RBA, BoC, and BoE to Decide the Policy this Week, PMI Data in Focus

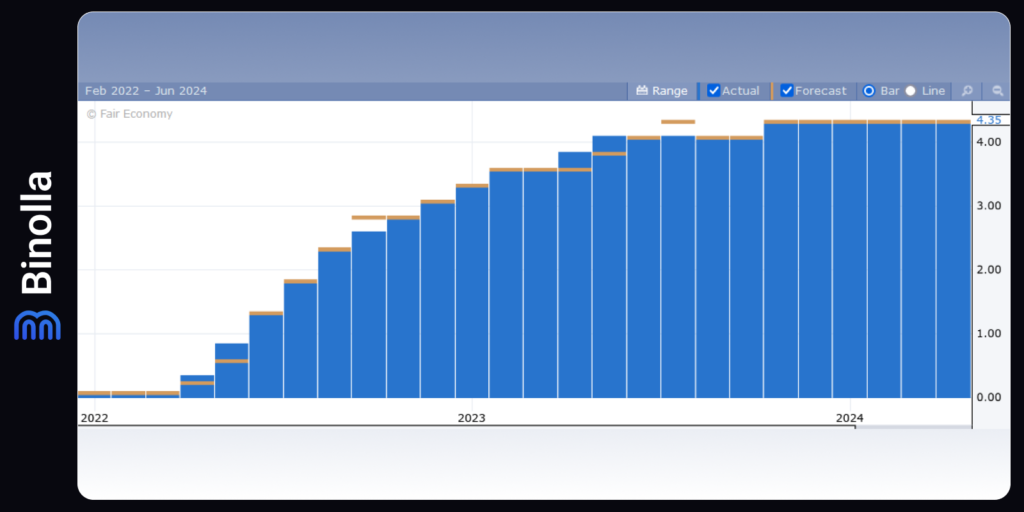

The Reserve Bank of Australia held a meeting on early on Tuesday during the Asian session. The June policy decision was to leave the interest rate unchanged at 4.35%. Central bankers supported the idea of being cautious in interest rate changes. There are several reasons for RBA officials to maintain the rate at 12-year high levels.

The key one is inflation, which slightly accelerated in April showing 3.6% y/y after a sharp drop seen in 2023. GDP grew by 0.1% in the first quarter, which prevented policymakers from hiking rates. When it comes to labor market, it appears to be tightening again, which is another reason for officials to stick to current rates instead of hiking them.

After judging the risks, RBA policymakers were unanimous to leave the rates unchanged, which was followed by the Australian dollar making new gains. The RBA head Michelle Bullock mentioned in a press conference that the case for hiking rates was discussed during the meeting, but policymakers decided to keep the benchmark interest rate at a 12-year high.

The Reserve Bank of Australia remains hawkish, which is not surprising as inflation is still far above the targeted levels. The Australian dollar meanwhile looks bearish given the stronger US dollar and slowing economic momentum in China, which is one of the key Australian trade partners.

Contents

- 1 Will the Swiss National Bank Cut Rates This Week?

- 2 Market Movements Create Opportunities—Will You Take Them?

- 3 BoE Meeting: No Storm is Forecasted

- 4 Eurozone’s PMI Figures are Unlikely to Be Game-Changing

- 5 US Retail Sales Data Could Support Hawkish Rhetoric by the Fed

- 6 Japanese Inflation Data in Focus

Will the Swiss National Bank Cut Rates This Week?

Disputes about the next SNB monetary policy decision are also in focus this week. The Swiss National Bank has already cut rates in March, which makes it the first major central bank to cut rates in this economic cycle. According to projections, about ⅔ of traders and investors see the SNB to make a 25 basis point rate cut again during the quarterly meeting in June.

However, some factors may prevent SNB officials from easing again. The Swiss economy has shown more-than-expected growth in the first trimester. Moreover, inflation accelerated by 1.4% in April and remained unchanged in May. The SNB’s inflation target ranges from 0.0% to 2.0%, which means that currently, the inflation rate is inside the acceptable boundaries. According to SNB president Thomas Jordan, the recent rate cut that took place in April may cause inflation risks to turn to the upside.

Should the Swiss National Bank keep the benchmark interest rate at 1.50%, the franc may extend its latest gains against the US dollar.

BoE Meeting: No Storm is Forecasted

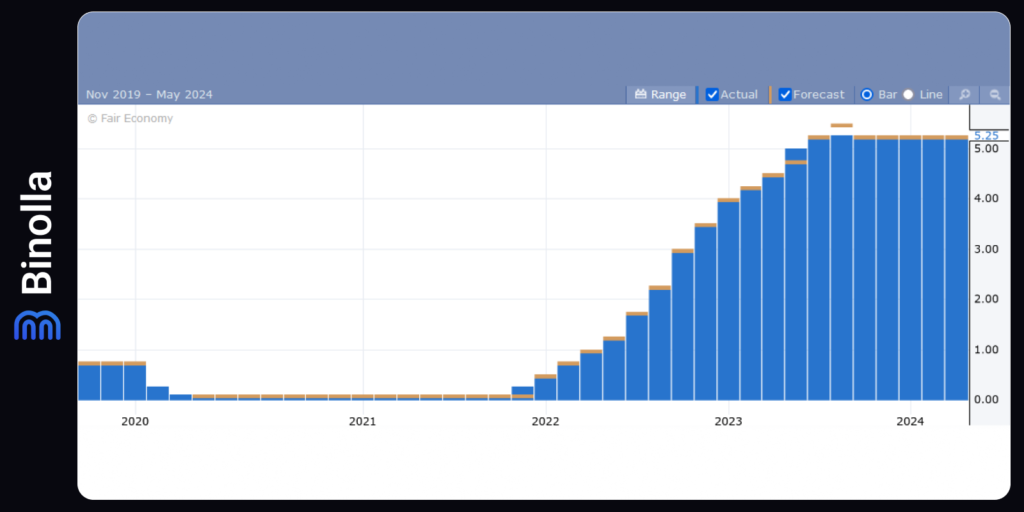

Unlike the SNB meeting that will take place prior to the BoE event, it seems that no one has doubts about the policymakers’ decision. The general election campaign that is currently in focus in the United Kingdom hints that the BoE is unlikely to say or do anything that may sway the voters towards any political persuasion.

In this situation, the BoE officials can buy some time to make more evaluations of the current economic state before making any further steps. The inflation rate plunged to 2.3% in April, while the salary growth is still at 6.0% y/y. The unemployment rate meanwhile rises for the fourth month in March.

August may bring important news as a new government will enter Downing Street and a new economic agenda will be in place. Therefore, we expect no changes in the policymakers’ statement in June.

The May CPI data that is going to be released on Wednesday will be followed by Friday’s retail sales. It is also recommended to take a look at flash PMI estimates that will also be released in the last day of this week.

According to the latest forecasts, about 40% of investors believe that the BoE will cut rates by 25 basis points in August. However, less bold predictions remove the date of the first cut rate to November 2024. It is worth noting that markets may underestimate the willingness of the Bank of England to initiate monetary policy easing earlier, especially if the May CPI data is below 2%.

Only two voting members of the BoE governing board speak out for decreasing rates. Seven of the voting members vote for the rate to remain unchanged. According to forecasts, the disposition is likely to remain the same after the upcoming meeting.

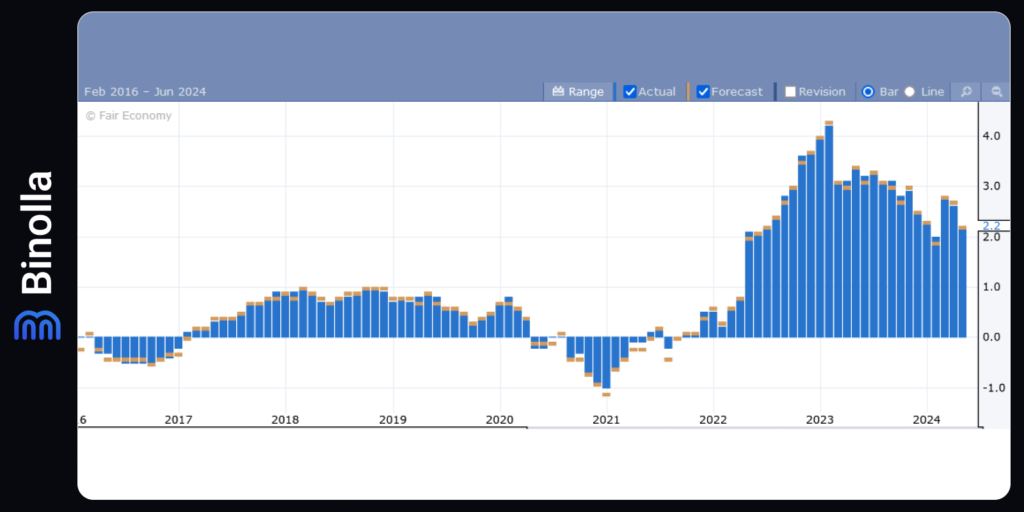

Eurozone’s PMI Figures are Unlikely to Be Game-Changing

As for the Eurozone, all the attention will be focused on Friday’s PMI data in Germany and France, as well as an aggregated index combining PMIs from the whole monetary union. The German Flash Manufacturing PMI is expected to have a one-point growth from 45.4 to 46.4, while services are likely to surge from 54.2 to 54.4 only.

Anyway, everything that is above 50 basis points means growth, which is a supportive factor for EUR. French PMI figures are also expected to be positive, which may also provide the Eurozone’s currency with additional support. Taking into consideration the latest selloffs of the US dollar that were caused by the expectations of the Fed to make their first rate cut in September, EUR/USD may have some gains by the end of the week.

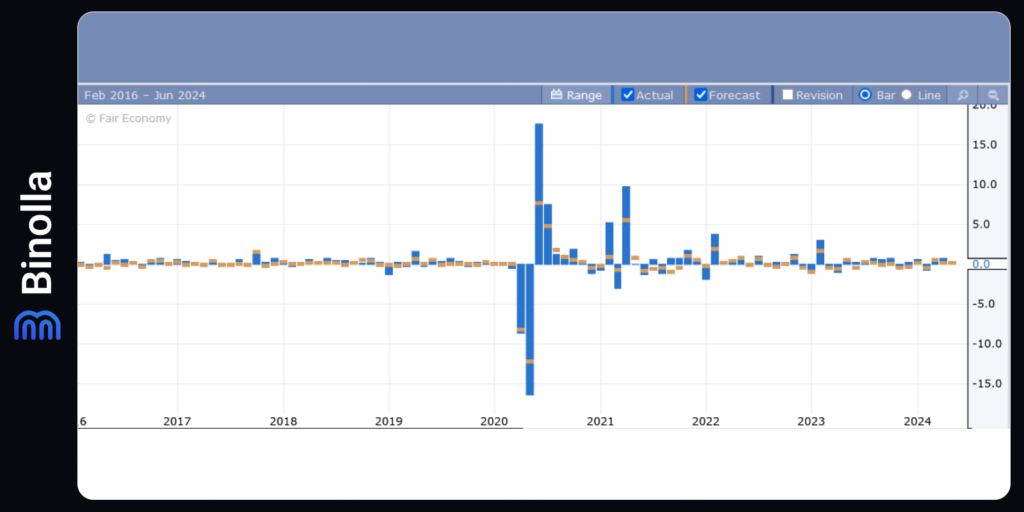

US Retail Sales Data Could Support Hawkish Rhetoric by the Fed

Consumer spending was one of the subjects mentioned by Fed Chairman Jerome Powell. According to expectations, FOMC hawks may become more aggressive this week. According to previous forecasts, about 72% of market participants expect the Fed to cut the rate by 25 basis points in September. Moreover, investors also expect the Federal Reserve System to ease the monetary policy again this year. The head of the Minneapolis Fed Kashkari mentioned that the central bank is considering the possibility of cutting the Federal Funds rate again in December.

The Atlanta Fed GDPNow growth estimate the GDP to show a 3.1% growth in the second quarter, which may be one of the reasons for the Federal Reserve to postpone the first easing and cut rates in December.

The US retail sales data will be the first piece of the puzzle to be considered by the Fed officials after the FOMC meeting that took place last week. The slowdown in inflation together with the increasing wagers support the domestic demand in the United States, which means that the Fed may take more time before making any further monetary policy decisions.

Japanese Inflation Data in Focus

For USD/JPY traders, the Japanese inflation data will be the focal point this week. The Bank of Japan has postponed any decisions until the next meeting that will take place in July. The Japanese yen slightly went down, but the inflation data may trigger a rebound. According to projections, Japanese core CPI y/y is likely to rise to 2.6% in May, from 2.2% in April. This may prevent BoJ from unleashing another round of stimulus.