Stop Loss and Take Profit: The Most Powerful Tools in Risk Management Every Trader Should Grasp

Having a good trading strategy is very important as it will allow you to make informed market decisions based on current and past price movements. Learning the market context is also crucial as you will understand the reasons behind any particular trend or swing. However, these are not the only aspects that you should know and use when trading in Forex. Risk management will allow you to maintain a positive balance between profits and losses and make consistent gains over time. By reading this article, you will learn about the most powerful tools of risk management in trading and how to apply them properly in your trading sessions.

Looking for reliable digital options and Forex brokerage? Join Binolla and enjoy all the benefits of a regulated company with hundreds of assets onboard.

Contents

- 1 Key Takeways

- 2 Stop Losses and Take Profit Orders: Why Do Traders Use Them?

- 3 Practice setting stops on the demo account!

- 4 The Most Popular Stop Loss Techniques

- 5 How to Place a Stop Loss Order on the Binolla Webtrader Platform

- 6 Trailing Stop Losses

- 7 Main Mistakes When Using Stop Loss Orders

- 8 Comparing Trading with or without Risk Management Tools

- 9 Conclusion

- 10 FAQ

Key Takeways

- There are three main risk management tools: stop losses, take profit orders, and trailing stops;

- Stop losses protect you from higher risk exposure, while take profit allows market participants to preserve gains;

- Traders can use a couple of methods to set stop losses;

- Trailing stops are augmented stop loss orders that “trail” the price when it moves in your favor.

Stop Losses and Take Profit Orders: Why Do Traders Use Them?

Trading is not only about profits. Even the most successful strategy will bring you about 60-70% of profitable trades, while 30-40% of them will have a negative output. Therefore, you need to be able to cut your losses in order to maintain a positive balance over time. You can do it manually by simply closing a trade on the platform when you think your losses are big enough, or you can use stop losses to do it automatically.

Most professional traders prefer the second way due to many factors. A stop loss is a special type of order that allows you to partially automate your trading. Once set, you don’t need to follow your position anymore as your risks are already cut by this specific order. If you use a take profit order, you set a desired level at which the trade will be closed with a profit. Therefore, if you integrate both in your trading strategy, you don’t need to monitor a trade anymore. It will either close by a stop loss or a take profit.

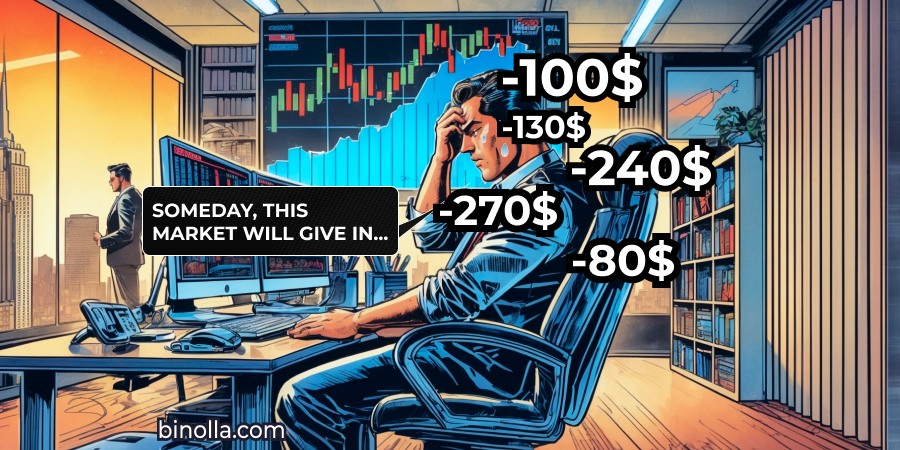

Automation is not the only reason for a trader to place a stop loss. Many market participants place this type of order to mitigate the influence of emotions. When you place a stop loss, you set your risk level in advance, and you can admit your loss at a specific level. When not, you may not want to close a trade at a specific loss level, thinking that the price will reverse in your favor.

Keep in mind that placing a stop loss does not guarantee that you won’t move it in the future. Moving a stop loss is one of the greatest disasters that traders can do to themselves. However, by placing this type of order, the possibility that you will move it or even remove it decreases.

Andrew Barkins – Binolla Trader

Moving stop losses was one of my greatest sins as a trader in the past. I used to do it frequently, and then, when I looked at my balance at the end of the month, I saw that even with quite a reliable strategy, my results were below my expectations. Sometimes, I used to close a month with zero profit and even with losses. The reason was simple – when I moved stop losses, I increased my losses, and they ate up my profits. Once I quit doing this, I started to grow my balance.

Ivetta Garcia – Certified Psychologist, Binolla Author

Consider moving stop losses as lying to yourself. When you do that, you deviate from your previous trading plan and put your balance in danger. Keep in mind that when trading leveraged CFDs, especially with a high leverage, you put all your money at risk, and your risk exposure increases significantly. When using stop losses properly, you can tackle your emotions and grow your profits over time.

There is another “not-so-evident” reason for using stop loss orders. While modern platforms and servers use cutting-edge technologies, you can’t guarantee that there will be no connection issues on your side. If one happens, you will lose connection to the server and will not be able to adjust your position or close it. When you place a stop loss, it is sent directly to the server and remains there until the position is closed or you decide to adjust it. Anyway, even if you lose a connection, the stop loss that you have placed before the connection interruption will trigger when the set price is reached. Therefore, by using a stop loss, you can mitigate non-trading risks as well.

The Most Popular Stop Loss Techniques

Even if you decide to place stop losses, you should use them wisely in order to succeed. By setting them randomly, you won’t get the desired results. There are several techniques for using stop losses in trading that you will learn by reading the following paragraphs.

Using Several Positions

Sometimes professional traders place several orders with several stop losses instead of placing one. They do this in order to trade with even higher precision. The approach allows you to diversify your risk and money management strategy. For instance, you see that the current resistance level at EUR/USD is at 1.1400. The next closest local resistance is at 1.1440. And the previous candlestick high is at 1.1455. You can break your order into three parts, with each having stop losses at the above levels. Therefore, you will diversify your risks.

Stop Loss and Break-Even Levels

Moving stop losses against your forecast may be very harmful. However, moving them along your trading idea may be a great solution. For instance, you have bought EUR/USD at 1.1330 and placed a stop loss at 1.1300. If the price moves higher and reaches 1.1350, for instance, you can move your stop loss to 1.1330.

Now, even if the currency pair moves down and the stop loss is triggered, you will lose nothing. However, you should be careful when losing this technique. Placing stop losses too close to the current price may lead to losing an opportunity to make money.

Math Calculations of Stop Losses

One of the most popular techniques that most professional traders use is to calculate stop losses. There is a so-called risk-to-reward ratio that allows you to know in advance how much you can lose or gain during the next trade. What is important here is that this approach allows you to know in advance how much you can gain over time and, thus, plan your trading activities in the right way.

The risk-to-reward method allows you to set a desired amount of risk as compared to the desired amount of your eventual profit. Most professional traders set it as 1:3 at least, which means that you put at risk 10 pips while you can gain 30 pips if the price moves in your favor.

Why is this approach reliable? If you close 10 trades with even 50% profitability, you will make money instead of losing them. Imagine the following situation. A trader has closed 10 trades, with 5 of them with positive results and 5 of them with negative. They used the 1:3 approach in each trade, which means they risked 10 pips and gained 30 pips as an outcome.

By the end of the series of trades, they have 50 pip losses (5*10=50) and 150 pip profits (5*30=150). Therefore, in total, a trader gains 100 pips for 10 trades with 50% profitability.

Pavan – Binolla Trader

When I started to use this approach, my results improved. While it is sometimes impossible to get 1:3, even with 1:2, I managed to increase my profits. The only thing is to stick to this strategy, which may sometimes be difficult, especially when you start using it. Emotions may lead you to break the rules. What I recommend is to set a stop loss and a take profit order and close the platform or simply go away and do something else. You can monitor the trade from time to time, but you shouldn’t interfere with it. Just let it close automatically.

How to Place a Stop Loss Order on the Binolla Webtrader Platform

Before delving deeper into how to set the distance between the entry price and a stop loss order, it is worth looking at how to start it on the Binolla Webtrader platform. Stop losses can be placed during the opening of the order or even when a trade is already active. Let’s see how to place a stop loss when you buy or sell an asset:

- Click the New Order button at the top of the platform.

- Set the volume of a trade.

- Press “+” or “-” in the field that is below Stop Loss to start. You can also indicate an exact level or drug on the chart to move the stop loss to the desired level.

- Press Sell by Market or Buy by Market to initiate a transaction.

Now that you have entered the market, the stop loss will be placed. You can also change its position by clicking on the stop loss line and dragging it to a desired level.

Setting Stop Losses/Take Profit Orders Above/Below Particular Levels

The next approach that you can use to set stop losses and take profits is to place them above or below specific levels.

In the example above, you can see that traders can use resistance levels to set stop losses. As you can see, later, the price moves down. Therefore, placing a stop loss order somewhere above the resistance level is a good idea. The distance can be calculated by your risk-to-reward ratio. For instance, if you plan to catch 30 pips as profit, then you can place it above the resistance level at a distance of 10 pips.

In this particular example, we have a shooting star pattern that allows us to place a sell order. The stop loss can be placed above the resistance level. When it comes to distance, the best place is above the peak of the shooting star formation. The distance between the close level of the shooting star and the peak of the pattern is 40 pips. Therefore, you should place your stop loss at 40 pips from the entry point. When it comes to taking profit, you can set it at 80 pips.

This is not a hammer as it has quite a big body, but a long tail allows us to enter the long position. When it comes to a stop loss order, you can place it below the dip of the formation. Even without calculating, you can see that the distance of the tail is covered many times by the upcoming upside movement, which means that placing a stop loss there is a justified decision.

Trailing Stop Losses

Apart from stop losses that you can place on the Binolla Webtrader platform, you can also set trailing stops that are modified stop loss orders. The difference between them is that a classic stop loss order can be set at a desired level, and it stays there until you move it manually or remove the order.

A trailing stop loss order is a special feature that allows you to use a wiser risk management approach. The main thing is that this order is set at a particular distance and “trails” the price when it moves in your favor.

When placing a trailing stop order, you need to set a desired distance between the price and the stop loss level. You can do it the same way as you define the distance between the classic stop loss order and the quotes. However, there is also another feature that allows you to set a distance at which the trailing stop order will be triggered. Once the price covers this distance in your favor, the order will be automatically triggered. Keep in mind that a trailing stop moves only in the direction of your position.

If you buy an asset, then the trailing stop moves higher, following your position at a specific distance that you set. If you sell a currency pair, stock, or cryptocurrency, then the trailing stop will move downward following the price. However, when the price moves in the opposite direction, a trailing stop order stays still. When the price reaches it, the order is triggered, and the trade is closed.

Let’s see an example. A trader decides to buy EUR/USD at 1.0800. They place a trailing stop at 1.0780 with a distance of 20 pips between the stop and the price. EUR/USD moved to 1.0830, and the trailing stop moved as well and reached 1.0810 (as you can see, the distance between the price and the trailing stop remains the same). The currency pair moves upwards again and reaches 1.0850. The trailing stop order follows the price and reaches 1.0830. At this point, EUR/USD reverses and moves to 1.0840. The trailing stop remains at 1.0830. Another downside movement leads to EUR/USD reaching 1.0830. The trade is closed automatically when the level is reached.

Should I Use Trailing Stop Orders?

By placing a trailing stop order instead of a classic stop loss, you can put your risk management to the next level and protect your gains if the price moves abruptly in the opposite direction. In the example above, you can see that EUR/USD reached 1.0850 and then reversed and reached 1.0830, where a trailing stop order was triggered. Therefore, you would earn 30 pips in this situation.

However, using trailing stop orders can also be harmful. If we take the same example where the price moved lower after reaching 1.0830, then you could preserve your gains. However, if the price moved higher again from 1.0820, you would be out of the market at this moment, which means that you won’t be able to capitalize on the upcoming leg of the uptrend.

Main Mistakes When Using Stop Loss Orders

Placing stop losses is a great idea. However, you should be aware of how to do it in the right way. Here are some of the most typical mistakes that you can make when placing these pending orders:

- Placing tight stops. Some traders place stops that are close to the entry point. This may lead to losses due to volatility. To avoid these mistakes, you should count volatility and other aspects;

- Too wide stops. The opposite situation is when traders place wide stops, as they are afraid of losing money. However, this may lead to breaking risk management rules. Stop losses should be based on your risk and money management system;

- Not revising stop losses. It is recommended to move stop losses if the price goes in your favor. By placing a stop loss at break-even or even in the positive area, you will lock in profits;

- Ignoring trading commissions. Placing stop losses without looking at spreads and other commissions may lead to failure. Always check the difference between the bid and ask prices before setting this order;

- Placing stop losses at clear levels. The price may make a fake breakout before moving in the direction of your forecasts. It is a good idea to place stop losses slightly beyond clear levels;

- Removing stop losses. Some traders remove stop losses or move them against their forecasts, hoping that the situation will improve. This may lead to even greater losses. Adjust stop losses only in your favor.

Comparing Trading with or without Risk Management Tools

Now that you know all the main tools that will help you manage your risks, let’s have a look at how they compare with different parameters.

| Aspect | Trading Without Stop Losses | Trading with a Stop Loss Order | Trading with a Trailing Stop Order |

| Risk Management | No risk protection, 100% exposure to trading and non-trading risks | Limited losses per trade | Limited risks that adjust depending on the market situation |

| Maximum Loss Potential | Traders risk all their funds when trading without stop losses | Losses are limited to stop losses | Limited and traders can lock gains |

| Manual Monitoring | Required | Not required | Not required |

| Emotional Impact | Traders who do not place stop losses are susceptible to high stress | Lower level of stress | Lower level of stress |

| Sensitivity to Volatility | High (severe drawdowns are possible) | High volatility may lead to position closure | Trailing stops are better adapted to market volatility |

| Suitable for | Experienced traders who know how to control their emotions | Both beginners and advanced traders who want to automate their trading strategies | Professional traders who want to make some gains in case of higher market volatility and swings |

Conclusion

Stop losses, take profit, and trailing stop orders are widely used by both novice and professional traders to mitigate their risks and adjust their risk management strategies. By using them, you can protect yourself from both trading and non-trading risks. However, simply placing a stop loss or take profit will not help you adjust your risk management method. You should delve into the rules and understand at what distance to place stop losses in each particular trade.

FAQ

What is the Best Ratio for Stop Loss and Take Profit?

The best ratio is 1:3, which is used by most professional traders. However, you can use 1:2 if you see that the upcoming trade is unlikely to develop.

What is the Best Stop Loss Rule?

The best rule is to combine calculations with the current market situations (support and resistance level).

What are the Best Risk Management Rules?

According to the classic risk management rule, traders should not put at risk more than 1-2% of their deposit amount.

Which One Is Better – Stop Loss or a Trailing Stop?

It depends on what you prefer. Trailing stops may be more advantageous, but in some cases, they prevent you from making higher gains.