The ATR Indicator: What is the Average True Range Indicator and How to Use It in Trading

The Average True Range indicator belongs to the cohort of the most popular technical analysis tools used by traders nowadays. It provides market participants with useful information about market volatility, allowing traders and investors to carefully plan their trading sessions. By reading this article, you will learn more about the basics of the ATR indicator as well as how to apply it in different strategies based on technical analysis.

Take the next step in trading! Join Binolla now and get access to innovative trading tools and expert insights.

Contents

- 1 Key Takeaways

- 2 ATR Basics

- 3 How to Add the ATR Indicator to the Binolla Platform

- 4 ATR Settings

- 5 Start using this indicator in your trading sessions!

- 6 How to Interpret the ATR Indicator

- 7 How to Use the Average True Range Indicator

- 8 The Benefits of the ATR Indicator

- 9 The Drawbacks of the ATR Indicator

- 10 Conclusion

- 11 FAQ

Key Takeaways

- The ATR indicator measures the market volatility allowing you to see whether the volatility is high or low at the moment as well as to check the dynamics;

- Average True Range can be applied to all types of assets allowing you to diversify your trading portfolio;

- The indicator does not show the movement direction;

- The technical analysis tool uses a 14 period by default, but you can change this parameter depending on the timeframe;

- ATR can be used in a few basic strategies to confirm market breakouts and reversals.

ATR Basics

ATR or Average True Range is a powerful technical indicator that was developed by Welles Wilder to measure market volatility. The trader behind this technical analysis tool is famous for creating RSI, another popular and straightforward tool, allowing market participants to benefit from market reversals. With ATR, you can empower every strategy with an additional tool allowing you to predict the range of price fluctuations and make even more informed decisions.

Unlike many other technical indicators, ATR does not focus on price movement direction, it measures the degree of price movement, which is important as market participants can adjust their risk management approach using this technical analysis tool.

One of the key benefits of this indicator is that it can be applied to any financial instrument and asset. Moreover, traders can use it on different timeframes, which makes it a universal tool for every possible strategy. In particular, traders and investors can use ATR when buying or selling currencies, stocks, indices, commodities, and even cryptocurrencies.

Welles Wilder used the following formula to calculate the indicator’s readings:

Previous ATR(n-1) + TR/n

Where:

- TR stands for True Range;

- n stands for the number of periods.

Happily, you don’t need to calculate anything as the indicator makes all calculations. You will see the line that you can use directly in any of your trading strategies.

How to Add the ATR Indicator to the Binolla Platform

To start using the Average True Range indicator, you need to add it to the platform first. With Binolla, you can do it in several simple steps. Here is how you can do it:

- Move the cursor to the upper part of the screen and push the Tools icon.

- Now find Oscillators on the left side of the screen and click on this menu.

- Select ATR and press on it to add the indicator.

ATR Settings

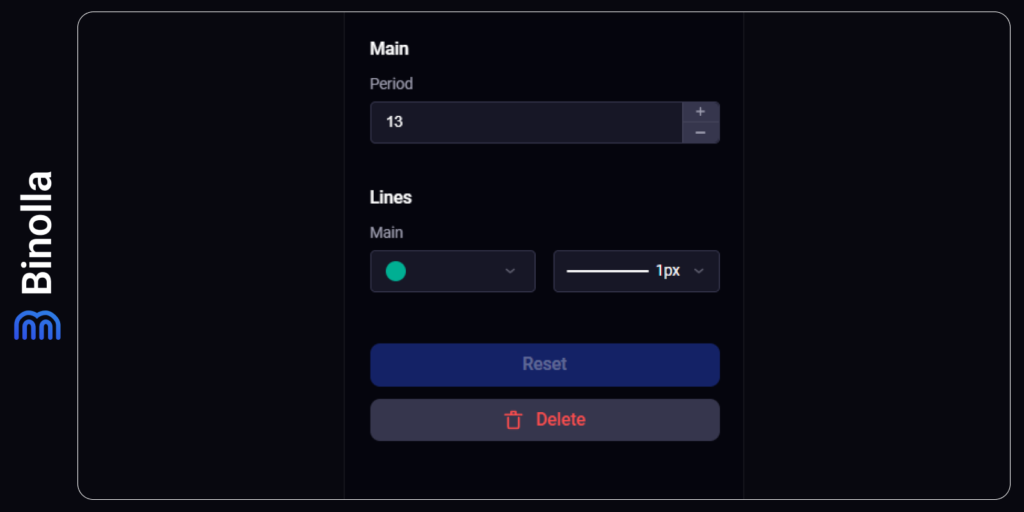

After the indicator is added to the platform, you can change its settings to adapt it to your specific strategies. The ATR indicator is a simple and straightforward tool that requires no previous skills. It offers only a couple of options that you can change to set it up. They include:

- Period. This feature explains how many periods will be included in the calculations. The standard period for ATR on the Binolla platform is 13. Welles Wilder used 14 periods for all his indicators, which gives almost the same results. While this period is universal, those who trade on lower timeframes can set the period between 2 and 12, which will add more flexibility, when trading on higher timeframes (from 1H), traders can set periods from 20 to 50;

- Lines. This option does not affect calculations, but it can be useful when you need some graphic adjustments. You can change the color of the indicator line as well as its thickness.

How to Interpret the ATR Indicator

The ATR indicator resembles all those momentum indicators, including RSI. However, while it belongs to the same group of oscillators, it does not allow you to find market reversals as the Average True Range is designed for other purposes. This indicator can be used to see the current market volatility and adjust your risk management approach according to the market situation.

The indicator line oscillates all the time, but it does not coincide with the price direction. This is due to the fact that the idea of the technical is to show the volatility. Therefore, when the indicator line is rising, the volatility is increasing, while when it is going down, the volatility becomes lower.

As you can see, the indicator line is at its lowest readings during the period of low volatility, while when a trend begins, the line moves upwards. Therefore, a trader should avoid misinterpreting this indicator.

How to Use the Average True Range Indicator

The technical analysis tool is used primarily to demonstrate the current market volatility and its dynamics. Therefore, you can’t build any strategy based on it solely. Instead, traders can add ATR to various strategies to enhance their performances. Let’s have a closer look at how one can improve their trading results by adding the Average True Range indicator.

Breakout Strategies

Professional traders sometimes use breakout strategies to capitalize on price fluctuations as such methods allow them to catch the momentum. In this particular example, the price moves below the resistance level for some time within a narrow range, which is confirmed by the ATR indicator, which is at its lowest readings (the volatility is low).

Next, the price tests the resistance level at some point and breaks above it. The Average True Range indicator can be used at this moment to confirm the breakout.

Using This Strategy for Forex

When using this strategy for Forex Trading, you need to wait until the breakout takes place and the breakout candlestick closes. Check the ATR indicator readings. If the indicator continues to increase, then buy a currency pair, cryptocurrency, or stock.

Digital Options Breakout Strategy

To trade with this strategy when using digital options, you simply need to wait for the price to make a breakout. If the ATR indicator moves higher, buy a Higher contract.

When it comes to the support line, the situation is the same, when the price tests it then then breaks it out, you can trade. Use the ATR indicator to check whether the volatility is rising. The trick here is that this time when the price is moving down, the ATR indicator shows higher readings. This is what we have already explained in the previous parts of this article. The indicator does not show the direction. It pinpoints volatility instead and when the price begins to fall, Average True Range will demonstrate it by increasing its value.

Using ATR for Trading Support Breakouts in Forex

Traders can use this strategy to sell an asset. After a currency pair, stock, or cryptocurrency breaks below the support level, wait for the candlestick to close and check whether the ATR is rising to open a trade.

Trading Digital Options with the Support Breakout Strategy with ATR

Traders can buy Lower contracts once the price breaks below the support level. Before pushing the button, check whether the ATR indicator is rising.

Finding Market Reversals with the Stochastic and ATR Indicators

Traders often use oscillators like RSI or Stochastic to find market reversals. When Stochastic leaves the overbought area, market participants search for downside signals, while when the indicator leaves the oversold area, market participants look for upside entries.

When adding the ATR indicator, traders can be even more sure about the position they are going to open. In case of a market reversal, the volatility is likely to grow, which means that the Average True Range indicator’s line should increase in such situations.

Trading Forex with Stochastic and ATR Combination

In this particular example, a trader sells a currency pair, stock, or cryptocurrency when the Stochastic indicator breaks below 70. The ATR indicator should rise to confirm the increasing volatility.

Digital Options Trading with Stochastic and ATR Combination

When trading digital options, a trader buys a Lower contract when the Stochastic indicator leaves the overbought area. The ATR indicator should confirm the following downside with higher readings.

The Benefits of the ATR Indicator

- The Average True Range indicator measures current market volatility and shows its dynamics, allowing market participants to see whether the volatility is rising or falling. By measuring this parameter, traders and investors will be able to understand whether the upcoming trends or reversal have potential;

- Market participants can measure the strength of the upcoming trend by using the ATR indicator. If the price is growing together with the ATR line, then you can expect a strong bullish momentum. When it comes to downtrends, the rising ATR indicator will show that the volatility is increasing during downsides, which will confirm strong bearish momentum;

- The Average True Range Indicator allows market participants to make a difference between trends and flats. During trends, ATR is rising all the time, setting new highs, while during range markets, the ATR is at its lowest readings;

- ATR is often used to confirm breakouts. Market participants can be more sure about the breakout when the volatility is rising. When a breakout occurs during the flat or declining indicator, the possibility of a false signal becomes higher.

The Drawbacks of the ATR Indicator

- One of the most evident drawbacks of the indicator is that ATR is lagging. The tool uses previous periods for calculations, which creates a lag between the current price readings and the indicator’s values. Therefore, traders should understand this drawback when applying ATR and plan their entries accordingly. For instance, during breakouts, a trader will enter the market a bit later when he gets confirmation from Average True Range;

- False signals are another key disadvantage of the ATR indicator. The indicator can draw a lot of whipsaws in ranging markets when there are no significant price movements for a long time. However, if you check both the indicator and current price, you will minimize this disadvantage and avoid whipsaw trades;

- The ATR indicator may give false signals when a trend changes abruptly. If there was an uptrend previously and then there was a sudden reversal, the line will fall together with the developing downtrend, demonstrating lower volatility, which is not true. This is due to the fact that the indicator calculates previous periods that may include a part of the uptrend.

Conclusion

The ATR indicator is used by traders to measure volatility. It allows market participants to see whether the volatility is high or low currently and whether it is going to rise or fall during the next several periods. The indicator can’t be used solely to plan your trading activities as it does not provide you with clear signals. Understanding volatility does not allow you to find an entry point. However, it can be useful when used together with other indicators to buy or sell an asset as well as to confirm trends/reversals.

FAQ

What Is ATR?

ATR stands for Average True Range, a technical indicator that was designed to measure volatility and provide traders with information about future price fluctuations.

How to Read the ATR Indicator?

Lower ATR readings show that the volatility is low, while when the indicator line is growing, the volatility is rising. High ATR readings are equal to high market volatility.

What Is the Difference Between ATR and Bollinger Bands?

Both technical indicators can show market volatility. However, ATR is based on the moving average of the current market range, while Bollinger Bands is based on two standard deviations from the price moving average.

What is the Best Timeframe for the ATR Indicator?

There is no best timeframe for this indicator as it can work perfectly on every timeframe. However, you should keep in mind that adjusting the indicator’s period is crucial.