The FOMC Meeting Minutes and Other Key Events: What to Expect from Markets This Week

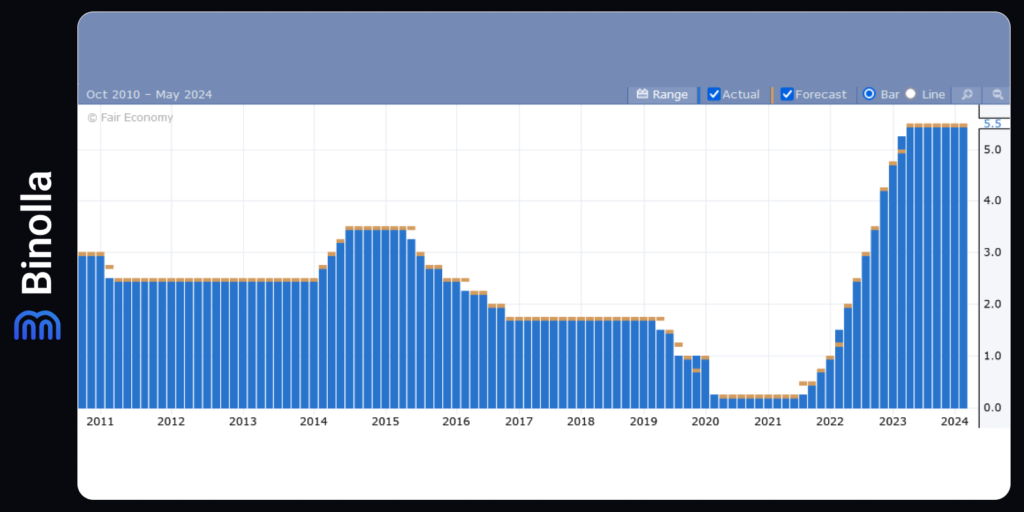

On Wednesday at 18:00 GMT, all eyes will be on the Federal Reserve (Fed) as they release the minutes from their early May meeting. During that meeting, the Fed decided to keep interest rates unchanged and dismissed the possibility of imminent rate cuts. However, they hinted that the next adjustment to borrowing costs would likely be a reduction, and they placed new emphasis on the labor market’s condition.

In the aftermath of this meeting, the labor market data has shown some troubling signs. The Nonfarm Payrolls report came in below expectations, indicating a smaller increase in hiring and a rise in unemployment. This disappointing performance has increased the focus on the upcoming minutes’ release, as traders and investors seek clues about the Fed’s level of concern regarding the labor market.

If the minutes reveal that dovish members of the Federal Open Market Committee (FOMC) are particularly worried about rising unemployment, it is expected that the US Dollar (USD) will weaken, leading to gains in other assets. On the other hand, if the minutes show that inflation — which has been decreasing more slowly than anticipated in the first quarter — remains the primary concern, the USD could strengthen.

It is crucial to understand that Fed officials meticulously revise the meeting minutes up until their release, fully aware of the market’s anticipation and reaction. Given that the latest Consumer Price Index (CPI) report indicated moderating inflation, it is anticipated that the tone of the FOMC Meeting Minutes will lean more dovish, potentially boosting market sentiment.

Even if the minutes adopt a more hawkish tone, any negative impact on the market is expected to be temporary. The overall stock market trend remains upward, and any hawkish comments are likely to be perceived as outdated, serving only as minor setbacks. Historically, market reactions to the release of Fed minutes tend to be short-lived.

In conclusion, while the Fed’s minutes are poised to provide valuable insights into the central bank’s current stance, the broader market trend suggests that any negative reaction will be brief. Investors should prepare for potential volatility but remain focused on the longer-term market direction, which continues to point upwards.

Contents

UK CPI Expected to Hit 2% Target, Impacting the Pound

On Wednesday at 6:00 GMT, the financial markets will be closely monitoring the Bank of England (BoE) as it approaches a crucial decision on interest rates. Speculation is rife that the BoE might cut rates soon, with many wondering if this could happen as early as June. Concurrently, policymakers at the European Central Bank (ECB) will also be scrutinizing the UK’s inflation data for April, as it could have significant implications for their own economic strategies.

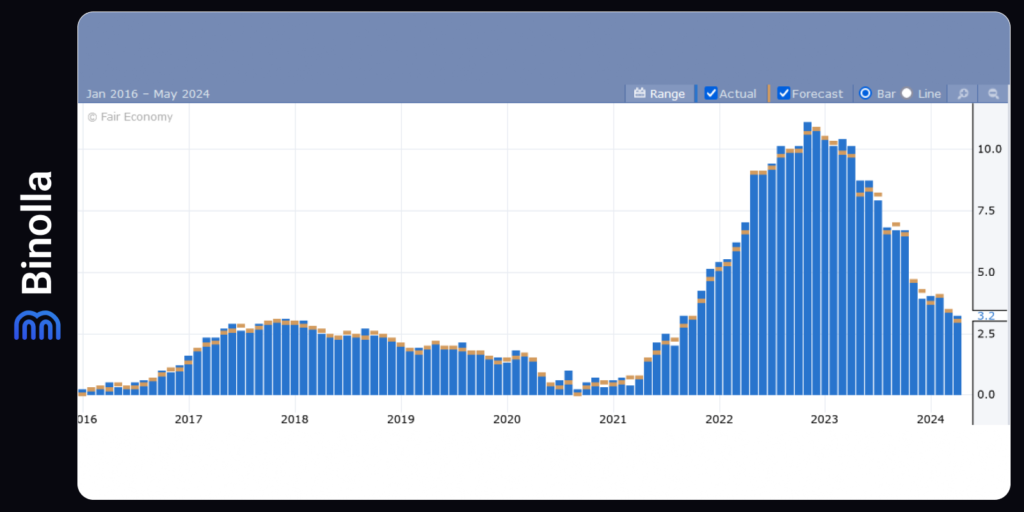

The UK inflation reports for April and October are particularly noteworthy due to the substantial influence of government-mandated energy prices, which typically undergo adjustments during these months. For April, a significant decrease in Natural Gas prices is anticipated to drive the headline Consumer Price Index (CPI) to a rise of 2.1%, a sharp drop from the 3.2% increase recorded in March. This dramatic shift highlights the volatility in energy prices and their substantial impact on overall inflation figures.

While the BoE’s primary focus is on topline inflation figures, market participants and investors will be paying close attention to the core CPI as well. The core CPI excludes volatile items such as food and energy, providing a clearer picture of underlying inflation trends. According to the economic calendar, core inflation is expected to decrease to 3.6% from 4.2%. A more significant drop in core CPI than anticipated would likely lead to a pronounced depreciation of the Sterling. Conversely, if core inflation remains stubbornly high, it could provide support for the Pound, signaling persistent underlying inflationary pressures.

The April UK inflation data is not only crucial for the BoE’s decision-making process but also has broader implications for the Euro. A lower-than-expected core CPI outcome would not only weigh on the Pound but could also affect the Euro, reflecting the interconnected nature of European economies.

Given the current global trend of inflation rates falling short of estimates, I anticipate that the UK’s inflation data will follow suit. If the inflation figures indeed fall short of expectations, this would reinforce the market’s belief that the BoE will proceed with an interest rate cut in the near future. Such a scenario would likely lead to a further decline in the Pound as traders adjust their positions in anticipation of the BoE’s next move.

The upcoming release of the UK’s April inflation data is set to be a pivotal moment for both the BoE and financial markets. The significant drop in headline CPI, driven by lower energy prices, alongside potential decreases in core inflation, will provide critical insights into the health of the UK economy and the likely trajectory of monetary policy. As the BoE navigates these challenging waters, the decisions made in the coming weeks will undoubtedly have far-reaching impacts on Sterling and broader market dynamics.

Will CPI Report Push Bank of Canada Closer to Rate Cut?

Inflation data will once again dominate the economic agenda in the upcoming week, with Consumer Price Index (CPI) numbers scheduled for release in Canada. The Canadian CPI figures will be the first to drop on Tuesday. Leading up to this, the week will have an unusually quiet start due to several markets being closed on Monday.

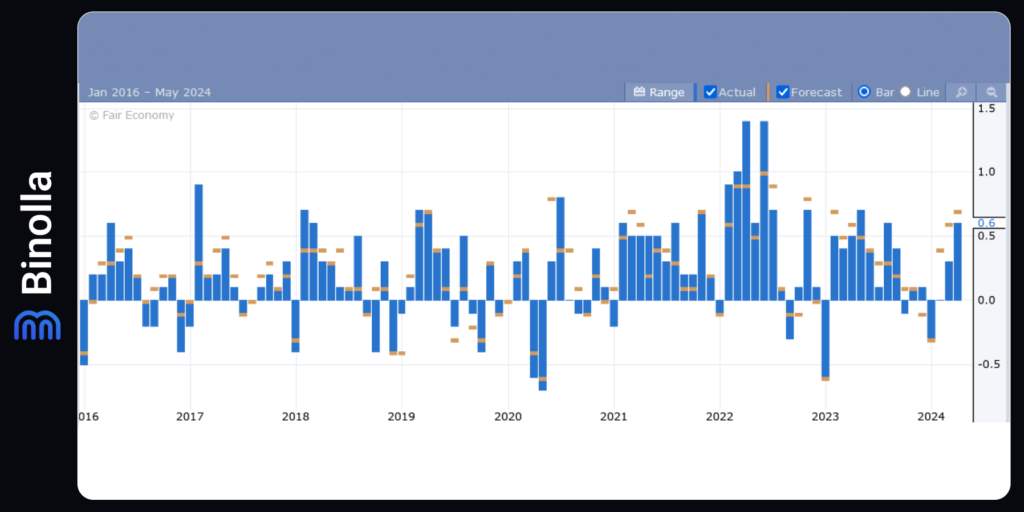

In Canada, price pressures appear to be waning again after the downward trend in various CPI metrics flatlined during the latter half of 2023. Key underlying gauges such as CPI trim, median, and common have eased for the third consecutive month in March. While the headline rate ticked up slightly to 2.8%, this marginal increase is not seen as particularly concerning, especially given that wage growth has also been moderating since the start of the year.

The Bank of Canada (BoC) is set to meet on June 5, and there is currently around a 40% probability of a 25-basis-point rate cut. A softer-than-expected CPI report for April could push those odds closer to 50%. However, despite ongoing progress in controlling inflation, a rate cut is more likely to occur in July rather than in the immediate meeting.

For the Canadian dollar, weaker inflation data could be a setback, particularly for its one-month long uptrend against the US dollar. However, in the grander scheme, expectations surrounding potential Federal Reserve rate cuts will play a more significant role in determining the loonie’s fate. Market participants will also keep an eye on the retail sales numbers for March, set to be released on Friday, as these figures could provide further insights into the strength of consumer spending and economic activity.

RBNZ Holds Steady, Spotlight Shifts to Timing

The Reserve Bank of New Zealand (RBNZ) is the only major central bank set to make a policy decision next week. Despite the gradual decline in inflation over the past year, the pace of this decrease has not met policymakers’ expectations.

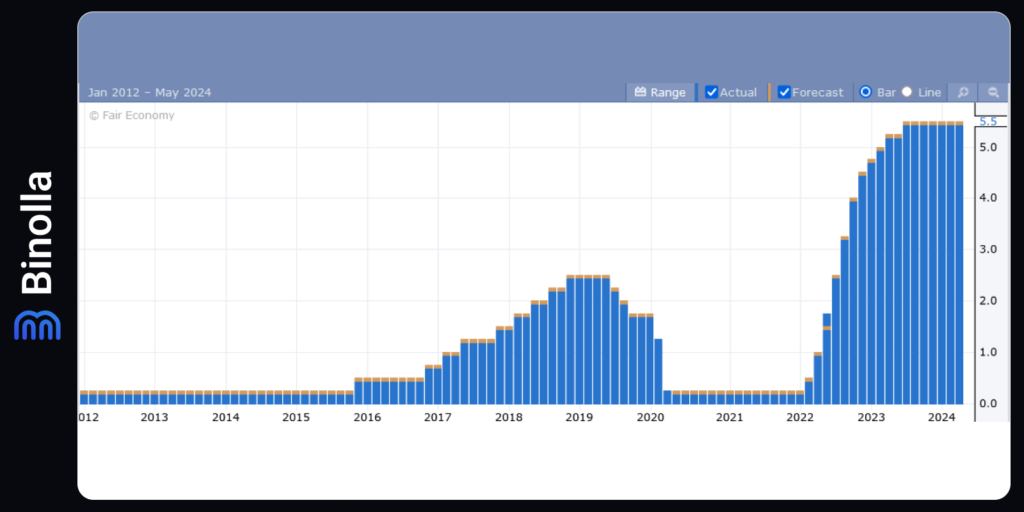

Although a cooling labor market and decreasing inflation expectations present a positive outlook, the RBNZ remains worried about persistent non-tradable inflation. Consequently, the central bank is anticipated to maintain the cash rate at 5.50% on Wednesday, without signaling any imminent rate cuts for the summer or autumn.

However, there is a slight chance that the RBNZ could adjust the timing of its expected rate cut. Originally projected for the second quarter of 2025, the updated Monetary Policy Statement might hint at an earlier cut, possibly in the first quarter or even sooner. Such a shift would likely be perceived as a dovish move.

For the New Zealand dollar, even if the currency reacts negatively to the prospect of an earlier rate cut, there is potential for a bullish rebound in the future. Market expectations are still distant, with many investors predicting a rate cut to start in October.

Additionally, Kiwi traders will be closely watching the quarterly retail sales figures, which are scheduled for release on Thursday.

Will Eurozone Recovery Halt ECB Rate Cuts?

In the euro area, the spotlight will be on the flash PMIs released on Thursday. Forecasts suggest a slight uptick in both services and manufacturing PMIs for May’s preliminary estimates, pushing the composite PMI further above the critical 50.0 mark.

Having emerged from a mild recession in the first quarter, the Eurozone’s growth trajectory could pick up momentum in the upcoming months. While a rate cut by the European Central Bank (ECB) in June appears almost certain, stronger-than-anticipated PMI figures could temper expectations for further rate cuts beyond June, potentially boosting the euro.

Conversely, if the PMI readings come in weaker than expected, the euro’s recent gains against the dollar might stall as investors adjust their outlook to anticipate more aggressive rate cuts.