Forex Pips in Trading Explained: Definition, Calculation, Examples

Forex pips are used to show price changes in the financial markets. They allow market participants to understand how much they can gain/lose over time. By using pips, traders can not only try to forecast their eventual profits but also set risk levels for better risk and money management. By reading this article, you will learn more about pips in trading and how they are calculated. Moreover, you will delve into some examples that will allow you to better understand this important concept.

Looking for digital option trading opportunities? Join Binolla now and start your way to financial freedom with a reliable brokerage.

Contents

- 1 Pip Basics

- 2 History of Pips

- 3 How to Calculate Pip Value in Forex Trading?

- 4 Pips Calculators

- 5 Types of Pips

- 6 How to Use Pips in Forex Trading: Stop Loss, Take Profit, and Spread Calculations

- 7 How to Choose a Broker Knowing Spreads?

- 8 Start Trading with Binolla

- 9 Pips Trading Strategy

- 10 The Main Traders Mistakes When Using Pips

- 11 Key Takeways

- 12 Conclusion

- 13 FAQ

Pip Basics

Pip stands for percentage in points. It is used in trading to establish the minimum price change. A pip is 1/100 of 1%, which means that one pip is equal to 0.01×0.01=0.0001. While it may seem complex at a rough guess, the concept is very simple. Most Forex currency pairs have four decimals after the dot, which means that a pip is the fourth decimal. Here is the formula:

1/100*0.01 = 0.0001

For instance, if the EUR/USD price has changed from 1.0200 to 1.0199, you can say that EUR/USD has lost one pip. One important thing to know is that the pips that we use in Forex trading are not the same as basis points, which are normally used to express changes in interest rates. One basis point is 0.01%.

Before delving deeper into the pips’ explanation, it is worth mentioning pipette as the minor price change in Forex. While a pip is a standard unit for a price change in the Forex market, pipette is used for brokerages with 5 decimals, which means that a pipette is a 1/10 of a pip.

History of Pips

Pips appeared not long ago with the establishment of the modern intrabank Forex market. While international trade has been conducted since ancient times only the post-gold era has seen the appearance of pips. The first step was made when US President Richard Nixon announced the suspension of the convertibility of the US dollar to gold. This was the beginning of the age of flexible quotes.

In order to make it easier to calculate rates, pips were introduced. In the 1980s, with the introduction of computer-based trading systems, a digital revolution in Forex trading took place. Pips became part of the new trading paradigm. They are allowed to know the price of each currency related to the other one.

In the 1990s the era of retail trading began and traders with lower amounts were admitted to the Forex market. All transactions were conducted via Electronic Communication Networks (ECN) connecting market participants from different regions. With this technological revolution, pips became available to traders from all over the world. They remain the most comfortable way to calculate profits, risks, spreads, and swaps.

How to Calculate Pip Value in Forex Trading?

The value of the pip in Forex allows you to calculate how much you can earn in a particular situation. For instance, if you deposit funds in US dollars and trade the EUR/USD currency pair, then one pip is equal to 0.0001. To calculate the value of each pip, you should multiply your position size by 0.0001. If you trade with 10,000 EUR, then your pip value will be $1.

Let’s move further and imagine that you have bought 10,000 Euros at 1.0200 and the price moved to 1.0210. Then your profit will be 10 pips, which makes 1×10=$10. Therefore for this trade, you will earn 10 US dollars.

The standard Forex lot is equal to 100,000 currency units. Therefore, by buying it, the Forex pips value will be $10 (100,000×0.0001=10).

Lot Size*1 pip = Pip Value

If you buy the EUR/USD currency pair at 1.0200 the price changes to 1.0210, then your profit will be $100 in this case.

Calculating the Pip Value in JPY

The USD/JPY currency pair has two decimals after the dot, which means that the situation is pretty much different. To calculate the pip value, you need to divide 1/100 by the exchange rate. To make it clear, let’s consider the following example. Imagine that USD/JPY is traded at 150.00 currently. Then to see the pip value, you need to divide 0.01 by 150.00.

0.01 / Exchange Rate * Lot Size = Pip Value

In this particular example it makes 0.01*150.00 = 0.000066. For a 100,000 USD trade, the pip value will be $6,6.

Pips Calculators

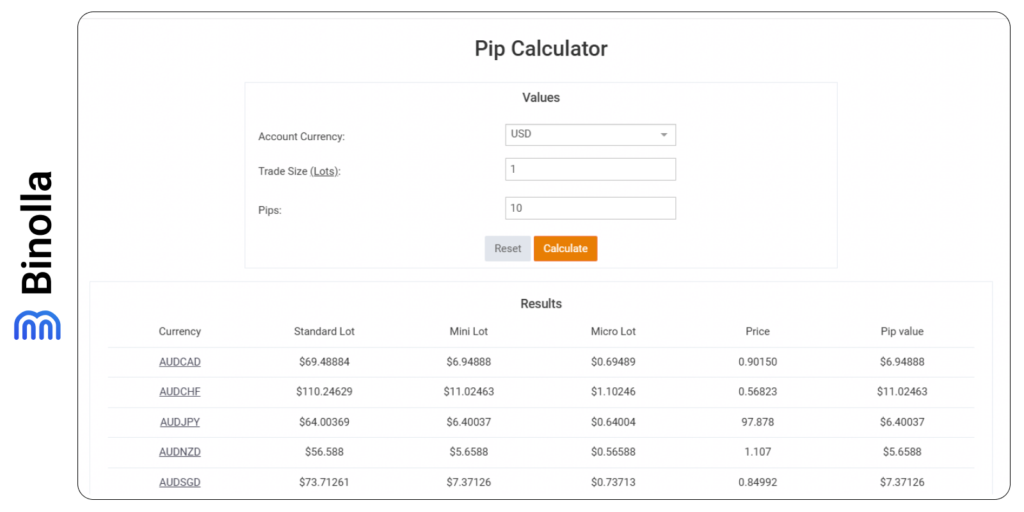

Knowing how to calculate pips is a very useful skill. However, you don’t need to do it on your own all the time. A so-called Pip calculator will have you do it without additional effort.

To start using it, you need to fill out the fields. You should define the currency, trade size in lots, and the number of pips to see their value. For instance, if we use USD with a trade size of 1 lot and 10 pips, then your standard lot size will be $69.48 in the AUD/USD currency pair. For 10 lots, the standard lot size will be $694.8. The pip Forex value in AUD/USD with 1 lot will be $10.

Some of the most popular pips calculators include:

- MyFxBook Pips Calculator;

- Investing.com Pips Calculator.

Types of Pips

You already know that pips stand for points in percentage and reflect the current price of a currency pair. However, they are not the only way to express quotes in trading. First of all, if you are trading stocks, then you have to learn more about points.

Points

They are used to measure the change in $1. When the price of a stock changes from $130 to $140, for instance, they say that the stock grew by 10 points. On the other hand, When a stock plunges from $120 to $115, they say that the equity lost 5 points. Apart from stocks, points are used to measure changes in indices.

Ticks

Unlike points, ticks denote the smallest possible price change to the right of the decimal. For instance, if the price of the asset has changed from 50.00 to 50.01 they say that it grew by one tick. Unlike pips, ticks refer to any price changes regardless of the number of decimals on the right side of the price.

How to Use Pips in Forex Trading: Stop Loss, Take Profit, and Spread Calculations

There are several ways of using pips in trading. One of the most frequent ones is to calculate the profits and losses of a trade. This will help you better understand your risks and eventual profits as well as manage them.

Stop Losses

A stop loss is a protective order that prevents your losses from growing after you open a trade. Placed at a distance from the price, it triggers if the price goes in the wrong direction and reaches the stop loss level.

For example, you expect the EUR/USD currency pair to grow. When you buy it, you also want to protect yourself from downside risks. To do that, you place the stop loss below the level at which you buy the currency pair. On the other hand, if you think that EUR/USD is going to plunge and sell it, you place the stop loss order above the price at which you sell the asset.

Professional traders use pips to calculate stop losses. They use the 1:3 classic formula, which means that they are ready to risk one pip Forex per 3 pip of profit. For instance, you can set a stop loss at 10 pips from the current price. Therefore, your take profit should be at 30 pips.

Imagine that you are going to trade EUR/USD. The currency pair is currently trading at 1.0300. You decide to use the 1:3 ratio, which means that you will place the stop loss at 1.0290 and your take profit will be set at 1.0330. Your risk per this trade will be 10 pips, while the eventual profit will be 30 pips.

If you think that 10 pips is not enough due to higher volatility, then you can increase it to 20 pips. In this case, by buying EUR/USD at 1.0300, you will place your stop loss at 1.0280 and the take profit order should be placed at 1.0360. This is how pips may help you manage your money and risks.

Spreads

Apart from setting stop losses and calculating your eventual profits, you can use pips to measure spreads.

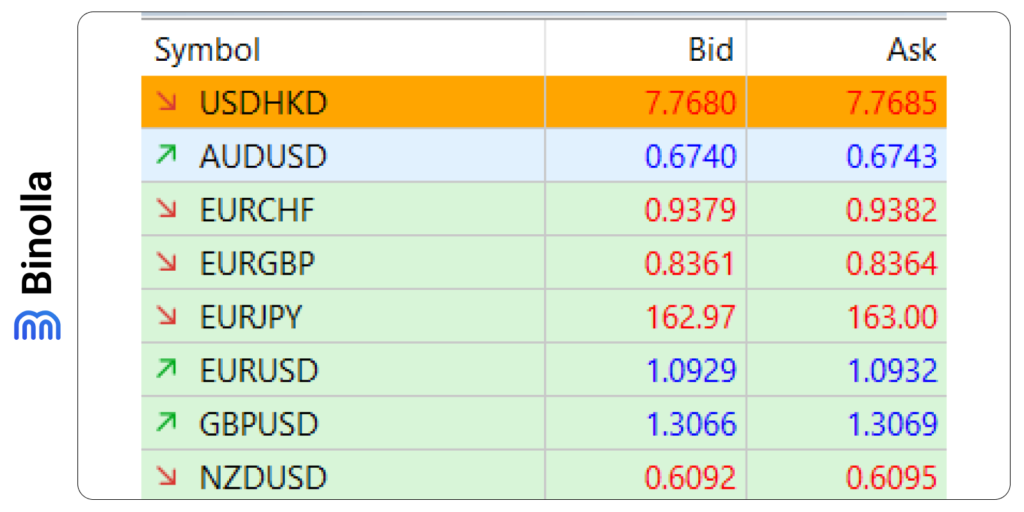

Spread in trading is the difference between the bid and the ask price. The bid price is one you will pay for the asset, while the ask is one at which you will sell the asset. The difference between them is nominated in pips as well.

For instance, if you are going to buy EUR/USD, the bid price may be at 1.0303, while the ask price will be at 1.0300. This 3 pips difference will be spread. This is why when you buy a currency pair in Forex, your trade is negative for some time.

How to Choose a Broker Knowing Spreads?

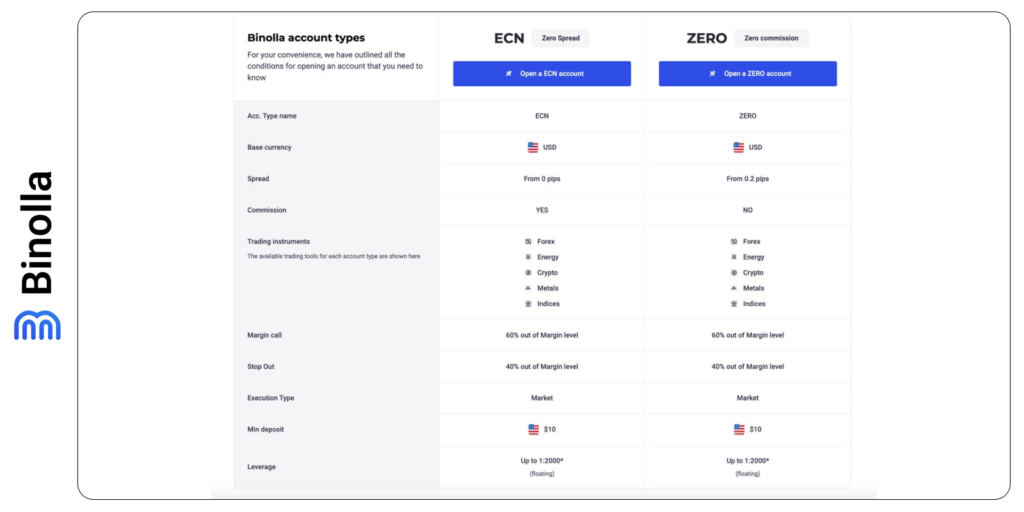

One of the most important aspects when choosing a Forex broker is to compare spreads. Some companies offer larger spreads, which means that each trade will cost more to you. On the other hand, some brokerage firms offer tighter spreads attracting traders with lower commissions. Here is how to select a broker. To do that, go to the account page where different types of accounts are compared and look at the following parameters:

- Types of spreads are available there (floating, fixed, floating/fixed).

- The minimum and average spread amount across various assets.

- Swaps and other commissions.

- The minimum deposit amount.

- The highest leverage.

- Margin call and stop out levels.

- Execution type.

Binolla Spreads

The Binolla brokerage company offers competitive spreads across the whole board of assets. The ECN account (Electronic communication network) offers lower spreads starting from 0 pips. When it comes to the Zero account, spreads start from 0.2 pips there, but there will be no trading commission.

With Binolla, you can trade Forex, Energy, Crypto, Metals, and Indices. The leverage for both accounts is up to 1:2000. To start trading with Binolla, you need to deposit at least $10. This gives you access to a simple and convenient platform with everything you need to begin.

Pips Trading Strategy

Now that you know the basics of spread, it is time to learn some methods or systems that may be useful to you in trading. Along with a lot of strategies involving making profits on larger price fluctuations, some professional traders use scalping strategies, which is also known as pips trading.

Pips Trading Strategy on the Naked Chart

One of the simplest and the most popular pips trading strategies is to catch them during the local trend. If you see at least three red candles, for instance, you can sell once the fourth candle breaks the lowest point of the third one. When it comes to closing a position, you can wait until your profit is 10 pips at least. Getting five pips per trade will be not enough if you are trading with a fixed spread, for instance, you will earn only two pips as about three pips will be paid for the spread. However, when it comes to floating spreads that start from 0.0 pips, even five pips may be enough.

A Simple Pips Trading Strategy with RSI

The classic RSI strategy requires a trade to wait until the line breaks above 30 or below 70 and open a trade on the next candlestick. However, in this pips Forex trading strategy, the idea is to buy when the price breaks above 30. You can hold the position until you get 10 pips and then close it.

What should you keep in mind when trading with such strategies? First, in order to get substantial results, such pips trading scalping strategies require higher investments per trade. Therefore, risks will also be higher. You should be in the standby mode all the time as if the price moves in the opposite direction, you should be able to close the position with minimum losses. Traders can also place stop losses, but in the case of fast movements, you may not have enough time to do that.

Pips trading may seem very attractive, but you should always be on guard. Moreover, this strategy is very exhaustive as you will have to open a lot of trades throughout the day.

The Main Traders Mistakes When Using Pips

Pips are very simple to calculate. However, not every trader does such calculations. Therefore, the main mistake is when a market participant opens a position without understanding the pip value which may lead to significant losses.

Imagine that you have bought EUR/USD at 1.0400 with a trade size of 1 lot (each pip worth $10). Therefore, when the price goes in the opposite direction for 10 pips only, your losses will be $100 already. If the currency pair makes 100 pips in the opposite direction, you will lose $1,000.

Therefore, understanding the pip Forex value before you open a position is crucial. It allows you to avoid situations when you put more money at risk than you can afford. Some other typical mistakes include:

- Bad risk calculation. Make sure that you know how to calculate your risks properly in order to avoid situations when you risk more than you can afford. If your stop loss is at 10 pips and the pip value is $1, then you risk $10 per trade;

- Poor profit calculation. Another problem may be related to poor calculation of profit that will prevent you from having a picture of your long-term performance. By using various calculators or calculating the pip value on your own, you can have a clear view of your eventual gains over time;

- Not understanding spreads. Spread is a kind of commission that you pay to the broker when opening a trade. Those who fail to understand spreads and pip value are unlikely to have good performance in trading over time;

- Overtrading. One of the key mistakes that most traders make is overtrading, which stands for opening a lot of positions throughout the day. While this approach may seem profitable, poor pip value calculation may lead to significant losses as you will not be able to understand the balance between the amount of pips you lose and the amount of pips you make in each trade.

Key Takeways

- Pips stand for point in percentage and are used to express the minor change in price of a particular asset;

- Pips are designed for Forex assets. Minor price change in stocks is expressed in points;

- Calculating pips value will allow you to understand your risk and eventual profit per trade;

- Spreads are the difference between the bid and ask prices. They are also expressed in pips;

- Pips trading is a simple yet powerful strategy allowing you to gain small profits;

- To choose a broker company with the best conditions, you should thouroughly examine pips;

- By trading with Binolla, you can expect a lot of benefits, including lower spreads, commissions, higher leverage and comfortable minimum deposit.

Conclusion

Forex pips are a very important aspect of trading as they allow market participants to evaluate their risks and potential profits. Moreover, they provide you with an opportunity to compare various brokers in terms of spreads. By using pips properly, you will be able to manage your funds in a way all professional traders do.

FAQ

What is a Pip in Trading?

A pip stands for a point in percentage. It serves to measure the minor price change in currency pairs.

How Much is 1 Pip in Trading?

One pip in trading is the minor change in the price of the four decimals. When measuring a pip, you should be able to calculate the pip value as it will allow you to understand how much you can earn per trade.

Why Use Pips in Trading?

Pips allow market participants to evaluate their risks and eventual profits in trading.

How to Calculate Pips in Trading?

You can do it on your own using the formula from this article. Also, you can use any pip calculator, available on the internet.