Will the US Dollar Plunge After Wednesday’s Fed Event?

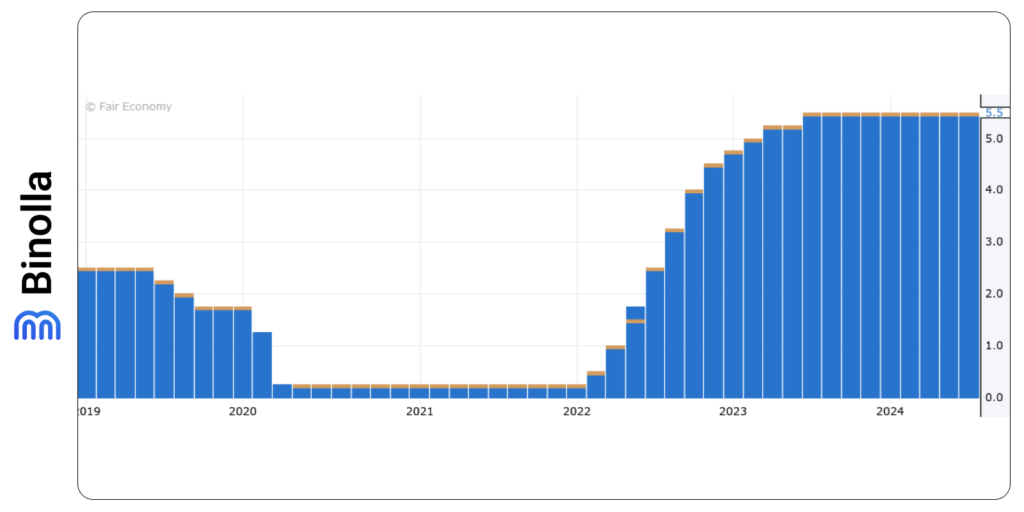

The US dollar is under pressure these days due to the upcoming Fed meeting. According to preliminary forecasts, the Federal Open Market Committee is likely to cut rates by 25 basic points. However, some economists expect the Fed to make even more aggressive steps and cut rates by 50 bps. The event will take place on Wednesday, September 28, and is likely to have a significant impact on financial markets.

The US Dollar index has lost over 5% since June 2024 while gold is around its all-time highs currently at 2,585 an ounce. Market participants expect the Fed to cut rates despite higher-than-expected US PPI data for August that was released last week. When it comes to jobless claims, they held steady last week, which is below July’s peak.

The probability of the Fed starting the cutting cycle by a 50 bps move is 59% currently, which is higher than in it was August. In our view, the latest inflation data release demonstrated positive tendencies and supported the Fed in its decision to begin the expansionary cycle.

According to Jerome Powell, the idea and the strategy of the Fed is clear. However, the timing and place of rate cuts will be adjusted by the inflation data. Currently, there are no barriers for the Federal Reserve system to make the first move.

In this situation, the US dollar may lose ground in the upcoming months as more rate cuts are expected. The growing US federal deficit will be a headwind for the greenback over the long term. Moreover, other major central banks are expected to cut rates less aggressively, which is likely to be another factor that weighs over the US dollar.

With all the above in view, gold’s rally is likely to continue. The precious metals have gained over 24% this year and according to our forecasts, the rally still has some space to go on. Gold-backed ETFs have shown an impressive growth in August and marked a four-month uptrend.

When it comes to cash, investment-grade bonds as well as diversified fixed-income portfolios are among the most attractive assets to watch currently.

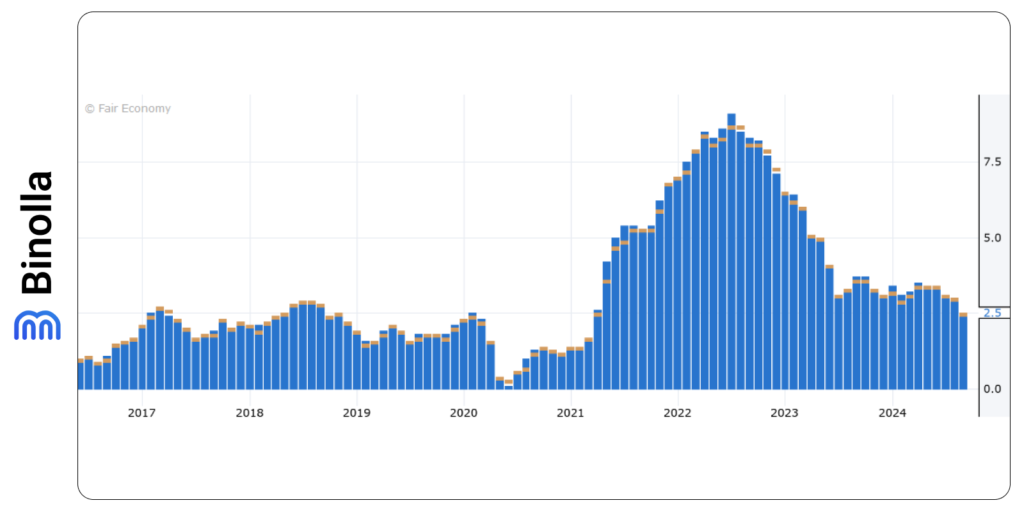

The Bank of England is Likely to Leave the Monetary Policy Unchanged

Another important event to watch this week is the BoE meeting that will take place on Thursday. According to forecasts, the Bank of England is unlikely to make any changes and the rate is expected to stay at 5.00%.

The Bank of England is expected to make no changes in the monetary policy due to persistent inflation, especially in services. The elevated wage growth will also be one of the factors influencing the steering committee’s decision.

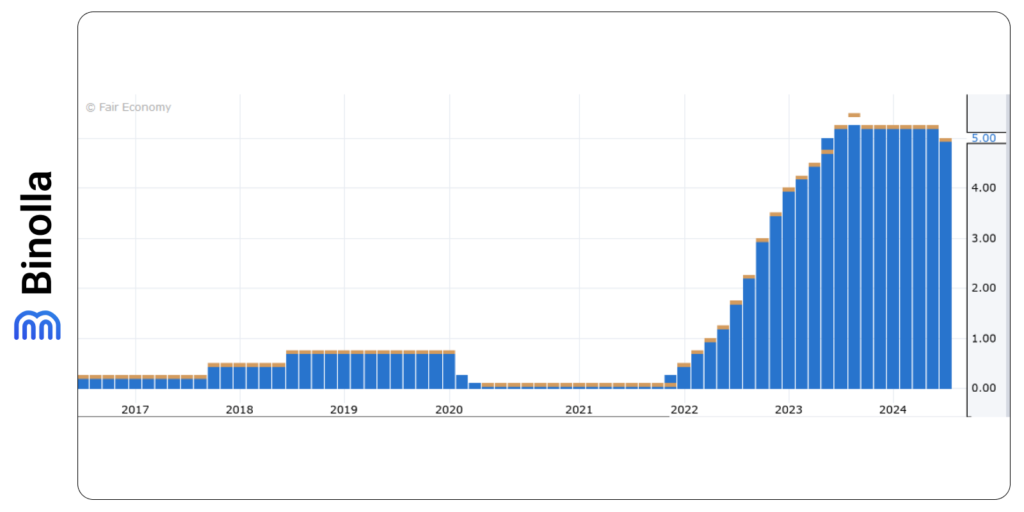

Moreover, the Bank of England is likely to announce another quantitive tightening and reduce its gilt holdings by 100 million GBP in the next twelve months.

While no one expects the BoE to cut rates during the decision announcement on Thursday, the votes are likely to be split. Two members are expected to vote for further expansionary steps, while seven will defend the current position. Therefore, the majority is expected to outweigh the minority and the rates will remain unchanged.

The inflation data in the United Kingdom is expected to show a 2.2% yearly growth, but core inflation is able to rebound to 3.6% due to the rise in services prices. A slight cooling seen this year may end and the inflationary pressure may be among the key concerns for the Bank of England.

Another important thing to mention here is the wage growth, which is now 4% and remains higher than in the pre-pandemic period. High wage growth keeps inflation higher as well.

The upcoming meeting will bring no macroeconomic projections from the BoE. The next major reassessment will take place in the meeting that will take place in November. The forecasts that will be made during this event may open the door for more aggressive expansionary steps by the Bank of England.

When it comes to quantitive tightening, the Bank of England is expected to reduce its gilt holdings by 100 billion GBP during the upcoming meeting. It should be mentioned that the BoE hDiscover the latest forecasts about the upcoming Fed meeting and its results. Find out more about how markets see the further monetary policy steps in the US and the UK. Explore the key macroeconomic data and its influence on interest rates.

as already trimmed its sheet last year by 100 billion GBP. The question is whether it is able to maintain this policy this year.

If the central bank decides to stick to this policy, it would have to scale back gilt sales from 50 billion to 13 billion GBP yearly as 87 billion GBP are already set to mature over the upcoming twelve months. Reducing the volume may ease some of the burdens and leave the BoE members some more room to maneuver before the Autumn Statement that will take place in November.

According to the current market expectations, the Bank of England is likely to make two more rate cuts this year in November and December. Moreover, starting in November, the BoE is expected to cut rates by at least 25 bps until June 2025 when the rate will reach 3.5%.

When it comes to a broader economic outlook, the UK economy is expected to demonstrate a moderate growth of 1.1% in 2024. The inflation is likely to be 2.6%, which is close to the BoE target. The environment, which is characterized by stable economic growth and moderate inflation speed supports expectations about further expansionary steps by the Bank of England.