Will the Fed Announce The Beginning of the Expansionary Policy This Week?

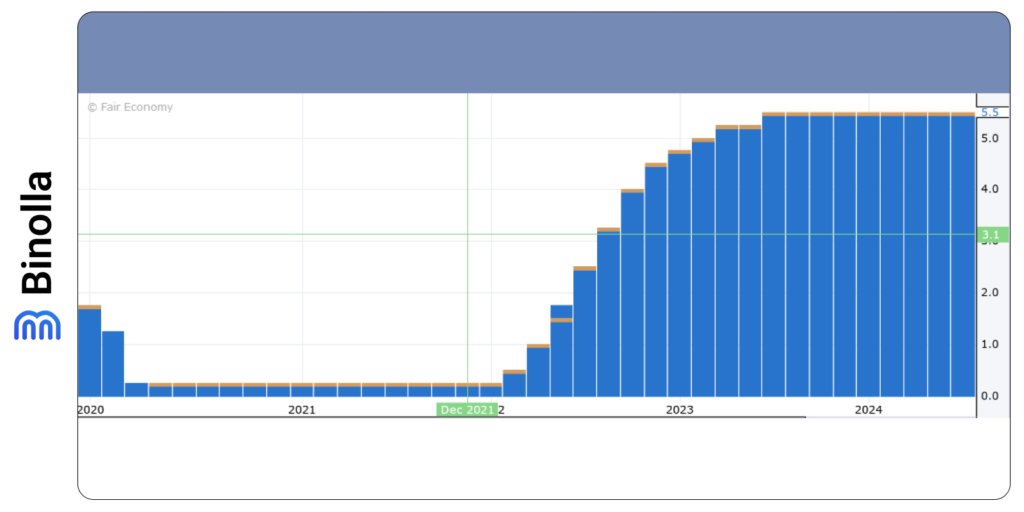

The NFP report for July was weaker than expected, which triggered panic sales a couple of weeks ago, and spurred expectations of more aggressive expansionary steps from the Fed. According to forecasts, investors and traders expected the Federal Reserve to cut rates by 125 bps by the end of the year.

However, economic data from the US that was released later, demonstrated that the economy is in a better stance, which shifted expectations from 125 bps to only 100 bps. Both variants are still dovish, as even a 100 bps cut should be spread among the three remaining meetings, with the first to take place in September.

According to the latest forecasts, the probability of a double cut (50 bps) at the meeting that will take place in September is around 25%, but this action is almost fully priced in December, at the last 2024 meeting. With all this in mind, traders and investors are anticipating the upcoming Jackson Hole Symposium that will take place on Thursday and Friday this week, with The Fed’s Chair Powell being among the key actors.

Moreover, along with Jerome Powell, a lot of other speakers will give their comments on the current situation and future changes in the monetary policy.

With the current situation with yearly inflation, which remains around 3%, it will be interesting to see whether the Fed is still ready to step into the dovish ground. Even with Powell’s latest comments about the door that is still open, there is no certainty about whether the FOMC is ready to make a double-cut or not.

Apart from commentaries on the monetary policy, the event is interesting for those following economic projections. Speakers, including Powell, are likely to make their economic projections, especially on the recession that triggers fears in the financial markets.

When it comes to the latest meeting, the minutes will be released on Wednesday. However, traders and investors are likely to give more weight to the symposium.

Contents

Global PMIs Are Also in Focus

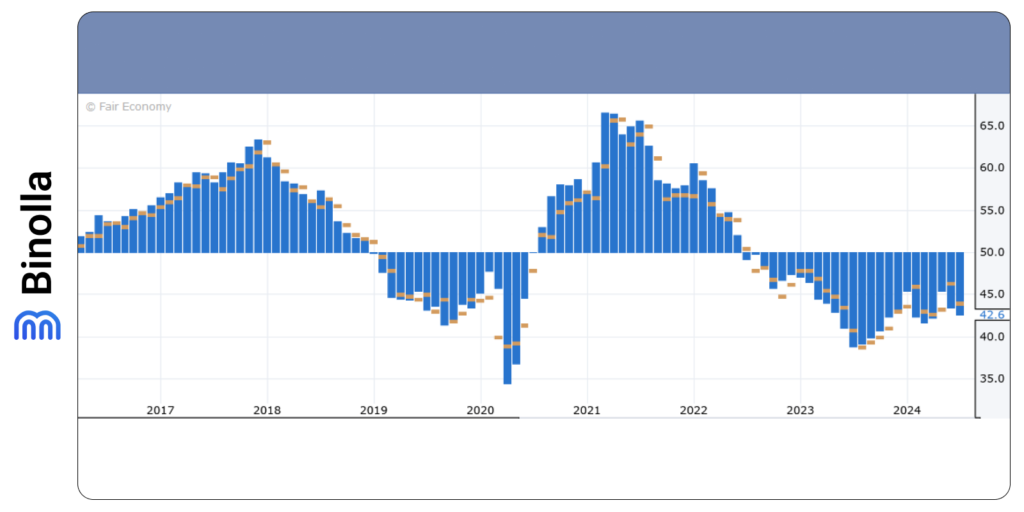

Apart from the Jackson Hole Symposium and the FOMC meeting minutes, it is worth looking at a series of PMIs that will be released on Thursday. The European Central Bank has decided to leave the rates unchanged in July with a 25 bps reduction forecasted in September. Moreover, the upcoming PMI from Germany and France, as well as an aggregated PMI from the Eurozone may support this view.

The German manufacturing PMI is expected to stay below 50, which means that the industrial business activities are not expanding. The previous manufacturing PMI in Germany was 43.2, while economists expect this indicator to rise by 0.2 to 43.4.

When it comes to German services PMI, a negative dynamics is expected on Thursday. The indicator is likely to lose 0.2 points and decrease from 52.5 to 52.3.

The BoE has signaled that it will be more careful about expanding its monetary policy. After cutting the rate on August 1, the next step will be weighed before the officials will cut rates again.

This week’s UK Manufacturing and Services PMIs are expected to have slightly positive dynamics. The unemployment rate that was released last week dropped from 4.4% to 4.2%, which was another sign of a better economic stance.

The CAD Recovery Depends on the CPI Data

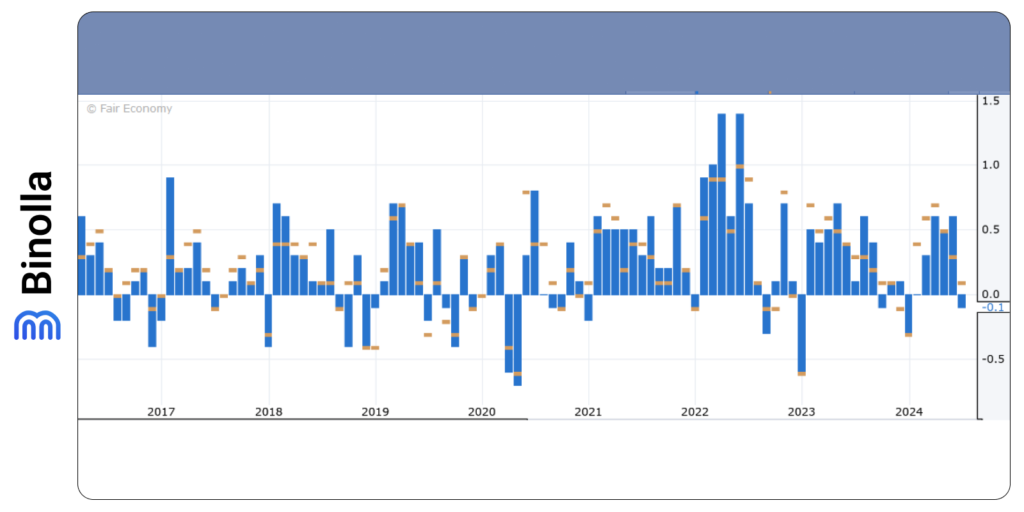

The Canadian CPI data that is going to be released on Tuesday attracted a lot of attention as the BoC cut rates at each of the two last meetings. Moreover, the officials have hinted that the door is open as more actions can be expected down the line.

According to the latest forecasts, the Bank of Canada is likely to follow this course and cut rates again this year. A further slowdown in inflation may add confidence to this opinion. If this happens, the CAD will be under pressure in the upcoming sessions.

However, not only inflation weighs on the oil-linked currency. The rebound in oil prices due to the increase of tensions in the Middle East may lead to supply problems. On the other hand, the demand is also expected to be lower due to a recession that may touch major and emerging economies. Therefore, the interest rate cuts are already priced and a slowdown in inflation is unlikely to make much noise.

Japan’s Inflation is Also in Focus

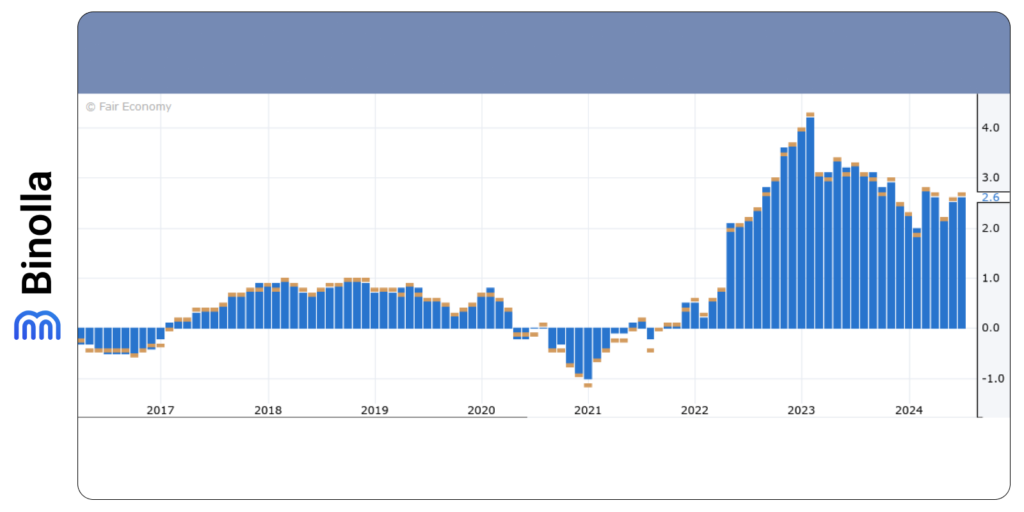

When it comes to the Japanese yen, Friday’s inflation data for July is forecasted to accelerate from 2.6% to 2.7%. If this happens, then the probability of another rate hike is only a matter of time. The BoJ is likely to tighten its monetary policy again this year.

Even if all these expectations lead to a stronger yen, it is unlikely that the rally will be long enough as interest rates are still very low as compared to other major banks.