French Political Crisis and US Shutdown: Two Key Drivers This Week

Global financial markets started this new week with uncertainty and under pressure due to the ongoing US shutdown and the French political crisis. The US president continues his attempts to reach an agreement with both sides to overcome shutdown and threats to begin massive layoffs if the deal is not reached.

The divides between both sides are deepening as they fail to agree on defense spending, immigration control, and social welfare. The White House urges lawmakers to restore operations quickly, but with the situation remaining uncertain, investors’ confidence quickly wanes.

Political turbulence is seen in France, where the new Prime Minister, Sebastien Lecornu, resigned just weeks after his appointment. The ratings of the French president are slipping, and his party is losing support, which creates a basis for the far-right to gain over its competitors. The most notable credit agencies have already issued warnings about the fiscal outlook for France, and the bond yields of this country have increased.

Contents

EUR/USD: French Uncertainty Puts Additional Pressure on Euro

The currency pair is under pressure due to the events in France. The political crisis creates an additional wave of uncertainty, and the second economy of the Eurozone risks falling into an even harder political crisis. This comes on top of the mixed macroeconomic data coming from the region, with the manufacturing sector contracting and services remaining strong. The European Central Bank is in a tough spot as the officials will have to balance between the risks of a recession and higher inflation.

From the technical analysis side, the currency pair is trading slightly below the middle line of the Bollinger Bands indicator, with bands expanding, signaling traders that the volatility is high. The currency pair has reached the local support and may reverse from here, targeting 1.1700. If the decline continues and the currency pair falls below 1.1650, then the targets will be at 1.1600-1.1570.

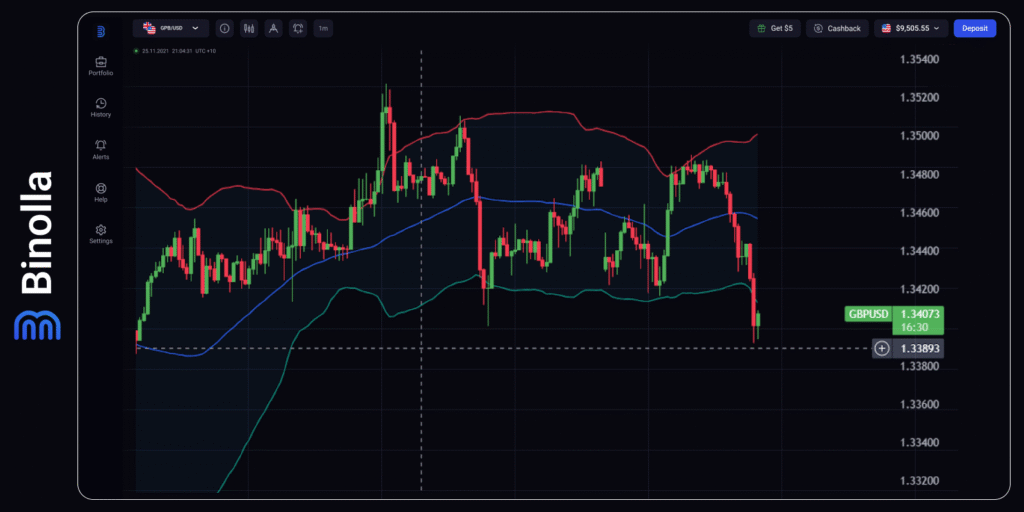

GBP/USD: Sterling Reacts to Political Headwinds and US Developments

The British pound is stable this week, although market sentiment is in the risk-off position at the beginning. Market participants are anticipating the UK data from ONS and some US data that may be released later this week. The Bank of England may hold rates at their current levels until the end of this year, which provided some additional support to the currency.

From the technical analysis perspective, the currency pair is trading close to the lower band of the Bollinger Bands indicator with some signs of an upcoming reversal. The bands are widening, saying that the volatility is increasing. In case of a reversal signal, buyers can target the middle line of the Bollinger Bands indicator, while sellers can focus on 1.3340-1.3300 in case of further downside development.

WTI: Oil Caught Between Geopolitics and Supply Pressures

Crude oil is moving in both directions this week as it is caught between fears of the global economic slowdown and geopolitical tensions. The US shutdown, along with the political crisis in France, put pressure on oil, as further negative developments may lead to deeper negative economic growth. Moreover, the market participants are anticipating some fresh cues on the supply side after the latest meeting of the OPEC+ countries that resulted in a lower-than-expected output expansion.

Oil is trading close to the middle line of the Bollinger Bands indicator on the hourly chart. Further downside is targeting the lower band of the indicator at 61.00. If the level fails to hold sellers, then the next support will be at approximately 60.60. On the upside, we have 62.40 as the closest resistance level.

Gold: XAU/USD Surges as Safe-Haven Demand Grows

Gold is trading higher this week amid political crises in France and the US. The safe-haven asset is now in demand, and the price is moving towards a new historical high at 4,000. The US shutdown pushes traders and investors away from riskier assets, creating additional demand for the precious metal. Moreover, expectations that the Fed may cut rates twice this year support gold.

From the technical analysis perspective, gold is trading close to the upper band of the Bollinger Bands indicator, demonstrating further upside pressure. The closest resistance level is at 4,000. On the downside, if a reversal occurs, the price will move towards the middle line at 3.940.