How to Make Money with Stocks Using Digital Options

There are different ways to trade stocks in the financial markets. You can buy them directly from various exchanges or even use a platform with CFD contracts and trade them with leverage. However, there is also an option of trading stocks with digital options; these innovative and simple contracts allow you to make significant gains in a single trade without high exposure to risk.

This article delves into trading stocks using digital option contracts. You will learn the basics of this trading instrument as well as how to use it to capitalize on stock market fluctuations.

Looking for a reliable digital options broker to start trading stocks? Join Binolla now and benefit from a lot of stock-related underlying assets and the highest quality of services.

Contents

- 1 What Are Digital Options?

- 2 How Digital Options Work with Stocks

- 3 How to Analyze Stocks When Trading Digital Options

- 4 Start trading stocks with digital options!

- 5 Comparing Trading Stocks: Digital Options, CFDs, and Direct Stock Exchanges

- 6 Common Mistakes and Realistic Expectations About Trading Digital Options on Stocks

- 7 Conclusion

- 8 FAQ

- 8.1 What is digital options stock trading, and how does it differ from regular stock trading?

- 8.2 Can I trade digital options on stocks for a living?

- 8.3 What is the best way to analyze a stock when trading digital options?

- 8.4 How much money should I invest per trade when trading stocks using digital options?

What Are Digital Options?

If you haven’t tried digital options so far, then this part will be important for you to understand how the contracts work. By the way, we have a special guide on digital options providing more details about the financial instrument. Here will be a brief introduction that will allow you to quickly grasp the essentials.

A digital option is a financial contract with all-or-nothing results, meaning that you either profit or lose the investment amount. Here are the key characteristics of this type of contract:

- Fixed return or loss. Digital options stand out for predetermined results. The payout is usually 70-90%. If you are wrong, you lose your entire investment.

- Short-term trading. With digital options, the traders can benefit from smaller price fluctuations and buy a contract for as short as 5 seconds.

- Simplified rules. Digital options are a great solution for beginners. You don’t need to manage your position or choose leverage to think about your risk exposure. All you need is to set the investment amount and buy a contract.

Trading stocks with digital options is also very straightforward. All you need is to:

- Choose a particular underlying asset like Tesla or the US500.

- Analyze the asset to define the direction.

- Set the investment amount.

- Press the button (Higher or Lower) to purchase a contract.

- Wait for the outcome to see whether you profit or not.

Digital options are often compared to traditional options. Here are some key differences allowing you to understand the nature of both.

| Feature | Digital Options | Traditional Options |

| Payout Structure | Fixed payout or loss | Varies based on how far in the money |

| Complexity | Simple (yes/no outcome) | Complex (strike prices, Greeks) |

| Expiry Times | Very short | Ranges from days to months |

| Flexibility After Entry | None | Can buy/sell before expiry |

There is one more interesting and beneficial feature that digital options offer for stock traders. Unlike exchanges and traditional options, here you can trade 24/7 with the over-the-counter feature. All assets are available around the clock, and you can buy contracts even on weekends.

As you can see, digital options are a quick way to capitalize on price movements. Before going further, let’s see how to make money in stocks using this type of contract.

How Digital Options Work with Stocks

When trading stocks using digital options, you can choose between indices and individual stocks like Tesla, Apple, and others. Buying digital options on stocks means trying to predict the direction of price fluctuations. There are two types of contracts that you can buy:

- Higher contract. By buying it, you expect the price of the stock to move higher as compared to the current price at which you purchase the contract (strike price).

- Lower contract. When you purchase this type of digital option, you expect the price of the underlying asset to plunge as compared to the strike price.

Now, let’s move to an example of trading stocks using digital options. Let’s say the S&P500, which is currently trading at 6,700, is likely to plunge. You decide to buy a Lower contract at this price and invest $100 in a contract with 90% profitability and 1-minute expiration.

The price of the asset plunged to 6,699 in one minute, which means that the deal ends in the money. You will earn $90 per trade, and your $100 will also return to you.

How to Analyze Stocks When Trading Digital Options

To make money when trading stocks using digital options, you should try to predict the direction of price fluctuations to choose between Lower and Higher contracts. To do that, you can use technical analysis, which allows you to read charts and find entry points. By reading further, you will learn more about which tools are available to traders to predict price fluctuations.

Technical Analysis for Stocks Trading Using Digital Options

Technical analysis is a type of market analysis that is focused on price action. Traders check the current chart situation and place trades accordingly. For digital options where timing is everything, this approach has great significance.

Traders can use both technical indicators and drawing tools to analyze a particular stock. For instance, if you see a series of higher highs and higher lows, you can expect the price to continue rising and act accordingly.

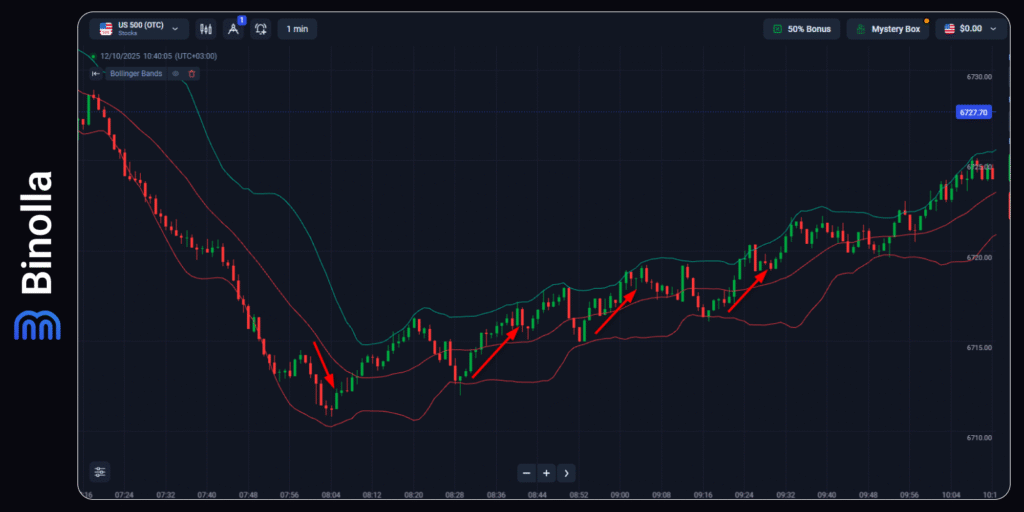

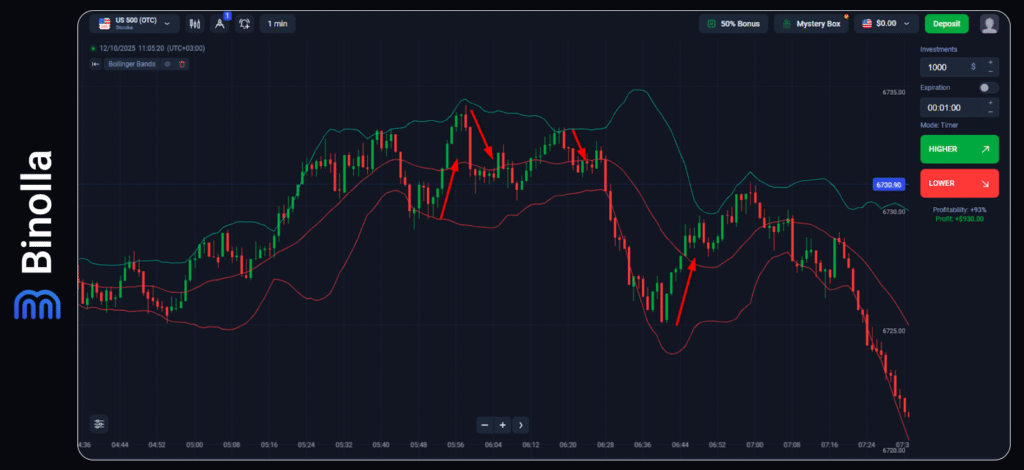

In this example, you can see how you can perform when trading digital options on stocks. This particular strategy involves using the Bollinger Bands indicator. Traders can buy Higher contracts when the price of the stock or index rejects from the lower band of the indicator, and buy a Lower contract when the price rejects from the upper band.

This is a very simple strategy that you can augment with Japanese candlestick pattern analysis. For instance, whenthe price is close to the upper band, you can search for reversal signals like shooting star, bearish engulfing, or evening star. When the quotes are testing the lower band, traders can use hammer, inverted hammer, morning star or bullish engulfing to find entry points.

There are also plenty of other indicators that you can use along with drawing tools like simple support and resistance levels, trend lines or even Fibonacci.

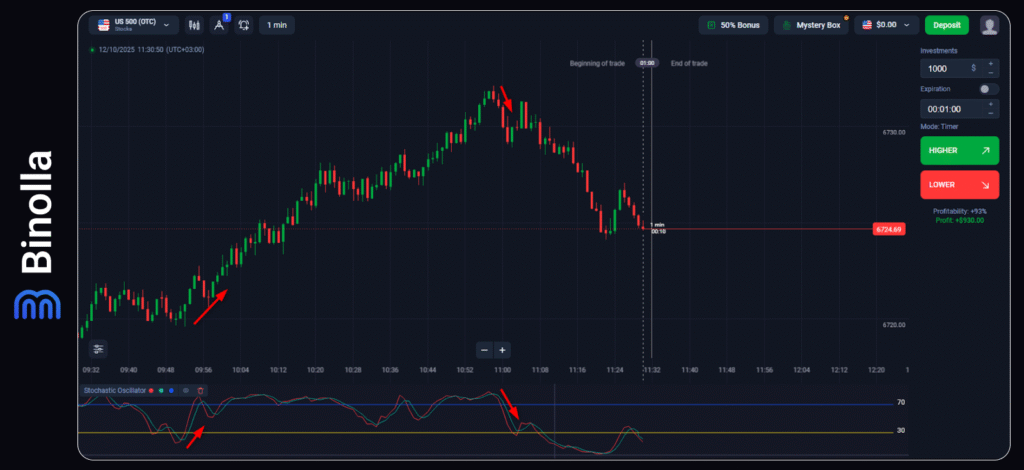

The next example involves trading with a very popular Stochastic indicator. In the first case, you buy a Higher contract when the indicator moves above 30 and leaves the so-called oversold area. In the second example, you buy a Lower contract when the indicator moves below 70 and leaves the overbought area. That’s simple, you can make money when trading stocks using digital options.

What makes technical analysis useful is that you don’t need to delve into market sentiment, economic situation, orС even the company’s affairs, as everything that you need is right in front of you on charts.

Fundamental Analysis in Stock Trading

Technical analysis tells you when to trade, while fundamentals tell you what to trade. By using this type of analysis, you can see which stock or index may perform next and bring you profit. Fundamental analysis in stocks trading uses various news and events that will help you understand which asset to pick for your next trade.

By utilizing this analysis type, you can look at a company’s strengths. Traders check events like earnings reports, which often lead to strong price fluctuations and even trends. If the report shows that a company generated higher profits, then the stock may rise, while weaker reports often lead to downtrends.

Apart from earnings, traders should check news reports and even macroeconomic indicators data that may show the overall country’s performance and influence the market sentiment. If the broad economic situation in the country is worse than expected, then the price may plunge as the company will be influenced by this data.

Digital option traders do not need to build long-term forecasts. However, they can use this data to make short-term trading decisions. If they trade during the company’s reports, then they can capitalize on sharp directional movements. The same is for macroeconomic data. Stronger labor market data, for instance, may positively impact both major indices and individual stocks.

Comparing Trading Stocks: Digital Options, CFDs, and Direct Stock Exchanges

Traders can buy stock using various methods, including digital options, CFDs or even buying them directly from exchanges. To make it clear, we have prepared a comparison table that will help you understand which way is better.

| Feature | Digital Options | CFDs | Direct Stock Exchange |

| Risk | Fixed, known upfront | Variable, can be high | Limited to invested capital |

| Reward | Fixed payout (up to 95% per trade!) | Variable, potentially high | Variable, based on market |

| Leverage | Usually no leverage needed | High leverage possible | None |

| Trade Duration | Short-term (minutes to hours) | Flexible (minutes to weeks) | Long-term (days to years) |

| Complexity | Low | Medium | Low to medium |

| Best For | Quick trades, defined risk | Experienced traders, margin use | Investors, long-term growth |

Common Mistakes and Realistic Expectations About Trading Digital Options on Stocks

When you decide to trade digital options on stocks, you should be able to set realistic expectations. This type of contract can be extremely profitable if you use the right strategy and understand the nature of this contract.

First, you should understand that your goal is not to win in every trade. You should focus on the long-term gains instead. This means that instead of trying to close every trade with profit, you should maintain your profitability level at least 70%, which will allow you to capitalize on stocks trading using digital options over time.

Also, you should know all the most common mistakes that traders make in order to stay in the positive zone and maintain the positive trend for your trading balance. Here are some of the most important mistakes and how to avoid them:

- Overtrading. You shouldn’t be in the market all the time. Focus on the most evident patterns instead. Remember that your goal is not to simply buy contracts. Therefore, trading too much is not the best solution.

- Do not ignore money management. If you invest too much money in a single trade, you may end up losing more than you can afford, which will lead to a quick depletion of your balance. Think about how much you want to put at risk per trade and stick to this amount.

- Trading without analysis. Simply guessing the direction of the price will never make you rich. You should conduct a proper analysis of the asset you are going to trade. Without technical analysis, you can’t maintain even 60% of the profitability of your trades.

- Emotional trading. Keep your emotions controlled. Don’t be greedy after making profits, and do not try to win back your losses.

A Trading Plan for Digital Options on Stocks Trading

To be able to deal with most mistakes and start trading consistently, you should have a trading plan. A good one may include the following parameters:

- Strict money and risk management rules, including how much you can invest per trade;

- The criteria that you will use to enter the trades (a trading strategy);

- Time when you are going to trade (including trading sessions).

Conclusion

Trading stocks with digital options may be extremely profitable as you don’t need to have much money to make substantial profits. Moreover, digital options offer a fixed payout and simplicity, which makes this type of contract useful for all categories of traders, including beginners.

To succeed in trading, you need more than just luck. You should be able to analyze markets and find entry points to capitalize on price fluctuations. Use technical analysis to improve your chances of making money.

While digital options are not a guaranteed way to get rich quickly, they allow you to pave your way to financial success over time if you stick to your strategy and trading plan. Like in any other business, if you trade smart, you will be remunerated with profits that can change your entire life.

FAQ

What is digital options stock trading, and how does it differ from regular stock trading?

Trading stocks via digital options is a simplified form of stock trading where you simply need to predict whether the price of the asset will rise or decline during a specific time. When you choose this form of trading, you don’t buy a stock itself but a special contract that allows you to capitalize on your predictions.

Can I trade digital options on stocks for a living?

Yes, you can. Like any other contracts of this type, digital options on stocks allow you to benefit from various stock fluctuations. However, you should use some tools, like technical analysis, to forecast future price movement and be able to profit from them.

What is the best way to analyze a stock when trading digital options?

Traders can use various tools, like technical indicators or price patterns, to predict price fluctuations. Sometimes they can also trade on news like earnings reports or macroeconomic releases to capitalize on large price movements and higher volatility.

How much money should I invest per trade when trading stocks using digital options?

It depends on how much you have in your balance. The best approach is to invest not more than 10% per trade. Thus, if you have $100 in your account, you can risk no more than $10 per trade.