Money Management for Beginners

Money management is a very important part of trading, whatever financial instrument you choose. The idea behind this concept is to be able to manage your funds efficiently so that you can not only stay afloat but also manage to increase your balance over time. If you already know the basics, you can start trading at Binolla.

Whatever trading strategy you have, it is not enough to be able to find entry points to succeed in trading and investing. Even if you think that your trading system is perfect or close to it, without proper money management, you will end up standing at the same place or, even worse, losing part of or all your investments. By reading this article, you will find out more about money management and how to apply it to your trading routine.

Contents

What is Money Management?

Money management in the context of trading means applying some strategies and techniques to limit your trading risks and increase your rewards over time. One of the easiest ways to manage your funds in trading is to set limitations on the position size, which is applicable to whatever market or financial instrument you choose.

Professional traders always use money management, as it is 50% of success in trading. It was already mentioned that you can use any type of trading strategy, but without proper fund management in trading, you can’t increase your profits over time.

Why is Money Management Important?

To make it clear, let’s look at a very simple real-life example. Imagine that you have some savings (let’s say $20,000) and you want to buy an RV. You take all your savings from the bank and even add all your monthly salary to make the dream come true. Now, after you bought the RV, you can go outside the city and have some fun in the forest, on a mountain, or close to a river.

However, now you have no money at all. This means that your budgeting strategy has failed. The same is true for financial market trading. If you do it improperly, you risk losing everything even faster than you can imagine. Therefore, money management is very important, and you should learn how to control your trading budget even before you open your first trade.

What Are the Risks of Not Using Money Management in Trading?

There is an old saying that says, “Cut your losses and let your profits run”. Therefore, your main goal in trading is to follow this rule. Without proper money management, you can put at risk more than you can afford. Here is a list of risks and mistakes that may ruin your trading efforts:

- Losing all your capital. This is a very common story when a beginner trader loses all the money that they have deposited for trading;

- Betting on a single trade will make them rich. This is a very common misconception when newcomers think that a single trade may change their entire life. Even if it is theoretically possible that this happens, the chances of making a life-changing trade are close to zero;

- Not knowing how much to invest in each particular trade. One of the most widespread mistakes is when traders do not calculate their single trade position size;

- Averaging losing trades. This is a crucial mistake that may cause death to your balance. This strategy is similar to Martingale, which is a bad money management approach that involves huge risks;

- Not knowing how to add to profitable trades. One of the basics of successful trading is knowing how to let your profits grow. Therefore, you should be able to add to profitable trades and take advantage of those situations (this refers to Forex and stocks);

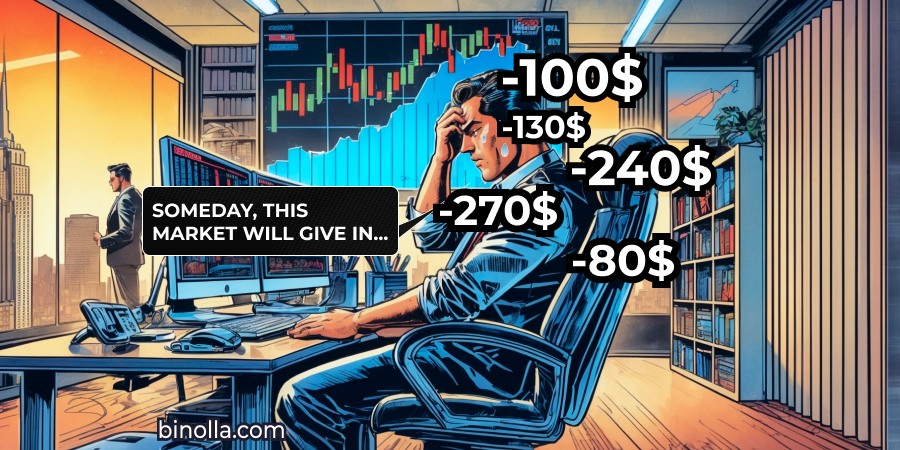

- Revenge trading. This is one of the worst strategies that newcomers often apply in trading. They open positions during a losing streak, trying to win back what they have lost. The worst thing about those revenge trading tactics is that traders often increase position sizes significantly and break all possible money management rules;

- Not knowing when to end a losing streak. Last but not least, traders often do not know when to cut losses or exit the losing streak (this refers to Forex and stock traders). Therefore, they accumulate losses instead of analyzing the reasons for their failures and finding better opportunities to open trades. Moreover, if you don’t know when to cut your losses, you will end up losing substantial amounts even in a single trade.

Money Management Strategies to Apply in Trading

You can try to elaborate on your own money management strategies. However, it is better to stick to some basic principles that were calculated by generations of traders. Find the most popular and useful money management strategies below.

The 2% Rule

This is a very simple and straightforward rule, which, by the way, is rarely followed by newcomers. One of the reasons for that is that traders often think that the more they put at risk the more they can get by the end of the day. While this seems logical, putting more money at risk may cause significant damage to your trading budget.

The 2% rule is relevant for both digital options and Forex CFD trading. The idea behind this concept is to risk no more than 2% in each particular trade. If you have $100 on your balance, then you can invest no more than $2 when buying a digital option or a currency pair.

This approach is great for beginners, as they don’t need to think much about their trading amount. They can focus on their strategy and other aspects instead.

Fixed Fractional Method

This money management strategy is applicable for Forex CFDs and stocks only. According to the idea of this approach, if you buy a currency pair or any other asset for $10, for instance, and the asset goes up in price, you can buy more assets to increase your profits even more. However, by using this technique, you should use stop losses or set levels when you are going to take profits if the price goes in another direction. This is crucial, as your eventual profits may turn into losses, and you will lose even more than you can afford per trade.

Assume that you have bought EUR/USD at 1.1000 and the price goes higher, hitting 1.1050. This allows you to use the fixed fractional method and buy even more assets as your first trade is successful. However, if you don’t set stop losses and EUR/USD goes below 1.1000, you will have losses on your first trade and, eventually, you may have losses on your other trades if the assets you buy are in positive correlation with EUR/USD.

Ratio Method

This is one of the most flexible money management methods so far. It is not applicable for digital options, but if you are going to trade Forex CFDs or stocks, you can use it at full pace. The idea behind this approach is that you set a ratio between your eventual losses and profits.

For instance, for one risk, you want to have a profit, which is equal to three risk amounts. Translating it into figures, for each $10 that you put at risk in trading, you want at least $30 in reward. This is a great approach that is used by many successful professional traders. It allows you to work with a lot of strategies, even if those tactics are far from being perfect.

With this method, you can even use strategies with 50% profitability. Assume that you have opened 10 trades that resulted in 5 losses and 5 profits. By using a 1:1 ratio, your total result will be negative, as you will lose money on the spread.

If you apply a 1:2 ratio, your 5 successful trades will cover your 5 losses and give you some profits. The higher the ratio, the more money you can earn by the end of the streak. This is where the rule of letting profits grow is 100% relevant.

Chart Method

This approach is not applicable to digital options, but if you are trading Forex CFD it may be very useful to you. Unlike all previous strategies that were described above, here you don’t need to calculate anything.

You cut your losses according to the current situation on the chart. The most popular strategy here is to find the closest price level and put your stop slightly below it. If there are fake breakouts of this level, you can put your stop loss below this fake breakout.

Here is an example of how this method works. The point here is that there is a fake breakout of the support level. Therefore, you can put a stop loss order below the closest lower low.

One of the drawbacks of this particular method is that it misses calculations. You can upgrade this approach by adjusting your position size depending on the distance between the price at which you buy an asset and the stop loss price. By doing this, you can apply the 2% rule again.

If the distance between the open price and the stop loss price is 10 pips, for instance, then you should adjust your trade amount so that you lose only 2% of your whole balance should the stop loss trigger.

Martingale

This money management strategy is very risky and can lead to heavy losses. It is applicable to all financial instruments, including digital options. The idea here is to open a trade in the same direction as the previous one and double your investment amount each time you lose money.

Martingale works the following way:

- You buy a Higher contract by investing $1 with an 85% payout, for instance;

- Assume that this trade brought you losses;

- You buy another 85% payout Higher contract but this time you invest $2;

- Assume that you have failed to profit again;

- Now your total loss in two trades is $3;

- You buy another 85% Higher contract with $4 as an investment and this time you profit;

- Now you have your $4 back and your profit is $3.4;

- Your net profit for all your trades in this streak is $0.4 as you have lost $3 previously and you have covered your losses with $3.4.

This strategy may seem perfect, but it breaks all the rules of money management. Moreover, there is one thing that makes it dangerous for traders. Each time you double your investment size, your losses become more substantial. If you have only $100 on your balance, for instance, you may have the following streak: $1, $2, $4, $8, $16, $32. If none of the trades are positive, you can’t develop this streak as the general loss amount will be $63 in this case, and your balance will be only $37. Therefore, Martingale would be a great strategy if you had unlimited resources. Since your balance amount is limited, it is better not to tempt fate.

Money Management Tips for Beginners

Even if you know all those basic money management strategies, sometimes it is not easy to apply them. We have prepared some useful tips for beginners that will allow them to control their trading budgets properly:

- Using stop losses. You should prepare yourself for using stop losses in each Forex or stock trade you open. Even if you have calculated all your risks and understand where to cut your losses, it would be a good idea to automate this process by setting a stop-loss order;

- Understanding market risks. Trading is not only about profits. You will encounter losses throughout your whole trading career. Therefore, you should understand your risks in advance and, what is even more important, accept them;

- Avoiding hasty decisions. One of the key scourges of traders is that they may make hasty decisions based on their perception of the market. Every decision you make in trading should be based on research, including the amount of investment you set per each trade;

- Keeping it real. Do not expect that trading is going to change your life after one successful trade. This is almost impossible. Therefore, you should keep it real and set your expectations according to your balance amount, per trade investment amount and the current market situation.

Conclusion

Money management is a very important part of trading that allows you to protect your balance from excessive risks as well as let your profits grow. There are plenty of tactics that you can use to ensure that your risks are reasonable and that you do not go beyond your money capabilities.

FAQ

What is Money Management in Trading?

This is a set of strategies that allow you to keep your risks at an acceptable rate while letting your profits grow.

How Do You Control Money Management in Trading?

To do that, you can set the amount that you can put at risk in each particular trade. Also, you should elaborate on your own strategy that will protect your balance from heavy losses.

What is the 2% Rule in Trading?

According to this rule, you shouldn’t put at risk more than 2% of your trading balance.

How Can You Avoid Big Losses in Trading?

To avoid heavy losses, traders should calculate the amount of risk per trade beforehand. Also, they should learn from their previous trades to minimize mistakes in the future.