US Jobs Data and Eurozone’s Inflation Are in Focus This Week

The latest policy meetings in March underscored June as the probable starting point for rate cuts across most central banks, yet uncertainties persist regarding the sustainability of inflation’s downward trend, particularly in the United States.

Despite the Federal Open Market Committee (FOMC) retaining its forecast of three rate reductions this year, hesitancy surrounds a precise timeline, as US inflation hovers around 3.0% amidst a tight labor market.

The dilemma lies in the potential repercussions of preemptive rate cuts on inflationary pressures, posing credibility risks for the Fed, while markets eagerly anticipate a soft landing scenario to sustain risk appetite, highlighting the delicate balance required in incoming data to avoid disrupting the Wall Street rally and potentially strengthening the US dollar.

Is the US job market genuinely displaying signs of a cooldown?

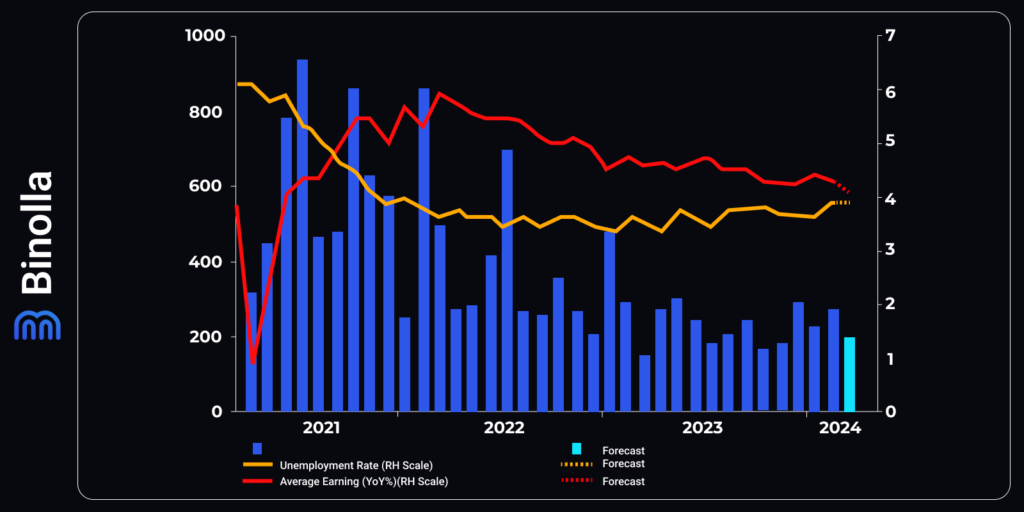

Undoubtedly, there has been a gradual cooling in the labor sector, a pace that has kept the Federal Reserve vigilant against overheating risks. The deceleration became more pronounced in February, marked by a slight uptick in the unemployment rate to 3.9%, coupled with a moderation in wage growth to 4.3% year-on-year.

However, job creation has remained sturdy, with nonfarm payrolls expanding by 275k. Projections for March hint at the addition of 198k new jobs, maintaining the unemployment rate at 3.9%, while average hourly earnings growth is expected to have eased to 4.1% year-on-year.

Ahead of Friday’s data release, attention will be on the ISM Purchasing Managers’ Index (PMI), with the manufacturing PMI scheduled for Monday and the services PMI on Wednesday. While the former is anticipated to exhibit marginal improvement in March, the latter is forecasted to have declined. Other notable releases include factory orders and JOLTS job openings on Tuesday, followed by the ADP employment report on Wednesday.

Should the figures present a generally positive outlook, especially with a robust Non-Farm Payrolls (NFP) print, it could mitigate expectations for rate cuts, potentially strengthening the dollar further.

Eurozone CPI in Focus as Prospects of June Rate Cut Intensify

While the Federal Reserve grapples with concerns over inflation surpassing its 2% target, the European Central Bank finds itself in a slightly more favorable position. Headline CPI dipped to 2.6% in February and is projected to decrease further to 2.5% in March. Meanwhile, Core CPI, which excludes volatile components such as food, energy, alcohol, and tobacco prices, is anticipated to see a slight dip to 3.0%.

Recent remarks from ECB policymakers have overwhelmingly favored a rate cut at the June meeting. Should there be a downside surprise in the CPI figures, it would likely strengthen the case for such a move, putting pressure on the euro. Conversely, stronger-than-expected readings could dampen the likelihood of a June cut.

Nevertheless, any potential uptick in the euro due to robust data is expected to be modest and short-lived. This is because a single month’s data is unlikely to significantly alter market expectations, particularly given the prevailing consensus within the ECB in favor of a summer rate cut.

Beyond CPI figures, upcoming data releases from the Eurozone include the bloc’s unemployment rate on Wednesday, followed by producer prices on Thursday. The week will conclude with German industrial orders and French industrial production data on Friday.

Canadian Jobs Data May Not Rattle the Loonie

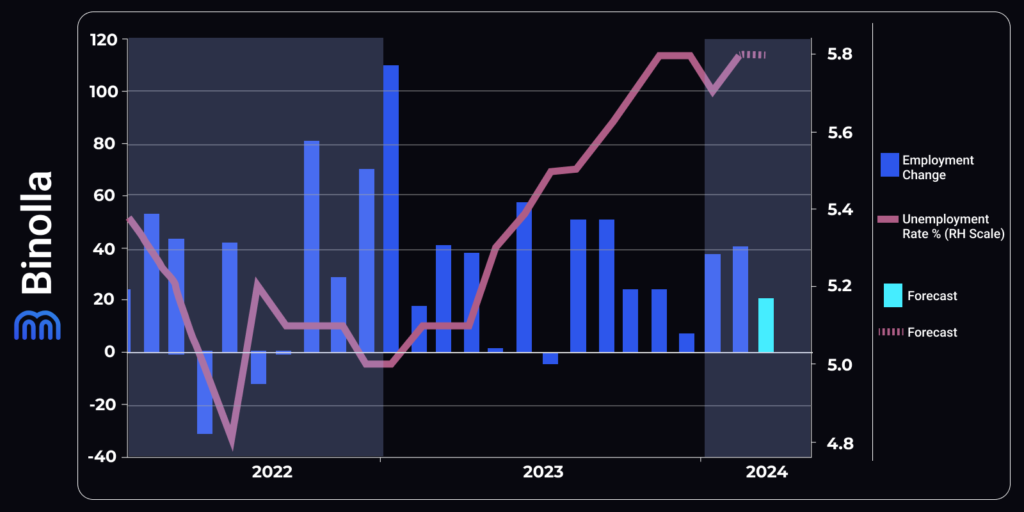

Upcoming employment statistics for March, set to be unveiled alongside the Ivey PMI on Friday, will take center stage in Canada. The Bank of Canada is poised to embark on its easing cycle in June, a move further solidified by a sharper-than-anticipated decline in inflation in February, dipping below the 3.0% mark. Moreover, the labor market has displayed signs of deceleration in recent months, reflected in the uptick of the jobless rate to 5.8%.

It’s anticipated that employment saw a modest uptick of around 20,000 jobs in March. However, this incremental change is unlikely to significantly sway the odds of a rate cut, barring a notable deviation from expectations.

Throughout 2024, the Canadian dollar has maintained a gentle downward trajectory against the US dollar, largely influenced by robust US economic data. Consequently, market reactions on Friday may lean more towards dynamics surrounding the US dollar, especially with the concurrent release of the Non-Farm Payrolls (NFP) report.

Global Financial Markets Overview

Gold Surges to New Heights Amid Holiday Lull

In a display of its enduring status as a safe haven asset, gold soared to unprecedented levels on Monday, hitting a pinnacle of $2,265 per ounce. This surge occurred within an environment of subdued trading activity, as much of Europe observed a holiday, resulting in thin market liquidity.

The precious metal has already seen a remarkable ascent of over 9% since the beginning of the year. This surge is underpinned by a variety of factors, including direct acquisitions by central banks seeking to diversify their reserves, optimism surrounding the prospect of cooling inflation leading to lower interest rates, and sustained retail demand from Chinese investors seeking a hedge against uncertainty.

What’s particularly noteworthy about this gold rally is its occurrence despite a generally robust US dollar and rising yields throughout the year. Traditionally, such conditions would be unfavorable for gold, which is dollar-denominated and yields no interest. The continued ascent of gold under these circumstances suggests a genuine underlying demand rather than a mere response to financial market volatility.

Looking ahead, the outlook for gold remains favorable. Central bank acquisitions signal a geopolitical landscape fraught with instability, coupled with China’s efforts to reduce dependence on the US dollar. This could translate into a prolonged period of heightened gold demand. Moreover, gold may continue to find support from declining interest rates, especially if the US economy shows signs of slowing down.

Yen Stands Steady Close to Its Three-Decade Low

Elsewhere in the currency markets, trading activity remains subdued with much of Europe on holiday. The yen, in particular, has stabilized near a three-decade low against the dollar, with trading range-bound between 151.00 and 152.00. While repeated warnings of FX intervention have deterred further yen depreciation, there’s little rush among traders to buy into the currency.

The upcoming week promises significant developments, particularly for the US dollar, with key data releases such as the ISM manufacturing survey and the highly anticipated nonfarm payrolls report on Friday, which will likely influence expectations regarding future Fed interest rate decisions.

EUR/USD Struggles to Recover

On Monday, the EUR/USD pair tumbled to 1.0730, marking its lowest level since mid-February. The surge of the US Dollar ensued as Wall Street opened, driven by a dip in stocks alongside robust United States (US) data, indicating the resilience of the domestic economy. Federal Reserve (Fed) Chairman Jerome Powell reiterated last Friday that the central bank remains unhurried in adjusting interest rates, citing persistent inflation and economic strength.

Despite hawkish remarks from European Central Bank (ECB) officials, the Euro failed to find support. Austrian Central Bank Governor Robert Holzmann suggested on Sunday that the ECB might move to lower interest rates before the US Fed. Holzmann emphasized that the timing of such a move would hinge largely on wage and price developments by June.

Turning to data, the US S&P Global Manufacturing PMI for March fell short at 51.9, below the anticipated 52.5. However, the ISM Manufacturing PMI pleasantly surprised by rebounding to 50.3 in the same period after contracting for 16 consecutive months.

Looking ahead, Germany is slated to release the preliminary estimate of the March Harmonized Index of Consumer Prices (HICP) on Tuesday, expected to come in at 2.4% year-on-year. Concurrently, the US will unveil February Factory Orders and JOLTS Job Openings data. Additionally, several Fed officials are scheduled to speak during the American afternoon, likely impacting market sentiment.

The Stock Market Is Ready to Resume Its Uptrend

On the equities front, Wall Street is poised to resume trading on a positive note, with futures indicating the S&P 500 is set to open at a fresh record high. Encouraging data from China, including a return to expansion in the manufacturing sector, has bolstered market sentiment, lifting not only stocks but also currencies like the Australian dollar sensitive to developments in China.

Cryptocurrencies Are Poised to Further Growth

Last week unfolded rather tranquilly for cryptocurrency prices, with Bitcoin striving to recover from its recent dip from all-time highs. Once again, flows into spot Bitcoin ETFs emerged as the primary catalyst behind this bounce-back, with the market displaying a penchant for buying the dip as Bitcoin prices approached the psychological barrier of $60,000.

Bitcoin and Ethereum, the two major cryptocurrencies, have been moving in tandem since the start of the year, demonstrating robust gains and outperforming traditional markets. Specifically, Bitcoin is poised to conclude the quarter with a remarkable 60% surge, while Ethereum is anticipated to register a 55% increase over the same period. Looking ahead into 2024, significant developments are anticipated for both digital assets.

Bitcoin traders are closely monitoring the upcoming halving scheduled for mid-April, while the Federal Reserve’s interest rate reduction campaign is anticipated to serve as a bullish driver for the broader crypto space. On the other hand, Ethereum’s outlook appears more nuanced, with bullish trends in Bitcoin potentially exerting upward pressure, while regulatory hurdles facing its spot-ETF approval seem to be capping its upside potential.

Turning to market events from last Friday, investor attention was drawn to the February PCE report, the Federal Reserve’s preferred gauge of inflation. Although financial markets were closed for the Good Friday holiday, any surprises in the data could have spurred significant movements in crypto assets, which trade 24/7 throughout the week. However, Bitcoin remained relatively stable in the aftermath of the PCE release, as the data closely aligned with expectations.

Furthermore, last Friday marked a significant development as Sam Bankman-Fried was sentenced to 25 years in prison for the collapse of FTX. This event represents a pivotal moment for the crypto industry and potentially marks the start of a more assertive bear market, particularly considering FTX’s status as the second-largest crypto exchange at the time of its collapse. As the industry navigates through such trials, coupled with the wave of Wall Street adoption through Bitcoin ETFs, it signals a new chapter where scandals and frauds are relegated to the past, ushering in a new era of legitimacy and growth for the crypto industry.