The FOMC Meeting Ahead: What to Expect from the Fed

The FOMC meeting will take place this week. While the Federal Reserve is unlikely to make any adjustments to its current monetary policy, traders and investors are likely to pay more attention to the comments from the officials, as well as the FOMC economic projections.

The central bank still holds to its wait-and-see strategy, and the first rate cut by the FOMC is expected in September. The Federal Reserve may make two cuts this year, totalling 50 basis points. If the economic situation worsens, the central bank is likely to be even more aggressive in its dovish steps.

Meanwhile, tensions in the Middle East add uncertainty to the financial markets. Both sides continue to exchange attacks, which threaten oil supply chains. This may, in turn, increase oil prices and lead to inflation growth in major economies. Shifts in market sentiment due to the possible escalation of the conflict push risky asset prices down.

Contents

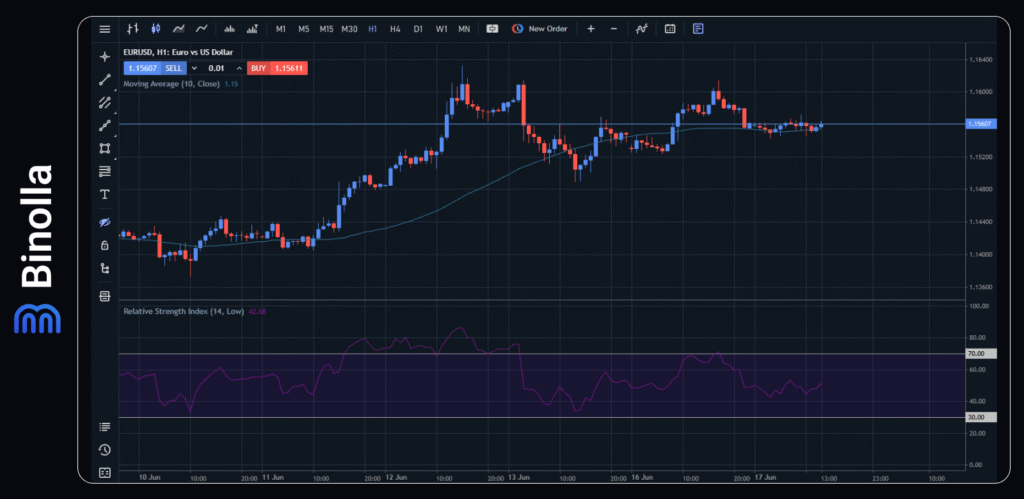

EUR/USD: The Currency Pair Is Under Pressure

The euro is under pressure amid the tensions in the Middle East. The probability of the escalation evaporates demand from the risky assets, including the currency, and adds support to the US dollar in the pair.

Israel and Iran continue to exchange fire for the fifth day in a row. The US President D. Trump urged citizens to leave Tehran. There are risks that the US will be involved in a conflict. Meanwhile, another reason for the currency pair to remain under pressure is the upcoming FOMC meeting. Powell and the team are unlikely to cut rates during the first summer central bank event. This may support the US dollar and put additional pressure on the currency pair.

When it comes to the Eurozone, no game-changing publications are expected this week. The ECB has recently changed its strategy with more hawkish comments from the president of the central bank and voting members. This may provide the currency pair with additional support in long term.

From the technical analysis view, EUR/USD is testing the 50SMA without providing any clue about the current dominant side. Traders can place buy stop orders at 1.1600-1.1610, targeting 1.1650-70. On the downside, sell stop positions at 1.1540 will be preferable, targeting 1.1500, 1.1470.

XAU/USD: Gold May Push Higher After the FOMC Meeting

Geopolitical tensions in the Middle East provided exceptional support to the precious metal. Gold has hit local highs on Monday but failed to move higher and corrected towards 3,380-3,400. This temporary downside is due to the global acceptance stage of the conflict and the possibility that it will be resolved in the near term.

However, both sides have exchanged fire for five consecutive days already, and the US is still hesitating on whether to engage or remain neutral. The US president has already supported Israel, but the US’s participation in the active phase is still unclear.

The upcoming FOMC meeting may help XAU/USD develop its downside correction below 3,380 as the Fed is likely to do nothing with the rate. However, economic projections as well as comments from the Federal Reserve voting members can switch the market sentiment towards gold.

The 1-hour chart still demonstrates that sellers are controlling the situation. The price is below the simple moving average of 50 periods, and the RSI indicator is at its lowest zone. Market participants prepare themselves for the FOMC meeting and break below 3,370, which will be the signal for sellers to step in and open short trades targeting 3,350-3,330.

On the upside, breaking above 3,400 will allow buyers to regain control and go long, targeting 3,420-3,440.

WTI: West Texas Intermediate May Push Higher

Oil quotes remain under pressure as market participants are looking forward to hearing more details about the Middle East conflict. However, the price may resume the uptrend at any moment if any news from the region supporting the idea of the escalation appears. Moreover, the possibility of closure of the Hormuz Straight provides additional support to WTI.

The Middle East tensions are among the key drivers currently. The increase in oil output by OPEC+ is not in focus currently.

From the technical analysis perspective, oil is trading straight above the SMA50, which means that buyers are regaining control. Long positions will be preferable above 72,00, from where you may expect the quotes to reach 74,00. On the other hand, if oil breaks below 71,00, traders can go short targeting 70,00 and below.

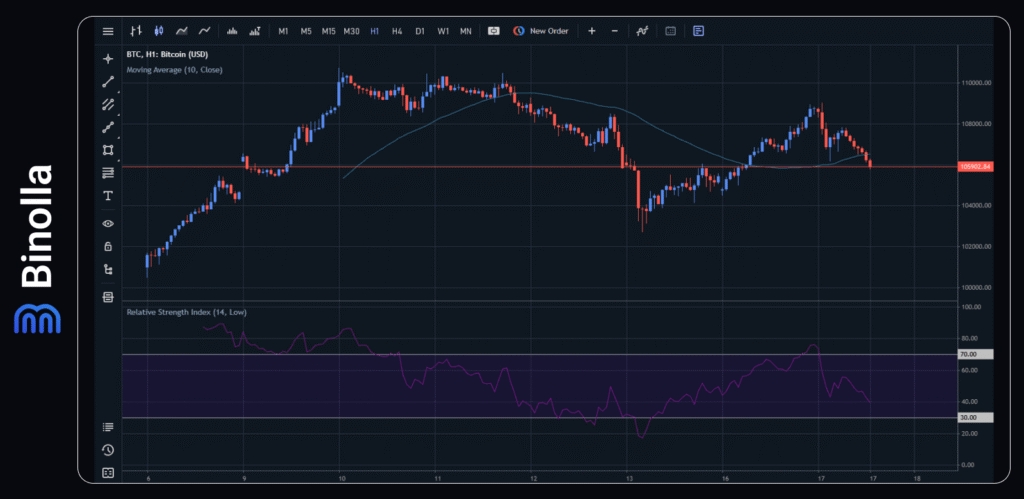

BTC/USD: Bitcoin Is Pressured by Geopolitics

The risky asset is under pressure due to the ongoing Middle East tensions between Israel and Iran. Bitcoin attempted to rise above 108,000, but failed to move higher due to the higher possibility of escalation. If the attacks between the two sides continue, BTC/USD may face further pressure and continue its downtrend.

BTC/USD hourly chart

From the technical analysis standpoint, the currency pair is trading below the SMA50, pinpointing the sellers’ dominance. If BTC/USD moves below 105,000, sellers may go short targeting 104,000 and even 103,000. When it comes to the adverse situation when the price moves above 106,000 and SMA50, buyers will be able to go long targeting 108,000 and 110,000.