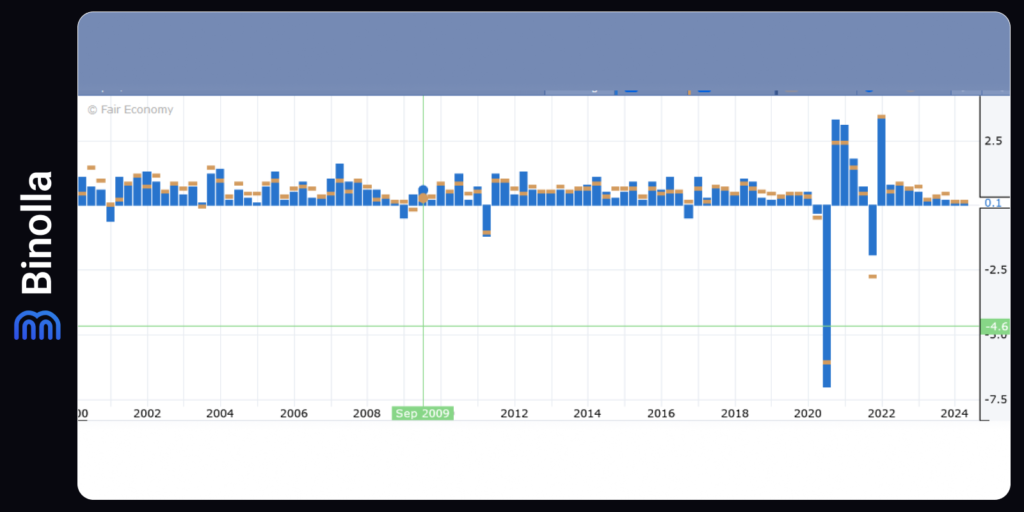

While the market’s focus is on the US jobs data that will be released on Friday, the Australian GDP is also among the key releases that are worth attention this week. According to forecasts, the GDP dynamics are likely to range from 0.1% to 0.2% q/q, which means that the annual economic growth in Australia is expected to dip below 1% and reach 0.8-0.9%, which is a sign of economic stagnation.

According to some experts, the Australian economy will face weak consumer spending, flat swelling construction, and lower business investment, which net exports are expected to be strong. This may lead to a continuation of recession.

The RBA forecasts a 0.9% economic growth, which is far below the forecasted growth for 2025 (2.6%). According to NAB economists, the quarter growth is likely to be 0.1%, while annual growth will hardly reach 0.8%. This can be the weakest annual growth since the COVID lockdown.

However, according to NAB, the GRP growth is likely to improve in the second half of the year. In particular, NAB experts acknowledge the potential economic boost from the income tax cuts. The RBA head Bullock will deliver a speech and touch on the economic outlook on Thursday.

Along with the GDP data, there are several economic indicators of minor importance that will be delivered this week, including sales, wages, as well as company profits. Moreover, traders can pay attention to finance figures, trade and housing.