Euro Makes New Gains Despite French Elections Results, FOMC Meeting Minutes and US Labor Market Data in Focus

French National Rally party has won the highest level of support from the local electorate during Sunday’s parliamentary elections. National Rally was ahead of the New Popular Front coalition miles ahead of the current president’s alliance. Marie Le Pen’s brainchild won the round but there is still work to do as nothing is decided yet and the second round is around the corner.

The head of the National Rally aims to achieve the majority by winning 289 in the next parliament, which will definitely make the life of Emanuel Macron difficult until 2027 when the next presidential campaign will take place. When it comes to the president, he is working on a new alliance with the left-wing coalition to beat Le Pen during the second round of the current campaign.

Both stocks and the EUR have shown a significant upside momentum on the news that the new coalition was agreed upon. However, if this coalition fails to outperform the National Rally during the next round, Le Pen will manage to achieve the parliamentary majority and this may push the Euro currency down even below previous levels achieved before the elections.

Contents

- 1 German and Eurozone Inflation

- 2 Key US Labor Market Data Can Shift the Focus

- 3 Market Insights You Can Trade On!

- 4 FOMC Meeting Minutes May Shed Light on the Future of the US Interest Rates

- 5 Canadian Labor Market Data in Focus

- 6 Asian Markets Are on the Eve of Important Data Releases

- 7 Crude Oil Rises Due to Increased Summer Demand and Middle East Tensions

German and Eurozone Inflation

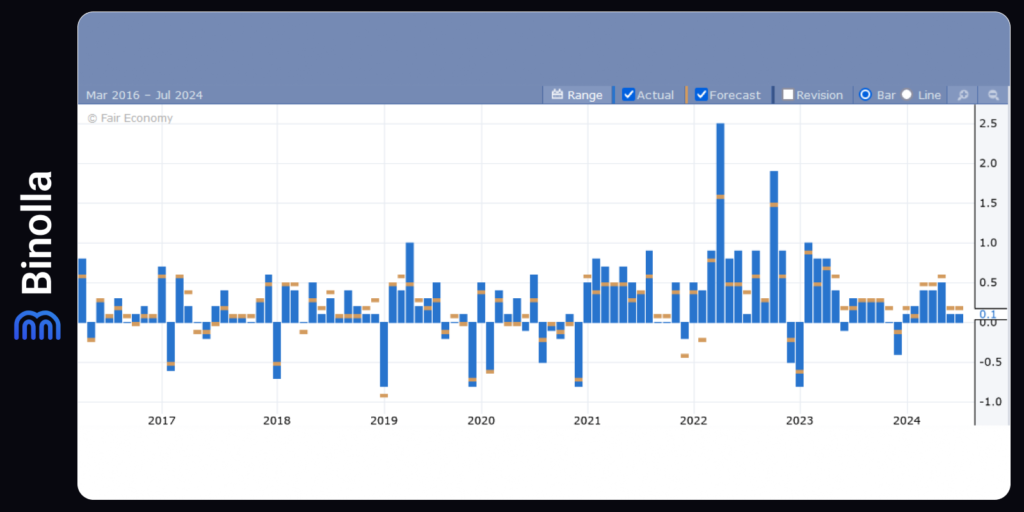

While French parliamentary elections are the number one topic, some macroeconomic data will also be influential in the future. German monthly inflation is below expectations, while market participants still analyze the results of the aggregate Eurozone’s inflation data, which is mixed. Core yearly CPI hasn’t changed since May, while yearly CPI in the Eurozone dropped to 0.1%, which was forecasted by experts.

Key US Labor Market Data Can Shift the Focus

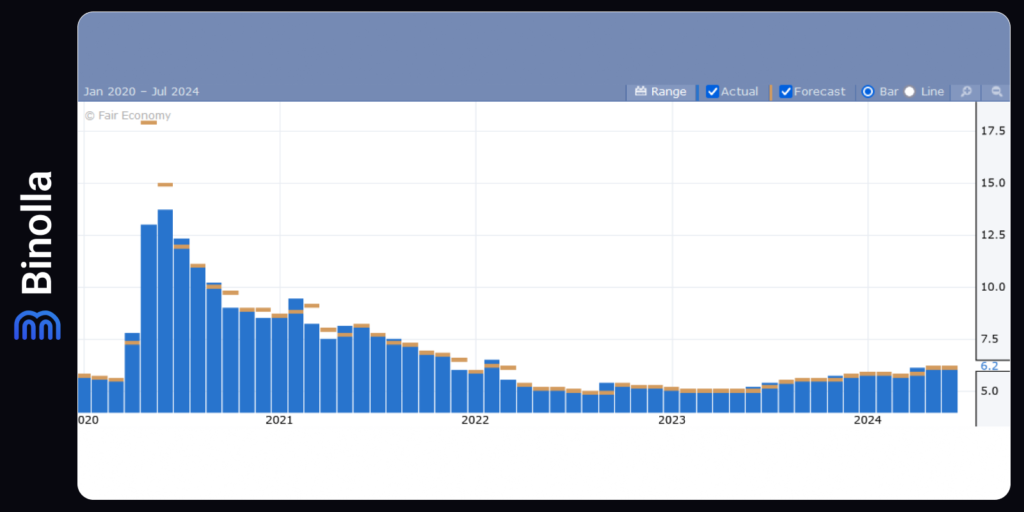

June’s manufacturing survey by ISM brought some weak optimism to the markets, but traders and investors are looking forward to seeing Friday’s US labor market figures, especially the results of the non-farm payroll report.

US employers are likely to cut positions, which wage shows moderate growth, which is another argument for Jerome Powell and major US central bankers to go from words to actions. The labor market data may be another sign of inflation slowing down.

According to forecasts, the number of new jobs is likely to increase by 190,000, which is a step down from May’s 272,000, which was a surprisingly robust growth. When it comes to the unemployment rate, it is expected to remain intact at 4.0% in June.

Average hourly earnings in the United States are expected to slow down from 0.4% to 0.3% in June.

FOMC Meeting Minutes May Shed Light on the Future of the US Interest Rates

One of the main topics that are discussed among investors and economists is whether the Federal Reserve is going to cut the rate in September or postpone the first expansionary step until December 2024.

Currently, the inflation rate in the United States is comfortable enough for the Fed to start cutting the benchmark rate. However, according to the latest commentaries from the FOMC officials, they need more time to weigh the inflation dynamics and make sure that it will remain in a comfortable area.

Canadian Labor Market Data in Focus

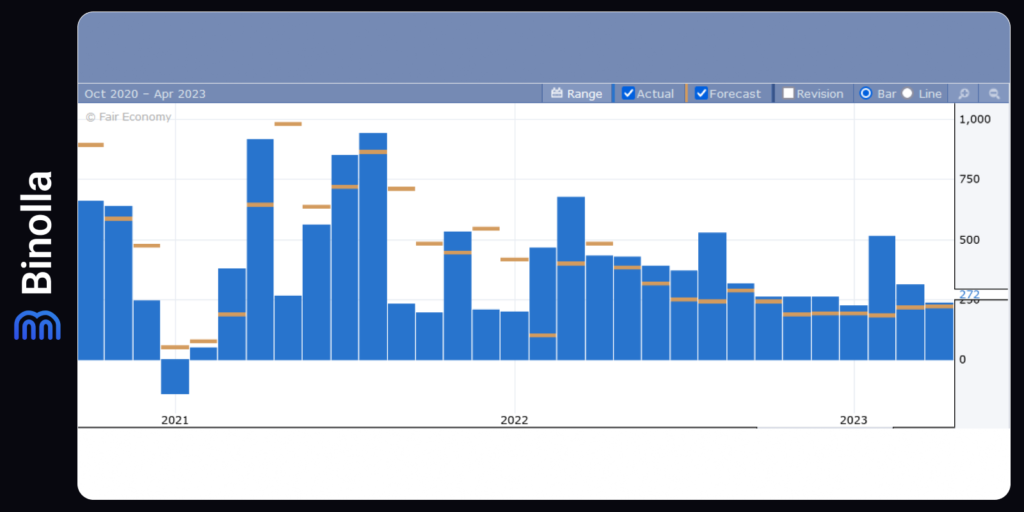

Employment data is among the most discussed topics for those trading CAD and other country-related assets. Both unemployment rate and employment change data will be released on Friday.

According to forecasts, the unemployment rate in the country is likely to add 0.2% during the upcoming release which may spur this optimism around the economic growth. The employment change data release is also expected to disappoint traders and investors as forecasts indicate a slight backward movement.

Asian Markets Are on the Eve of Important Data Releases

Switching to Asia, there are several important reports that may bring more volatility to markets. Chinese PMI remains stable at 49.5, which was also predicted by economists.

Chinese manufacturing activity contracted for the second consecutive month, signaling weakness in the sector that is among the top priorities. Other PMI indexes will be released during the week. Moreover, similar indexes will be delivered from other Asian countries, which may add volatility.

Japan’s Tankan survey is another important data to watch. According to forecasts, business sentiment is likely to hold steady for the second consecutive quarter. Japan’s household spending data will also be in focus as it will likely be among the indicators that will influence the BOJ decision about a rate hike in July.

Crude Oil Rises Due to Increased Summer Demand and Middle East Tensions

The US crude oil benchmark reached $83,60 on Tuesday. This uptrend was bolstered by the increased demand for oil which normally takes place in summer and geopolitical risks that still prevail in the Middle East.

In particular, oil traders added positions amid worries that tensions between Israel and Lebanon-based Hezbollah will fire up a greater conflict, which, in turn, may break oil supply chains.

Along with this, increasing summer demand is likely to boost TWI quotes. According to the EIA figures, both production and demand for petroleum products increased and reached four-month highs in the mid-spring.

On the other hand, higher US federal funds rates put pressure on the crude oil price as economic growth can slow down, which, in turn, will cut the demand for this commodity. According to Fed officials, the monetary policy is working and it is too early to make any conclusions about whether it is time to begin a new cycle of rate cuts or not. San Francisco Fed president Daly mentioned recently that if inflation stays at comfortable rates, the Fed is going to cut rates. However, currently, there is no clear decision about when to start easing.