Trading with Cashback and Bonuses: Main Features and Benefits

Cashback in plain words is when you get money back for some spending. Online and offline stores, for instance, remunerate their customers with a percentage of their buying. When it comes to digital options, cashback has the same meaning. Traders can get a percentage of their spending or losses back. A deposit cashback, for instance, allows you to get back some amount that you spend to top up your balance.

Trading with cashback may be extremely beneficial even if your strategy is far from being perfect. Before making the final decision, check the calculations that we have made. By comparing various situations, you will be able to conclude how much to deposit. Read this article to learn more about how to calculate profits with or without cashback as well as discover the main parameters that we include in the estimates. Register on the Binolla platform to claim a cashback.

Parameters to Be Used in Calculations

To conduct calculations on whether to use cashback or not, we have added several parameters. We are going to consider all of them in the following paragraphs of this article.

Deposit

We always consider three deposit variants in this article. The first is $200, which is the average deposit amount traders make at Binolla. Then, we consider $500 to show how much you can get by depositing a bit higher. Finally, we use a $1,000 deposit in our calculations as the maximum cashback at Binolla is $1,000. Therefore, if you want to get the most out of it, you should deposit not less than $1,000. Topping up your balance with a higher amount may not be reasonable either.

Probabilities

Another variable that we use in our calculations is probabilities. When a trader uses no strategies and trades randomly, their probability of successful trading is about 50%. By applying simple methods, a trader can increase this percentage to 51% and higher. We consider probabilities until 60% to show readers how their outcomes may change and how they can perform with or without cashback. Traders can reach this probability if they use strategies, especially if you are reading the Binolla blog.

Investment Amount

The investment amount is a sum that a trader uses each time they open a trade. According to classic money management rules, a trader should put at risk no more than 1-5% of their current balance.

We used a standard amount of $10 that most traders invest in a single trade when they buy digital options contracts. This sum meets the risk parameters and is suitable for most market participants.

Contract Profitability

The average profitability of digital options contracts is between 80% and 95%. We use an average meaning of 90% in our calculations. To estimate your eventual profits with this profitability, you should use the following formula:

For instance, if your investment amount is $10 and the contract profitability is 90%, you will receive $19 where $9 is your profit and $10 is your investment amount.

Number of Trades

The trading results variable was introduced to estimate the outcomes of trades. To calculate this parameter, we have used the following formula:

If your deposit amount is $200, for instance, with an investment amount of $10, 50% probabilities, and 90% profitability, you can open 20 trades in total with the following result:

($200/$10)*$10*0.5*1.90=$190

Therefore, after 20 trades with the above-mentioned parameters, your trading results will be negative as you lose $10. However, you still have $190 on your balance, and in the next round, you can place 19 trades with $10 of investment each. The same operations are repeated until either a trader depletes their balance or completes the turnover requirement.

Turnover

To receive cashback, traders should meet a certain turnover, which is calculated by the following formula:

Deposit Amount*x, where “x” is a number set by the brokerage company

For instance, if a trader deposits $200 and the turnover at the brokerage company is x50, then this trader is required to make $200*50=$10,000.

Turnover Balance

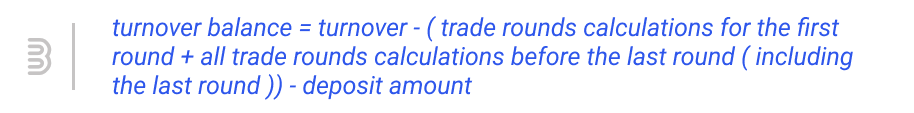

Unlike the turnover variable, this one is used by us to calculate the turnover a trader makes in a series of trades. The formula we applied looks like the following:

The result of such calculations will show the turnover that a trader has to make in order to complete the requirements. With each new round of trades, this figure will decrease, which means that a new amount is added to the turnover balance and the difference between the latter and the turnover itself becomes smaller.

For a $10,000 turnover and the minimum deposit of $200, the calculations will be the following:

$10,000-($190 (the result of the first round) + $180.5 (the result of the second round)) – $200 = $9,429.5

As new rounds are added, the turnover balance will decrease. Once it reaches $0, it means that the turnover set by the brokerage company is completed by the trader.

Profit

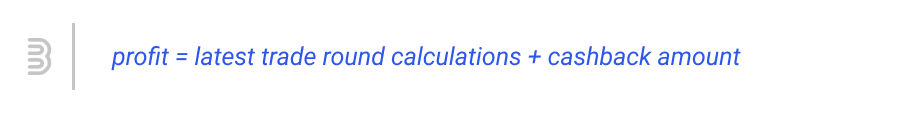

This variable is introduced to show profits that a trader makes with various probabilities. Moreover, it allows readers to see the difference between profits made with and without cashback. To calculate this parameter is equal to the results of the latest Trade Round calculations and shows how much money a trader has at the end of a series of trades. The formula for profit calculations is the following:

For instance, if your latest Trade Round calculations are $190 and your cashback amount is $200, then, your Profit will be calculated as

$190 + $200 = $390

Where $190 is a current trader’s balance (which is $10 minus the initial deposit), $200 is the initial deposit itself and $390 is the total profit.

ROI

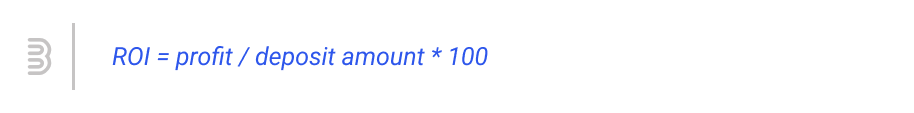

The return on investment is calculated in the following way:

If you a trader have deposited $200, for example, and their profit is $600, then the ROI is calculated as $600/$200*100 = 300%

Trading with a 50% Probability

Now that you know all the variables that can be used to conduct calculations, it is time to delve into estimations themselves. First, let’s watch how a trader can perform without cashback with a 50% probability. For example, the first calculation will look like the following:

($200/$10)*$10*0.50*1.90 = $190. After receiving this result, we continue calculations. However, this time we take $190 instead of $200 (as after 20 trades with $200 only $190 is left of the balance): ($190/10)*10*0.50*1.90 = $180.5. Each time a new series of calculations is made, we pay attention to the turnover balance, which should reach 0 to meet the turnover requirements.

| Cashback | Profit | ROI | Turnover | Turnover balance | Deposit | Probabilities | Investment amount | Contract Profitability |

| 0 | 0 | 0.14% | 10,000 | 6017 | 200 | 50% | 10 | 90% |

| 0 | 0 | 0.14% | 25,000 | 15043 | 500 | 50% | 10 | 90% |

| 0 | 0 | 0.14% | 50,000 | 30087 | 1,000 | 50% | 10 | 90% |

In the table above we take three types of initial deposits – $200, $500, and $1,000. With a 50% probability of positive results, a trader will gradually lose their money to finally hit $0 (or $1 if the deposits are $500 and $1,000). In all cases, a trader can’t continue trading with the same parameters as their balance is not enough to conclude the next deal.

If we take the same situation, but with 100% cashback, the results will be similar. A trader fails to meet the turnover requirements (you can see this information in the Turnover balance column of the table). Therefore, even if a trader claims cashback, they won’t meet the turnover requirements and, thus, they won’t receive cashback.

Key Takeaways from This Example

Regardless of the initial deposit, a trader can’t meet the turnover requirements with a 50% probability. According to our calculations, the balance will be 0 before the turnover requirements are met. Moreover, with these particular conditions, you won’t be able to receive cashback due to the reason that the turnover requirements are not met.

This was the case when trades were opened randomly. However, if you apply some technical analysis tools or use Binolla analytics, you can tip the balance. To change the situation, a trader needs to improve the probability by increasing it to at least 52%. Even a basic strategy will be enough to perform such changes.

Trading with a 52% Profitability

Things will change when you manage to increase the probability to 52%. We have used the same numbers as parameters. In particular, we consider three types of deposits ($200, $500, and $1,000), 1.90 as contract profitability and $10 as the investment amount for each three initial deposits. Here is what the results look like.

| Cashback | Profit | ROI | Turnover | Turnover balance | Deposit | Probabilities | Investment amount | Contract Profitability |

| 0 | 81 | 40.44% | 10,000 | -8.2 | 200 | 52% | 10 | 90% |

| 0 | 202 | 40.44% | 25,000 | -20.4 | 500 | 52% | 10 | 90% |

| 0 | 404 | 40.44% | 50,000 | -40.8 | 1,000 | 52% | 10 | 90% |

The table above shows calculations without cashback. As you can see, the turnover balance is slightly negative, which means that after a series of trades, a trader managed to meet the turnover. However, with a 52% profitability, your profit is still negative. If a trader deposits $200, for instance, once they meet the turnover requirements, they have only $81 left on their balance. For those who deposited $1,000, losses will be even heavier as they will have only $404 on their balances by the moment they meet the requirements. When it comes to ROI, it is negative as you will get only 40% of your investment amount. According to calculations, your losses will be slightly less than 60%.

Now let’s change the situation and add cashback to the table.

| Cashback | Profit | ROI | Turnover | Turnover balance | Deposit | Probabilities | Investment amount | Contract Profitability |

| 200 | 281 | 140.44% | 10,000 | -8.2 | 200 | 52% | 10 | 90% |

| 500 | 702 | 140.44% | 25,000 | -20.4 | 500 | 52% | 10 | 90% |

| 1,000 | 1,404 | 140.44% | 50,000 | -40.8 | 1,000 | 52% | 10 | 90% |

As you can see, everything looks totally different. A trader who deposited $200 and received a $200 cashback will have $81 as a net profit ($200 (initial deposit) + $200 (cashback) – $119 (total losses when making a turnover) = $81). Now you can withdraw the whole amount ($281, as cashback is withdrawable after you meet turnover requirements) or use it to continue trading.

With $500 as the initial deposit, a trader shows even better performance when it comes to cashback, as instead of $202 (which is what is left from $500 after a trader meets the turnover requirements), they receive $702 which is fully withdrawable.

The most beneficial case is when a trader deposits $1,000 and after making a $50,000 turnover, they receive $1,404 in total ($404+$1,000). Therefore, a trader turns net losses into net profits with cashback in this situation. The ROI in all cases is 140.44%. This means that with cashback, you will be able to increase your ROI from 40.44% to 140.44%, which is a totally different situation. The cashback allows you to make slightly more than 40%.

Key Takeaways from This Example

The example shows that even if you still have negative results over time, by using cashback, you have a chance to increase your profit and ROI by the end of your trading session. Therefore, a 52% probability is not enough to make money in the long run, but, with cashback, you can change the situation and have a second chance.

Trading with a 55% Profitability

To increase profitability, a trader can use various strategies and market reviews. If the profitability is 55%, the situation is completely different. This time, a trader can meet the turnover requirements in all three cases and make a net profit even without cashback. With the initial deposit amounts of $200, $500, and $1,000, 55% of probability, $10 of investment amount, and 90% of profitability, we have received the following results.

| Cashback | Profit | ROI | Turnover | Turnover balance | Deposit | Probabilities | Investment amount | Contract Profitability |

| 0 | 628 | 314,07% | 10,000 | -142.3 | 200 | 55% | 10 | 90% |

| 0 | 1,570 | 314,07% | 25,000 | -355,7 | 500 | 55% | 10 | 90% |

| 0 | 3,141 | 314,07% | 50,000 | -711.3 | 1,000 | 52% | 10 | 90% |

Here you can see that by investing $200, a trader can make a net profit of $428 ($628 – $200 (initial deposit)). In the situation when the initial deposit amount is $500, the profit will be even higher and reach $1,070 ($1,570 – $500 (initial deposit)). While with $1,000 of the initial deposit amount, a trader can receive the highest profit of $2,141 ($3,141 – $1,000 (initial deposit)). When it comes to ROI, you will have 314,07% even without cashback. This means that you will add 214% to your initial deposit as profit.

| Cashback | Profit | ROI | Turnover | Turnover balance | Deposit | Probabilities | Investment amount | Contract Profitability |

| 200 | 828 | 414,07% | 10,000 | -142,3 | 200 | 55% | 10 | 90% |

| 500 | 2,070 | 414,07% | 25,000 | -355,7 | 500 | 55% | 10 | 90% |

| 1,000 | 4,141 | 414,07% | 50,000 | -711,3 | 1,000 | 55% | 10 | 90% |

By adding cashback that the trader will definitely receive in this case as they have met the turnover requirements, the results look even better. In the first case, the net profit will be $628 ($828 – $200 (initial deposit) + $200 (cashback)).

If a trader deposits $500, their net profit with cashback will be even higher as they can receive $1,570 ($2,070 – $500 (initial deposit) + $500 (cashback)). Finally, the best results will show a trader who deposited $1,000. Their net profit will be $3,141 ($4,141 – $1,000 (initial deposit) + $1,000 (cashback)). The return on investment here is even higher as a trader can make 414.07%. This means that a trader adds 100% of additional profit when they use cashback.

Key Takeaways from This Example

As you can see, trading with a probability of 55% will turn the situation to the better as even without cashback, you can make money. Moreover, if you claim cashback, your trading results will be even more substantial as your withdrawable sums will be $628, $1570, and $3,141. Using cashback in this case will allow you to increase your ROI which will be 414.07% for all three examples.

Trading with a 60% Probability

If the probability of positive results is 60% your trading outcomes will be even more confident and you will feel more comfortable as your profits will gradually increase. Even without cashback, you will make more money at a distance, which our calculations confirm. The first table shows the results of trading without using cashback.

| Cashback | Profit | ROI | Turnover | Turnover balance | Deposit | Probabilities | Investment amount | Contract Profitability |

| 0 | 1,428 | 713,79% | 10,000 | -196,1 | 200 | 60% | 10 | 90% |

| 0 | 3,569 | 713,79% | 25,000 | -490,2 | 500 | 60% | 10 | 90% |

| 0 | 7,158 | 713,79% | 50,000 | -980,4 | 1,000 | 60% | 10 | 90% |

With $200 of the initial deposit, a trader can make $1,428 in total. This means that by depositing this sum, your net profit will be $1,228 ($1,428 – $200 (initial deposit)). For the situation when a trader deposits $500, the net profit will be even higher and reach $3,069 ($3,569 – $500 (initial deposit)). Finally, the best results will be if a trader deposits $1,000. Their net profit will be $6,138 ($7,138 – $1,000 (initial deposit)). The ROI in this example is 713.79%, which is the highest rate so far in all our examples. Even if you don’t use cashback, you can add 613.79% to your initial balance, which is quite a serious profit.

| Cashback | Profit | ROI | Turnover | Turnover balance | Deposit | Probabilities | Investment amount | Contract Profitability |

| 200 | 1,628 | 813,79% | 10,000 | -196,1 | 200 | 60% | 10 | 90% |

| 500 | 4,069 | 813,79% | 25,000 | -490,2 | 500 | 60% | 10 | 90% |

| 1,000 | 8,138 | 813,79% | 50,000 | -980,4 | 1,000 | 60% | 10 | 90% |

Now we are going to consider an example where a trader trades with a 60% probability and claims cashback. If they deposit $200, their net profit will be $1,628 ($1,628 – $200 (initial deposit) + $200 (cashback)).

For a trader who deposits $500, the situation looks even better as their profit will be $4,069 ($4,069 – $500 (initial deposit) + $500 (cashback)). Finally, the best possible results will be performed by a trader who deposits $1,000. Their net profit with cashback will be ($8,138 – $1,000 (initial deposit) + $1,000 (cashback)). As for ROI, a trader will be able to make an impressive 813.79%. As you can see, using cashback can be even more profitable as it will give you an additional 100% of the enormous profit that a trader can make with these parameters.

Key Takeaways from This Example

Trading with a 60% probability strategy is profitable in any way. As you can see, a trader can have a positive balance after a lot of trades and increase their ROI. However, by claiming cashback, a trader can improve their results and show even better performance. The best possible outcome is when the market participant uses the highest deposit of $1,000 as they receive another $1,000 on their balance.

How to Receive Cashback at Binolla?

Binolla offers a special cashback for all new players that is available within the first month after registration. Traders can receive up to 100% of their initial deposit amount by topping up their balances with at least $10. Traders can receive cashback four times within the first month after registration! To participate in this program, you need to complete the following steps:

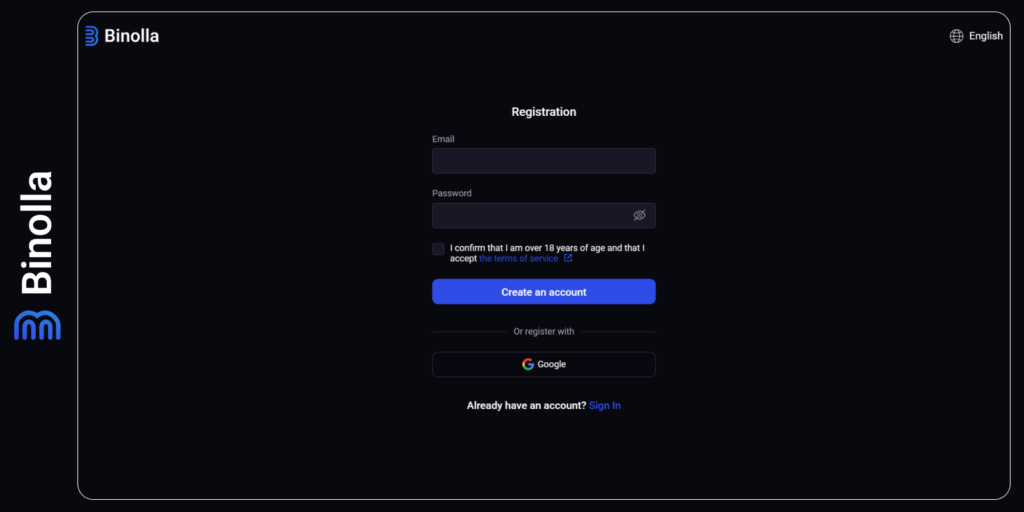

- Create an account on our website.

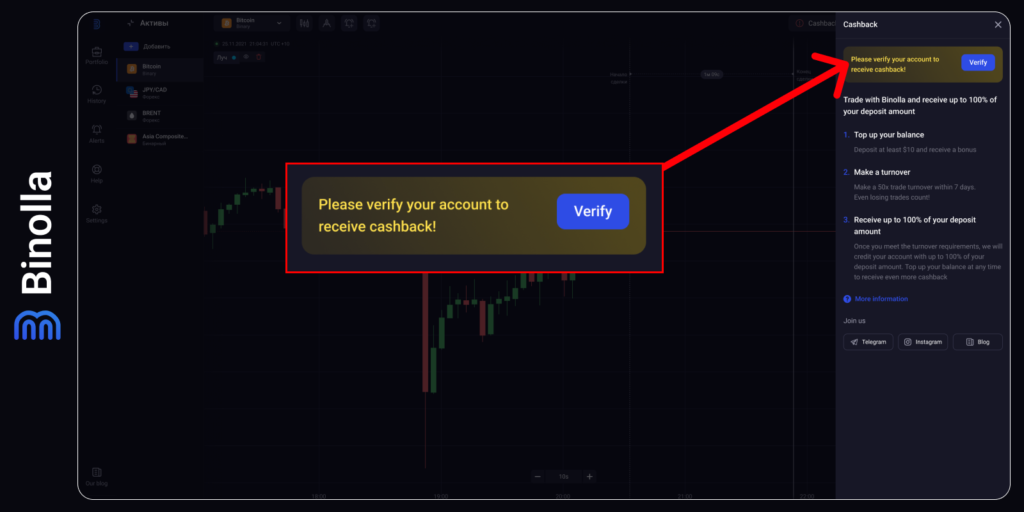

2. Click the Cashback button at the top of the page.

3. Press Verify to confirm your identity.

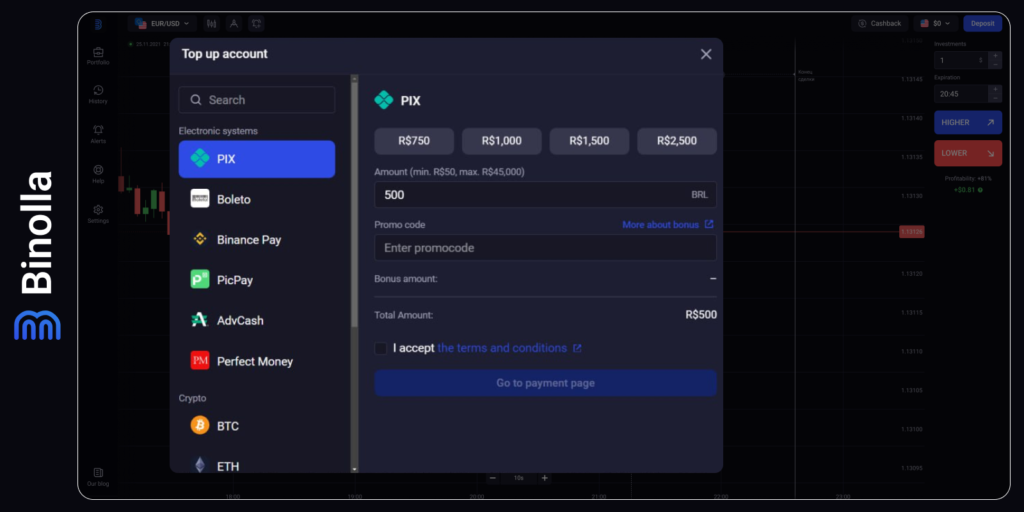

4. Top up your balance with any of the available banking options (you need to deposit at least $10).

5. Claim a cashback offer in your personal account within 30 days from the moment of registration and make a 50x turnover within seven days.

Conclusion

To conclude all the above it is worth saying that trading with cashback may be very beneficial. In some cases, it allows you to cover your losses and have a positive ROI even if your trading results are negative, while in other cases, cashback can bring you additional profit that will increase your ROI to even higher rates.

FAQ

What is the Maximum Cashback Amount I Can Receive at Binolla?

The maximum cashback amount at Binolla is 100% of the deposit amount, but no more than $1,000.

Is the Cashback Amount Withdrawable?

Yes, it is. Once you meet the turnover requirements, you will receive cashback on your main trading balance and you can withdraw it or continue trading with it.

What Are the Turnover Requirements at Binolla?

The turnover requirements at Binolla are 50 times the cashback amount. If you deposit $1,000 (your cashback will also be $1,000 if you meet the turnover requirements), the turnover you are required to complete is $50,000

What is the Validity Period of the Binolla Cashback?

Cashback is available one month after registration. Traders can claim it four times in total. Each cashback that you claim at Binolla is valid for seven days.