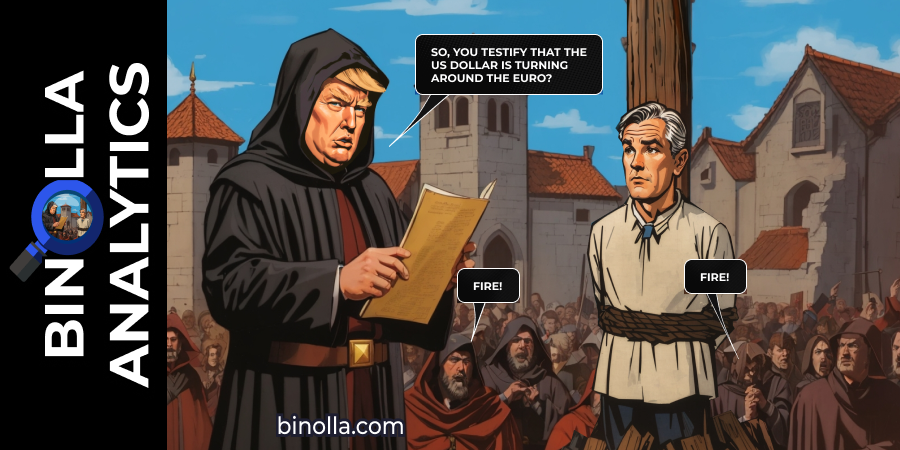

Will Trump Fire Powell? Tensions Between the White House and the Fed Continue

The tensions between the White House and the Fed are escalating. The US president accuses the FOMC head of being inactive and holding higher rates for too long. Currently, Donald Trump is looking for opportunities to fire Jerome Powell. While there is no direct way to do it, the investigation of the Fed head’s activities were launched. One of the weak points is the spending on renovation of the Fed head-quarters in Washington.

With the increasing pressure, the Fed still sticks to the wait-and-see approach. The central bank looks closely at inflation and is going to make the next move according to the coming data. Today’s US CPI publication is likely to shed light on the further steps by the regulator.

Contents

- 1 EUR/USD: Market Participants Are Looking Forward to See the US-EU Deal

- 2 GBP/USD: The Currency Pair Is Under Pressure Amid the Dovish Tone by the BoE

- 3 Know the Market. Trade with Confidence

- 4 WTI: Crude Oil Dips Below 66.00 on Trump’s Sanctions Against Russia Deadline

- 5 BTC/USD: A Downside Correction After a Strong Upside

EUR/USD: Market Participants Are Looking Forward to See the US-EU Deal

The US president announced new 30% customs duties on goods coming from the European Union. The deadline is set on August 1, which means that if the parties are unable to reach the deal before this expiration date, the tariffs will come into force.

The market sentiment improvde this week amid the ongoing negotiations between the two sides. The US president also announced the visit of EU officials which is considered a positive step that may lead to trade war deeascalation between the two major partners.

It should be mentioned that the US dollar is still under pressure due to the ongoing confrontation between the US president and the FOMC head. If Donald Trump manages to “fire” Jerome Powell and appoint a new head with more dovish stance, then the US dollar may lose ground again.

From the technical analysis perspective, the currency pair fluctuates within a narrow range on the eve of the US inflation data report. The key points to consider are 1.1700 and 1.1650. Traders can place a buy stop order at 1.1700 targeting 1.1760 and then 1.1800. When it comes to the downside, selling from 1.1650 will be preferrable.

GBP/USD: The Currency Pair Is Under Pressure Amid the Dovish Tone by the BoE

The Disapointing macroeconomic data from the United KIngdom as well as the recent comments by the BoE Head Andrew Bailey stimulate negative market sentiment towards the British currency. According to the Bank of England’s chair, the central bank is on the way to cut rates. Market participants expect the regulator to make another easing move not later than during the next meeting in August.

The Fed, on the other hand, still secures its wait-and-see approach. While a couple of doves from voting members are likely to support the rate cut in August, it is more likely that the rate will remain intact in the summer and the first move may be done in September. As it was already mentioned, the US central bank will monitor the inflation closely and act accordingly. The current economic situation in the United States allow the Fed officials to avoid aggressive steps.

On the technical analysis side, the currency pair remains below the SMA50, which is a clear signal of the bearish dominance. The descending highs support this idea. Traders can place sell stop orders below 1.3420 targeting 1.3350 and even lower. On the upside, placing buy stop order is preferrable above 1.3470.

WTI: Crude Oil Dips Below 66.00 on Trump’s Sanctions Against Russia Deadline

Crude oil is trading at 66.00 currently after dipping even below this mark on news that the US president set the deadline for new sanctions that may hit Russia’s trade partners. The 50-day delay will expire in September and Trump has promised 100% tariffs on any country trading with Russia.

On the supportive side, the upbeat data from China stimulate WTI growth as fears of a decline in demand ease. This may help the Crude to move higher in the near future as the growing demand will stimulate production. Moreover, the OPEC+ countries have decided to pause supply hikes in October, which is another positive news for WTI.

Oil is trading below the SMA50, but stays within a wide range without a clear direction. After hitting the support level at 65.50 today, quotes moved higher and tested 66.00. If the price manages to move higher, traders can buy. While if the price dips below 65.50, sellers will come into play.

BTC/USD: A Downside Correction After a Strong Upside

Bitcoin surged significantly since our last review and managed to hit 122,000 within just one week amid the positive market sentiment and risk appetites. However, after reading another ATH, the cryptocurrency began a correction due to the rising uncertainty over global trade relations and other factors.

When it comes to technical analysis, Bitcoin is trading below the SMA50, which is a signal that bears are taking control. Sell stops can be place below 116,000 targeting 110,000. When it comes to long positions, they will be preferrable if BTC/USD returns above the SMA50.