June’s ECB Meeting and Other Important to Watch This Week

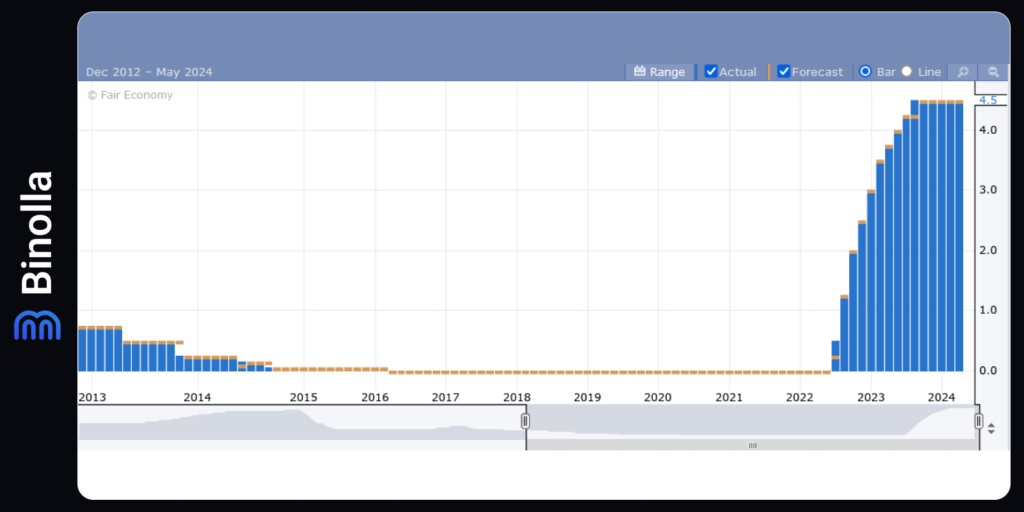

Financial market participants anticipate the June’s ECB meeting for the officials from the European Central Bank to cut rates for the first time since September 2019. Currently, the majority of members of the board are voting for monetary policy easing, even those with traditionally hawkish attitudes. The central bank is likely to cut rates to 25 basis points.

Once the European Central Bank lowers rates, the investors attention will shift to the forward guidance to see whether ECB is going to make any other adjustments in 2024. Any hints on further monetary policy adjustments, including those about the inflation meeting the target levels will push EUR lower.

However, a so-called “Quantitive Tightening” still tightens financial conditions in the monetary union. The inclusion of the PEPP (Pandemic Emergency Purchase Program) in June will expand Quantitive Tightening with an average target of 7.5 Billion euros. The program will be active until December 2024. Starting from the next year, partial reinvestment will be abolished, which will, in turn, accelerate the rate of decline and put pressure on the money supply.

Investors and traders expected the 25 basis point cut in May. However, forecasts about the future rate cuts are under question. Inflation stopped its downtrend in May and some core sectors, including services, demonstrate signs of heating. With this in mind, ECB officials will be more cautious when undertaking any other steps.

Contents

Will the BoC Head Macklem Keep His Promises?

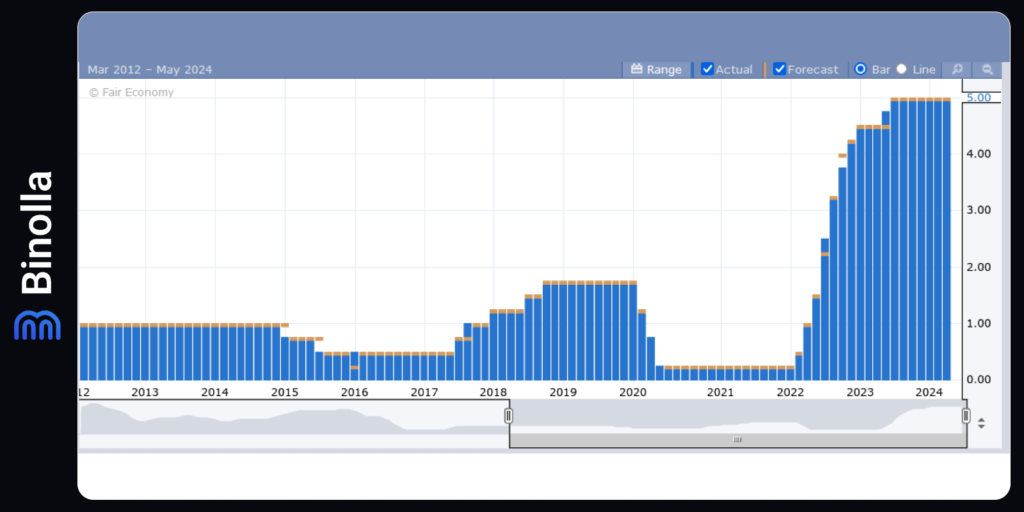

On Wednesday at 9:45 am ET, the Bank of Canada (BoC) will release its policy statement, followed by a press conference hosted by Governor Macklem and Senior Deputy Governor Rogers 45 minutes later. This meeting will not include a Monetary Policy Report, which will be provided at the July 24th meeting.

The June, July, and September meetings are all potential opportunities for the BoC to implement a first rate cut. Markets are partially pricing in a 25 basis point cut for this meeting, fully pricing in a cut for July, and anticipating additional easing by September. While consensus is divided, with a slight majority expecting a cut this week, our forecast leans towards a hold, with higher odds of a cut in July or later. Rushing into a cut now poses a higher risk of policy error, and there is much to gain from a more thorough assessment in July.

Arguments for Cutting Rates Now

Several points support a rate cut at this meeting. First, Canada has experienced four consecutive months of lower core inflation, with trimmed mean and weighted median CPI showing modest month-over-month declines. Some argue that this indicates a persistent softening in inflation, justifying immediate easing.

From a risk management perspective, if inflation risks appear to be balancing, it may be prudent to begin easing while acknowledging uncertainty about the future path. This approach echoes former Governor Carney’s 2010 strategy of cautiously adjusting rates in response to uncertain economic conditions.

Governor Macklem has historically been quick to support easing measures at the first sign of inflation control. His tendency to act swiftly in such scenarios could influence the decision to cut rates now.

Additionally, Canada’s economy has shown signs of slack, with GDP growth tracking poorly from Q4 2022 through Q4 2023. This could indicate lagging disinflationary pressures. If these conditions are expected to persist, the BoC might want to begin easing soon, given the delayed effects of rate cuts on growth and inflation.

Finally, market expectations play a role. With markets pricing in a rate cut, the BoC may not want to disappoint.

Arguments for Waiting

However, several reasons suggest that the BoC should exercise patience. Governor Macklem has emphasized the need for “months” of further evidence before cutting rates. A cut now would contradict his recent guidance, potentially undermining the BoC’s credibility.

Macklem outlined a three-stage process for rate cuts: first, a period of soft core inflation; second, confidence that this trend will persist; and third, beginning discussions on lowering rates. Currently, it’s unclear if all conditions have been met.

Given past failures to predict inflation accurately, the BoC should demand more substantial evidence before acting. Temporary factors, such as an unusually warm winter, may have influenced the recent soft patch in inflation.

The BoC has previously shown a willingness to surprise markets if necessary. By the July meeting, the BoC will have additional data on inflation, job growth, wages, GDP, and other indicators. This comprehensive data set will provide a better basis for any decision.

Furthermore, the July meeting will include updated surveys of business and consumer inflation expectations, which are crucial for the BoC’s decision-making. The timing of this full forecast meeting is ideal for a significant policy shift.

The BoC may also want to consider the outcomes of the upcoming FOMC communications on June 12th. If the FOMC signals a slower pace of cuts, the BoC might choose to align its actions accordingly.

Finally, four months of soft inflation data are insufficient to conclude a sustained downward trend, especially given the potential impact of temporary factors. Shelter inflation remains high, driven by immigration and housing shortages, which the BoC cannot ignore.

Additionally, the economy has performed better in the first half of 2024 than anticipated, particularly in consumer spending. Cutting rates now could reignite imbalances in the housing market, where demand is highly sensitive to rate changes.

A premature rate cut could trigger a rally in the five-year Government of Canada bond market, leading to easier financial conditions and potentially overheating the housing market. The BoC should be confident in its decision before signaling the start of an easing cycle, given the significant market implications.

In conclusion, while there are arguments for an immediate rate cut, the case for waiting and gathering more evidence is stronger. The BoC should prioritize a comprehensive assessment in July to avoid the risks associated with a hasty decision.

The US Employment Data: What to Expect from May Figures?

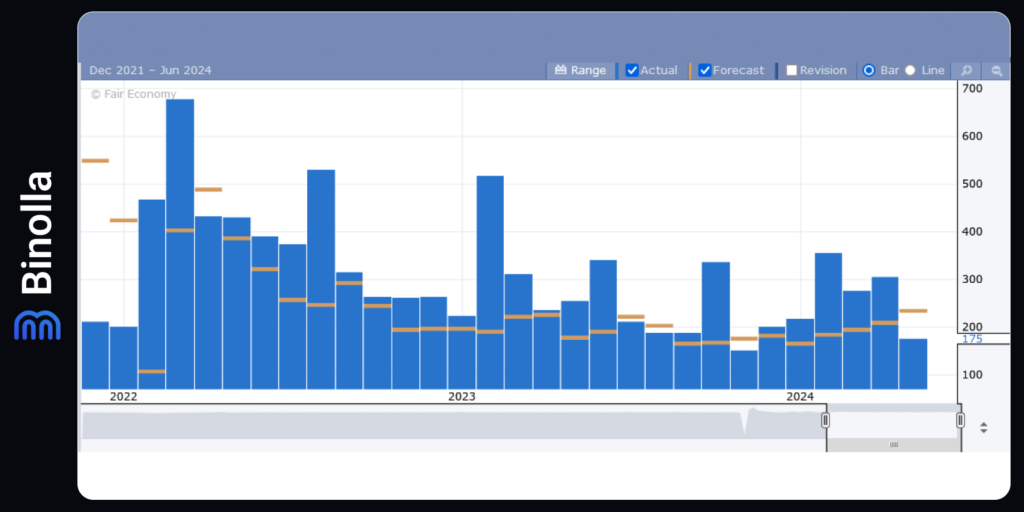

The upcoming release of the May employment report at 8:30 AM ET on Friday is poised to be a critical indicator of the state of the labor market. Analysts will be scrutinizing the change in nonfarm payrolls to determine whether it meets, exceeds, or falls short of market expectations.

In April, nonfarm payrolls increased by 175,000, marking a notable deceleration from the first quarter’s monthly average of 269,000. Despite this slowdown, April’s growth rate still reflects a robust hiring pace for an economy experiencing moderate expansion.

Projections for May suggest that the report will likely reveal a similar level of job gains. Should this be the case, it would indicate that the labor market is cooling in line with Federal Reserve policymakers’ forecasts, as economic conditions begin to stabilize and normalize.

There are three noteworthy factors to consider when interpreting the May employment data. First, the data collection reference period spans five weeks, from April 13 to May 18. This extended timeframe may capture additional workers who were hired late in April but received their first paycheck in May.

Second, with many college graduates securing jobs before graduation, some might have already been added to payrolls in May. This is a common occurrence, but if businesses have been particularly proactive in hiring graduates with in-demand skills, it could result in higher-than-usual payroll figures.

Third, the early timing of Memorial Day this year (May 27) might have led to earlier and more aggressive hiring within the travel and leisure sectors, with businesses adding staff sooner than the typical seasonal hiring patterns.

The implications for monetary policy hinge on how the payroll numbers align with market expectations. If the employment figures closely match forecasts, there should be little change in the outlook for monetary policy. However, a significantly weaker report could prompt speculation about an earlier rate cut. Nevertheless, without the accompanying inflation data for May, such anticipation might be premature.

The Consumer Price Index (CPI) for May is scheduled for release on Wednesday, June 12, at 8:30 AM ET, and it will likely play a crucial role in shaping the Federal Open Market Committee’s (FOMC) policy statement due at 2:00 PM ET the same day.

A cooler labor market combined with continued disinflation could lead the FOMC to consider the timing of a rate cut more seriously. Conversely, if the labor market cools while the CPI remains flat or rises, particularly in the areas of housing or non-housing prices, the FOMC is likely to adopt a more cautious stance. In such a scenario, policymakers might not feel sufficiently confident about the trajectory of inflation to justify easing monetary policy immediately.

Overall, the May employment report and subsequent inflation data will be critical in shaping market expectations and guiding the Federal Reserve’s next moves. As these data points emerge, they will provide clearer insights into the health of the labor market and the broader economy, influencing how and when the Fed might adjust its monetary policy stance.