Inflation Data is Ahead: What to Expect This Week

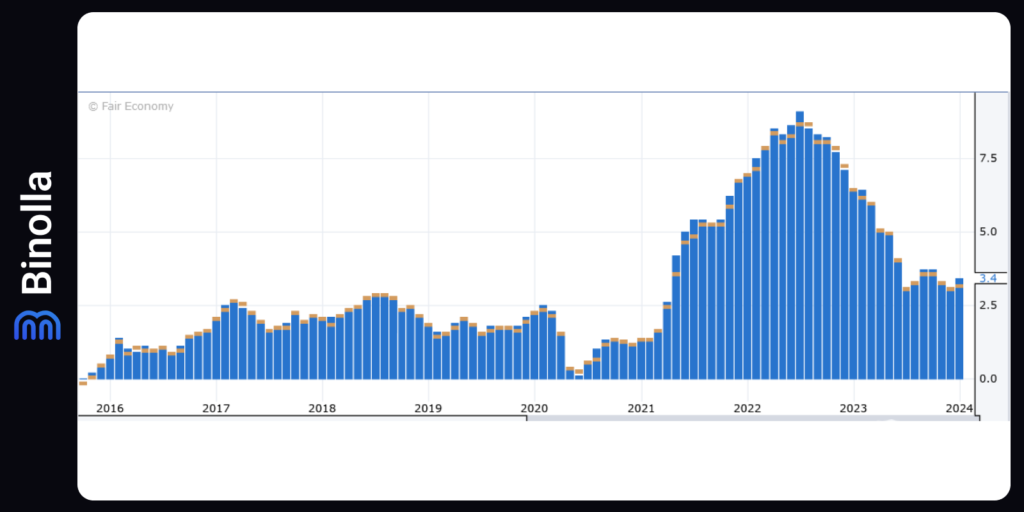

The US inflation data will be the leitmotif of the price fluctuations this week. According to forecasts, yearly inflation in the United States is going to shrink to 2.9% from 3.4% which was marked in January’s report.

In general, consumer inflation in the US has become flat with a small range between 3.5% and 3%, which is close to the Fed target of 2% yearly inflation.

According to Jerome Powell’s latest comments from January’s meeting, “six months of good inflation” will be a trigger for the FOMC to start cutting rates. This means that the first change in the monetary policy can be expected at the meeting that will take place in May 2024.

Monthly inflation in the United States is also likely to slow down from 0.3% to 0.2%, which is a positive factor. However, when it comes to Core CPI, no changes are expected during the release of this data on Tuesday, February 13.

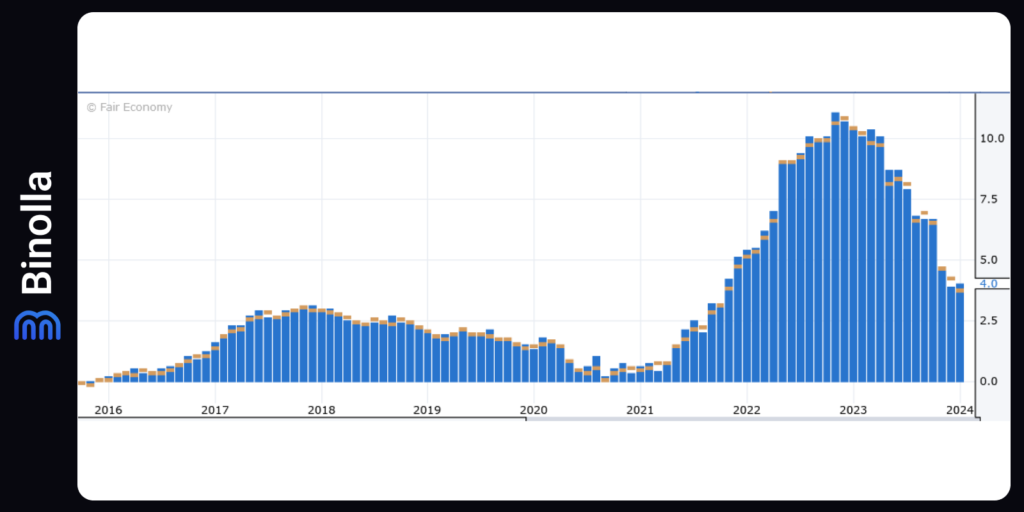

UK Inflation is Still Above BoE Goals

Another important data release will take place on Wednesday, February 14. According to experts’ consensus, yearly inflation in the United Kingdom is likely to rise and hit 4.1%, which is slightly higher than the previous 4.0% rate that was marked a month ago.

The Bank of England managed to curb inflation in the UK, but it is still at the levels that prevent the monetary policy decision-makers from cutting rates. However, the BoE officials are under pressure as the UK economy is likely to slow down month-over-month to show a negative growth of 0.2% during the upcoming data release that will take place on Thursday, February 15.

With this in mind, the BoE will have to balance between inflation that is still above targets and GDP, which shows near-zero growth, and contracts for two consecutive months.

Voting members of the BoE steering committee have slightly changed their positions during the January meeting with one official moving to the neutral camp against 2 officials to vote for the rate cut and 6 to leave the current monetary policy unchanged.

How the US and UK Inflation Data May Change the Situation on Forex

US yearly inflation is expected to slow down to 2.9%. However, if the scenario remains unchanged, we can’t expect the FOMC to vote for a rate cut until the last month of spring 2024. This means that even if the volatility is going to rise during or slightly after the release of the US inflation data, no significant changes are expected in currency rates.

Nevertheless, if the US inflation is going to slow down faster than expected, which means that it can reach the Fed’s targets faster, the US dollar may lose its position as investors’s expectations about the first rate cut in 2024 will also shift. On the other hand, provided that the US inflation shows higher figures, the US dollar may have an uptrend as the FOMC plans for cutting rates in May 2024 may change.

When it comes to the UK inflation data, economists expect it to slightly accelerate, which means that the beginning of the monetary policy contraction phase may be postponed again. CPI data below 4.0%, on the contrary, may lead to the GBP price decrease as it approaches the moment when the voting members of the Bank of England will “press the cut button”.

EUR/USD Daily Review

The currency pair is still under pressure below the descending trendline. The US dollar is supported by the Fed’s hesitation and a slower-than-expected global economic growth acting as a safe-haven asset.

The closest support line is near 1.0750. If the day ends with a bearish engulfing, we can expect another series of the EUR/USD downtrend targeting 1.0750. In the event that the currency pair breaks this level, the next support line will be around 1.0500.

EUR/USD Hourly Review

For intraday traders, EUR/USD offers one more support line, which is at 1.0766. The price is currently between the descending trendline from higher timeframes and the support at 1.0766, making a descending triangle. With this in mind, EUR/USD may stay within this tapering range for today and even tomorrow, until the important data releases will bring more volumes to the market.

EUR/USD Minute Review

EUR/USD is testing 1.0772 at the moment of writing this review and even managed to rebound from this level, which means that there is a small growth potential targeting 1.0782. If the price continues to move upward, we can see it testing 1.0782 in the upcoming hours. However, if the upside movement fails to develop, the price may drop even lower to hit 1.0766, which is a stronger support level from the hourly chart.