Underlying Asset

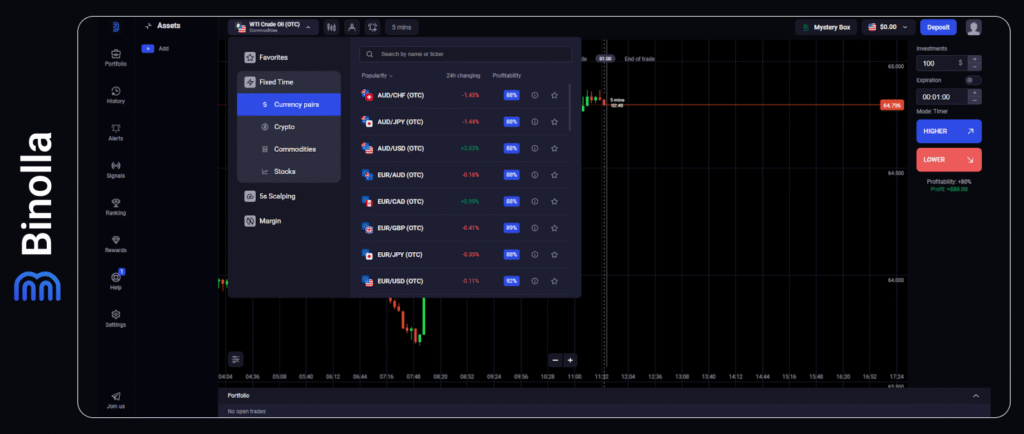

An underlying asset in digital options trading stands for a currency pair, commodity, cryptocurrency, stocks, or any other financial instrument that acts as an underlying asset in a contract (Higher or Lower). When buying a specific digital contract for an asset, a trader tries to predict whether its price will rise or fall at the moment of expiration. The main types of assets in trading include:

- Forex currencies (EUR/USD, GBP/JPY, BRL/USD, and others). Forex is among the most liquid markets where currencies are traded against one another. With trillions of dollars of liquidity, you can expect that all your positions will match without any downgrade in price. Volatility in Forex presents an opportunity for all traders, whether they prefer calm or turbulent markets. Forex currencies are available for trading 24/5, which means that you can find a comfortable session for placing trades.

- Commodities (Crude oil, Gold, Silver). These are physical assets that are traded in global markets via exchanges. Apart from reacting to macroeconomic news, they stand out for their geopolitical sensitivity. Commodities are also known for their long and sustainable trends.

- Stocks and indices (Tesla, NASDAQ, S&P500, NVidia). These are individual company shares and aggregated indices showing the wealth of whole sectors. When trading stocks, market participants should pay attention to company news and reports as well as macroeconomic indicators.

- Cryptocurrencies (Bitcoin, Ethereum, Litecoin). Based on blockchain technology, cryptocurrencies are traded 24/7 and offer high volatility and relatively high liquidity.

When trading with Binolla, you can choose between buying assets that are traded on major exchanges and OTC, which stands for over-the-counter assets. The latter is traded outside market hours and on centralized exchanges. With this option, Binolla clients can have access to financial markets 24/7, even on weekends and during national holidays when all exchanges and banks are closed.

Quotes in OTC trading are provided by special liquidity providers who aggregate trades that are made when the major markets are closed. By using OTC quotes, traders have a unique opportunity to continue their trading activities at any moment.