Market Storm: Market Sentiment Shifts Drastically as the FOMC Meeting Approaches

Market sentiment is shifting as more traders and investors now believe that the Federal Reserve will cut rates. If only about 30% of market participants believed last week that the FOMC would ease the monetary policy in December, currently, more than 80% expect the central bank to make another move this year.

Several FOMC policymakers acknowledge that the US economy needs more stimulus as the labor market is showing signs of strain, while inflation is cooling down across various sectors. With this information in view, the Federal Reserve may support the idea of another rate cut in December.

Another important aspect to be mentioned is that the economic momentum is slowing down, with consumer spending having softened and job growth moderating. Tight financial conditions create risks of further economic cooling, which makes a preemptive cut one of the most important steps to stabilize the economic outlook for the upcoming year.

The shift in sentiment is widely seen in the financial markets so far, with the stock market getting support and funds draining from safe-haven assets. Risk assets now attract more buyers, and even cryptocurrencies have left their dips for higher targets.

When it comes to global conditions, they are also playing a huge role in market expectations. Weaker economic situation in Europe and some Asian countries increases the appeal of monetary policy adjustments.

However, despite the number of those who expect the rate cut by the Fed in December has drastically increased, some scepticism still remains. Several FOMC members who will vote during the upcoming meeting mention that risks of higher inflation persist, and as prices are not returned to target levels.

Contents

EUR/USD: Euro Benefits from Rate Cut Expectations in the US

According to the latest news from Germany, the local economy shows signs of stagnation with the quarterly GDP data posting 0.3% growth same as in the second quarter, when it contracted. Even with this in mind, the Euro is still getting support as the ECB is not planning to make any adjustments this year, while the Fed is likely to cut rates one more time this year.

From the technical analysis perspective, the currency pair is trading close to the upper boundary of the Bollinger Bands indicator, which is flat, meaning there is no trend currently. In case of an upside breakout, traders can target 1.1590 and 1.1650. On the downside, if the price breaks below the middle line of the indicator, traders can target 1.1500 and 1.1470.

GBP/USD: BoE Rate Cut Expectations Weigh on the Pound

The British currency remains under pressure while making some fresh gains on Tuesday. Softer inflation supports expectations that the Bank of England may cut rates again this year. According to the latest data, inflation in the UK softened to 3.6% in October. About 80% of market participants now expect the BoE to cut rates in December.

The same situation is with the US dollar, as about 80% of market participants expect the Fed to cut rates by 25 bps in December.

From the technical analysis perspective, the currency pair is trading close to the middle line of the Bollinger Bands indicator. If it goes upside down and breaks above the upper band, then traders can target 1.3160 and 1.3210. On the downside, if the currency pair breaks below the lower line of the indicator, then traders can target 1.3040 and 1.3010.

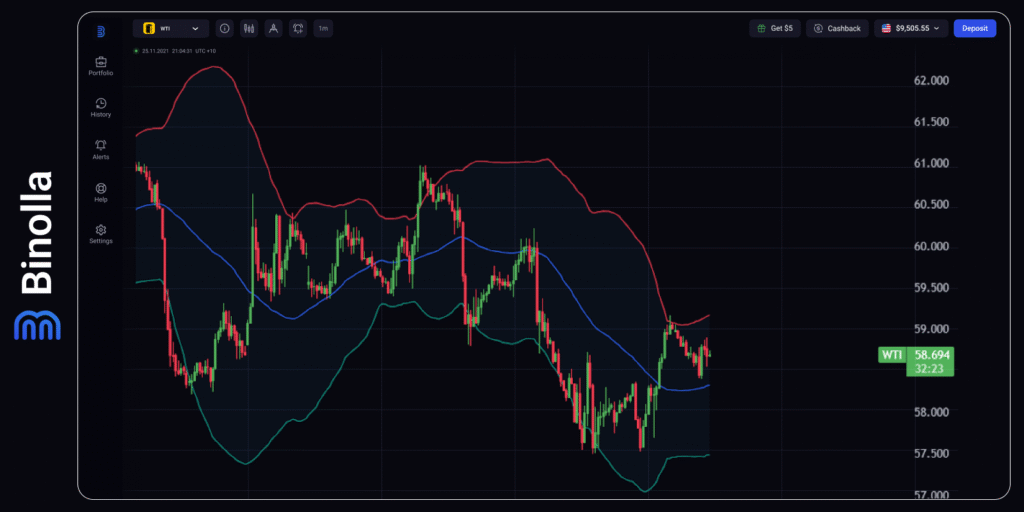

WTI: Ukraine Talks Weigh on Oil

Crude oil lost positions this week after successful negotiations in Geneva, as the US administration is sure that the peace talks may bring de-escalation in Europe. However, according to reports, there have been made significant changes to the peace plan proposed initially by Washington, which may support crude oil. Moreover, market participants increased their bets on the Fed rate cut, which may put pressure on the US dollar and provide further support to WTI.

On the technical analysis side, WTI is trading close to the middle line of the Bollinger Bands indicator. If the asset breaks above the resistance level, traders will eye 60.00 and 60.90. On the downside, market participants will target 58.30 and 57.50.

Gold: XAU/USD Benefits from Fed Rate Cut Rumors

Expectations of another FOMC rate cut this year support gold. Lower rates may spur inflation, which is one of the main drivers supporting interest in gold.

From the technical analysis perspective, XAU/USD is trading between the upper and middle lines of the Bollinger Bands indicator with an upside slope. On the upside, traders can target 4,150 and 4,200. On the downside, closest targets are 4,040 and 4,000.