Digital Options Trading Bonuses: The Ultimate Guide with Step-by-Step Calculations

Trading digital options with bonuses can be truly beneficial as you will have additional money at hand to boost your trading balance. However, not all bonuses are good and give you an advantage. Therefore, before claiming them, it is worth looking at their conditions. In this article, we will delve into the most popular types of bonuses and demonstrate calculations that will help market participants understand which type of bonus is better.

Contents

- 1 What is a Trading Bonus?

- 2 Types of Trading Bonuses in Digital Options

- 3 Trading with Bonuses: Use Cases

- 4 Comparing Trading with Fixed Bonuses of Different Sizes (Non-Withdrawable)

- 5 Claim bonuses with Binolla!

- 6 Comparing Trading with Flexible Bonuses (Non-Withdrawable)

- 7 Comparing Trading with Withdrawable Bonuses of Different Size

- 8 Binolla Welcome Bonus

- 9 How to Start Using the Binolla Welcome Bonus

- 10 FAQ

What is a Trading Bonus?

A trading bonus is an additional amount of money on the balance that a trader can use to open trades. Bonuses can be expressed as a percentage of the amount you deposit or a fixed amount of money. For instance, if you top up your balance with $100 and a company gives you a 50% bonus, then you will have $150 available for trading. The higher the percentage is the more money you can rely on.

While bonuses seem very attractive, not all of them give you an advantage, to tell the truth. While some promotions may provide you with opportunities, others may not be as attractive as they seem to be at first glance. Before accepting a bonus, traders should familiarize themselves with their rules and conditions. We are going to provide you with the main features of most bonuses in the following paragraphs.

Types of Trading Bonuses in Digital Options

There are several types of bonuses that digital options traders can use when trading. We have collected the most popular ones (by their terms) in the following table.

| Bonus Type | Description |

| Fixed bonus | Traders can receive a fixed amount depending on the bonus percentage. For instance, a broker may offer a 50% fixed bonus, which means that regardless of the amount that you deposit, you will receive 50% of this sum. |

| Flexible bonus | With this type of bonus, the amount you can get depends on the sum that you deposit. For smaller deposits from $10 to $100, the bonus may start from 20%, while for those who deposit more, like 1,000, the bonus may reach 100% |

| Withdrawable/non-withdrawable bonuses | With withdrawable bonuses, you can cash out your profits together with the bonus amount, while in the case of non-withdrawable bonuses, you can withdraw only profits, while the bonus is canceled |

| Bonuses with turnover | This type of bonus requires a trader to make a turnover before they can withdraw profits from it. For instance, if a trader claims a 100% bonus with a 50x turnover and deposits $100, they should make a total turnover of $5,000 (profits+loses-deposit amount) |

| No deposit bonuses | By claiming such promotions, traders can receive an amount of money without depositing funds. Such bonuses are limited and traders can’t get more than $100 in most cases. They come with turnover, which can reach x50-70 and their validity is mostly limited to 2-7 days. |

Remember that more than one of the features described in the table above may apply to a single bonus. For instance, those promos with withdrawable bonus amounts mostly come with turnover. This is relevant for both fixed and flexible bonuses. Now that you know more about bonuses themselves and their main types of conditions, let’s check some calculations to see which bonuses may be suitable for you.

Trading with Bonuses: Use Cases

Before showing you the results of calculations that will reflect the profit and ROI that you can get when using a bonus in different situations, it is worth looking at the parameters that are used.

Deposit Amount

This is how much a trader deposits to the trading account (in most cases, this is the minimum possible amount to activate a bonus). We start with $100 and will give examples with $200 (an average deposit amount at the Binolla), $500, and even $1,000 (which is the maximum bonus amount in most cases). You will see how your profit and ROI will change in different situations when you deposit different amounts.

Bonus Amount

The table that we used to calculate our cases uses the following formula for the bonus amount:

Deposit amount*Bonus percentage/100

For instance, if a trader deposits $100 and the bonus is 90%, the bonus amount will be 100*0.90=90, which makes $190 in total on their trading balance. For those who deposit $200, the bonus amount will be 200*0.90=180, which makes $380 on their balance in total.

Investment Amount

This figure reflects how much you put at risk in each trade. We have taken $10 as an example, which is an average investment amount that Binolla traders use. According to the classic money management rule, a trader should not exceed 1-5% of their balance. However, in some cases, market participants may use up to 10% of their balance to put a trade.

Profitability

The maximum profitability of Binolla digital option contracts is 92%. This is how much you can get by investing a particular amount. For instance, if you decide to place a trade with $10 and 92% profitability, then you can get $9.2 if the trade closes positively. To make it easier, we have taken 90% profitability.

Probability

This is a very important parameter reflecting the ratio of profitable and losing trades of a trader. For instance, a 50% probability means that from 10 trades, one gets 5 profitable and 5 losing. If the probability rises to 60%, then by placing 10 trades, a trader gets 6 profitable and 4 losing. The minimum probability that we use in calculations is 50% as this is a random approach, allowing you to trade without any strategy. Keep in mind that to increase your probability, you will be required to use some strategies.

R(x)

R stands for a round in our calculations. A round is several trades that a trader can make when depositing a certain amount with a certain investment amount. For instance, by depositing $100 and defining the investment amount as $10, you can open 10 trades in a single round of trades (Rx).

The formula that is used to calculate Rx is the following:

((Deposit amount+Bonus amount)/Investment amount)*Investment amount*Profitability*Probability.

Let’s break this formula down for better understanding:

- (Deposit amount+Bonus amount)/Investment amount. In this part, we calculate how much funds a trader will have on their balance by depositing a particular amount and getting a bonus amount. Then, we multiply the total balance on the investment amount to receive the number of trades a trader can open with it with a particular investment amount. For instance, by depositing $100 and getting $90 as a bonus amount, a trader can open (100+90)/10=19 trades before depleting the balance;

- ((Deposit amount+Bonus amount)/Investment amount)*Investment amount*Profitability. By multiplying the result from the previous point by the investment amount, we can calculate how much we will gain by conducting 10 trades with a $10 investment amount with a certain profitability. With a 90% profitability, you will get $90 as a profit or $190 in total (as when you have profitable trades, the investment amount returns to your balance with the profit amount). Keep in mind, that this figure is applicable when all 100% of trades are profitable;

- ((Deposit amount+Bonus amount)/Investment amount)*Investment amount*Profitability*Probability. Finally, we add probability that allows us to calculate the results in a single round of trades. In the previous point, we had $190 in total. If we apply a 50% probability, then the results after 10 trades will be $95 ($100/$10)*$10*1.9*0.5=$95.

Now that we have explained all the columns in the table, let’s delve deeper into calculations.

Turnover

The turnover is applicable if a bonus requires traders to make a turnover before they can withdraw winnings and the bonus amount. The turnover includes both profitable and losing trades minus the deposit amount.

Turnover Balance

We also use this parameter so that you can see how much of the turnover is left after a series of trades. To calculate it, we deduct all the results of all the trading rounds that were summed up from the turnover balance. The deposit amount should be deducted from the results of the previous calculations.

Balance with Bonus

This is your balance including the bonus amount that you can see on the trading platform.

Balance

This parameter refers to the balance without the bonus amount. Keep in mind, that unlike the Balance with Bonus, this one is withdrawable.

Net Income

This parameter excludes the bonus and your initial deposit. It shows how much you have earned by trading.

ROI (Return on Investment)

Finally, we also calculate ROI, which shows how much you can add (or lose) in percentage as compared to your deposit amount. The ROI is calculated as

(Profit-Deposit amount)/Deposit amount*100.

For instance, if your profit is $200 and your deposit amount is $100, then your ROI will be:

(200-100)/100*100=100%.

Comparing Trading with Fixed Bonuses of Different Sizes (Non-Withdrawable)

In the first case, we are going to compare trading with bonuses of different sizes. First, we will see how a trader can perform when trading randomly with a 50% probability.

| Net Income | Balance | Balance with Bonus | ROI | Turnover | Turnover Balance | Deposit amount | Bonus Amount | Investment Amount | Profitability | Probability |

| -40 | 60 | 60 | -40% | 0 | 0 | 100 | 0 | 10 | 1,9 | 0,5 |

| -48 | 52 | 72 | -68% | 0 | 0 | 100 | 20 | 10 | 1,9 | 0,5 |

| -60 | 40 | 90 | -110% | 0 | 0 | 100 | 50 | 10 | 1,9 | 0,5 |

| -64 | 36 | 96 | -124% | 0 | 0 | 100 | 60 | 10 | 1,9 | 0,5 |

| -68 | 32 | 102 | -138% | 0 | 0 | 100 | 70 | 10 | 1,9 | 0,5 |

| -72 | 28 | 108 | -152% | 0 | 0 | 100 | 80 | 10 | 1,9 | 0,5 |

| -76 | 24 | 114 | -166% | 0 | 0 | 100 | 90 | 10 | 1,9 | 0,5 |

In this example, the bonus varies from 20 to 90 percent with no turnover. Also, we have considered a situation with no bonuses at all. After 10 rounds, a trader with a lower bonus amount will have a higher balance of $52 as only $20 is deducted from the balance with bonus. At the same time, a trader with the highest bonus amount ($90) will have the lowest balance of $24. If we look at the balance with bonus, which is the third column in the table, the situation is totally different.

Those who trade without the bonus will have a tiny $60 balance, while those with the biggest bonus amount will perform almost twice as well. When it comes to net income, you can see that it is negative as the dynamics are negative and a trader has lost more than they have earned.

| Net Income | Balance | Balance with Bonus | ROI | Turnover | Turnover Balance | Deposit amount | Bonus Amount | Investment Amount | Profitability | Probability |

| 7 | 107 | 107 | 7% | 0 | 0 | 100 | 0 | 10 | 1,9 | 0,53 |

| 9 | 109 | 129 | -11% | 0 | 0 | 100 | 20 | 10 | 1,9 | 0,53 |

| 11 | 111 | 161 | -39% | 0 | 0 | 100 | 50 | 10 | 1,9 | 0,53 |

| 12 | 112 | 172 | -48% | 0 | 0 | 100 | 60 | 10 | 1,9 | 0,53 |

| 12 | 112 | 182 | -58% | 0 | 0 | 100 | 70 | 10 | 1,9 | 0,53 |

| 13 | 113 | 193 | -67% | 0 | 0 | 100 | 80 | 10 | 1,9 | 0,53 |

| 14 | 114 | 204 | -76% | 0 | 0 | 100 | 90 | 10 | 1,9 | 0,53 |

Now let’s change the situation and check how a trader can perform with or without a bonus having at least a basic strategy at hand, which allows them to increase probability to 53%. As you can see, over 10 rounds of trades, a trader has managed to make profits. The highest amount they can gain is when they use a 90% bonus. Moreover, if we take gross profit, which is the second column, the situation is even better and a trader has more funds to increase their future profits.

Comparing balances with the bonus for 20% and 90% bonuses gives us an almost two times advantage of the 90% bonus. When trading without a bonus, a trader will have the lowest performance.

Key Takeaways

What conclusions can be made in this situation? If you decide to withdraw what’s left when trading with a 50% probability, then trading with a lower bonus amount will be an advantage as you will have more money as your net profit. Moreover, if you take no bonus at all, you will have even more money at hand as nothing will be deducted from your gross profit. Keep in mind that with a 50% profitability, your net income will be even lower than your deposit amount.

However, if you want to continue trading, then having a higher bonus amount will be a huge advantage as you will have more funds at your disposal.

The second table confirms this idea as those traders having a 90% bonus will perform better as compared to all others, while those with a tiny 20% bonus will have fewer funds to continue trading. Traders without a bonus will have the worst results. Therefore, their road to higher profits will be much longer.

Comparing Trading with Flexible Bonuses (Non-Withdrawable)

The next case demonstrates how a trader can perform when using a flexible bonus.

| Net Income | Balance | Balance with Bonus | ROI | Turnover | Turnover Balance | Deposit amount | Bonus Amount | Investment Amount | Profitability | Probability |

| -48 | 52 | 72 | -68,15% | 0,00 | 0,00 | 100 | 20 | 10 | 1,9 | 0,5 |

| -602 | 398 | 898 | -110,19% | 0,00 | 0,00 | 1000 | 500 | 10 | 1,9 | 0,5 |

| -2408 | 592 | 3592 | -180,25% | 0,00 | 0,00 | 3000 | 3000 | 10 | 1,9 | 0,5 |

We have three variants. A trader deposits $100 and gets a 20% bonus, a trader deposits $1,000 and gets a 50% bonus, and a trader makes a deposit of $3,000 and gets a 100% bonus. In the first example, a trader uses no strategy and trades randomly with a 50% probability. As you can see, the balance is higher in the third case. ROI is negative in all three cases, but the third one is even lower as a trader will lose more. They will have only $592 on their balance, which is almost 6 times lower than the initial deposit.

However, if a trader decides to continue trading, then their balance with bonus will be higher in the third case as they will have $3,592 against 72 in the first case. Let’s now see how a market participant will perform with this type of bonus if they start using at least a basic strategy with a 53% probability.

| Net Income | Balance | Balance with Bonus | ROI | Turnover | Turnover Balance | Deposit amount | Bonus Amount | Investment Amount | Profitability | Probability |

| 9 | 109 | 129 | -11,33% | 0,00 | 0,00 | 100 | 20 | 10 | 1,9 | 0,53 |

| 108 | 1108 | 1608 | -39,16% | 0,00 | 0,00 | 1000 | 500 | 10 | 1,9 | 0,53 |

| 433 | 3433 | 6433 | -85,55% | 0,00 | 0,00 | 3000 | 3000 | 10 | 1,9 | 0,53 |

The situation is totally different now. A trader with the highest bonus amount will significantly outperform the one with the tiniest amount. The ROI of the trader with the highest bonus amount is almost twice as high, while the difference between their net and gross profits is tremendous.

Key Takeaways

Using a flexible bonus can also be very advantageous for traders, but only if they use at least a basic strategy. Trading with no strategy will change the situation as those with a higher bonus amount will lose more when the bonus amount is deducted. However, if they decide to continue trading, then they have better chances as their amount is still decent and if they start using a strategy, they are likely to reach their financial goals faster.

Comparing Trading with Withdrawable Bonuses of Different Size

Withdrawable bonuses may seem a big advantage at first, but they mostly come with one important feature. You should make a turnover to be able to withdraw such a bonus. Let’s check how a trader will perform with such a bonus if their profit probability is 50%.

| Net Income | Balance with Bonus | ROI | Turnover | Turnover Balance | Deposit amount | Bonus Amount | Investment Amount | Profitability | Probability |

| -40 | 60 | -40% | 0 | -299 | 100 | 0 | 10 | 1,9 | 0,5 |

| -48 | 72 | -68% | 1 000 | -129 | 100 | 20 | 10 | 1,9 | 0,5 |

| -60 | 90 | -110% | 2 500 | 1 114 | 100 | 50 | 10 | 1,9 | 0,5 |

| -64 | 96 | -124% | 3 000 | 1 528 | 100 | 60 | 10 | 1,9 | 0,5 |

| -68 | 102 | -138% | 3 500 | 1 942 | 100 | 70 | 10 | 1,9 | 0,5 |

| -72 | 108 | -152% | 4 000 | 2 357 | 100 | 80 | 10 | 1,9 | 0,5 |

| -76 | 114 | -166% | 4 500 | 2 771 | 100 | 90 | 10 | 1,9 | 0,5 |

In this first example, a trader with a higher bonus amount will perform better as compared to others. This is due to the fact that the balance will be equal to the balance with the bonus as the bonus is withdrawable. However, general dynamics are negative and traders will lose even more if they continue to trade without any strategy.

A trader who uses a 20% bonus will manage to meet the turnover requirements in 10 rounds of trades, while others will have to continue trading. Anyway, if a trader does not use any strategy, they will gradually lose their money.

| Net Income | Balance with Bonus | ROI | Turnover | Turnover Balance | Deposit amount | Bonus Amount | Investment Amount | Profitability | Probability |

| 7 | 107 | 7% | 0 | -299 | 100 | 0 | 10 | 1,9 | 0,53 |

| 29 | 129 | -11% | 1 000 | -468 | 100 | 20 | 10 | 1,9 | 0,53 |

| 61 | 161 | -39% | 2 500 | 690 | 100 | 50 | 10 | 1,9 | 0,53 |

| 72 | 172 | -48% | 3 000 | 1 076 | 100 | 60 | 10 | 1,9 | 0,53 |

| 82 | 182 | -58% | 3 500 | 1 462 | 100 | 70 | 10 | 1,9 | 0,53 |

| 93 | 193 | -67% | 4 000 | 1 848 | 100 | 80 | 10 | 1,9 | 0,53 |

| 104 | 204 | -76% | 4 500 | 2 234 | 100 | 90 | 10 | 1,9 | 0,53 |

Now let’s improve the situation a bit and see how a trader can perform with a withdrawable bonus requiring turnover if they start using at least a basic strategy with a 53% probability. First, the dynamics are positive this time as the profit is gradually growing. Those who use no bonus at all will show a lower performance than those who use a higher bonus. The second row shows that a trader with a 20% bonus has managed to meet the turnover, which means that their $129 is now withdrawable, while other traders will have to continue trading in order to meet the turnover. With a 53% probability, they will manage to make the turnover and have even higher profits.

| Net Income | Balance with Bonus | ROI | Turnover | Turnover Balance | Deposit amount | Bonus Amount | Investment Amount | Profitability | Probability |

| 271 | 371 | 271% | 0 | -299 | 100 | 0 | 10 | 1,9 | 0,6 |

| 325 | 445 | 305% | 1 000 | -1 882 | 100 | 20 | 10 | 1,9 | 0,6 |

| 406 | 556 | 356% | 2 500 | -1 078 | 100 | 50 | 10 | 1,9 | 0,6 |

| 433 | 593 | 373% | 3 000 | -810 | 100 | 60 | 10 | 1,9 | 0,6 |

| 460 | 630 | 390% | 3 500 | -541 | 100 | 70 | 10 | 1,9 | 0,6 |

| 487 | 667 | 407% | 4 000 | -273 | 100 | 80 | 10 | 1,9 | 0,6 |

| 514 | 704 | 424% | 4 500 | -5 | 100 | 90 | 10 | 1,9 | 0,6 |

What if a trader starts using a decent strategy with a 60% probability? The situation changes drastically as they manage to meet the turnover in 10 rounds with all bonus sizes. Moreover, the profit of one who uses a 90% bonus will be almost two times higher than the gains of a trader using no bonuses at all.

Key Takeaways

As you can see, a withdrawable bonus with turnover may have its advantages when you use a strategy with a 60% probability of success as you will be able to make the turnover faster. In all other cases, you will spend more time to meet the requirements.

Moreover, you will have to spend much time and effort to get a relatively small amount (up to $90 in this case), which makes this bonus less competitive as compared to a non-withdrawable one, but without turnover, as you will be able to withdraw your profits without being obliged to trade more in order to reach the turnover amount.

Binolla Welcome Bonus

Understanding the situation with the turnover and the bonus size, Binolla offers an exclusive welcome bonus. It requires no turnover at all, which is important as you won’t spend time and nerves trying to meet the requirements. While you can’t withdraw the bonus amount itself, you can cash out all profits made with it without any restrictions or limitations.

Moreover, the bonus has no maximum amount, which means that you can receive it even if you deposit $500 or higher. If you want to claim it, check our guide below.

How to Start Using the Binolla Welcome Bonus

To be able to use the welcome bonus by Binolla, traders should create an account first. Then, they should proceed with the following steps.

1: Click the Bonus Button at the Top of the Screen

To claim the welcome bonus at Binolla, you need to log in to your account and then click the green button that is highlighted with the red arrow in the image above.

2: Initiate Promo Code Activation

In the window that appears, you need to copy the promo code and click Activate to initiate the procedure.

3: Complete Deposit

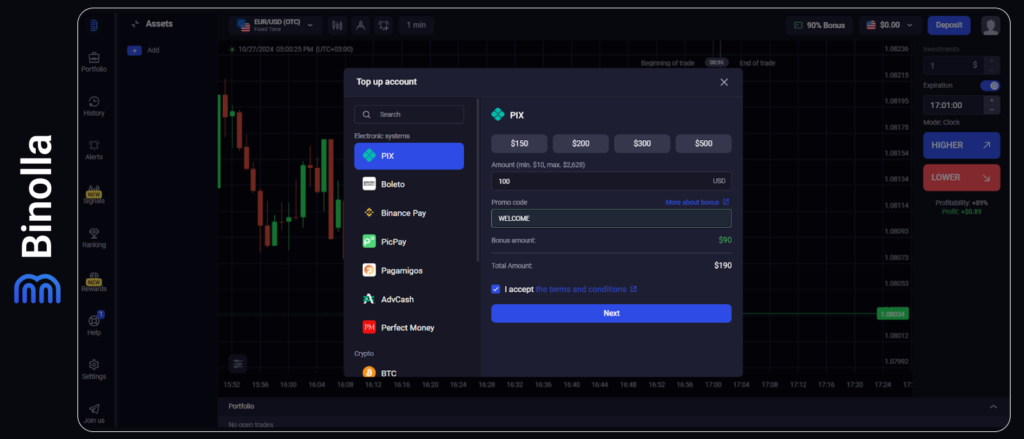

Now you will see a window with deposit methods. Choose one, indicate the amount you want to deposit, paste the promo code, check I accept the terms and conditions, and click Next to proceed with depositing.

4: Provide Additional Data (If Required)

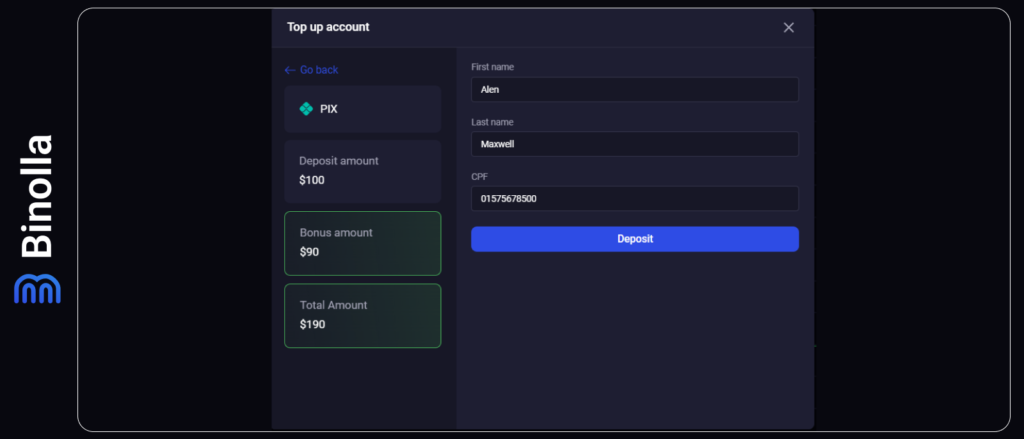

Some payment methods may require additional data before the payment can be completed. You need to provide it and then click Deposit.

5: Complete the Transaction and Check Your Balance

Once all the steps are done, send money to the Binolla account from your payment method. Check your balance. You will see that the sum is 90% higher as you have activated the welcome bonus.

FAQ

What is the Limit of the Binolla Welcome Bonus?

The Binolla welcome bonus comes with no limit, which means that the amount depends only on the sum of your initial deposit.

Is There Any Wager to Complete Before I Can Withdraw My Profits If I Claim the Binolla Welcome Bonus?

No, there is no wager to complete. You can withdraw profits without any limitations.

Can I Withdraw the Bonus Itself?

No, you can’t. The bonus amount is non-withdrawable.

Can I Use the Welcome Promo Code Twice?

No, you can’t. The promo code is available only once upon registration.