Graphic Patterns in Trading: Must-Learn Technical Analysis Patterns for Every Trading Situation

Graphic patterns also known as chart patterns are widely used by professional traders. They are simple to learn and to understand but their performance should not be undervalued. Traders can use such graphic chart patterns in different situations whether looking for a trend continuation or reversal/correction. By reading this article, you will discover the basics of chart patterns in trading as well as the most popular ones that you can start using right away to upgrade your trading strategy.

Ready to make your first steps in trading? Join Binolla now and enjoy outstanding quality paired with our sophisticated trading platform!

Contents

Key Takeaways

- Chart patterns are based on the historical repetitiveness concept of the technical analysis;

- All types of triangles in trading can give signals to both sides regardless of their types;

- Graphic patterns can predict both trend reversal and continuation depending on a particular formation;

- Confirmation is the key when trading with graphic patterns;

- Using stop losses and take profit orders will help you better control your funds and plan your trading sessions;

- Chart patterns can be used for both CFD and digital options.

Chart Pattern Concept

Technical analysis is based on three key postulates. One of them states that history repeats itself. This concept was taken as a foundation for chart pattern analysis. All graphic shapes that you will see in this article are based on this principle.

What is this about? Everything that you have seen in the chart previously is likely to show up again in the future. For instance, if you look at a symmetric triangle now, it was once observed by market participants and described as a symmetric triangle first. This can be applied to any other chart pattern. Noticed once in charts, they are currently widely used by traders.

Another key thing to understand is that every chart pattern is based on market sentiment. Whether you are trading a double bottom or a head and shoulders, they can tell you more about the current market sentiment than you can even imagine. Now that you know the basic concept of chart patterns, it is worth looking at the most popular formations of this type in trading.

How to Trade Chart Patterns

Before delving deeper into patterns and examples, it is worth learning some general rules on how to use these formations:

- Learn 3-4 chart patterns so that you can identify them on the chart freely.

- Go to charts and switch between assets before you find one of the patterns that you have mastered.

- Wait for the signal to come once you have found a pattern.

- Confirm the pattern with additional technical analysis tools (technical indicators or Japanese candlestick patterns) if you want to increase the performance of any chart pattern.

- Place a trade once a pattern is confirmed.

- Do not forget to set a stop loss in order to mitigate your trading risks.

- Wait for your target to be reached and close a trade or use a take profit order to do it automatically.

Now that you know the basics of how to trade chart patterns, let’s have a closer look at some of the most popular formations.

Symmetric Triangle

A symmetric triangle is a relatively popular graphic pattern that tells market participants that the market is currently in uncertainty. It is characterized by two trendlines that move to meet at one single point. The symmetric triangle can either be a continuation or a reversal pattern. Trading within it is not recommended as the distance between both lines becomes tighter. Traders should wait until the price breaks one of the trendlines of the triangle to engage. Triangles often appear before key macroeconomic data or events as the market is uncertain about the results and traders place trades on both sides with lower volumes, which results in tiger fluctuations.

Forex and CFD

One of the best strategies that a market participant can use when trading with symmetric triangles is to buy when the upside breakout occurs and sell when the downside breakout takes place. Moreover, you can place a trade in advance by using limit orders. For instance, if you expect the price to go higher, you can place a Buy stop order above the upper trendline. For those who expect the price to plunge, a Sell stop order can be chosen.

When it comes to stop losses, traders can place them within the triangle in the opposite direction of the price movement. To calculate profits, you can use the distance between the upper and lower trendline at the beginning of the triangle.

Digital option

Digital option traders can buy a Higher contract once the price leaves the triangle through the upper line. If the quotes break below the lower line, then a trader can buy Lower in this case.

Descending Triangles

Unlike symmetric triangles that have two trendlines, this one has only one trendline at the top. The bottom of this type of triangle is a support line. Descending triangles are considered bearish patterns, which means that the price is likely to break the lower edge of the model and move downwards. However, in some cases, they may work on both sides, which means that the upper breakout is also possible.

The psychology behind this pattern is very clear. The descending trendline at the top makes new lower highs, which means that buyers can’t reach new highs, while they still can control the price at the support level. At some moment, bears win this contest and push the price lower, below the support line, which is a signal to engage.

Forex and CFD

Trading within the descending triangle is not recommended. However, once the price moves below the support line, you can sell a currency pair, cryptocurrency, stock, or any other asset. Use the support line to set a stop loss above it. A take profit may be set at a distance that is equal to that between the highest and lowest points of the triangle at its beginning.

Traders can also use Sell stop order to trade descending triangles. Place it below the support level and wait for the price to break below it. If the price moves upwards, then you can remove this order and simply buy an asset.

Digital Options

The descending triangle is considered a bearish pattern, which means that you are likely to buy Lower contracts in most cases. Push the Lower button once the price breaks below the support level. However, if the price moves upwards, buy a Higher contract when it breaks above the higher line.

Ascending Triangles

This is another type of triangle in trading where the lower line is an ascending trendline and the upper one acts as the resistance level. In general, this pattern results in an uptrend. However, in some cases, the price may leave the triangle via the ascending trendline and lead to a new downtrend.

Similar to other triangles, this one indicates the market uncertainty about future fluctuations. Price fluctuations become narrower and at some point, quotes leave the triangle with the increasing volume.

Forex and CFD

To trade with this triangle, you should wait until the breakout takes place. As it was already mentioned, the ascending triangle indicates a higher probability of an uptrend, which means that you can buy if the price breaks above the resistance line. Moreover, you can set the buy stop order in advance to automate your trading routine a bit and not miss the main upside movement.

Stop losses should be placed below the resistance line. To calculate profits, you can use the width of the triangle at its starting point.

Digital Options

Digital option traders can use this pattern to buy Higher contracts. Open a trade when the price breaks above the resistance level. However, if the quotes break below the ascending trendline, a Lower contract should be bought.

Flags and Pennants

These are among the most popular graphic patterns in trading as they can be frequently found on charts. Flags and pennants are trend-continuation formations, which means that you can expect the price movement direction to continue once you find them on charts. There are two types of such patterns in trading:

- Bullish flags and pennants. They appear after the uptrend and are regarded as a small correction. Once it is over, a new signal for buying a currency pair, stock, or cryptocurrency comes into play;

- Bearish flags and pennants. These patterns appear in the middle of the downtrend and are considered a correction or consolidation. Once this correction is over, a trader can sell a currency pair, stock, or cryptocurrency.

Forex and CFD

To trade a bearish flag, you need to wait until the pattern is formed. Here you can see that after the downtrend, the price began an upside correction for a while and formed a king of a rectangle. Once the quotes break below the lower edge of the flag, you can sell the asset with a stop loss above the lower line and take profit at a distance that is equal to that of the flagpole (previous downtrend).

Digital Options

To open a digital option trade, you need to wait for the breakout to occur. Once the price steps outside the lower band of the flag, open a Lower contract.

A bullish flag is another trend-continuation pattern that allows you to buy a currency pair, cryptocurrency, stock, or any other asset when the price goes upward. It appears in the middle of the uptrend and allows market participants to predict the development of this price movement direction.

Forex and CFD

The bullish flag itself is a correction, which interrupts the bullish trend for a while. Traders should prepare for buying when the price leaves the flag and moves upwards. To place a trade, you need to wait until the candlestick, which breaks the upper line, closes, which means that the bullish flag is confirmed.

To manage your trading risks, you can set a stop loss below the upper line of the flag. Take profits can be equal to the flagpole, which is a part of the uptrend before the flag.

Digital Options

To buy a Higher contract, you need to wait until the price breaks above the upper line of the flag pattern. The key difference between using flags for forex or digital options trading is that when you buy a contract, you don’t need to wait for confirmation. Simply buy the contract on the momentum that comes right after the breakout takes place.

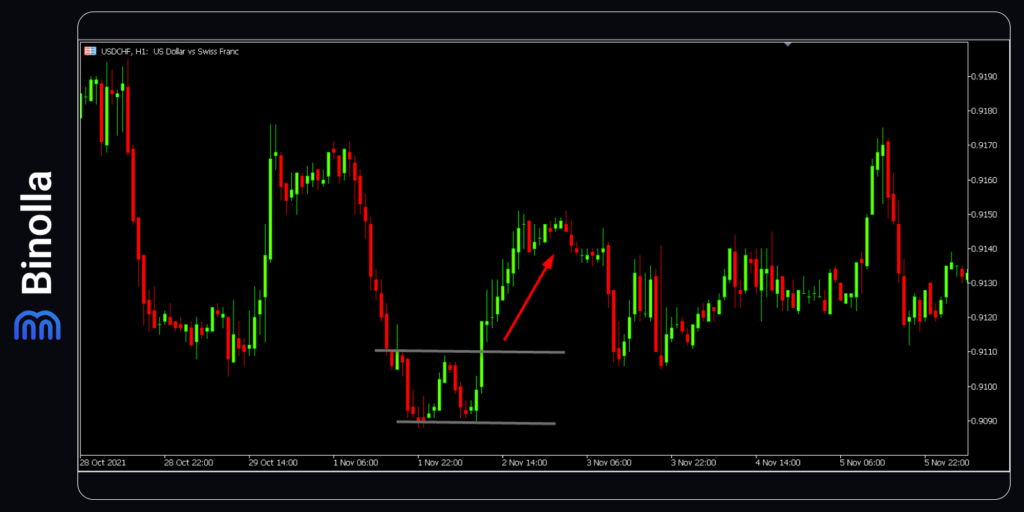

Double Bottom

The double bottom pattern consists of two lows and a local high between them. The price tests the support level and then moves upwards to touch the resistance level. Then, it makes another low and goes towards the resistance level. However, this time it breaks the resistance (known as the neckline) and moves higher.

Forex and CFD

To trade this pattern, you need to wait until the price breaks the neckline. Before buying a currency pair, cryptocurrency, or stock, wait for the candlestick to close. This is a very important condition if you don’t want to trade an unconfirmed signal. Next, you should place a stop loss below the neckline at a distance that you find comfortable for your funds. A take profit order can be placed at a distance that is equal to that between the support level of the double bottom pattern and its neckline.

Digital Options

When the price steps outside the neckline, traders should buy a Higher contract. The signal comes right after the crossover, which makes it different from the signal for CFD traders who should wait for the crossover candlestick to close.

Double Top

The double top pattern looks similar to the double bottom pattern but it is formed at the top of the market. The quotes make the first top and then reverse to the local support level. The next peak is at the same level as the first one and the price retests the support level (neckline) and breaks it down finally.

Forex and CFD

For CFD traders it is recommended to wait for the candlestick to close before selling a currency pair, stock, or cryptocurrency. A stop loss can be placed above the neckline at a distance that you find comfortable. The take profit order can be measured as the distance between the peak and the neckline.

Digital Option

Digital option traders can buy a Lower contract right after the breakout. Similar to the double top pattern, they should not wait for the candlestick to close. They can buy the contract right away with the rising volume.

Diamond Pattern

Unlike most patterns that we have described in this article, the diamond chart formation can be both bearish and bullish. The difference between them is in the previous price movement. If there is a downtrend, the diamond pattern will provide you with the buy signal, while in the contrary situation, the price will move downwards.

Forex and CFD

When the price leaves the upper line of the diamond pattern, you can buy a currency pair, cryptocurrency, or stock. A stop loss can be placed below the upper descending trendline of the pattern.

Digital Options

The signal to buy a Higher contract comes at the very moment of a breakout. Check the volumes and purchase the contract when the momentum occurs.

Key Recommendations on Trading with Chart Patterns

Chart patterns are among the most popular strategies used by most professional traders. While they provide market participants with reliable signals, some recommendations below can be very useful:

- Use indicators to confirm patterns. You can augment some of these patterns with technical indicators. For instance, by using RSI, you can have confirmations when trading with most reversal formations;

- Wait for confirmation. When trading CFDs, you should wait for the candlestick to close before entering a trade;

- Think about risk management. When trading with chart patterns, place stop losses to protect your positions from risks you can’t afford. You can also use take profits optionally if you want to fix the amount you will gain;

- Check current market volumes. All the patterns described in this article work when the volumes are rising. Every time you see that the signal comes, check the momentum and the volume;

- Make sure the pattern is reliable. When finding a pattern, compare it to the classic one to avoid misinterpreting.

Conclusion

Graphic patterns aka chart patterns are formations on charts that help market participants predict future price fluctuations. They are used by professional traders to get insight into how the price direction may change under certain conditions. Knowing basic formations is crucial as they will allow you to buy or sell various types of assets in different market situations.

FAQ

Which Chart Pattern is Best for Trading?

All graphic patterns are good depending on the situation. If there is a triangle, for instance, you can expect the price to move outside one of its edges and capitalize on the directional price movement.

How Effective is a Chart Pattern?

The effectiveness of chart patterns is high. However, you should watch them in the general market context. Moreover, traders should keep in mind that there is a risk of fake breakouts or some patterns may fail.

Why Do Chart Patterns Fail?

Financial markets are complex mechanisms where prices are established by supply and demand. Therefore, there is no guarantee that a particular pattern will work as you expect it. The good news is that they give positive signals most of the time.

Which Timeframes Are Best for Chart Patterns?

It is better to look for chart patterns on 15-minute timeframes or higher. If you take lower timeframes there are risks of market noise.