Will the US Labor Market Data Dictate Near Term USD Direction?

The Fed has cut rates by 50 bps during the meeting that took place in September 2024. However, this is just a beginning of the expansionary monetary cycle that is expected by most economists, investors and traders. There are several rounds of interest rate cuts ahead and it is only a matter of time. This week, the US jobs data is likely to shed light on the upcoming FOMC decisions.

The next central bank’s meeting will take place in November 2024. Therefore, the focus has shifted from what was already done to what is expected. September’s labor market data in the US is expected to show a healthy yet mederating labor market. According to forecasts, payrolls are likely to hit 146,000. That’s similar to what we have seen in August

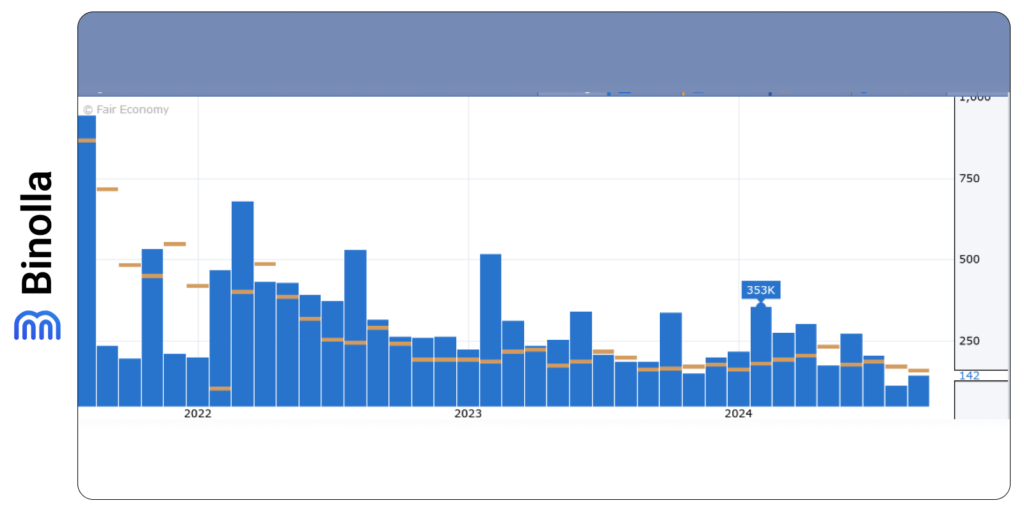

Currently, US payrolls are close to their weakest readings since mid-2019. The jobless rate is expected to hold at 4.2$, while the average hourly earnings are projected to rach 3.8% from the previous year.

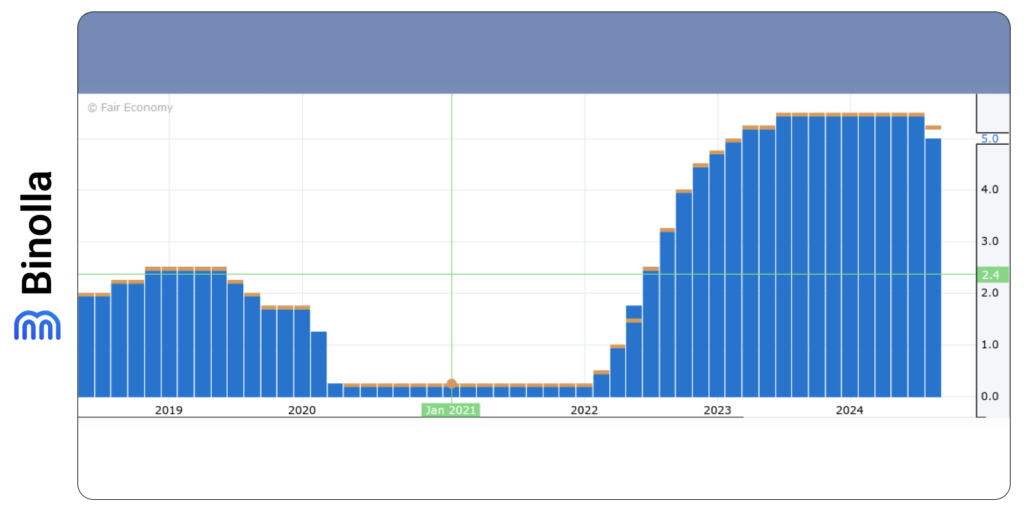

Recent unrest in the labor market suggests Friday’s report will be the last clean reading before the policy makers will get together in November. Along with the payrolls data that will attract attention of traders and investors this week, it is also worth looking at the job openings data. According to forecasts, the readings are likely to be close to the lowest level since the beginning of 2021.

Contents

Will the Fed Opt for Another 50 BPS Rate Cut?

The upcoming November meeting of the Federal Reserve is among the key topics that economist and traders discuss nowadays. According to the latest comments from the Fed, the central bank is ready to make another 50 bps rate cut this year. Moreover, some rumors say that the FOMC may go even further and make an even larger 75 bps cut this year. Currently, a back-to-back double cut in November is expected by 50% of market participants and economists.

With all this in view, Christopher Waller and Neel Kashkari are voting for slower reduction. While the US dollar is currently trading in a consolidation phase, there are upside risks if the upcoming data will favore more moderate cuts this year. This week, market participants will have an opportunity to hear comments from a lot of FOMC members, including Jerome Powell, who has already spoken on Monday.

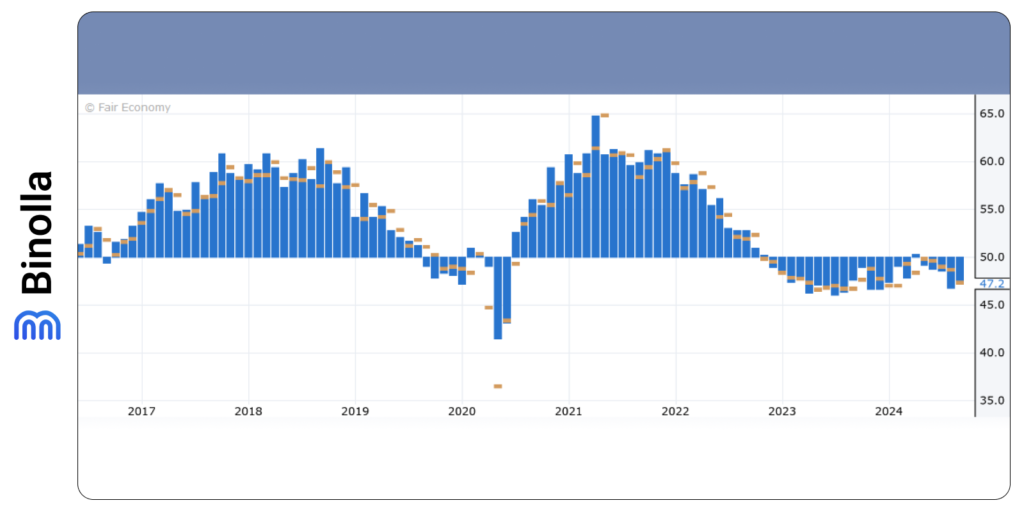

The US ISM Data Is in Focus

While the US labor market data will be the key release to watch this week, market participants should also pay attentiokn to the ISM indicators. If the numbers agree with the Powell’s view after last week’s decision that the economy is in good shape, the US dollar may find ground and even have an upside as there will be no necessity in making other expansionary steps in the near future.

However, for the US dollar to move upwards, the Friday’s labor market data should also show some better figures. We have already mentioned that the NFP is forecasts to show slight dynamics and the figures are likely to be close to their lowest readings since 2019.

The forecasts are not poiting to a game-changing reports. However, in case of decent ISM prints and less-dovish than expected comments from the FOMC members this week, can support the US dollar.

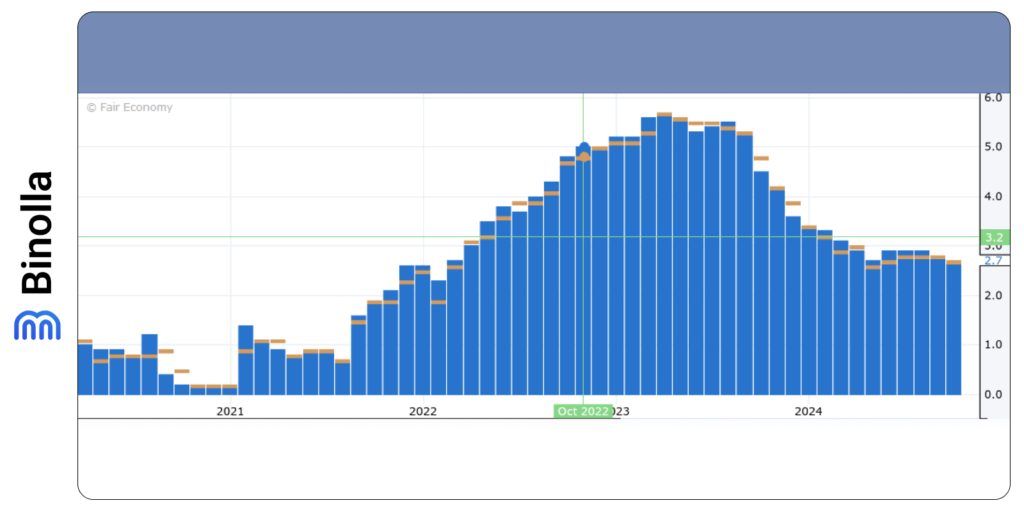

Eurozone’s Inflation Data in Focus

Another important series of macroeconomic data is expected from the Eurozone. German monthly CPI data has printed positive dynamics from -0.1% to 0.0%, while economists expected the consumer price index to hit 0.1% in September.

When it comes to ECB, Lagarde and other policymakers do not show any intention to make another cut during the upcoming October meeting. However, disappointing PMI data has increased bets of another reduction.

Currently, the probability of a 25 bps rate cut is expected by 75% of market participants. According to latest rumors, the upcoming decision is wide open. Doves are likely to vote for a rate cut after weak PMIs, while hawks will argue for a pause not to make another back-to-back cut. There is also a compromise solution to cut rates in December while making a pause in October. However, the latter is not guaranteed as policymakers will examine the upcoming macroeconomic data first.

The current base scenario is reduction during both October and December meetings. Weak inflation data could solidify that view. EUR/USD could move down in this case and extend its downside if the US data will favor a pause in rate cuts for the Fed this year. When it comes to quotes, the bearish trend may begin right after EUR/USD breaks below 1.1000. If confirmed by macroeconomic data, this may lead to a significant downtrend.