ECB Meeting in Focus: What Will Be the Next Move By the Central Bank?

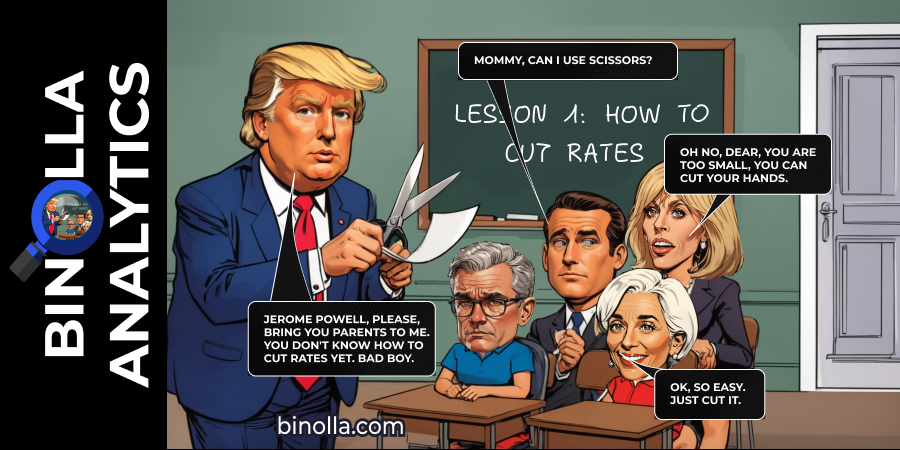

The ECB meeting will take place on Thursday, but the event has already had a large impact on the EUR/USD currency pair. While market participants do not expect the European Central Bank to cut rates this week, they will closely monitor the ECB press conference to hear some clues about the future moves by the central bank.

The central bank has already had a series of rate cuts, and the current rate is 2.15%. The upcoming event is expected to bring a pause to this streak, but traders and investors are sure that the European Central Bank is going to cut rates again in 2025. Moreover, current trade tensions between the EU and the US may put pressure on European economic growth that will, in turn, push the ECB to make another rate cut later this year.

Contents

EUR/USD: Markets Expect the US and the EUR to Reach a Deal

Along with the expectations of the upcoming ECB meeting, market participants are anticipating the results of the trade deal negotiations between the EU and the US. According to the latest news, the US President is ready to impose tariffs of up to 30% on all goods coming from the European Union if there is no deal between the two trade partners.

The Fed is likely to postpone its rate cut decision during the upcoming July meeting. According to FedWatch tool, about 50% or respondents expect the central bank to cut rates in September. Positive economic data allows the Federal Reserve to stick to its wait-and-see approach.

On the technical analysis side, the currency pair is trading within a narrow range and above the SMA50, which confirms the positive bias. Buy posititions will be preferable above 1.1720 with the closest targets at 1.1750 and 1.1800. On the downside, sell positions will be preferable below 1.1680. Traders can short the currency pair from there targeting 1.1600. However, you should make sure that EUR/USD breaks below the SMA50 for the bearish scenario to become true.

GBP/USD: The British Pound Trades Steady Ahead of PMI Data

The currency pair demonstrates stability ahead of the upcoming PMI data that will be released on Thursday. Traders and investors will closely monitor the UK PMI data, which is expected to slightly beat the previous readings. The manufacturing PMI is expected to reach 48.1, while services is forecasted to remain closee to 53, which is a rather strong data that may push GBP higher against its major peers.

On the other hand, the Bank of England is likely to cut rates in August to stimulate further economic growth. This may exert pressure on GBP, but in longer term. Currently, the British pound may extend its upside trend.

From the technical analysis perspective, the currency pair demonstrates bullish sentiment as the price is above the SMA50. Long positions will be preferable after GBP/USD moves aboe 1.3500. On the downside, short positions can be opened below 1.3460.

XAU/USD: Gold May Resume the Uptrend

The gold’s downside is limited due to rising trade tensions and the situation with Fed’s independence. The deadline on the tariffs delay is approaching, but the deals are still not concluded with major peers. This supports the precious metal as traders and investors react with fears to such uncertainties.

Another factor that pushes gold higher is the recent comments from the US Tresury secretary Scott Bessent who suggested the revision of the whole Fed institution and their role in the US economy. This exerts pressure on the US dollar and, thus, help XAU/USD to gaim more power right below the resistance level.

From the technical analysis side, gold is ready to burst higher and move above 3,400. Long positions will be preferable even from current levels, but it is better to buy from 3,405 to be sure that XAU/USD confirmed the breakout above 3,400. On the downside, selling from 3,380 targeting 3,340 will be preferable.

WTI: Oil Is Under Pressure Amid Rising Trade Tensions

The geopolitical situation is no more supporting oil prices as Middle East tensions seem to be out of focus. What really matters now is the situation with trade tariffs between the US and its key partners. The US president has already threatened his peers about the upcoming tariffs and that there will be no more delay after the deadline occurs.

New tariffs may push the demand for oil down, which is the major concern among traders and investors currently. In absence of fueling data, WTI quotes may continue to plunge reaching new levels below.

From the technical analysis perspective, oil prices are below the SMA50, confirming the bearish bias of the financial instrument. Short positions will be preferable from 64.90 targeting 64.00. When it comes to long positions, traders can buy from 65.90 above the SMA50 and target 67.00.