A Black Monday? What to Expect from Major Economies This Week

The broader market plunged 3% on Monday, turning worries into a grandiose selloff. The Dow index has lost 1,000+ points, and the Nasdaq, which is full of tech companies fell by 3.5%. Along with this massive escape from shares and other risky assets in the United States, Japan’s Nikkei 225 plunged 12%, which is the worst drop in history. Asian and European markets followed the US and Japan marking substantial losses on Monday.

What was the reason for the markets to react this way? Currently, there are fears of a recession in both the US and the world. Moreover, growing concern that the Fed has failed to act appropriately, push the markets down as well. What is even more interesting is that there is a strong belief among investors that the AI boom will not pay off.

Contents

Will the US Economy Face a Recession?

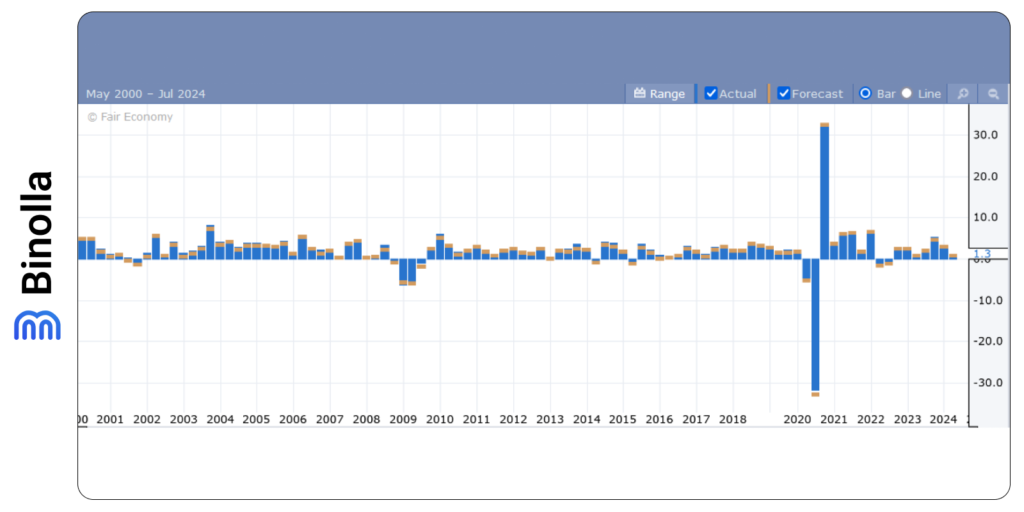

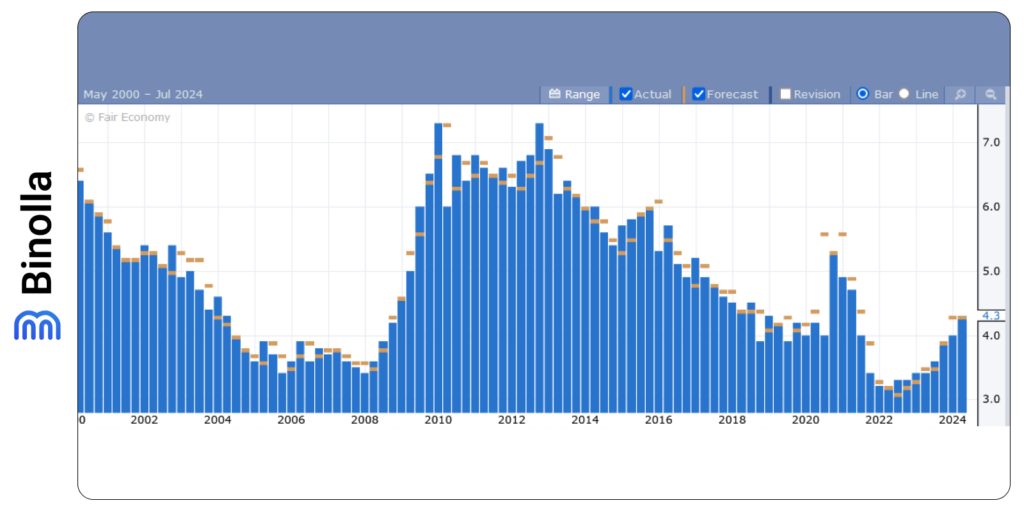

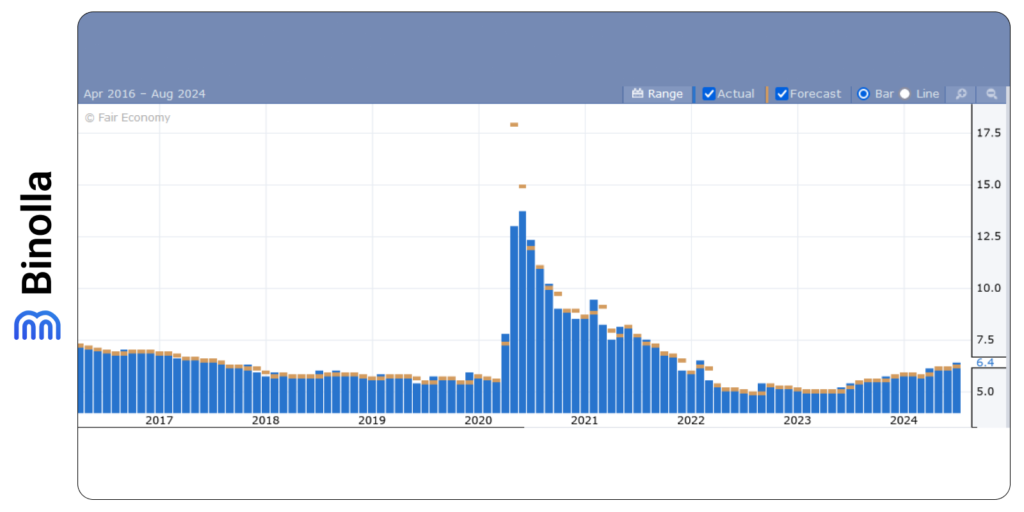

The biggest fear among investors is that the US economy may struggle from recession in the near future. Friday’s labor market data raised serious concerns about the economic growth in the United States. The unemployment rate jumped to 4.3% from 4.1% and the number of new jobs was 144K only, which is far below expectations. When it comes to wager dynamics, it grew by only 0.2% during the reported month.

While the figures may seem frightening, the US economy remain strong as it grew more than expected during the second quarter. However, the fears about the future of the US economy are mounting. According to Goldman Sachs, the possibility of a recession in the coming 12 months has increased, but it is only 10% higher than before Friday’s US labor market release.

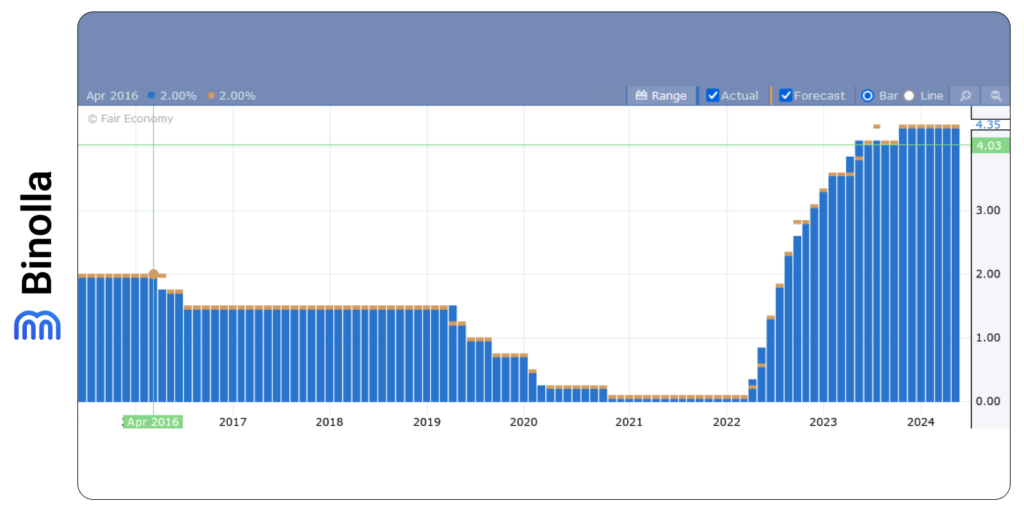

When it comes to the Fed, markets still expect the central bank to cut rates in September after a series of aggressive steps taken by the FOMC during the past couple of years. According to some investors, this patience is a mistake and the Fed should cut rates during the last meeting that took place in July.

While the FOMC had to hold rates at its historical highs, some economists believe the central bank should have started cutting rates sooner. This could help support the labor market by cutting the borrowing costs for companies and freeing more money for expansionary purposes.

Currently, the Fed is ready to step in but this decision will take time to work. With the inflation cooling down dramatically and the unemployment rate hitting new anti-record, the Fed may be too late to reject contractionary policy.

There are three Fed meetings ahead in September, November, and December. According to preliminary forecasts, the FOMC is likely to cut rates twice this year. The first cut is expected to take place in September. Then, there will be two more meetings for the Fed to decide whether to continue to add liquidity to the economy or not.

The AI Factor

Along with the fears about the economic growth in the United States, lots of investors have doubts about the future of the AI sector. It seems that markets have overestimated the industry and given it too much credit in the past. Tech stocks had been flying high over in the past couple of years as many believed AI will create a new global technological revolution.

However, as time shows, the industry is still far from being profitable. Moreover, the technology is still unproven and its perspectives are shadowed. Therefore, investors and traders get rid of tech stocks, including Apple, Microsoft, Meta, Amazon, and others that were at the peak of their popularity since early 2023.

According to the latest reposts, Berkshire Hathaway, Warren Buffet’s company, has just sold half of its Apple stake, which is another negative sign for the tech sector. It should be mentioned that these companies make up an enormous chunk of the S&P500 index, which will result in a sell-off in a broader market.

Will the RBA Change Its Policies?

The RBA made no changes in the monetary policy during the meeting this week. While the interest rates remain unchanged, discussions about whether to hike rates by another 25 bps or not took place. The inflation in Australia is cooling down, but its dynamics are slower than in other major economies.

Monthly y/y CPI in Australia rose to 4.0% in May, which intensified speculations about the possibility of another interest rate hike. However, even if yearly inflation has increased, the worries about the performance of the Chinese economy together with other macroeconomic indicators convinced the RBA voting members that hiking rates will not be the best solution this time.

Will BoJ Support Yen by Other Aggressive Hawkish Steps?

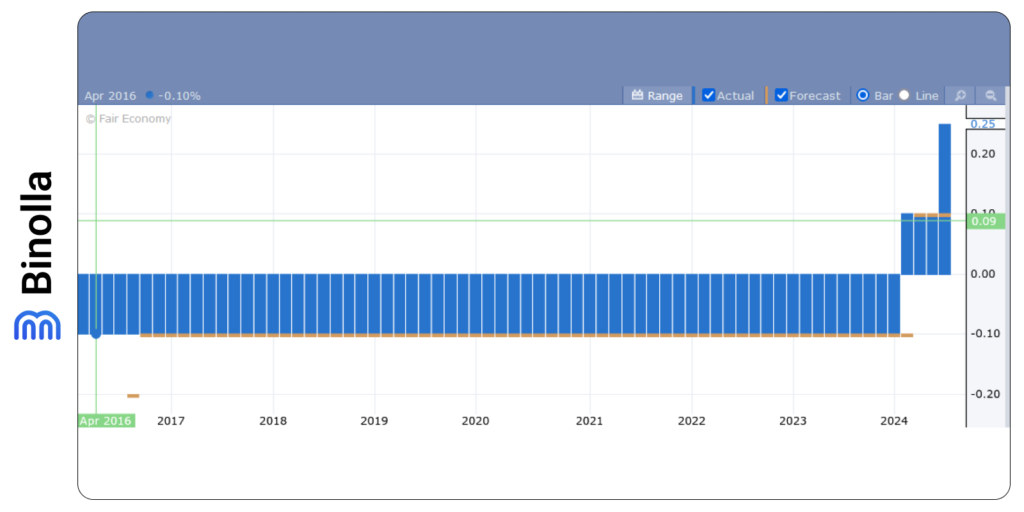

The Bank of Japan released a summary of opinions last week and hiked rates by 15 bps again this year, which was quite unexpected as market participants considered a 10 bps move with a 50% probability. This move from the BoJ supported the Yen again and allowed the Japanese currency to extend its rally.

It should be mentioned that the BoJ has become more hawkish, which means that investors may expect more aggressive monetary policy steps in the future, which, in turn, will support the Japanese Yen. There are several meetings this year ahead. Yen traders should follow the BoJ comments and adjust their positions accordingly.

New Zealand Jobs are in Focus

The New Zealand employment data is also in focus this week. According to the latest forecasts, the unemployment rate in NZ is likely to rise to 4.7% from 4.3%, which may be a major concern for the RBNZ officials.

The Q2 inflation dropped to 3.3% y/y from 4.0% previously, which is a positive signal for the Reserve Bank of New Zealand officials. However, they still hold interest rates waiting for more signals. According to forecasts, the RBNZ will make two 25 bps cuts this year and the first one may take place in August. The labor market data may change expectations to even higher marks as RNBZ will have to consider the worsening conditions and the possibility of a recession.

Will the Canadian Labor Market Follow the Others?

The situation with the Canadian labor market is likely to be similar to that of other major economies. A long period of high interest rates slows down economic growth which results in lower recruiting. The BoC is expected to undertake a third rate cut in September 2024. According to forecasts, the Bank of Canada will reduce the rate by 25 bps.

Another important data release this week from Canada is Ivey PMI. According to forecasts, the index is likely to lose 2.5 points, but it is still far above 50, which means the economy is expanding.