Will the US Shutdown End This Week?

Global markets started a new week under pressure due to the ongoing US shutdown and political instability in France, which is the second-largest EU economy. Traders are watching the developments in Washington, as the deal can be reached this week. When it comes to France, reappointed Prime Minister Sebastien Lecornu has already survived two votes of no confidence, but he is still in place, which means that the political situation may improve in Europe.

When it comes to the United States, the government has remained partially shut down for almost 30 days already. According to the US Treasury Secretary, if the shutdown continues, it may surpass previous ones by its negative consequences. In addition to the French political crisis, in Germany, coalition tensions begin. Weakening industrial data puts pressure on the euro, which may lead to a broader downtrend.

Key reports this week will be released on Friday with PMI data from the Eurozone, the UK, and the US. Keep in mind that the planned US inflation data may not be released due to the ongoing shutdown.

Contents

- 1 EUR/USD: Traders Remain Cautious Due to Political Uncertainty and Shutdown

- 2 GBP/USD: UK Inflation Data and US Developments Make the Pound Balance

- 3 Use Your Trading Ideas with Binolla!

- 4 WTI: Oil Prices Remain Under Pressure Due to Global Uncertainty and Trade Wars

- 5 Gold: Market Sentiment is Improving and Gold Loses Ground

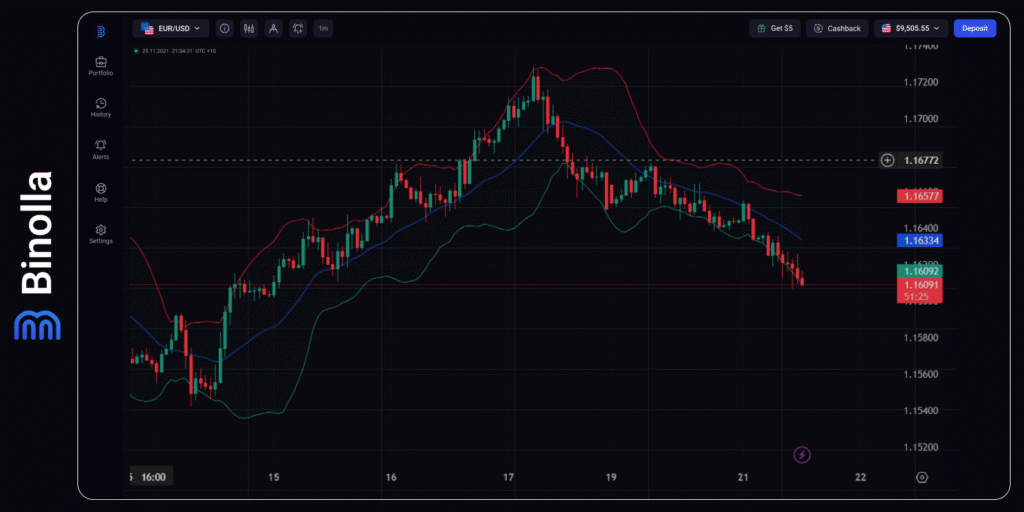

EUR/USD: Traders Remain Cautious Due to Political Uncertainty and Shutdown

The euro continues to slide down on the negative market sentiment, which is based on the ongoing US shutdown and the political crisis in Europe. Economic indicators from Eurozone are mixed, with a continuous crisis in the manufacturing sector and resilience in services. Market participants will closely watch the situation with the shutdown and whether the US officials will be able to resolve this crisis during this week.

From a technical analysis perspective, EUR/USD is trading below the lower line of the Bollinger Bands indicator, which has a downside slope, meaning bears are still controlling the market. The next target for sellers will be at 1.1550 and 1.1500, which is a round psychological number. In case of a reversal, the closest targets will be at 1.1640 and 1.1670.

GBP/USD: UK Inflation Data and US Developments Make the Pound Balance

The British currency is trading steadily as it is supported by the fact that the Bank of England is unlikely to cut rates this year. However, some negative factors, including weaker spending data put some pressure on GBP. Market participants are anticipating the results of the UK inflation data release, which may add volatility and even define the direction of the currency pair’s future fluctuations.

From the technical analysis perspective, GBP/USD is trading close to the lower band of the Bollinger Bands indicator, which means that bears are currently controlling the market. However, unlike EUR/USD, we have some signs of recovery, including reversal signals at the bottom of the indicator. Closest targets for short positions include 1.3360 and 1.3320, while on the upside, traders can target 1.3390 and 1.3430.

WTI: Oil Prices Remain Under Pressure Due to Global Uncertainty and Trade Wars

Oil is trapped between conflicting drivers. On the one side, the OPEC+ is going to increase the supply, which may lead to oversupply in 2026 and, thus, put additional pressure on WTI quotes. Additionally, political and commercial uncertainty, especially between the US and China, removes support from oil. On the other hand, market participants expect the Fed to conduct at least two rate cuts this week, which may support oil as it will put additional pressure on the dollar and stimulate the US economic activity.

On the technical analysis side, WTI is trading right below the upper band of the Bollinger Bands indicator. The indicator itself is tight, hinting at lower volatility with no exact price movement direction.

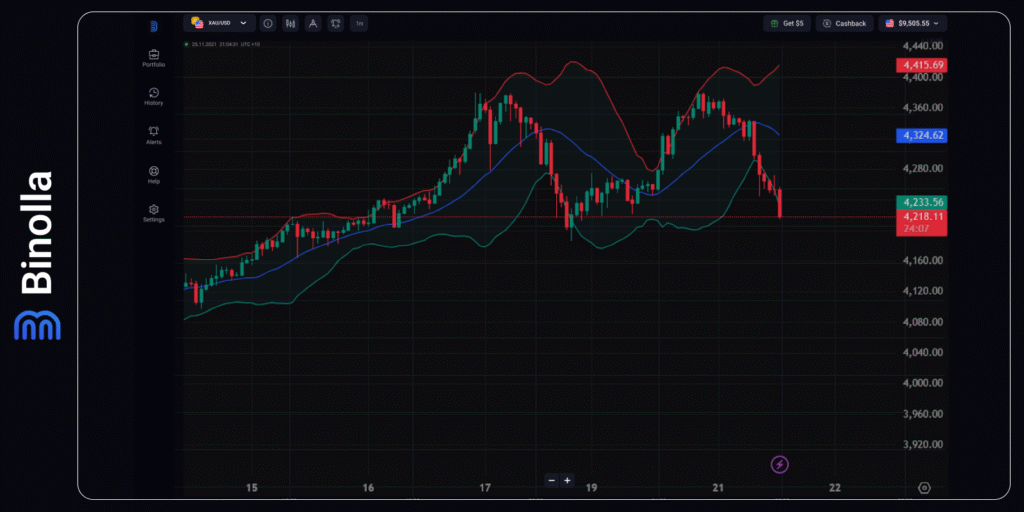

Gold: Market Sentiment is Improving and Gold Loses Ground

Gold is under pressure due to seversal factors, including a possibility of the end of the shutdown, which may happen this week. Moreover, the US-China trade tensions are eased as negotiations in Malaysia, as well as the meeting between the both leaders are planned for the near future. This may put further pressure on gold, which has already stepped away from its all time highs.

From the technical analysis perspective, gold is trading below the Lower band of the Bollinger Bands indicator and is moving lower on fundamentals and improved risk sentiment. Closest targets for sellers are 4,200 and 4,145. Buyers can target 4,260 and 4,320.