ECB Meeting in Focus, US Retail Sales Data to Watch

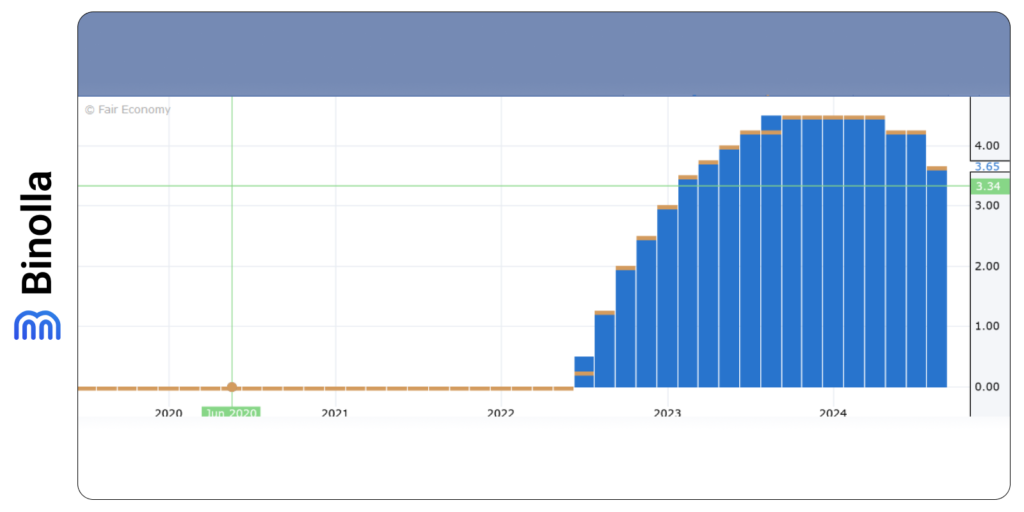

The ECB meeting is among the key events market participants anticipate this week. After a rate cut by the RBNZ last week, the European Central Bank is expected to continue its expansionary steps and cut rates by 25 bps this week. Although, ECB president Lagarde and her colleagues were optimistic about economic growth during the last meeting, disappointing PMIs and inflation drop raise expectations that the central bankers will have to cut rates.

Traders and investors are fully pricing the reduction by 25 bps which is likely to take place on Thursday. Moreover, market participants expect another round of monetary policy easing to occur during the last ECB meeting in 2024 which will take place in December. Therefore, a 25 bps cut is unlikely to result in significant price fluctuations and the focus will shift to the President Lagarde press conference that will take place later that day.

While the upcoming meeting will not be accompanied by macroeconomic projections, the ECB head is likely to be asked about the economic and inflation outlooks and whether they have changed since the last meeting that took place in September. The ECB president has mentioned recently that confidence about inflation returning to target levels will be reflected during the upcoming meeting, which supports expectations of further monetary policy easing that may take place in October and December.

If the ECB cuts rates by 25 bps and Lagarde keeps the door open for another rate cut this year, EUR is likely to remain under pressure. The robust US jobs report for September was a catalyst for EUR/USD to plunge below 1.1000, which made a double top formation on the chart. A dovish decision by the European Central Bank is likely to fuel another decline and EUR/USD can reach 1.0880.

However, even if a rate cut may be evident for market participants, the doves are expected to have strong resistance from the hawks’ side. Some sources noted that there is a compromise solution, where rates remain unchanged in October, but a rate cut will be delivered in December if there are no positive changes in data.

Hawks are supported by the comments by the ECB Vice President de Guindos, who says that it is too early to claim victory over inflation. According to the flash estimates, inflation fell by 1.8% in September.

If policymakers agree to wait until December, EUR/USD is likely to have support and rebound as investors will unlikely expect such a step from the ECB. A return over 1.1000 is possible in this case.

Contents

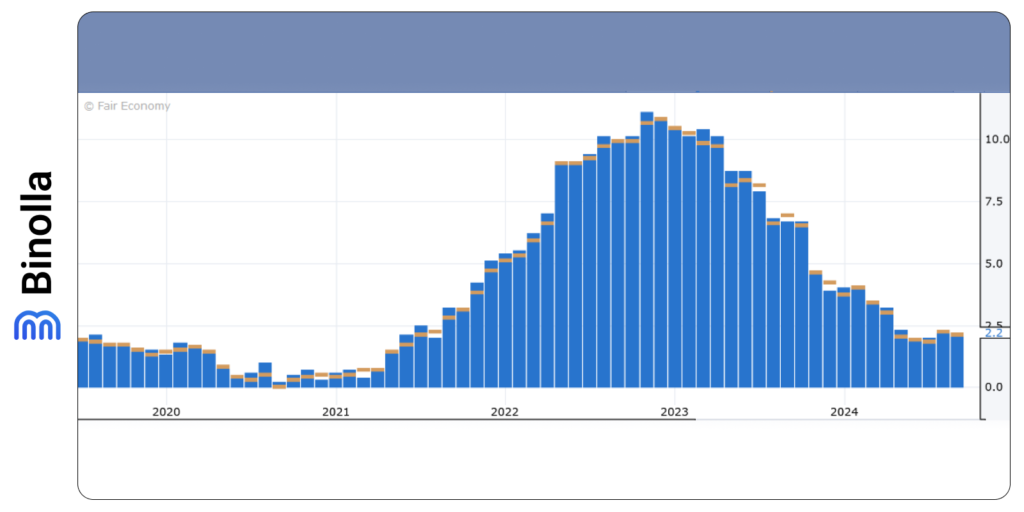

The UK Inflation Data Will Bring Clarity

The British pound has been consolidating after a strong downward movement that was triggered by BoE Governor Bailey saying that the central bank may need more active steps if inflation continues to slow down.

With this in view, traders are likely to pay more attention to this week’s CPI YoY report from the UK. This will help market participants make more informative assumptions on the further steps by the Bank of England. Currently, investors expect the BoE to cut the rate by 25 bps during November’s meeting. Another round of rate cuts is expected in December.

PMI release in September revealed that the data is still far from showing growth as the private sector eased and reached a 42-month low. A further inflation cooldown adds to their rate cut expectations, which may push the British pound lower.

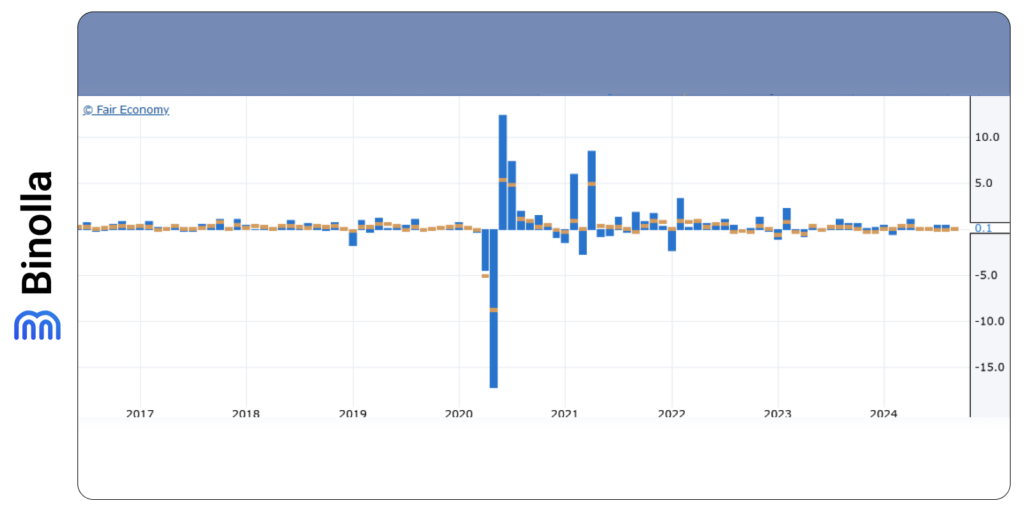

Latest US Data Makes the Future Fed Decisions Unclear

The Labor market data release at the beginning of the month demonstrated better figures and supported USD as the recovery may begin even before the Fed makes its next expansionary step. Moreover, inflation data last week was also above expectations as the yearly CPI fall dropped to 2.4% against 2.3% which was forecasted by economists.

Retail sales data that will be released on Thursday is expected to be positive as investors expect this indicator to increase by 0.3% in September against 0.1% in August. All these indicators open the door for the FOMC to hold on to current rates for longer, which, in turn, means that the US dollar is likely to have support against other currencies.

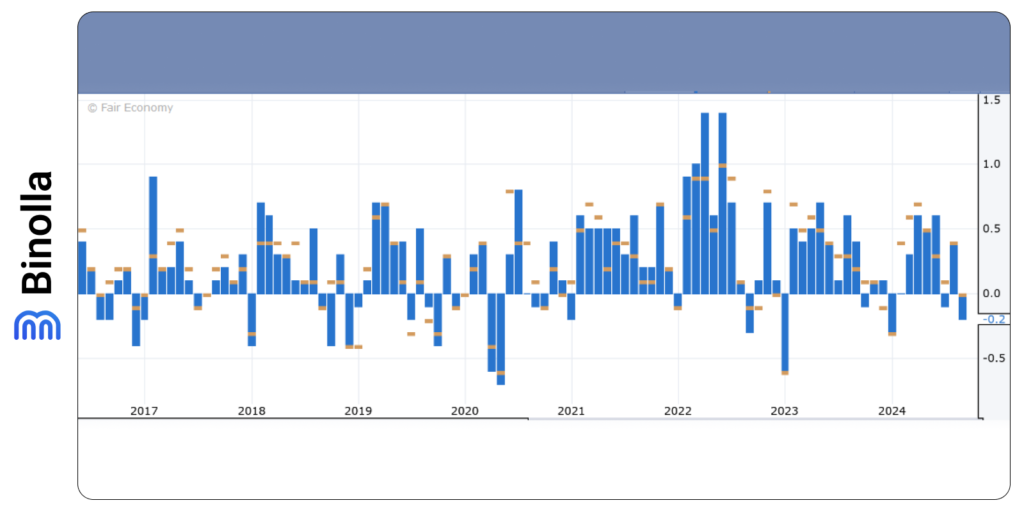

Canadian and New Zealand CPI Data This Week

Canadian CPI numbers will be crucial for the next BoC decision. Monthly CPI is expected to remain in the negative area (-0.2%), while median inflation year-over-year is expected to post a 2.3%, which means that there will be no dynamics at all as compared to the previous report.

When it comes to inflation in New Zealand, quarterly numbers are likely to hit 0.7% as compared to 0.4% in the previous report. This may stimulate the RBNZ to be more aggressive in their rate-cut steps. It should be mentioned that policymakers have already reduced borrowing costs by 50 bps during their October meeting.

BoJ Will Decide Whether to Hike Rates Again

Japan struggles with high inflation and the question is more about whether to hike rates rather than launch a stimulus round. The inflation data that will be released on Friday is expected to demonstrate a cooldown from 2.8% to 2.3%. However, these numbers are still above the 2%, which is targeted by the central bank. With this in mind, the BoJ is likely to consider another round of rate hikes, which may support the Japanese yen in the near term.

Chinese GDP Data Matters

Quarterly Chinese GDP data will be released on Friday. The growth is forecasted to slightly cooldown from 4.7% to 4.6% y/y. Industrial production and retail sales data for September will also be released on Friday. Chinese inflation data and producer price index fell more than expected on Sunday. In particular, yearly inflation dropped to 0.4% from 0.6% in August, while the PPI developed its negative dynamics by marking -2.8% in September.

The stimulus measures that the PBC has unveiled recently may not be enough to stimulate economic growth and support inflation. Therefore, more stimulus may be needed and this means that the yuan will be under pressure in the following months.