Trump Threats Powell: the US Dollar Sets New Lows

The US president attacks the Fed chair for being inactive and postponing the rate cut. According to Donald Trump, the Federal Reserve should immediately step in and ease the monetary policy in order to support the American economy. According to the White House head, the current “wait and see” policy favors to further economic slowdown. Therefore, D. Trump searches for opportunities to dismiss Jerome Powell.

The Fed has already reacted to the comments from the White House by supporting its independence. The dispute between the president and the Fed chair raises fears and uncertainties and pushes the US dollar even lower. Gold hit its new all-time highs as traders are looking for safe-haven assets in this situation. When it comes to major currencies, they develop uptrends as market participants are concerned about the future Fed’s actions.

Contents

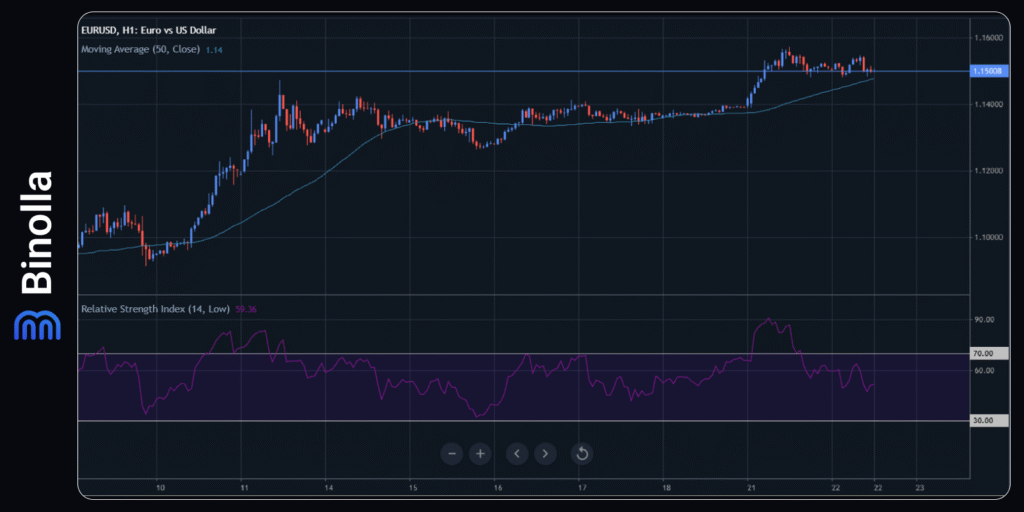

EUR/USD: Euro is Stuck Right at its Multi-Month Highs

The currency pair reached its multi-month highs last week, but currently, new drivers are required for EUR/USD to resume the uptrend. On the other hand, sellers are almost inactive amid concerns of the global effect of the US tariffs and the changes that may occur in the Fed in the near future.

The key set of data will be released on Wednesday this week. European PMIs, together with business activity indices in the United States, will likely indicate the future direction for EUR/USD fluctuations. Major economies are expected to demonstrate contraction in business activities (except the German services sector, which is likely to stay above 50).

On the technical analysis side, EUR/USD is trading close to SMA50 and slightly above the moving average, showing bulls’ domination. Long positions can be opened above 1.158,0, targeting 1.1600 and 1.1650. Short positions will be preferable below the SMA50 if the price breaks below 1.1480.

GBP/USD: The British Pound is Supported by the White House-Fed Tensions

The British pound gains additional support on trade wars and tensions between the White House administration and the Fed. According to the latest comments from the US president and his British counterparts, the negotiations between the two sides are positive, which adds support to the UK currency. However, the UK business activity is expected to remain low in April in the manufacturing sector (the indicator is expected to stay far below 50). The situation is better in the services sector, where the indicator can stay above 50 even with a smooth downside.

From the technical analysis perspective, the currency pair is trading above SMA50, which means that bulls are currently in control. The upside is limited by 1.3430, which acts as a resistance level currently. Traders can place buy pending orders above this level. On the downside, by breaking below 1.3360, the currency pair will return to 1.3300 and can move even lower. This means that short positions from 1.3360 will be a good idea.

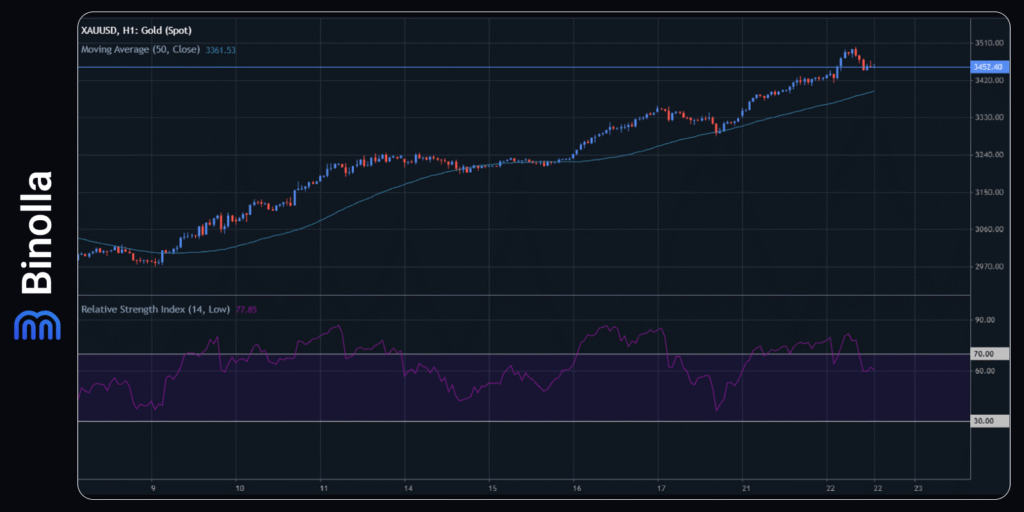

XAU/USD: Gold Breaks All Records

Gold hits new records and reaches 3,500 on fears of a global downturn as the tariff wars continue. The precious metal gets additional support on tensions between the Federal Reserve and the White House administration. The US dollar index downtrend also supports the precious metal. Gold is likely to develop its upside after a while as there are no signs of relief in trade tensions.

From the technical perspective, we have a clear uptrend as XAU/USD remains above the SMA50. Gold’s new high is at 3,500, but the precious metal retreated from this level to gain more power and to return above it. Long positions will be a good decision above 3,500. On the downside, if gold breaks below the SMA50, traders can go short. The RSI indicator has left the overbought area, which means that the downside correction is over, and the precious metal may gain more support currently.

WTI: The Market Sentiment Is Strongly Negative

Several factors push the WTI quotes down. First is an uncertainty about global growth amid trade tensions. Market participants are concerned about the probability of a global downturn, which may lead to lower demand, especially from China, which is the largest oil consumer and importer in the world. The next factor is the pressure on the Fed. Finally, an increase in production by 411,000 barrels in May by OPEC+ is also among the factors that exert pressure on WTI quotes. Moreover, the possibility of a deal between Iran and the US pushes the quotes down as well.

From the technical analysis perspective, WTI stays above the SMA50, which means that bulls are still in control. On the upside, the uptrend is limited by 63.40. On the downside, short positions are preferable when the price breaks below 62.50.