US Inflation Data and ECB Decision to Boost Volatility in the Financial Markets

The week ahead promises to be volatile as several reports and events may fuel local and even mid-term trends. The US inflation data is likely to be the main driver followed by the FOMC meeting minutes, ECB and BoC meetings, and some other important reports.

Contents

- 1 Focus on US Inflation and Fed Meeting Minutes

- 2 ECB Meeting: Potential Rate Cut on the Horizon

- 3 Market Movements Create Opportunities—Will You Take Them?

- 4 RBNZ Rate Decision: Timing of Potential Cuts in Focus

- 5 The UK GDP Report: No More Surprises?

- 6 Bitcoin (BTC) Approaches Record High Ahead of Halving Event

Focus on US Inflation and Fed Meeting Minutes

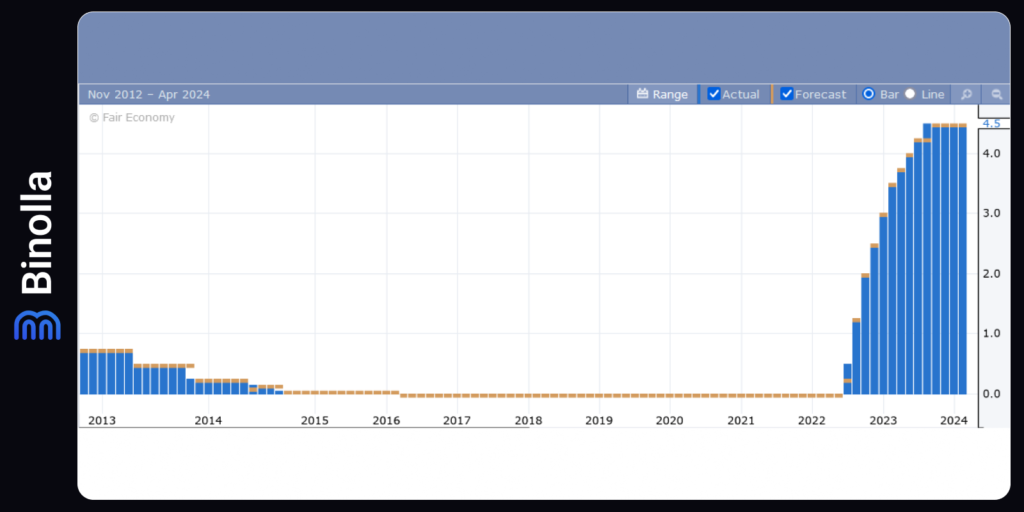

The United States is gearing up for significant events this week, with all eyes on the Consumer Price Index (CPI) inflation data and the release of the latest Federal Reserve meeting minutes, both scheduled for Wednesday. These key indicators will play a pivotal role in shaping investor expectations regarding a potential rate cut by the Fed in June, currently standing at a 70% probability in the markets.

Initial forecasts suggest a potential uptick in inflation, with the CPI rate expected to reach 3.4% in March, up from the previous 3.2%. However, the core inflation rate is projected to decrease slightly to 3.7%. This discrepancy is likely attributable to the surge in oil prices during the month, as the core rate excludes energy price fluctuations.

The implications for the Fed are mixed. A decline in the core inflation rate may signal a continuation of the broader trend of disinflation, despite elevated headline inflation driven by rising energy costs.

Simultaneously, the release of the Fed meeting minutes will provide insights into the discussions held during the March meeting, where Federal Open Market Committee (FOMC) officials upgraded their growth and inflation forecasts while maintaining projections for three rate cuts this year. While the minutes may offer valuable behind-the-scenes perspectives, significant revelations are unlikely, given the extensive public comments made by officials since the meeting.

Regarding the dollar’s performance, it experienced volatility throughout the week, initially weakening following a disappointing ISM services survey before rebounding amid risk aversion spurred by concerns over potential Iranian actions against Israel.

Overall, the US economy appears relatively robust compared to other regions, with GDP growth expected to reach 2.5% this quarter according to the Atlanta Fed. While the broader outlook seems positive, sustained strength in the reserve currency may require further indications of weakness in foreign economies or a risk-off environment that drives demand for safe-haven assets.

ECB Meeting: Potential Rate Cut on the Horizon

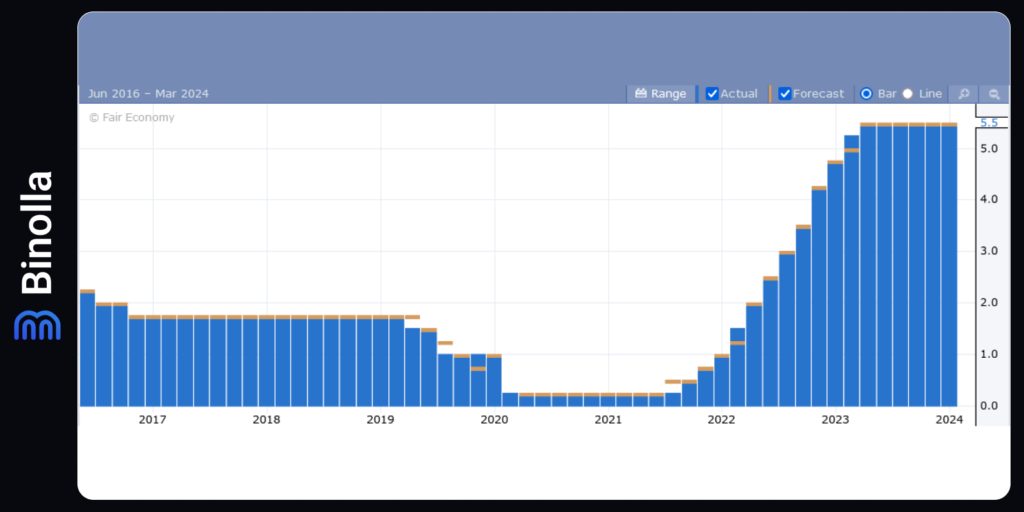

The Eurozone economy has faced challenges over the past year, with growth nearly stagnant. Germany, in particular, has struggled, slipping into contraction due to a global trade slowdown impacting export demand and its manufacturing sector.

On a positive note, the economic slowdown has helped alleviate inflationary pressures. In March, inflation dropped to 2.4%, edging the European Central Bank (ECB) closer to considering an interest rate cut. Most ECB officials have indicated June as the likely time for such a move.

Investors are aligned with this expectation, as a June rate cut is already fully factored into money markets. This reflects the subdued growth momentum and cooling inflation, alongside a slight uptick in the unemployment rate this year, suggesting a downward trajectory for inflation.

Therefore, the upcoming ECB meeting on Thursday is anticipated to serve as a precursor to potential rate cuts in the summer. President Lagarde may emphasize progress on inflation and argue that lowering rates soon could mitigate the risk of recession.

However, the euro’s resilience in the face of gloomy economic fundamentals has been buoyed by external factors. The currency benefited from a plunge in natural gas prices, which bolstered trade, and the upbeat sentiment in stock markets, which restrained demand for the safe-haven US dollar.

Yet, this reliance on external market developments presents a precarious situation. Any shift in these trends could weaken a significant support pillar for the euro, exposing it to the realities of sluggish growth and impending rate cuts.

In essence, the euro’s stability hinges on low gas prices and bullish stock markets. Without these factors, attention may turn to the Eurozone’s lackluster growth prospects and the potential for monetary easing.

RBNZ Rate Decision: Timing of Potential Cuts in Focus

The upcoming meeting of the Reserve Bank of New Zealand (RBNZ) on Wednesday marks the culmination of recent policy discussions, where the prevailing sentiment has been one of caution, signaling a likely continuation of the status quo. Economists are unanimous in their prediction that there will be no policy change, with the Official Cash Rate (OCR) expected to hold steady at 5.5%.

Despite the central bank’s steadfastness, market sentiment is growing restless. This meeting would mark the sixth consecutive occasion without any adjustments to interest rates in New Zealand, coinciding with the country’s entry into a technical recession and a continued decline in business confidence. Pressure is mounting on the Monetary Policy Committee (MPC) to offer some form of economic relief.

The consensus among surveyed economists is that rate cuts are inevitable; however, opinions diverge on the timing. While the majority anticipate the first cut by the end of the third quarter, others suggest a later timeline, with a few even projecting a delay until the beginning of the following year.

Investors seeking clarity on the timing of potential rate cuts may find themselves disappointed, as the RBNZ is scheduled to issue only its Monetary Policy Report, lacking updated projections for inflation and economic growth crucial for precise forecasting of easing measures.

It’s important to acknowledge the possibility of surprises from the RBNZ, given its recent history of deviating from market expectations, often resulting in significant fluctuations in the New Zealand dollar (Kiwi). Governor Adrian Orr’s commentary could introduce unexpected dovish tones or policy shifts, particularly amidst ongoing transitions within the MPC, including the departure and addition of board members.

While current projections indicate a gradual decline in inflation towards target levels by the quarter’s end, the market is pricing in two rate cuts by year-end. However, past RBNZ comments suggest a willingness to maintain relatively high rates to anchor inflation, regardless of achieving lower inflation levels.

The relative timing of the RBNZ’s first rate cut compared to the anticipated Federal Reserve action could influence the NZD/USD currency pair. Presently, markets expect the Fed to cut rates in June, potentially followed by the RBNZ. Any deviation from this expected sequence could impact the Kiwi’s performance in the currency markets.

The UK GDP Report: No More Surprises?

The UK is set to release its February monthly GDP report, providing detailed insights into the country’s economic performance. The Bank of England defines a recession as two consecutive quarters of contracting GDP, and under this criterion, the UK experienced a mild recession in the second half of 2023. While the economy expanded by 0.2% in January, February’s figures may indicate stagnation. The PMI data signals ongoing struggles in the manufacturing sector, although the services sector could offer some support. January saw a notable 1.1% surge in construction, but this growth is unlikely to be replicated.

Traditionally, the UK’s trade balance tends to improve in February, potentially lessening its impact on overall growth. Exports experienced a significant decline of 10.3% year-over-year in Q4 2023, but this contraction may be moderating at the beginning of this year. Import figures consistently fell on a year-over-year basis throughout last year.

Bitcoin (BTC) Approaches Record High Ahead of Halving Event

Bitcoin has surged back above the $70,000 mark and is tantalizingly close to reaching a new all-time high, as buyer activity intensifies ahead of the imminent halving event. The recent brief sell-off has now been completely erased, with today’s upward movement propelling Bitcoin beyond the recent highs clustered between $71,200 and $71,800. With minimal technical barriers in its path, BTC/USD is poised to venture into uncharted territory.

The primary driver behind Bitcoin’s impressive rally in recent months has been a surge in institutional buying, spurred by the approval of eleven spot Bitcoin ETFs in early January. During the first quarter of 2024, these ETFs collectively acquired a net total of $12.1 billion worth of Bitcoin, marking a substantial influx of $26.8 billion in inflows compared to $14.7 billion in outflows.

The significant demand currently witnessed in the Bitcoin market is poised to collide with a supply shock as the forthcoming halving event approaches. Halving events occur approximately every four years, wherein the reward for mining a new block undergoes a 50% reduction. At the upcoming halving event, the reward will decrease from 6.25 BTC to 3.125 BTC per block. This cycle will persist every 210,000 blocks until the total supply of 21 million coins is mined, a milestone anticipated to be reached by 2140.