The Truth Behind the Biggest Trading Myths

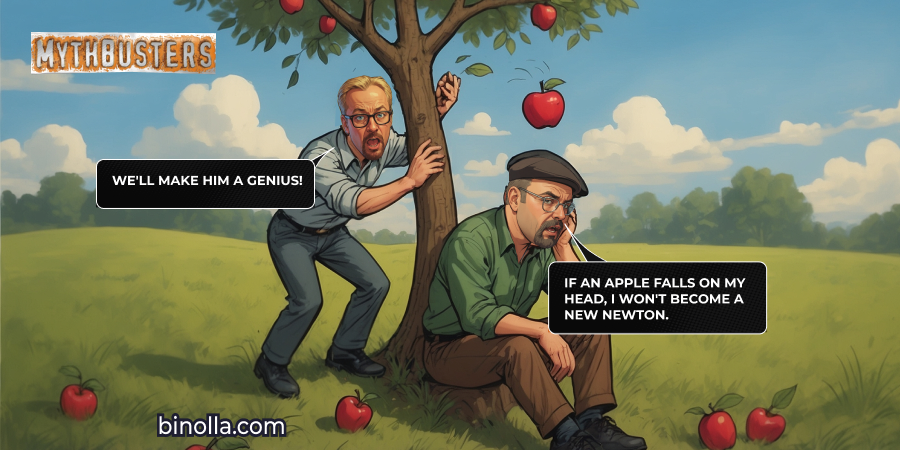

Trading attracts a lot of people by offering them multiple opportunities to get rich every day. Some see this as a quick way to make millions in a relatively short period. Others do not even try, because they think that trading is only for rich guys who are ready to invest a lot of money. There are a lot of myths surrounding trading that prevent one from trying and others from making money. Knowing the truth will help you change your opinion about trading and understand what you really need to become a successful trader. This article delves into 10 of the most popular trading myths and busts them in a simple and clear way.

Contents

- 1 Myth 1: Trading is Similar to Gambling

- 2 Myth 2: Trading Requires a Lot of Money

- 3 Myth 3: Only Insiders Make Money in Trading

- 4 Myth 4: Price Fluctuations Are Always Logical

- 5 Bust All These Myths with Binolla

- 6 Myth 5: The More Trades I Open, The Better

- 7 Myth 6: Professionals Never Lose

- 8 Myth 7: Technical Analysis Always Works

- 9 Myth 8: Following Professionals Guarantees Profits

- 10 Myth 9: Leverage Always Increases Profits

- 11 Myth 10: Trading Can Make You Rich Overnight

- 12 Conclusion

- 13 FAQ

Myth 1: Trading is Similar to Gambling

Well, some of the most popular myths about trading are that it is similar to playing roulette. The outcome is unclear, and you can only rely on your luck. This is partly true because you don’t know exactly whether the price will rise or fall in 99.99% of cases. So, can we say that trading is gambling? NO!

Let’s delve deeper to bust this widely spread myth about the similarity of both activities. While gambling is based on pure luck, as you can’t predict which pocket on the wheel the ball will hit in roulette, or which combination in an online slot will appear in the next round, in trading, you can improve your chances, using market analysis and risk/money management strategies.

When a gambler looks at roulette, they think something like “Let it hit 8” or “Let my red bet pass”. When a professional trader looks at charts, they see a clear picture of a price movement. They can identify the current trend and even predict where the price may reverse or begin a correction.

Are professional traders always right in their market forecasts? No, but the rate of their positive outcomes is always between 60-90%, which allows them to make money in the long run. When it comes to gambling, even if you can win huge at some point, you will definitely lose all your money if you continue playing.

Trading is not gambling, but only if you use a trading plan, which includes a trading strategy and your risk/money management rules. Otherwise, trying to guess the direction blindly will turn trading into gambling, like any other activity. Like children trying to put their fingers into an outlet, not knowing about the danger of doing it. The professional trader will never try to “put their fingers into the outlet” as they know what will happen.

Myth 2: Trading Requires a Lot of Money

Many people think that trading is only for the rich. This misconception often prevents beginners from trying. They think that small accounts are useless and they can’t make money with them. However, the truth is that modern trading platforms like Binolla allow market participants to begin with even smaller amounts and make substantial profits over time.

Imagine that you invest $100 in trading, having a reliable strategy with 60% profitability. Your daily results will be 6 profitable and 4 losing trades. With $10 of investment per trade and an average of 80% payout, you will make 6*$10*80%=$48. On the other hand, you will lose $40. Your daily profit will be $8.

If you continue to stick to your strategy, in a month you will have your balance by around $160 (if we take only business days), which is more than twice your initial balance. In one year, your results will be multiplied by 12x, which makes almost $2,000. You can increase the amount of your per-trade investment and make even higher profits.

Now, if you are going to increase your investment amount accordingly, you may have more impressive results. Imagine that your balance reached $200 and you still stick to your 10% money management strategy. Therefore, the investment amount per trade will be $20 on average, which will allow you to make $6*$20*80%=$96, while your losses will increase to $80, which means that you will make $16 daily. This will allow you to make $352 in the first month and $4,000+ within a year.

If you double the investment amount each month, then your results will be:

| Investment Amount | Monthly Outcomes |

| $10 | $160 |

| $20 | $352 |

| $40 | $704 |

| $80 | $1408 |

| $160 | $2,816 |

| $320 | $5,632 |

| $640 | $11,264 |

After trading for half a year, you will have $11,264 in your balance, which is more than 100 times your initial investment.

The same is for CFD, where you can also start with smaller amounts and make your balance grow gradually. Yes, if you want quick and substantial profits and you have enough funds, you can start with $1,000 and even more. However, even if you don’t have this amount at hand to spend on trading, you can take a longer road and make it within 1 year.

Myth 3: Only Insiders Make Money in Trading

Many of those who think about whether to start trading or not don’t even try because of this myth. They are persuaded that only people with access to some special information or even some secrets can make money in trading. Even some of those who try later say that they lost money just because they didn’t have access to insights.

The truth is that most traders and investors do not have access to special information. They use various strategies, analyze markets, and check fundamentals to succeed. Financial markets are full of data that is publicly available. For instance, you can see the GDP, labor market, PMI, and inflation data. Also, you can read reports by companies to evaluate their performance and make a reasonable decision on whether to buy a stock or not.

For instance, Alexandr Elder created his own technical analysis strategy, known as Elder Screens, that helped him make a lot of money without even using the fundamental analysis. Alexandr Gerchik, another famous trader, uses technical analysis and teaches his strategies to traders worldwide.

Successful trading is impossible without knowledge. However, the knowledge is fully accessible to all. The thing is how you use it. If you have a good and reliable strategy, you will make consistent profits.

Myth 4: Price Fluctuations Are Always Logical

Many beginners believe that price fluctuations are full of logic. The quotes move in a predictable way according to the latest news, patterns, indicators, etc. The truth is that even if you see a perfect trading pattern, you should still hold on to your strategy and money and risk management rules.

There are a lot of examples when those who are new to financial markets open trades that they think are perfect and invest all their money or a substantial part of it in a single deal, thinking that they will become rich soon. They think that the movements are always logical and the market will react to some events or patterns the way it should. They end by losing this money and becoming disappointed about trading in general, thinking that they did everything in the right way, and the market was wrong.

Remember that the market is never wrong. The market is moved by various types of participants, from large-scale institutions to retail traders and investors. Therefore, the reaction to any event can be different. Sometimes, markets price in some events in advance, and when the event takes place, there is no reaction at all, or the reaction is not as strong as it was expected by the trader.

Keep in mind that success in trading is not about placing a single trade with a positive outcome. It is a long-term work that you should conduct in order to grow your balance gradually.

Myth 5: The More Trades I Open, The Better

Trading is not about opening many trades. While frequent activity may help you generate higher revenues in most businesses, when it comes to trading, things are different. The trade itself is not an activity, but a result of your efforts. Before you buy or sell a digital option contract or a CFD, you need to conduct analysis, which is the main activity in trading.

If you increase the number of trades, you should also increase the time that you devote to analysis and other preparations. If you don’t have such time, it is better to stick to your current trading schedule without increasing the number of trades. Moreover, sometimes the market does not offer a lot of opportunities throughout the day. Therefore, increasing the number of trades may be illogical.

The best approach is to open fewer trades but with higher profitability and payouts. This will help you spend less time on analysis and make more gains over time as with each new trade your risks are also higher.

Myth 6: Professionals Never Lose

One of the biggest misconceptions about trading is that successful traders never lose. This, in turn, prevents many beginners from making a good start. Newcomers often think that the rate of success is measured in the number of successful trades, which means that the more skilled they are, the lesser number of losing trades they will have.

The reality is different. Good traders use reliable strategies that allow them to increase the probability of profiting. If you trade randomly, for example, your chances of winning in every trade are 50% or even less. When you begin to use a good strategy, your chances increase to 50-60%. This is quite enough to make money over time.

You may think that professionals never lose in trading. However, if you take several famous names, they had significant losses before they became rich. For instance, George Soros in his early career experienced multiple financial losses before he made fortune. The same was for Paul Tudor Jones, who lost hundreds of thousands of dollars before becoming the head of the hedge fund. Ray Dalio lost about 20% of his funds in the 1980s, but managed to recover and return to the game with even higher gains.

Traders should record their results or check the history of trades on the platform to see their overall performance over time and make adjustments to their strategy and risk/money management rules. If your strategy gives you a 60% profit probability, then you can successfully trade digital options and CFDs.

Myth 7: Technical Analysis Always Works

Overrelying on technical analysis may lead to significant problems in trading. Technical analysis helps you read the charts and find market opportunities. However, with every trade you place, you should never forget that even the strongest signals or patterns may fail. Markets are influenced by many factors, and some patterns may be broken simply because an important news release changes the market sentiment.

Therefore, you should not treat the technical analysis like something that guarantees you profits. Instead, you should think about it as a probabilistic tool that may help you improve your trading results. A failed pattern means losses, but if you continue to stick to your strategy, other patterns may bring you profits, and you will be able to improve your performance over time.

Again, trading is a long road, which is not always straight. You will find a lot of pitfalls on it, but if you hold on to your approach or adjust it properly to improve your results, you will succeed.

Myth 8: Following Professionals Guarantees Profits

Another misconception in trading is that following trading experts’ signals guarantees success. Many beginners join signal groups trying to make money along with professional traders. However, not all of them make profits.

The reason is that even experienced traders make mistakes. Therefore, when you follow signals from them, you should be prepared to lose, and do not break your money management rules by investing substantial amounts and thinking that you will become rich in a single trade. Most signal providers from the Internet offer around 60-70% of profitability, which means that by following them, you will make money, but not today.

In addition, they provide signals with some small lags, which may cost you money as the situation may change drastically.

Also, do not follow these signal providers blindly. Watch their previous trades and try to calculate how many profitable and losing deals they close within a day/week/month. This will help you make reasonable expectations about your future trading results.

You should keep in mind that when using such signals, commissions from brokers may apply. By choosing Binolla, however, you will avoid such fees as the broker do not impose any commmissions on traders.

Myth 9: Leverage Always Increases Profits

This paragraph is dedicated to CFD trading and leverage as its integral part. Most beginner traders think about leverage as an opportunity and forget that this is a double-edged sword. Yes, when using leverage in trading, you can increase your overall gains. However, your risks also become higher with the higher trading volumes or more open trades.

Therefore, first, when you choose leverage in trading, you should think about risks. Professional traders calculate their per-trade risks and place stop losses to cut them timely. This helps them avoid situations when they can lose a substantial part of their funds in a single trade.

Also, you can try different types of leverage on the demo account to understand how it affects your balance. Moreover, you can try different trade sizes and check which one is more suitable for you. This may help you choose the right leverage for you and benefit from this feature instead of making losses ruin your account.

Myth 10: Trading Can Make You Rich Overnight

To tell the truth, trading may make you rich overnight if you are already rich and can afford a large deposit amount and, thus, increase your position size to hundreds of thousands or even millions of US dollars. If not, do not expect fast, substantial gains. Focus on gradually increasing your balance without sharp, massive investments.

When making your first steps in trading, prepare yourself that you have a long road ahead and don’t try to make shortcuts, as they may make you start at the points from where you began. If you have a reliable strategy and a consistent approach, you will be surprised in just one year at how much you have already done.

Most rich traders did not become wealthy overnight. They worked a lot on their strategies and psychology to make huge fortunes.

Conclusion

Trading is full of myths surrounding this activity, which may mislead beginners and create false expectations. This, in turn, may lead to significant losses or even prevent some newcomers from trading just because they believe in those myths.

The reality is different. Trading success does not depend on how much you invest. It depends on knowledge, discipline, strategy, and money/risk management. By understanding the truth behind trading myths, you will avoid making first trading mistakes and will be able to make a smooth start in trading.

FAQ

Is trading like gambling?

It depends on your approach. Trading can be like gambling if you just try to guess without trading with a strong foundation built on your strategy, risk/money management, and psychological readiness. For professional traders, trading is a business where their earnings depend entirely on how they act.

Can I make substantial games with a large amount as a beginner?

It depends on the situation. However, you should remember that even investing $100,000 or higher does not guarantee that you will make a profit, as you may lose the entire amount.

Why does my analysis sometimes fail?

If you do everything in the right way but your trade still fails, you should understand that any type of analysis is not all-mighty. Even the most reliable patterns that you can see on charts may fail. Therefore, you should use strict money and risk management rules to mitigate your trading risks.

Can I get rich quickly throught trading?

Yes, it is possible, but it requires knowledge, patience, and effort from you. Also, in most cases, you need to invest more to get rich quickly.