The US Presidential Elections Are Approaching: Financial Markets Are Heads-Up

The main price catalyst this week is the approaching elections in the United States where former president Donald Trump is trying to get back to the Oval Office, while Kamala Harris makes all her possible to allow democrats to stay in the White House for another presidential term. Both candidates are widely supported by the Americans and they have almost equal chances to win. About 1% separates them currently and the situation is unlikely to change significantly until the very day of elections.

This uncertainty supports mainly the US dollar, gold, and other assets that are considered safe-haven as investors and traders are in the risk-off mode now. If Donald Trump returns to the Oval Office, a new era of trade wars may begin (the former US president promised to impose tariffs), which may lead to negative consequences for the Eurozone’s economic growth. Moreover, new tariffs may also push the Chinese economy down if applied. Therefore, such fears currently make traders and investors look for safer assets.

Another factor that supports the US dollar is tensions in the Middle East. Israelis attacked the Irani military infrastructure on Saturday in response to Iran’s attack on October 1. This is one more step closer to escalation, which makes investors and traders search for safe-haven assets. However, on the other hand, the fact that attacks touched only military infrastructure can be considered as a possibility of future de-escalation.

Contents

The US Data Ahead

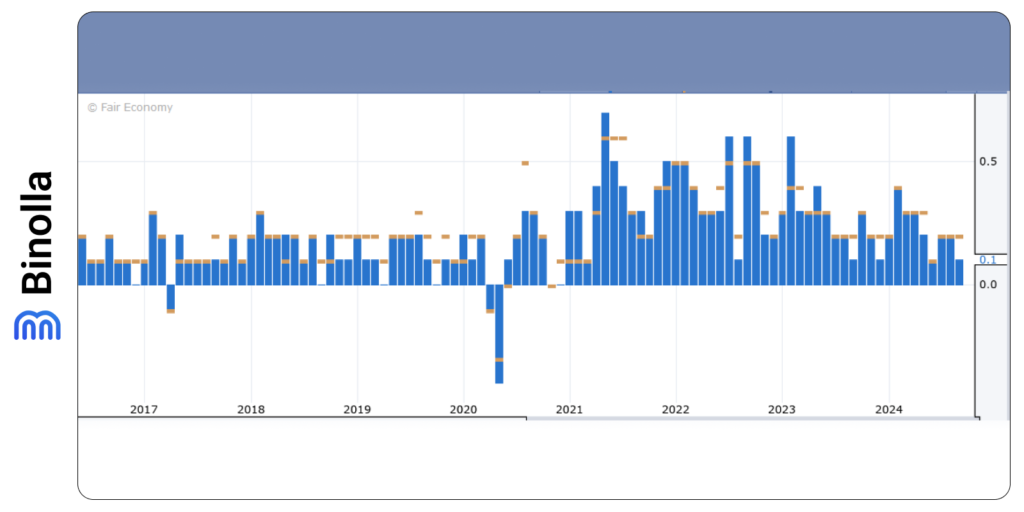

The week ahead will be rich in the US data that will be analyzed by traders and investors worldwide. In particular, market participants are anticipating the update on the Core PCE price index MoM, which will be released on Thursday, October 31. According to forecasts, PCE inflation is likely to accelerate in September from 0.1% to 0.3%, which may support USD as the Fed looks closely at this parameter and if inflation rises, the FOMC is likely to avoid more aggressive easing this year.

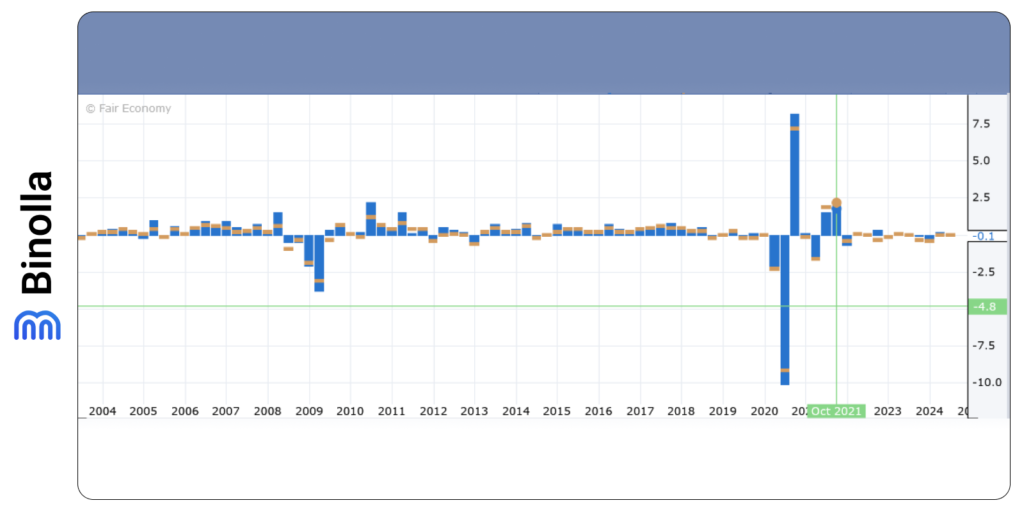

Another key macroeconomic indicator to watch this week is the US labor market data. The unemployment rate is expected to remain at 4.1%, while new jobs in the non-farm sector can fall abruptly to hit 108,000 only from 254,000 in the previous report. Wages are expected to slow down by 0.1%.

Traders and investors are also anticipating the US ISM Manufacturing PMI, which will be released on Friday. While business activity in the manufacturing sector is still below 50, which indicates the contraction, the positive dynamics may support the US dollar.

EUR/USD: Traders and Investors Look for New Data Sets

The main theme for traders and investors is the next move by the European Central Bank when it comes to monetary policy. While there is almost no doubt that the central bank will cut rates again this year, the size of easing matters. Some ECB officials have mentioned that there are risks that inflation will remain below 2% for longer.

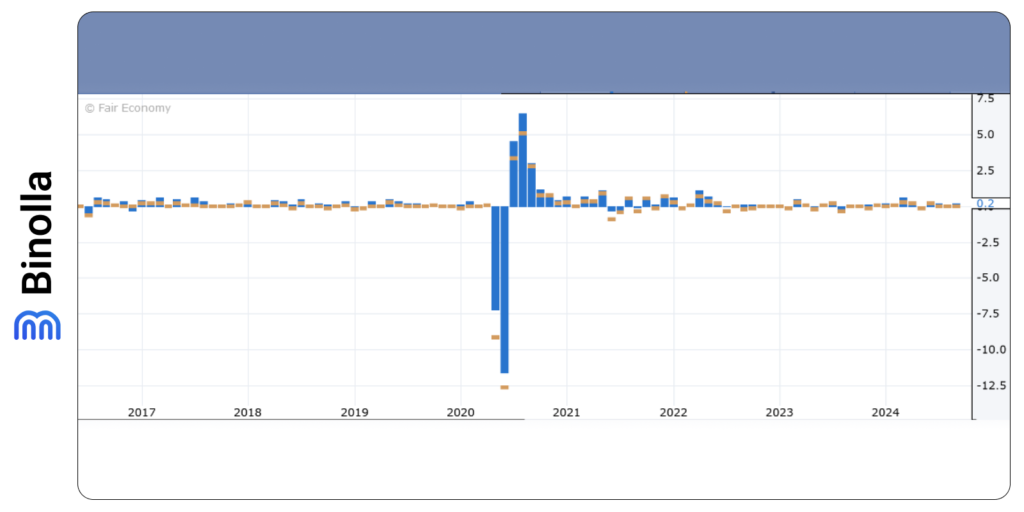

Fears of German and Eurozone recession have pushed the ECB to cut rates. Moreover, a low inflation rate in the monetary block will be a driver for the European Central Bank to cut rates again this year. According to forecasts, the German economy may contract by 0.3% as compared to the second quarter, while the Eurozone’s economy is likely to grow by 0.8%, which is higher than 0.6% in the second quarter.

Apart from GDP data, traders and investors are likely to pay close attention to the HICP data for October in Germany and Spain. While German HICP is likely to grow at a faster rate of 2.1%, Spanish HICP is expected to remain below 2.0%.

Canadian Dollar Suffers from Oil Price Dump

Tensions in the Middle East have significantly impacted the CAD quotes. The oil price dump on Monday resulted in a slight downtrend as Canada is one of the major oil exporters. However, not only oil prices push CAD lower.

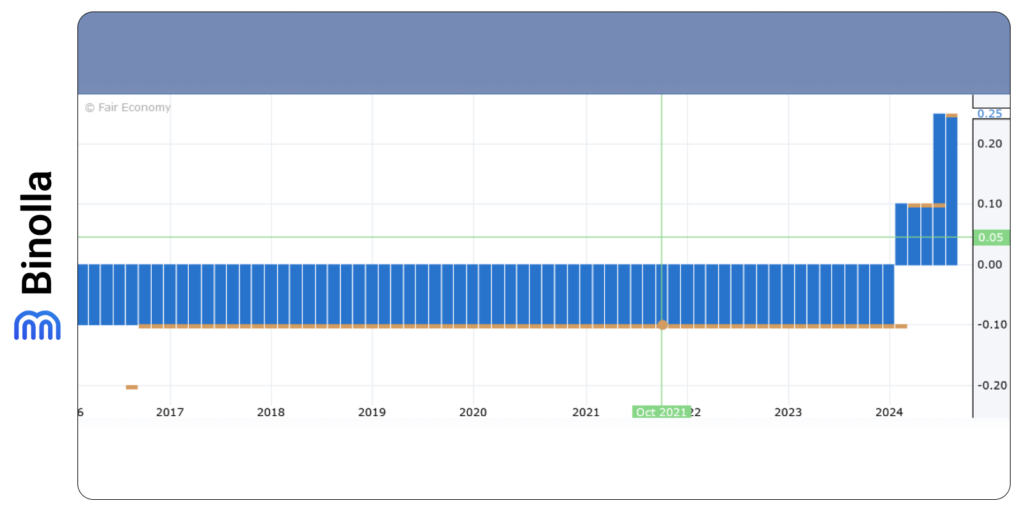

The upcoming Canadian GDP data is expected to add negative aspects and put more pressure on CAD. According to forecasts, the economic growth in Canada is expected to slow down to 0.0% monthly as compared to 0.2% in the previous report.

Also, it is worth looking for some cues from the BoC head Macklem who gives a couple of speeches this week. Slowing economic growth may stimulate the central bank to review its current monetary policy and make one more cut this year. The question is whether the next monetary policy easing will be 25 or 50 bps. If the worst forecasts come true, the BoC may have less room for maneuver and resume its expansionary steps.

Will BoJ Cut Rates?

The Bank of Japan holds a meeting this week. According to forecasts, the BoJ is likely to avoid making any contractionary steps on Thursday. However, it is worth checking BoJ members’ commentaries as they may shed light on future monetary policy decisions.

According to the latest Tokyo consumer price data inflation in Japan is below 2%, which is one of the factors that will likely prevent the BoJ from taking more rate hikes this year. The timing for the next rate hike is uncertain now, but the Bank of Japan is likely to raise rates to 1% by the end of 2025.