The US Inflation and GDP Data in Focus This Week

The July Fed meeting is around the corner. While no one expects the FOMC to make any decisions during the two-day event, it is important to pay attention to the comments from voting members, including those from Jerome Powell to understand what to expect from the Federal Reserve in the future.

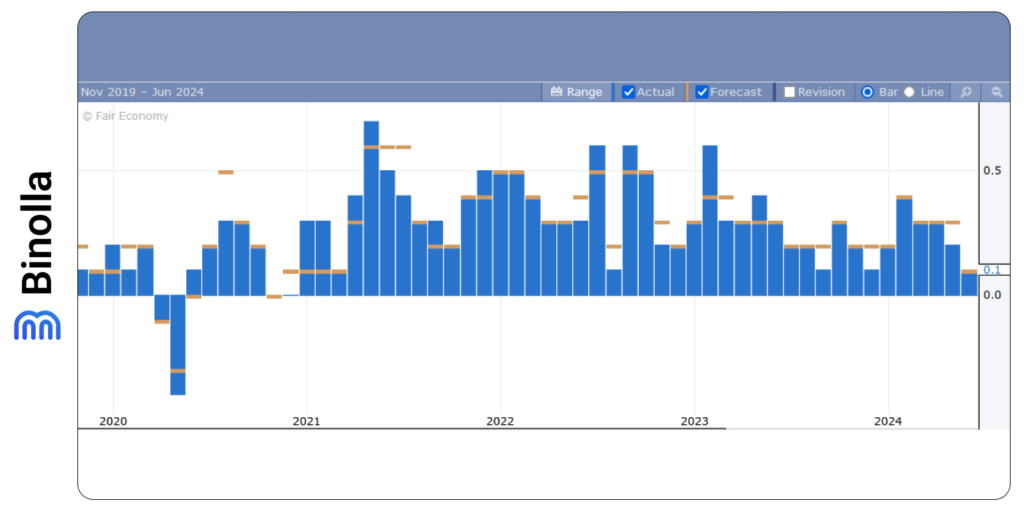

As there is still time before the main event of July to take place, there are a couple of data releases from the United States that may attract traders’ attention. First, personal consumption expenditures (PCE), which is known as one of the key indicators for the Fed. Yearly consumer inflation in the US is expected to ease from 2.6% in May to 2.4% in July. However, the monthly Core PCE index is likely to increase from 0.1% in May to 0.2% in July.

The personal income and consumption numbers are also included in this report. The former is expected to grow by 0.4% in June, which is, however, 0.1% lower than in May, while the latter is likely to increase by 0.3%, which is 0.1% more than in May.

According to recent data, consumer spending is finally curbed and this may be another argument for the Fed to cut rates. However, if an unexpected acceleration takes place, the Fed is likely to be more cautious about cutting rates in September.

Economic growth is expected to quicken in the second quarter. However, in general, the US economy seems to lose steam this year. The advanced quarterly GDP is expected to show 2.0% yearly growth against 1.4% in the prior three months.

The Fed is not in a rush to cut rates. We have already mentioned that any changes in the monetary policy in the United States in July are rather unlikely. According to the latest comments, policymakers are comfortable waiting for more signs of lower inflation.

Along with macroeconomic factors that influence the market sentiment right now it is worth mentioning US elections that are likely to impact the US dollar fluctuations. While Joe Biden made a decision to leave the presidential race on Sunday, the nominee from Democrats, Kamala Harris has a better chance of entering the White House.

Contents

BoC Is Likely to Cut Rates on Wednesday

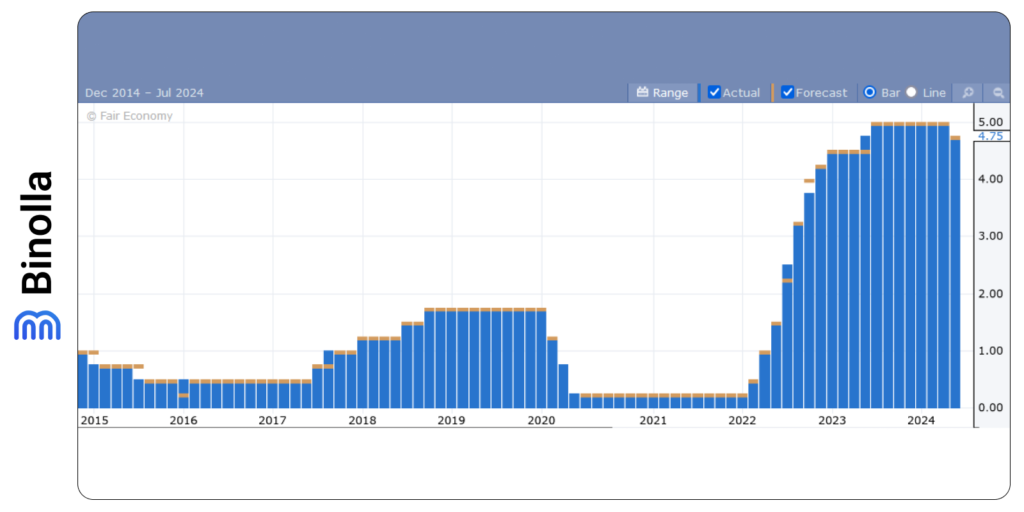

Another round of monetary policy easing by the Band of Canada is likely to take place on Wednesday. At least investors are confident that the BoC will cut the rates from 4.75% to 4.50%. If this come true, the Bank of Canada will be among the leaders in the easing cycle at least among the major central banks. The question is whether the BoC will be comfortable going ahead of its major peers in monetary policy easing.

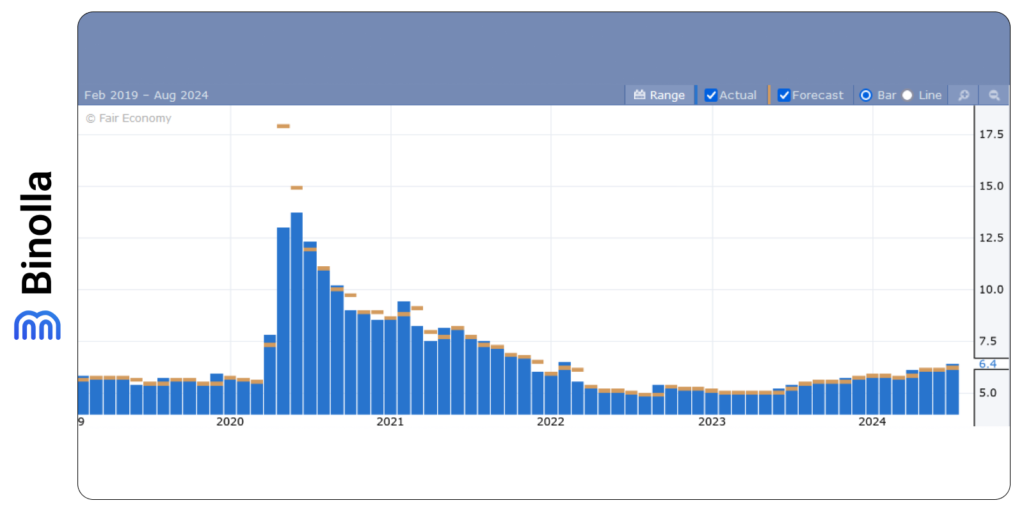

The inflation in Canada demonstrated the lowest annual change since March 2021, which was, by the way, within the target range set by the BoC between 1% and 3%. Moreover, the unemployment rate climbed to a two-year high, while household debts remained problematic.

While the Boc did not hesitate in that situation, the second cut is still in question. Some economists think that the next round is not necessary. The inflation in June reached 2.7% after a climb to 2.9%, which was still below the BoC projections of 3%. When it comes to the core inflation, it was 1.9%, which is slightly below the midpoint of 2%.

With the unemployment rate hitting 6.4%, the central bank is likely to make another dovish decision during the upcoming meeting. In this situation, even though the fight against inflation is not over, the reasons for the second cut in a row are more than evident. The BoC is likely to stimulate economic growth and fight unemployment while inflation is within the targeted range.

As for the number of eventual rate cuts this year, the Bank of Canada can do it again within one of the next meetings that will take place in September, October, and December. With the FOMC expected to initiate a rate cut in September, the Bank of Canada can undertake one more easing this year.

PMIs Could Attract More Attention than US Developments

While we have already become accustomed to the fact that the major news comes from the United States, the upcoming PMIs may change this tradition. The presidential race in the US still dominates the headlines, but the news from the Eurozone and Great Britain may also bring volatility. At least, the importance of figures that will be published on Wednesday should not be underestimated.

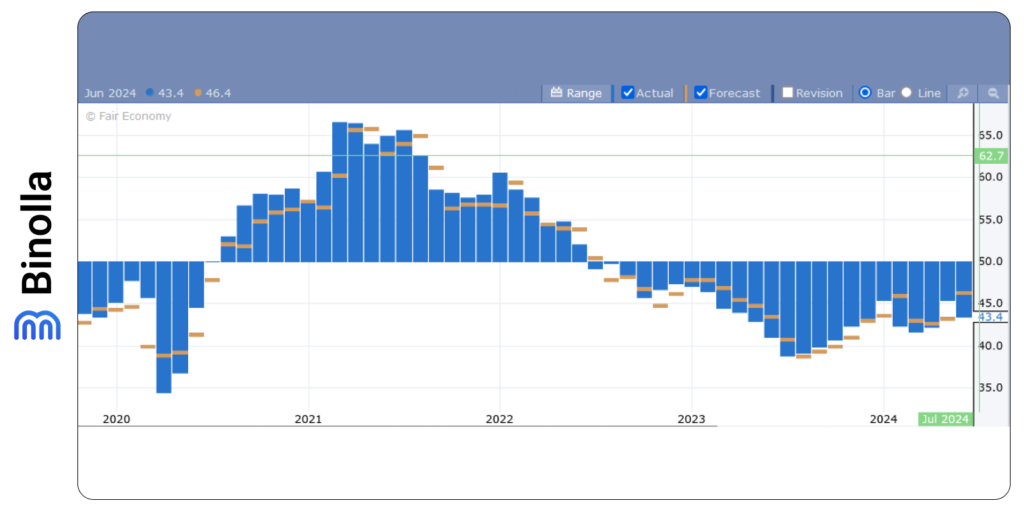

The question is whether the Eurozone’s service sector is capable of saving the day again. While there were no surprises during last week’s ECB meeting and rates were kept again, the door for a cut-rate in September is still open for the central bank. Moreover, this will be even more likely if the Fed decides to cut rates in the first month of fall.

The ECB President Christine Lagarde said last Thursday that PMIs are of great concern (both service and manufacturing). While services pulled the Eurozone’s economy out of recession, the manufacturing sector still suffers from soft activity, which is one of the major problems the ECB has been facing for quite a long time already.

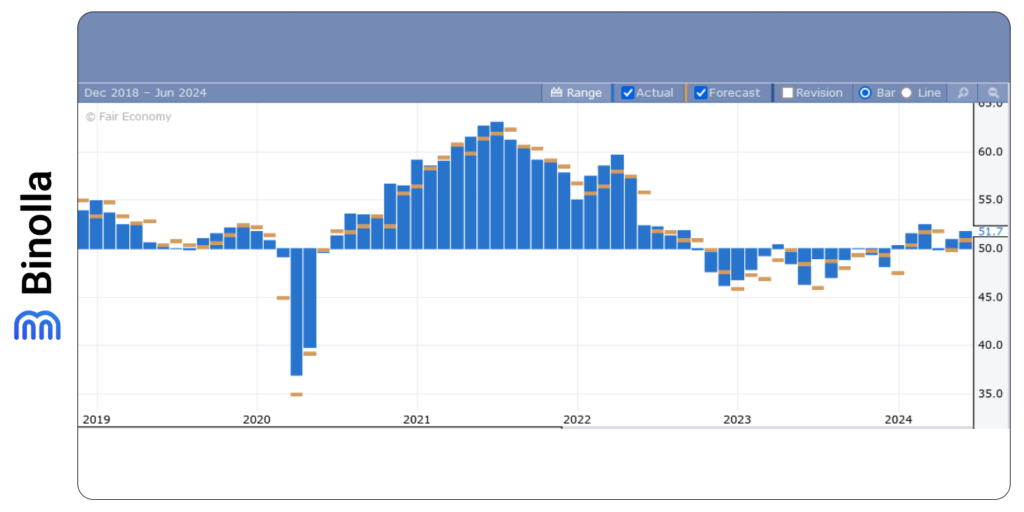

The manufacturing sector has been stuck below 50 for the past two years. Germany played a significant role as a major contributor to the manufacturing sector of the Eurozone for years. However, currently, due to the lack of cheap energy from Russia, its competitiveness is lower. Markets expect small improvements in both sectors during Wednesday’s data releases.

While the Institute for Supply Management (ISM) indices remain the Fed’s preferred set of indicators, ahead of the July 31 meeting, Fed members will likely only have access to PMI surveys that have already been published. These PMIs accurately reflect the U.S. economic advantage over the eurozone, as the composite PMI jumped in June to its highest level since May 2022.

As in the eurozone, the services sector is a key growth area for the US economy, with the corresponding services PMI rising to a 2-year high. However, unlike in the eurozone, the PMI for the manufacturing sector has recently risen above the 50 mark and appears to be on a smooth uptrend.

The market is currently forecasting a slight rise in the manufacturing PMI but a decent correction in the services sector. Confirmation of this data is unlikely to change the Fed’s outlook, as the market fully expects a 25bp rate cut in September. In fact, weaker data may allow the Fed to start cutting rates with a clear conscience despite the current high inflation rate. The July 31 meeting may be uneventful, but the Jackson Hole symposium at the end of August could be crucial in the current cycle.

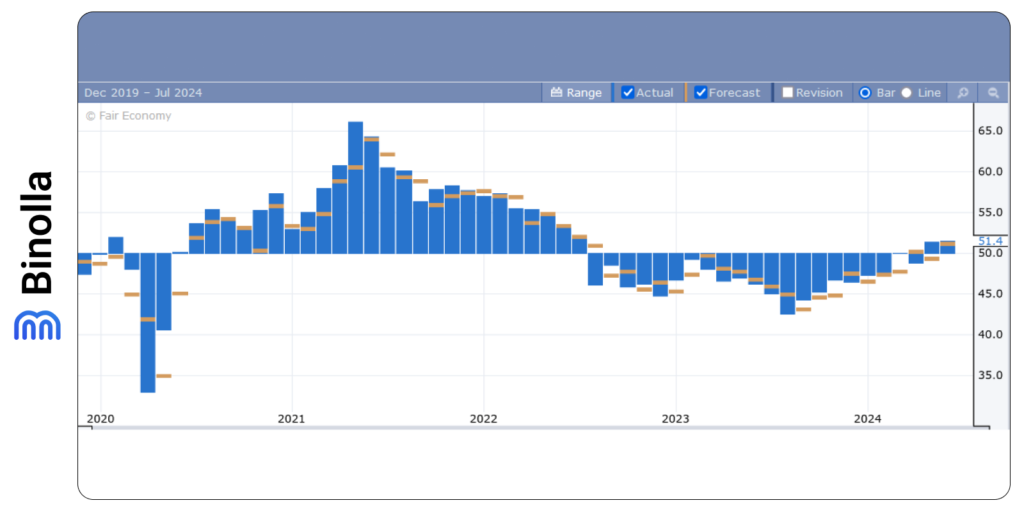

The story is different in the UK, where the services PMI remains above the 50 level but has failed to make the kind of progress seen elsewhere in the region. The recent general election has likely improved sentiment in the sector, so it will be interesting to see if the recent weakness reverses on Wednesday.

Interestingly, the industrial sector is actively recovering from the 2023 trough and has actually returned above the 50 mark over the past two months. This is quite remarkable given the very weak Eurozone data, but strong domestic demand in the UK perhaps explains the strong performance of the manufacturing sector.

The market is expecting positive data, with the services business activity index rising to 52.5 and the industrial sector to 51.1. The Bank of England will meet on August 1, the day after the Fed meeting, and the market has recently eased its expectations for an August rate cut. A strong downward surprise from the PMI indices on Wednesday may incline the Bank of England doves to bring a rate cut to the table at the next meeting.