Another Busy Week: What Will BoE and ECB Decide on Thursday

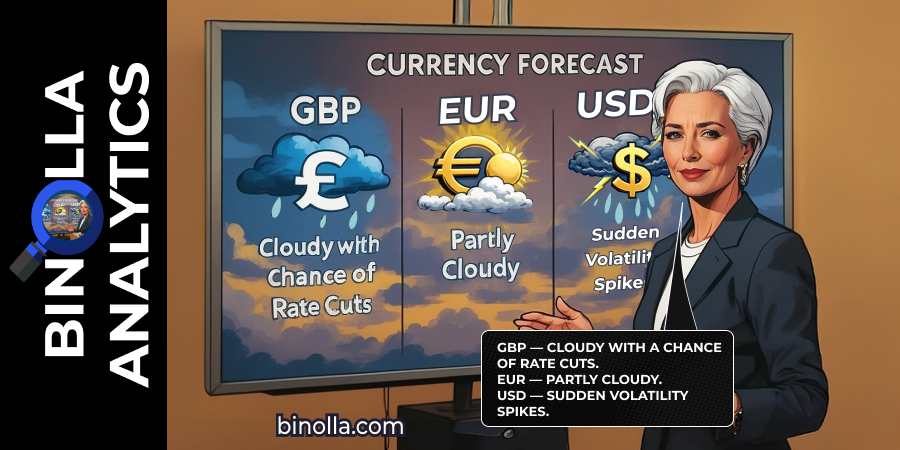

The week ahead is expected to be busy for financial markets as two major central banks, ECB and BoE will announce their monetary policy decisions. The Bank of England faces growing pressures as the economic situation in the UK remains unstable. While the economy is showing signs of slowing, the inflation is easing, which provides policymakers with some room to cut rates in December. At least, BoE voting members can deliver dovish comments, which will support expectations of the rate cut in the beginning of 2026.

When it comes to the ECB, policymakers have already commented that the next rate cut is unlikely to take place before the end of 2026. The situation in the Eurozone is more favorable, while growth still remains fragile. The central bank is likely to maintain the rate during the meeting on Thursday. Officials are expected to confirm their current approach and focus on the upcoming data to make any further decisions. However, in case of any surprises, this will rise volatility in EUR/USD.

When it comes to the US dollar, the Fed has already cut rates during the December meeting, but the Fed Chair Powell confirmed a wait-and-see approach. There will be a lot of data releases today from the United States, including labor market data, which may add vollatiltiy to the financial market and provide further guidance on the future steps by the Fed. If the unemployment rate rises to 4.5%, while non-farm payrolls show softer figures, the US dollar may feel additional pressure.

Contents

EUR/USD: ECB Stability May Put the Currency Pair Higher

The currency pair is supported by expectations that the European Central Bank will leave the rate at its current levels and confirm that the future rate cut will be delivered by the end of 2026. Market participants will also anticipate the US labor market data, which may put pressure on the US dollar and support the currency pair this week.

From the technical analysis perspective, EUR/USD is trading close to the upper band of the Bollinger Bands indicator with low volatility as bands are narrow. Long positions are preferable above 1.1770 with targets at 1.1850-1.1870. Short positions, in turn, can be performed below 1.1740 with targets at 1.1700-1.1680.

GBP/USD: BoE Uncertainty Puts Pressure on the Pound

The British pound remaind under pressure as the Bank of England may decide to cut rates this week. However, the currency pair is moving towards its local highs on Tuesday as the US dollar loses momentum. Market participants await for the BoE meeting that will take place on Thursday. In case of a direct rate cut or dovish comments from policymakers, the pound may lose ground against the US dollar.

From the technical analysis view, the curency pair is trading above the upper Bollinger Band line, which means that the local uptrend is developing. However, we’ve almost reached the local high, and at least a correction may occur. Buy positions will be preferable above 1.3440 targeting 1.3500 and 1.3520. Short positions will be preferable below 1.3370 targeting 1.3300 and 1.3280.

WTI: Oil Is Between Growth Expectations and Supply Risks

Crude oil remains under pressure due to fears of global growth slowdown. However, on the other hand, risks of supply shortage support the black gold. Catious central banks stance can undermine support, but geopolitical tensions, especially in regions where oil is produced, may provide some additional support to WTI.

From the technical analysis perspective, WTI is trading close to the lower band of the Bollinger Bands indicator, which means that the downtrend may continue. Traders can sell WTI below 55.50 targeting 55.00 and 54.60. On the upside, traders can buy WTI above 56.40 targeting 57.00 and 57.40.

Gold: XAU/USD May Gain Additional Support Amid Dovish Stance

Gold continues to benefit from fundamental support as the Fed is expected to continue its dovish policy steps in 2026. While the Fed Chair Powell expects only one rate cut the next year, market participants are anticipating 2-3 rate cuts in 2026, which puts pressure on the US dollar and provides support to gold, which is considered a safe-haven assets in times of higher inflation.

From the technical analysis perspective, gold is trading close to the lower Bollinger Bands line, but is likely to resume its upside towards local highs. Long positions will be preferable above 4310 targeting 4350. Short positions will be preferable from 4270 targeting 4240.