How to Use the FedWatch Tool by CME In Your Trading Routine

The CME FedWatch tool is a special gauge that demonstrates the probability of interest rate decisions by the Fed in the future. Unlike various opinions or forecasts, this tool relies on money positioning in special futures that track Fed Funds to calculate whether traders and institutions price in a rate cut, rate hike, or a decision to leave the rate unchanged. By using this tool, traders can anticipate future interest rate decisions before they appear in the economic calendars and adjust their strategies accordingly. By reading this article, you will learn more about how the CME FedWatch tool works and how to read and apply it to your trading systems.

Start trading using this and other useful tools with Binolla! Join a reliable brokerage and pave your way to financial independence!

Contents

- 1 CME FedWatch Tool Basics

- 2 The Meeting Day vs. Expectations

- 3 How to Deal with the FedWatch Tool

- 4 Use This Tool to Improve Your Trading Results!

- 5 How to Use the FedWatch Data in Trading

- 6 Trading Strategies that Work with FedWatch Tool

- 7 Combining FedWatch with Other Fundamental Analysis Tools

- 8 Common Mistakes Traders Make When Using FedWatch

- 9 Conclusion

- 10 FAQ

CME FedWatch Tool Basics

The CME FedWatch tool is a special feature designed by the Chicago Mercantile Exchange that is based on Fed Funds futures contracts. These contracts, in turn, allow market participants to capitalize on the average effective funds rate for a given month in the future. These instruments are actively used by both retail traders and investors and institutional bodies like banks, hedge funds, and others.

The FedWatch tool calculates the probability of different rate outcomes, like a hike, a pause, or a cut at upcoming meetings. For instance, if market participants anticipate a rate hike, the tool will show the percentage of those who believe in higher rates. One of the benefits of this tool is that the probabilities update constantly, and you can see current expectations almost in real time.

The Meeting Day vs. Expectations

Before using the tool, it is vital to understand the difference between the day when the decision is made and the period of expectations. The decision day is the moment when the Fed announces the rate. By this moment, the rate is already priced in. However, some unexpected events may still occur.

When it comes to the expectations period, this is where the FedWatch tool by CME is most valuable. It demonstrates how probabilities shift before the meeting, which allows market participants to adjust their strategies and expectations. The biggest trends often happen during this time when expectations change.

A Common Misconception of the FedWatch Tool

One of the most common misunderstandings is that the CME FedWatch tool predicts when the Fed will decide during the upcoming meetings. That’s not true. The tool reflects the market consensus and has nothing to do with the Fed’s intentions. Sometimes, the Federal Reserve may surprise the market. However, the value of the tool lies in its ability to show what’s already priced in. If reality derives from consensus, which is shown by the CME FedWatch tool, a significant price movement may occur.

How to Deal with the FedWatch Tool

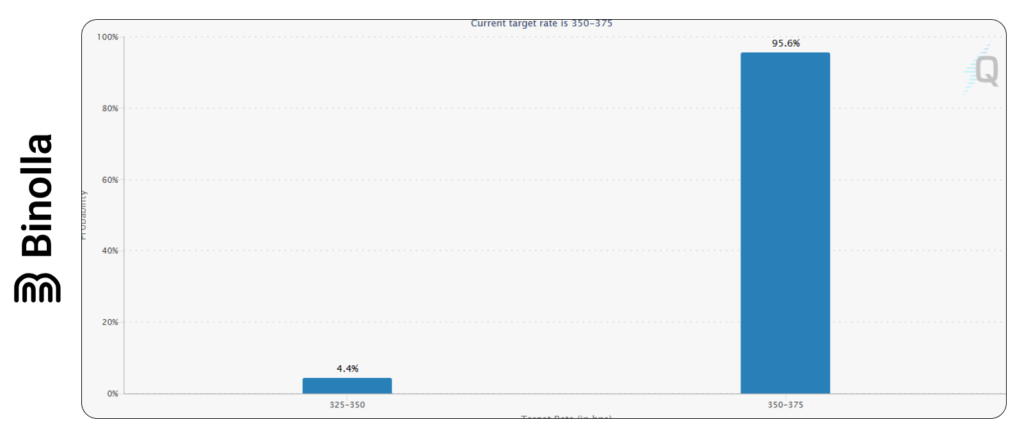

The CME FedWatch tool has quite a simple interface, which allows you to start using the feature right away, even if you have not dealt with it previously. The main screen is the chart where you can see two columns. The left one is the rate change. This column shows how many traders and investors believe that the rate will be cut or increased during the meeting.

The right one is a column showing the percentage of traders believing that the FOMC will leave the rate unchanged. In this particular example, you can see that only 4.4% of market participants believe that the rate cut by 25 bps will take place during the upcoming meeting. More than 90% believe that the Fed will leave the rate unchanged.

Apart from watching the current month, traders can switch between the upcoming meetings that will take place throughout the year.

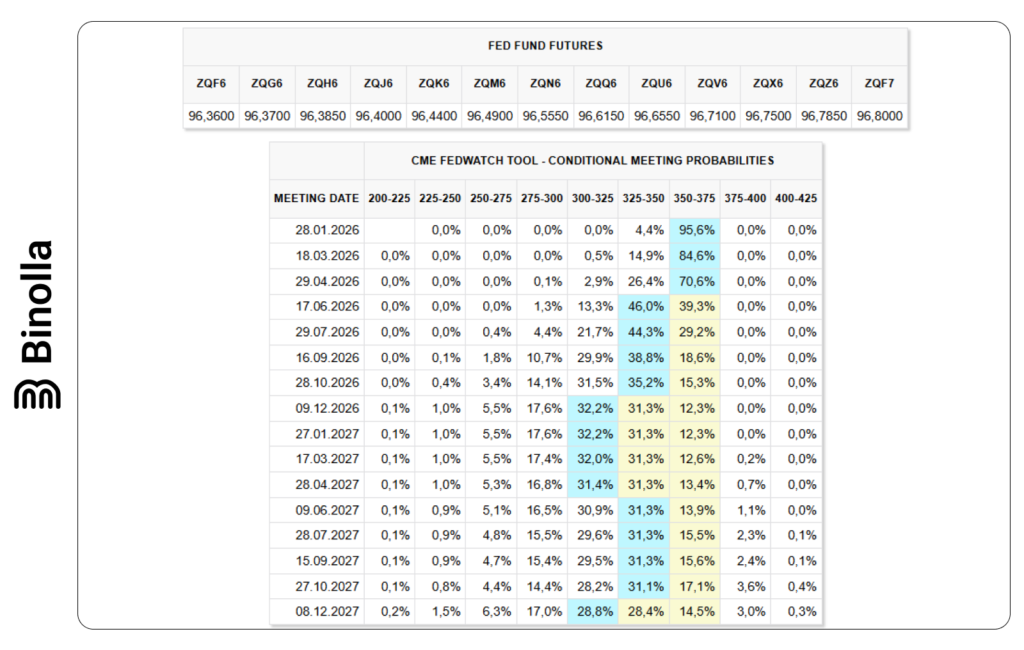

Traders can also look through a special table showing probabilities of different interest rates for a long period. As you can see, there are blue cells (the most probable outcomes), and the yellow ones with less probability. The rest is white.

If you check the second row, for instance, you will see that currently, 84% of market participants expect that the FOMC will do nothing with the rate in March. About 14.9% believe that the Fed will cut the rate by 25 bps. And about 0.5% think that the Fed may cut the rate by 50 bps.

How to Use the FedWatch Data in Trading

When using this tool, you can’t find exact entry points. However, you can see the context, which is also very important in trading. These expectations will allow you to see how market participants anticipate a particular decision by the Fed and place a trade in this direction.

For instance, if rate-cut probabilities rise, you will see that the equity market will receive some additional support. This is due to the fact that cheaper liquidity is expected by the markets, and this liquidity may be spent on stocks.

When it comes to gold, it may surge as well as lower rates will stimulate inflation. Crypto assets will gain inflows as well. The key driver is the expectation and not the rate cut itself.

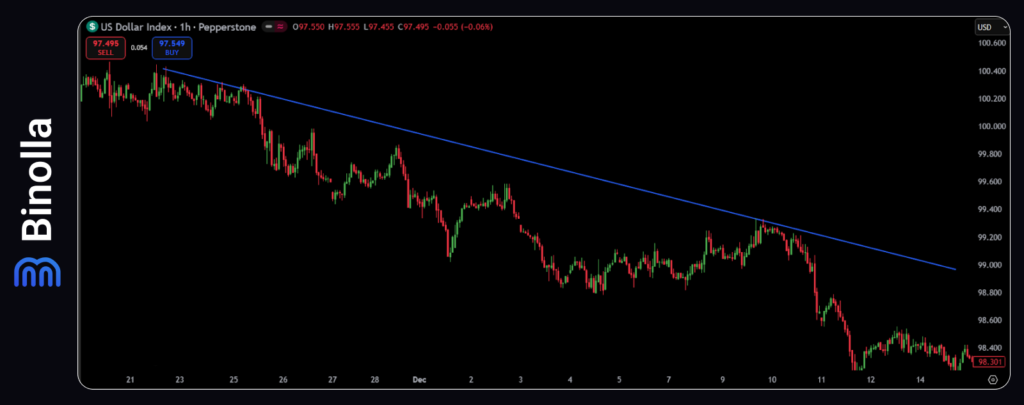

Rising rate-hike probabilities may strengthen the USD first. This is due to the fact that rate differentials will move in its favor. Next, the stock market will be under pressure as higher rates will put pressure on economic growth. Similar works for risk assets, which underperform under these conditions.

Trading Strategies that Work with FedWatch Tool

Traders can use various strategies when they trade with the FedWatch tool. While the feature does not provide clear entry points, it can be integrated into a broader trading plan. This will allow you to see when risk builds, where the market may move, or how markets may react.

Pre-FOMC Trading

Traders often check the FedWatch tool weeks before the main event takes place. Trends often form during this period and may change if anticipations switch. You can scale into positions as probabilities increase. Knowing the main direction, you can use various technical analysis strategies to place trades in the direction of the general price movement.

This strategy can be applied by both CFD and digital options traders. The latter may see the main trend and buy contracts accordingly. For instance, if you see that the market is pricing in a rate cut and you trade the USD, then you can focus on Lower contracts and buy them when local downside reversals occur.

FOMC Meeting Trading

The very day of the meeting, traders can also use the FedWatch tool and place positions before the announcement of the rate decision. However, you should be aware of some corrections and reversals that may take place. This is due to the fact that the rate decision is fully priced in, and there are no more buyers or sellers to support the movement. Also, profit-taking by major institutions may also happen, and this will stop the major trend and may lead to a correction.

When the announcement takes place, you should trade not the rate itself, but the market reaction. Both CFD and digital options traders engage at this very moment expecting capitalize on increased volatility. However, you should also be aware of the fact that the movement may not be as volatile as you expect, as if the final decision meets expectations, there will be no additional liquidity.

Post-FOMC Trading

Trading after the decision is made is also possible. If the Fed guidance aligns with market expectations, for instance, the FOMC is going to continue policy easing at the next meeting, then the trend may continue as well, and traders can join it. Digital options traders can use this opportunity to place their trades during the one-sided movement in the direction of the main trend.

However, in some cases, the Fed may cut or hike the rate and then pause the next change. This means that some sharp adverse movements may occur, which may also be used by traders to capitalize on price fluctuations. Therefore, market participants should not only use the FedWatch tool but also check FOMC members’ comments during the meeting to understand where the price may go next.

Combining FedWatch with Other Fundamental Analysis Tools

Using FedWatch alone can be useful, but if you add several other indicators, you can have even more advantages. For instance, you can check inflation data to be aware in advance whether the Fed is going to cut rates or not during the upcoming meeting. Here are some indicators that can be applied by market participants to improve their results:

- CPI and PCE. US inflation data is among the key indicators that the Fed uses to make any changes in its monetary policy. Softer inflation increases rate-cut probabilities, while higher inflation figures may push the FOMC to hike rates to cool prices down.

- Labor market data. This is another important indicator that is used by FOMC members to evaluate the current economic situation. Lower employment signals some issues in the economic growth and may lead to another round of monetary policy easing, while healthy employment may allow the Fed to conduct a wait-and-see strategy or even hike rates if they need to curb inflation.

Common Mistakes Traders Make When Using FedWatch

FedWatch is a very powerful tool that is used by many traders worldwide. However, you should know how to use it correctly. Most mistakes come from a misunderstanding of probabilities that are demonstrated inside:

- FedWatch tools show probabilities and not certainties. This is the first thing that you should understand when using this feature. There is no 100% guarantee that the Fed will cut or hike rates even if the probability is almost 100%.

- Ignoring market liquidity. The feature shows consensus and not the direction of trades or liquidity. Even if you see that markets price in a certain decision, this doesn’t mean that the outcome will meet your expectations. Markets sometimes sell on hawkish and buy on dovish decisions.

- Trading all probability shifts. Traders should keep in mind that probabilities may shift over time. However, this doesn’t mean that they should engage once figures change. It is better to use additional fundamental indicators like inflation data or labor market statistics for a better understanding of the bias.

- Expecting bigger moves on the meeting day. If the FedWatch tool predicts the rate cut or hike correctly, then there may be some minor changes during the decision announcement. As it was already mentioned, the markets have priced in the decisions before, and no more buyers or sellers can push the price in the direction of the trend. Moreover, a correction or even a reversal is possible.

Conclusion

The FedWatch tool is a useful feature that tells traders what markets believe will happen during the upcoming meetings. It shows a real-time view of consensus, risk, and potential surprise. Traders should not only watch the ratio, but they should also check how the price behaves. By understanding how to use this tool properly, you can significantly improve your chances of making the right market decisions.

FAQ

Does the FedWatch tool predict what the FOMC will do?

No, this is not correct at all! The tool shows the consensus or market expectations about how the Fed will act during the meeting. By checking it, you can understand how traders are positioned.

Why do markets sometimes move against the probabilities shown in FedWatch?

There are many reasons for that. You should check the broader context to understand them. For instance, if FedWatch shows a higher probability of a rate cut during the upcoming meeting, but inflation is still elevated, the US dollar may gain upside momentum even if many still believe that the FOMC will ease its monetary policy.

What probability level can be treated as priced in?

When FedWatch shows around 70-80% of the outcome, then you can consider that the event is priced in. At this time, you should watch closelyth comments from Fed members to find confirmation or be aware of any surprises that may arise.

Should I check FedWatch every day?

No, not at all. It is better to check the tool after important data releases or FOMC members’ comments.