How to Choose an Underlying Asset in Trading

Picking an underlying asset is one of the keys to successful trading. If you do it randomly, you may end up with losses for simply not understanding the underlying mechanisms that drive the price movements. Whatever financial instrument you use in trading, digital options, or a Forex CFD, you need to do your own research before you buy a fixed-time contract or a CFD. If you want to start trading now, you can open an account at Binolla.

While there are plenty of types of underlying assets that you can choose from on the Binolla platform, we are going to focus on the Forex currencies pair as an example. By reading this article, you will learn more about currency pairs and how to choose them in trading.

Contents

Types of Underlying Assets for Digital Options

This is one of the most popular markets for traders to choose from. Those financial assets allow traders to benefit from the price movements of different currency pairs. When buying a Higher contract for EUR/USD, for instance, you expect EUR to outperform the US dollar. If you purchase a Lower EUR/USD contract, then you think that USD is likely to outperform EUR for a set period of time.

Forex’s underlying assets are among the most popular because many traders come from Forex CFD. Moreover, when you trade currency pairs, you can have quick access to the latest macroeconomic news and profit from higher volatility or momentum trends that may appear in the post-data period.

Another reason for FX assets to be popular among digital options traders is the volume of the market. According to the latest calculations, Forex daily volumes exceed $6 trillion, which makes FX the largest market in the world.

FX currency pairs price movements are considered to be more clear. Currencies can be analyzed with both fundamental and technical tools that allow you to find entry points and earn money.

Commodities

This is a separate class of assets that is presented by various raw materials that are used to produce various items, foods, types of energies, etc. The commodities themselves can be divided into:

- Precious metals. This subclass is represented by gold, silver, platinum, etc. Precious metals are among the most popular assets for trading as their price correlates directly with other financial markets, while demand demand/supply are driven by both inner and outer factors. For instance, the gold price is influenced by demand and supply, the global economy, information about current gold deposits, etc.;

- Base metals. Those metals are mostly used in the industrial sector. The category includes copper and aluminum. They are rarely traded for lower liquidity and interest among traders;

- Agricultural commodities. This subclass includes various agricultural assets like wheat, cotton, corn, etc. Like base metals, agricultural commodities are of less interest to traders;

- Energy. Trading oil and natural gas may be very interesting, especially in times of significant global changes or geopolitical turbulence. The lack of those commodities in global markets leads to higher demand, while when the markets are oversupplied with natural gas and oil, the price of those commodities goes down.

Stocks

Buying digital contracts for stocks may be very exciting, as those assets have high liquidity and volatility. However, not all stocks meet those parameters. When trading those assets, you should conduct additional company analysis in order to understand its future performance and make data-driven decisions. Anyway, stocks are very attractive as underlying assets, and many traders add them to their asset trading portfolio.

Cryptocurrencies

This is a separate group of assets that is characterized by lower liquidity, higher volatility, and huge price movements. Bitcoin, for instance, can make over $1,000 per day in both directions, which makes it a very hard asset to trade. However, if you have guts and are looking for serious price fluctuations, then you can try it. Moreover, apart from Bitcoin, the cryptocurrency market is represented by many other cryptos and tokens (both security and utility) that may attract your attention.

Trading cryptocurrencies as underlying assets is beneficial as you do not “freeze” your money for investing. You do not own the underlying asset but a contract for it, which is canceled after expiration. Therefore, you don’t need to see the distant future in order to trade cryptocurrencies as digital options. Your main goal is to define whether a particular coin or token is going to rise or fall in the near future.

Forex Currency Pairs Basics

Before you even think about what currency pair to choose, it would be a good idea to understand all types of those assets. There are three main classes of Forex currencies:

- Major currency pairs. Those are the currencies of the developed countries that are traded against the US dollar. The list of major currency pairs includes:

- EUR/USD

- GBP/USD

- AUD/USD

- NZD/USD

- USD/CHF

- USD/CAD

- USD/JPY

- Cross-rate currency pairs. Unlike the previous list, this one includes the same currencies of the developed countries, but they are traded directly without the US dollar. Here are some examples of such cross-rate currency pairs:

- EUR/GBP

- EUR/AUD

- GBP/CHF

- EUR/JPY

- AUD/NZD

- AUD/CAD

- GBP/AUD

- Exotic currency pairs. Currencies from emerging countries like China, Mexico, Brazil, South Africa, Turkey, and others are also traded against the US dollar. Those pairs include (but are not limited to):

- USD/TRY

- USD/ZAR

- USD/MXN

- USD/BRL

- USD/CNY

While major and cross-rate currency pairs are for both beginners and skilled traders, exotic currency pairs are better suited to professionals only. They offer much stronger volatility and lower liquidity as compared to the two first categories. On the other hand, if you prefer stronger movements, you will find a lot of underlying assets in this exotic category that will offer you a rush of adrenaline.

How to Choose Your Currency Pair for Trading

Choosing a currency pair is rather complex, as there are plenty of factors that should be considered before you buy a particular one. Skilled traders have already done all due research throughout their careers, and they can switch between various underlying assets without being trapped.

When it comes to beginners, they still have to do this research, and we would like to provide you with our 5-step guide on how to pick a currency pair.

Think about your Trading Style

In digital options, you can apply mostly two trading styles – scalping and short-term trading. However, even those two styles may require a different approach. Moreover, your trading style may affect your underlying asset selection. If you are using a currency pair with very low volatility, for instance, you may not expect significant price movements. Therefore, the risks of losing when you apply a scalping strategy are higher.

On the other hand, volatile assets with huge price momentum are better for scalping, as they allow you to stay calm when the price chooses a particular direction. You can expect that you will earn profits on such significant price movements.

Your Attitude Toward Risks

While most traders tend to minimize risks, they still remain and you need to think about what risks you can afford in your trading strategy. It should be mentioned that when choosing a particular asset like EUR, JPY, GBP, USD or any other for trading, you should evaluate your risks.

Those who have guts can trade even cryptocurrencies that are more volatile as compared to most asset’ classes. If you feel that you can withstand huge price movements during the day, then this is a good solution. However, if you want to lower your risks, you should choose something less volatile.

Make Your Watchlist

The first step before choosing a currency pair is to create a watchlist where you can add several assets to have a closer look at them. The only advice here is to avoid overloading this watchlist. You don’t need to add all major currency pairs to it, or there will be no effect from this step. Add one or three assets and devote some time to your research on them.

Go Through the Main Data Releases

The next thing that should be done when choosing a currency pair as a trading asset is to find out which macroeconomic releases or events can influence price fluctuations. While they may be named differently, they reflect the main economic parameters, such as GDP growth, inflation, and the labor market. Moreover, apart from those major indicators, you should also look through the monetary policy of each central bank for the currencies that you have added to your watchlist.

You should keep in mind that all macroeconomic data releases may affect monetary policy decisions. Therefore, by watching statistics, you will be able to understand central bankers’ behavior during the next meeting.

Conduct Technical Analysis

Even if you are not going to trade a particular currency pair right now, it would be a good idea to draw support and resistance lines, apply indicators, or look for price action patterns depending on what exact strategy you are going to use during your trading routine.

This will allow you to understand how your trading system is applicable to a particular asset in various situations. You can also trade with virtual money using the demo account, which will allow you to test your strategies in the field.

The image above shows the most popular technical analysis drawing tools that include trend lines and resistance levels. Even if you limit your trading strategy to them, you can see the whole picture of what is going on in the market.

Intermarket Analysis

There are plenty of currencies whose prices may be affected by external causes. If you take the Canadian dollar, for instance, you can find a correlation between this currency and oil prices. Canada is known for exporting oil, and, therefore, its economic wealth depends on the prices of this commodity.

Another example of using this intermarket analysis is when you are trading a cross-rate currency pair. Consider that EUR/GBP is growing while USD loses its position. Therefore, you should buy EUR/USD and not GBP/USD.

Consider the Trading Sessions

Finally, before picking a particular currency pair for trading, you should consider a trading session when you are ready to trade. Keep in mind that depending on the time that you are ready to devote to trading, various currency pairs may have different levels of volatility and liquidity. Therefore, trading EUR/USD during the Asian session is not a good idea, while USD/JPY during the European session may disappoint you.

The Most Traded Forex Currency pairs

Trading volumes are crucial when choosing a currency pair, especially when it comes to beginners. A currency pair that can boast higher liquidity will also be in demand and, therefore, provide you with more stable trading results. We have decided to create our own top that includes the most liquid Forex assets.

EUR/USD

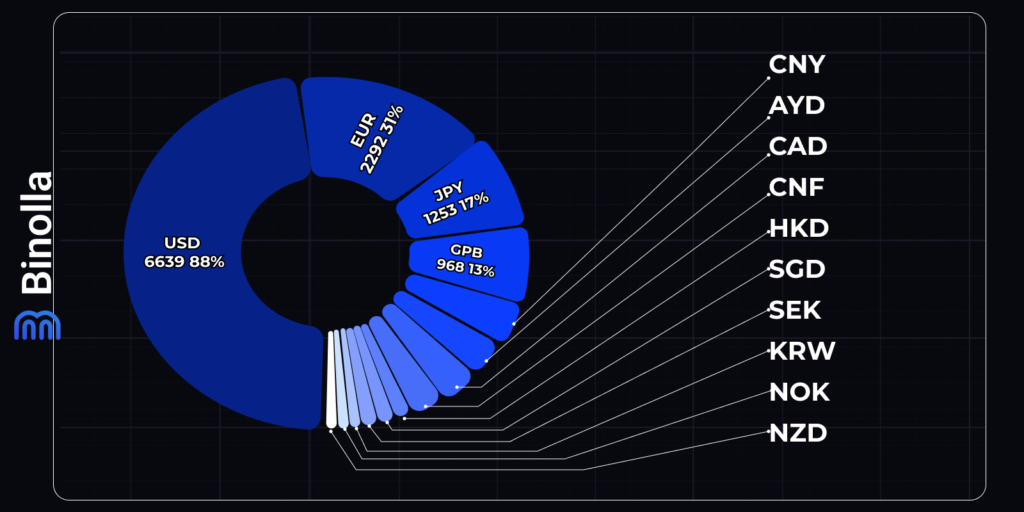

According to the Bank for International Settlements (BIS), both EUR and USD are the most traded currencies in the world. USD holds the leading position with 88%, and EUR stands right after with 31% of the general currency turnover as of 2022.

EUR/USD is suitable for all categories of traders, as they can use various types of technical analysis to predict prices. The image above shows a trend line that you can use to buy Higher contracts while EUR/USD is in an uptrend.

The currency pair has a lot of daily liquidity, which results in tighter spreads. Both are crucial for traders. The exchange rate of this currency pair is determined by a lot of factors, including:

- FOMC and ECB decisions;

- GDP data;

- US labor market;

- US and Eurozone’s inflation;

- PMI ISM indexes, and more.

USD/JPY

Another popular currency pair is USD/JPY, with the Japanese yen taking third place in the BIS currencies turnover table with 17% of overall turnover by the end of 2022. The currency pair is known for its liquidity and high trading volumes, but you should keep in mind that its activity time comes with the beginning of the Asian trading session.

Like in the previous example with EUR/USD, USD/JPY offers a lot of opportunities for digital options traders. In particular, you can apply a simple trendline to find a lot of signals and buy various types of contracts.

When it comes to factors that influence the currency pair, apart from those that affect USD, here are some important sets of data that you should keep an eye on:

- Bank of Japan decisions;

- Inflation data (Japan has suffered from exhausting deflation for a long time);

- Trade balance (since Japan is an export-oriented country);

- GDP growth rate and other economic data releases.

GBP/USD

The British pound takes fourth place in the BIS table with 13% of the share in the general currency turnover. GBP/USD boasts high liquidity and trading volumes, especially during European and American trading sessions.

GBP/USD is a great asset for traders to choose from as it offers a higher level of volatility as compared to EUR/USD. Moreover, you can use all those classic strategies, including Japanese candlesticks. In the example above, there are Shooting Star signals as well as Hammer.

As for the factors of influence, apart from what makes the USD price move in a particular direction, here are some sets of data to look at:

- Bank of England’s (BoE) decisions;

- BoE interest rate votes;

- GDP data;

- Labor market data;

- Inflation, and many more.

AUD/USD

The Australian dollar is the sixth largest currency in the world with 6% of the share in the general currency turnover. The value of the currency is closely related to the country’s exports, especially iron ore, and coal, which make up the largest part of Australia’s GDP.

With this in mind, changes in commodity prices have a huge impact on AUD. Apart from this, when analyzing AUD/USD, you should also pay attention to China’s economy as Beijing is the closest Australia’s trade partner. Apart from factors that affect USD, you should also pay attention to the following ones:

- Reserve Bank of Australia (RBA) decisions;

- Inflation;

- Trade balance;

- GDP, and others.

USD/CNY

While the Chinese yuan is not included in the pack of major currency pairs, its influence has been growing over the past years and allowed the currency to occupy the fifth position in the BIS table of currencies according to their turnover, with a 7% share of the general currencies’ turnover. However, even with this major share, USD/CNY is not as popular as the previous currency pairs because the People’s Bank of China has control over the currency.

USD/CAD

The Canadian dollar stands right below AUD in the BIS table with 6% of the turnover share. The CAD price closely depends on oil, as Canada is a major regional exporter of this commodity.

Expensive oil supports CAD, while when the price of this commodity goes down, CAD heads down as well. As for the other drivers, they may include:

- Bank of Canada (BoC) decisions;

- GDP;

- CPI;

- PMIs, and more.

USD/CHF

The Swiss franc is among the most popular currencies because of the Swiss financial system, which is believed to be stable and has proven its sustainability throughout decades. With this in mind, traders and investors often buy CHF in times of financial and economic crisis, while they stay away from this currency in periods of global growth.

Therefore, the Swiss franc is not actively traded, as are all the currencies that are included in this list. However, CHF remains on the list of the most popular currencies by turnover.

Safe-Haven Assets

Before making the full stop, we would like to provide you with information about safe-haven assets that you may want to consider when trading during economic and financial turbulence periods. Those safe-haven assets are often used by investors of all sizes to protect their investments from global market downturns.

While safe-haven assets are mostly used by investors, traders should also know more about them. There are several financial instruments of this type that you can use, and you have probably even traded already.

One of the most popular safe-haven assets is gold. You may have heard that this precious metal gains positive momentum during an economic crisis. One of the examples of gold becoming one of the most popular assets was the post-crisis period after a serious downturn in 2008. Digital options traders can also consider gold as a good underlying asset to trade during global turbulence.

US Dollar

Another safe-haven asset belongs to the FX market. The US dollar is considered a stable currency and has been trusted by investors and traders for a long time. Moreover, a long period of low interest rates contributed to a strong belief that the US dollar can be a safe-haven during hard times of market or economic uncertainty.

Keep in mind that this is a reserve currency, which is traded not only against other currencies in so-called currency pairs but also against various commodities like gold, oil, etc. Therefore, confidence in the USD remains strong. You can use this concept in times of market downturn.

Other Safe-Haven Currencies

The US dollar is not the only currency that is considered safe during the “risk on” mode. Along with USD, the Japanese yen and Swiss franc are also in demand during economic and financial turbulence. Both became safe-haven assets for the long-term low-rate policies of their central banks. Moreover, Switzerland is a neutral country with a strong economy and banking sector, which makes it attractive for investors even in periods of market uncertainty. When it comes to Japan, the country has a surplus in trade over its debt.

Final Words

Choosing an underlying asset is crucial for traders, as this will have a direct impact on their trading results. The wrong choice of assets may lead to significant losses that will be accumulated over time. The reason for those losses is a lack of understanding of the asset as well as bad timing. Moreover, some assets may not suit traders in terms of trading style or traders’ risk assessment.

There are several classes of underlying assets that you can choose from when trading digital options. The most popular are FX currency pairs, which are subdivided into major, cross-rate, and exotic currencies. However, you can find some interesting solutions when picking other assets as well.

To choose a particular underlying asset for trading, it is recommended to pay attention to various aspects, including your trading style, risk assessment, price action, as well as some outer factors like macroeconomic analysis, etc. When picking an asset, you should go beyond a single currency pair, as it will help you build a strong trading portfolio.

FAQ

What is an Underlying Asset?

Digital options, like many other derivatives, are traded via contracts, meaning you buy a contract for currencies, stocks, commodities, and other underlying assets.

What Are Major Currency Pairs?

Those are the assets that include currencies from developed countries. Some examples of major currency pairs include EUR/USD, GBP/USD, AUD/USD, and others.

What Are the Most Common Underlying Assets in Digital Options?

The most common and popular underlying assets in digital options trading are FX currencies. This is due to the fact that Forex is one of the most liquid markets, with over $6 trillion in daily volumes. Moreover, many traders are familiar with Forex currencies, and they seem to be more clear and easier to analyze.

Why Choosing an Underlying Asset is Important?

Choosing an underlying asset matters because it allows traders to calculate risks and hedge them.

How to Choose an Underlying Assets for Digital Options?

Traders need to consider several aspects, including technical analysis, macroeconomic data releases, trading sessions, and others.