Forex Pair Correlation: How to Use It to Build Your Trading Portfolio

Traders use various tools to predict price fluctuations, whether they trade digital options and CFDs. Apart from technical indicators, patterns, and fundamentals, professional market participants often look for a relationship between various assets. Forex pair correlation allows them to see how two or more currencies behave over time and whether they move in the same or opposite direction. With this knowledge, they can build a balanced trading portfolio and even find entry signals. This article delves into forex pair correlation and how to use it to improve your trading performance.

Contents

- 0.1 What is Forex Pair Correlation?

- 0.2 Why Correlation Matters for Digital Option and Forex CFD Traders

- 1 Calculating Forex Pair Correlation

What is Forex Pair Correlation?

Correlation refers to a statistical relationship between two assets, revealing their price movement connection. There is a special correlation coefficient that ranges from +1 to -1. Positive forex pair correlation, as you may guess, is +1, while negative is -1. When the reading of the correlation coefficient is close to 0, there is no correlation between assets.

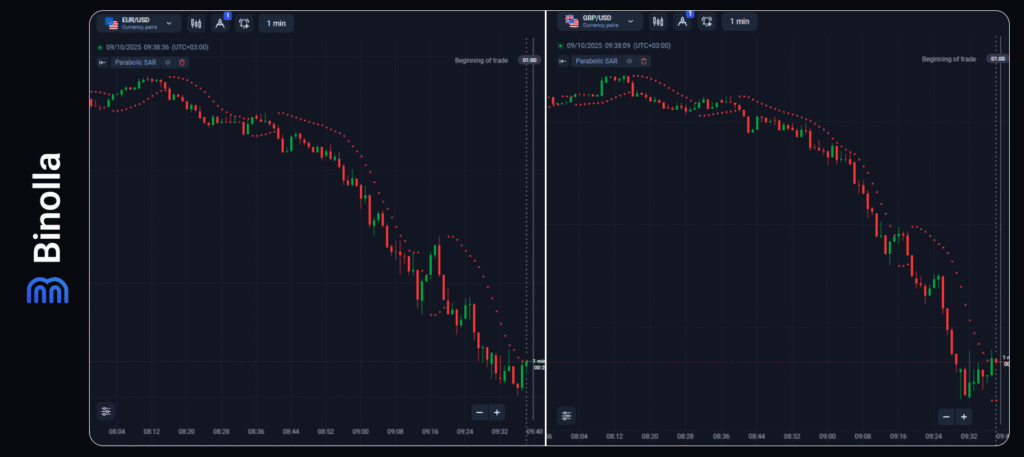

The concept of this connection between forex currency pairs and other assets is crucial for many professional traders as they use it in their strategies. Some currency pairs may contain the same currency, like EUR/USD and GBP/USD, and, therefore, they may react similarly to some fundamentals. For instance, when the US data is released and it is positive for the US dollar, then both currency pairs may plunge.

If we take EUR/USD and USD/CHF, these currency pairs sometimes move in the opposite direction, and when the US dollar is gaining strength, EUR/USD will plunge, while USD/CHF will gain positive momentum.

The correlation analysis helps market participants not only find entries, but also build their own portfolio of assets and even hedge their risks. Moreover, they allow traders to avoid unnecessary risks.

Why Correlation Matters for Digital Option and Forex CFD Traders

Understanding correlation is crucial for proper risk management and consistent trading, whether you buy digital option contracts or capitalize on CFDs. Professional traders often open several positions to improve their chances of profiting or to hedge their positions. However, simply buying several assets, like forex currency pairs, for instance, or digital option contracts on them, will not bring you fortune.

For instance, when you buy Higher contracts for EUR/USD and GBP/USD simultaneously, and the US dollar is gaining strength, your risk exposure increases twice. If you understand forex pair correlation, you will know in advance the risks of opening more than one position and will be able to diversify your trading portfolio. This will allow you to reduce overall trading portfolio volatility.

Correlation also helps traders build better hedging strategies. For instance, if you buy EUR/USD and want to reduce your risk exposure, you can sell USD/CHF, which moves in the opposite direction most of the time. This will help you protect part of your funds while still staying in the market.

When it comes to digital options, if you buy a Higher contract in EUR/USD and see that the price is moving down, you can hedge your position by buying a Higher contract in USD/CHF. While the overall result is likely to be negative, you will cover most of your losses with this second position.

Also, using forex pair correlation in your trading routine will allow you to grasp the global market sentiment. If you see that the US dollar is strengthening across the whole board of currency pairs, then you can expect a global shift in the market sentiment and act accordingly. Keep in mind that if the US dollar is the first in the currency pair, then when the US dollar is strengthening, the currency pair will grow. When the US dollar is the second in the currency pair, this pair will decline when the US dollar becomes stronger.

Calculating Forex Pair Correlation

Nowadays, you don’t need to calculate forex pair correlation because many services allow you to see it in real time, calculated automatically. However, to better understand how it works, we will show you how to do it. The formula of correlation is the following:

r = Σ[(X – X̄)(Y – Ȳ)] / [√(Σ(X – X̄)²) * √(Σ(Y – Ȳ)²)]

Where:

r – correlation coefficient

X and Y – daily returns for currency pairs

X̄ and Ȳ are their respective average returns

Σ – summation

Again, the formula may seem complex, but you won’t use it in your daily routine. Nowadays, traders use special tables where correlation is already calculated, and you only need to pick the results from there to use them in trading.

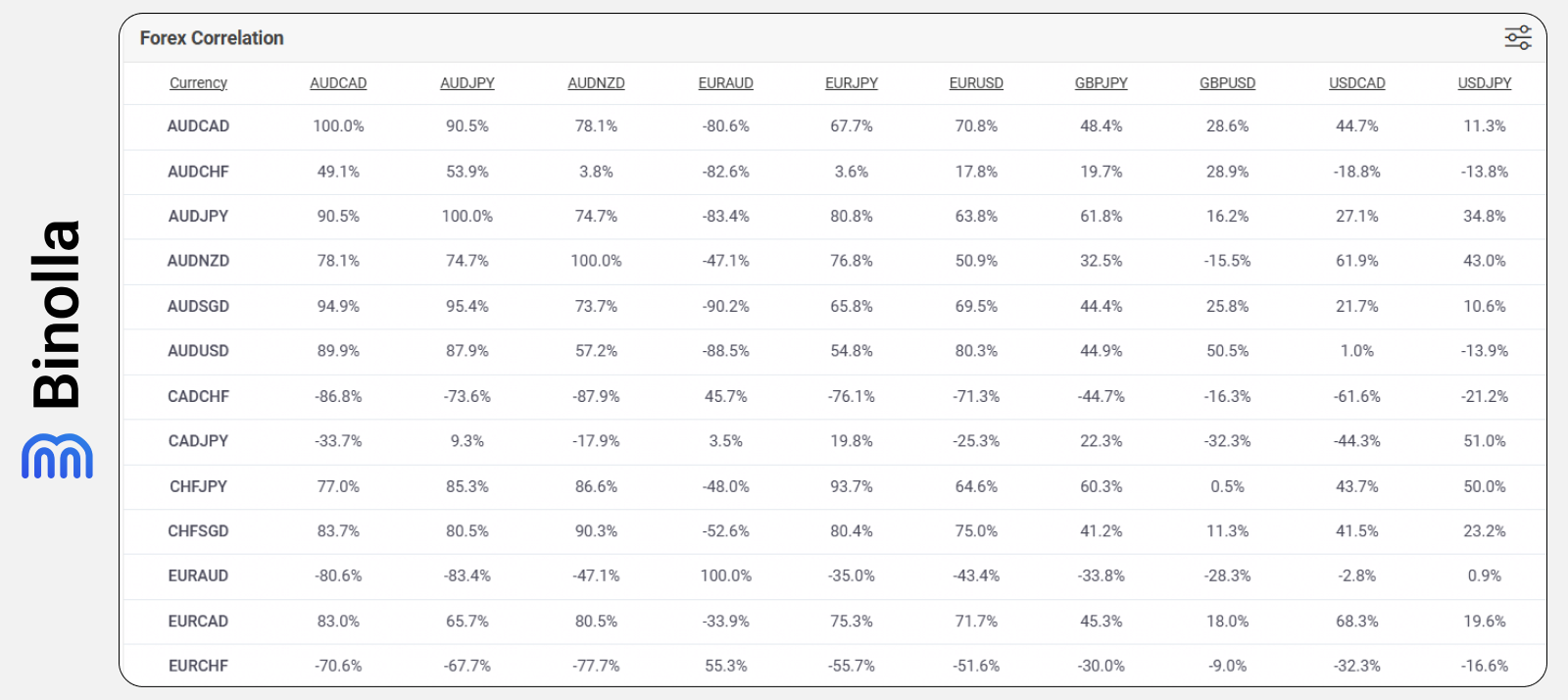

What is important to know about correlation and calculations is that this parameter is not fixed. Correlation changes all the time, and the results over time may significantly vary. For instance, currency pairs that correlated last month may demonstrate zero correlation currently. It all depends on the market sentiment. Here is an example of a correlation table.

| EUR/USD | GBP/USD | USD/JPY | AUD/USD | USD/CAD | USD/CHF | NZD/USD | EUR/GBP | |

| EUR/USD | 1.00 | 0.85 | -0.30 | 0.80 | -0.75 | -0.85 | 0.77 | 0.70 |

| GBP/USD | 0.85 | 1.00 | -0.25 | 0.75 | -0.70 | -0.80 | 0.70 | 0.90 |

| USD/JPY | -0.30 | -0.25 | 1.00 | -0.45 | 0.65 | 0.50 | -0.40 | -0.20 |

| AUD/USD | 0.80 | 0.75 | -0.45 | 1.00 | -0.65 | -0.78 | 0.88 | 0.60 |

| USD/CAD | -0.75 | -0.70 | 0.65 | -0.65 | 1.00 | 0.65 | -0.60 | -0.55 |

| USD/CHF | -0.85 | -0.80 | 0.50 | -0.78 | 0.65 | 1.00 | -0.72 | -0.68 |

| NZD/USD | 0.77 | 0.70 | -0.40 | 0.88 | -0.60 | -0.72 | 1.00 | 0.55 |

| EUR/GBP | 0.70 | 0.90 | -0.20 | 0.60 | -0.55 | -0.68 | 0.55 | 1.00 |

To be able to analyze correlation properly, traders should research this parameter over various timeframes. For instance, a pair of currencies may have a strong correlation on the minute timeframe, but this parameter will be lower on higher timeframes. By observing these differences, you can better use forex pair correlation in your trading strategies.

How to Build a Trading Portfolio Using Correlation

By applying forex pair correlation to your trading portfolio, you can better perform your trades and manage risks effectively. By checking the current correlation rate, you can understand which assets should be added to increase your profits and which can be added to hedge your positions.

The first step you should take is to check the forex pair correlation with negative rates, like EUR/USD, USD/JPY, and AUD/USD, for instance. This will allow you to build a portfolio with currencies with negative and weaker correlation. By doing this, you reduce the risks of all your positions going against you right away.

When trading two currencies with positive and absolute forex pair correlation, you can adjust your position size for one, investing more in a currency pair with a clearer setup and less in one where the setup is not so clear. The same is relevant for hedging positions, where more money can be invested in a buy position with a clear setup and less in a sell position that you use to hedge your risks.

Traders can also build their portfolios based on the US dollar and correlation in dollar-nominated currency pairs. If the US dollar is strengthening, the chances that USD/JPY and USD/CAD will rise, while EUR/USD and GBP/USD will fall, increase significantly. If you see this trend, you can act accordingly by buying a Higher contract in USD/JPY and USD/CAD and a Lower contract in EUR/USD and GBP/USD.

Main Strategies Based on Correlation

Now that you know that two or more currencies may correlate, you can add forex pair correlation to your trading routine. Apart from allowing you to control risks, this aspect allows you to identify trading opportunities and even confirm trading setups or hedge your open positions. Some of the most interesting strategies that are based on correlation are described below.

Hedging

Whether you are trading Forex CFDs or digital options, you can use hedging to protect your position against unexpected price fluctuations. For instance, if you buy GBP/USD and you want to protect your trade, you can also sell USD/CHF. However, in this case, you bet on the US dollar’s weakness. This may protect you from negative fluctuations in GBP, but if the US dollar becomes stronger, both positions will result in a negative outcome.

Therefore, another hedging strategy is to protect your balance from higher risk exposure by buying two assets with negative correlation. If we take the same example with GBP/USD and USD/CHF, when you buy both, one of the outcomes is expected to be negative, but the idea is to cover part of the losses with a profitable trade.

Confirmation

The next strategy is to use forex pair correlation to confirm your trading ideas. For instance, if you take EUR/USD and GBP/USD, which have a positive correlation most of the time, and you see that there is a strong reversal upside pattern in GBP/USD, then you can expect EUR/USD to make an upside as well, even if there is no pattern on the chart at all.

Therefore, you can buy EUR/USD or buy a Higher contract or even spread your investment amount among both to double your eventual profits or, at least, hedge one of the trades with another.

Arbitrage

Sometimes, forex pairs with strong correlation may begin to move in the opposite direction. The idea behind the arbitrage strategy is to find these moments and use them to open trades, expecting that the strong correlation will be restored and both assets will move in the same direction. This will allow you to capitalize on price fluctuations.

Whatever strategy you choose, you should never forget about the external factors before applying correlation to your trading journey. You should also consider interest rates, global risk sentiment, and economic/market conditions before making any trading decisions. If you do not apply fundamentals, you should at least watch for technical situations on charts before making any decision.

Tools to Use to Track Forex Pair Correlation

We have already mentioned that you don’t need to calculate correlation on your own. There are special services that do it clearly, and you will have live results that you can use right away. Here are some of the most interesting solutions that you can find on the internet:

Myfxbook

Correlation service at Myfxbook

This is a detailed forex pair correlation tool allowing you to see the relationship between all types of currencies, including major, minor, and exotic pairs. Using this service is simple. The higher the percentage, the stronger the positive correlation. There is a special filter allowing you to sort only chosen currencies to allow you to use the table in a more effective way.

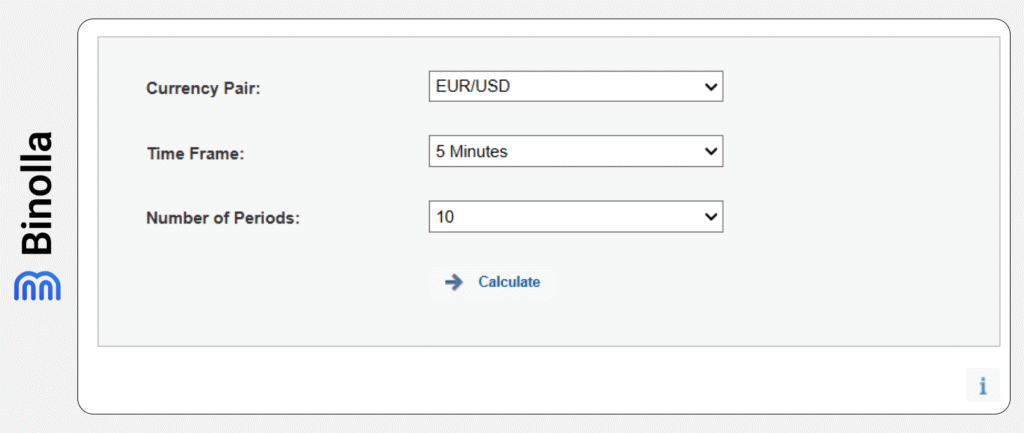

Investing

Forex pair correlation service by investing.com

Investing.com offers its own correlation service. It is very simple to use. To find a correlation for a particular tool, you need to choose a currency pair, a timeframe, and the number of periods (quantity of candlesticks).

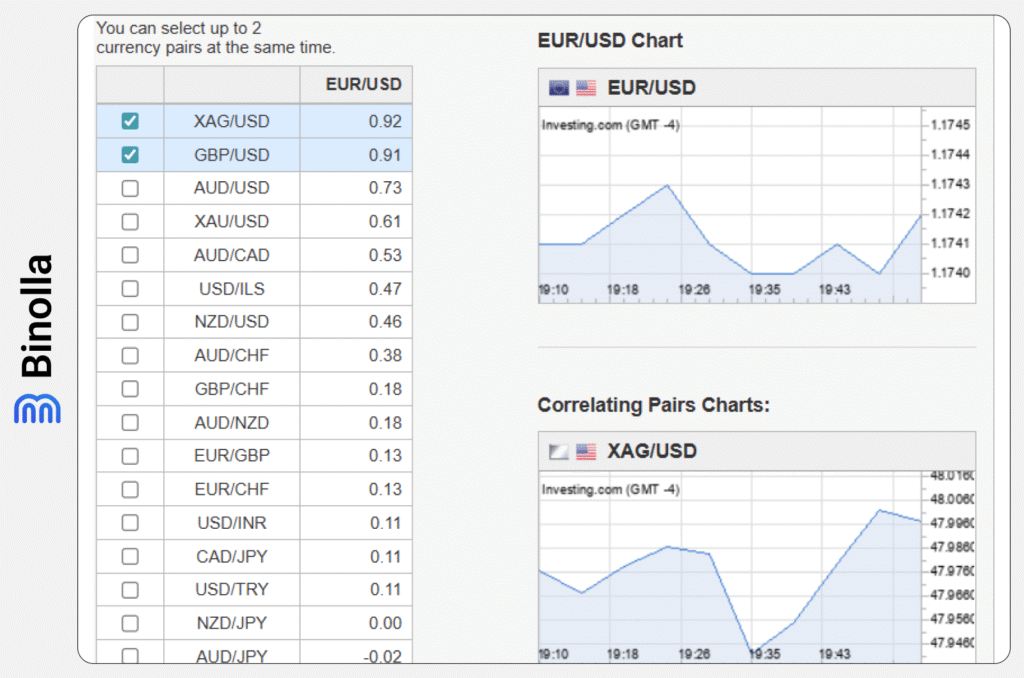

Results of calculations on investing.com

Here you can see a table demonstrating how EUR/USD is correlating with other currencies and assets. The benefit of this service is that it sorts out the assets with the highest correlation, like XAU/USD in this case, which shows almost perfect correlation with EUR/USD.

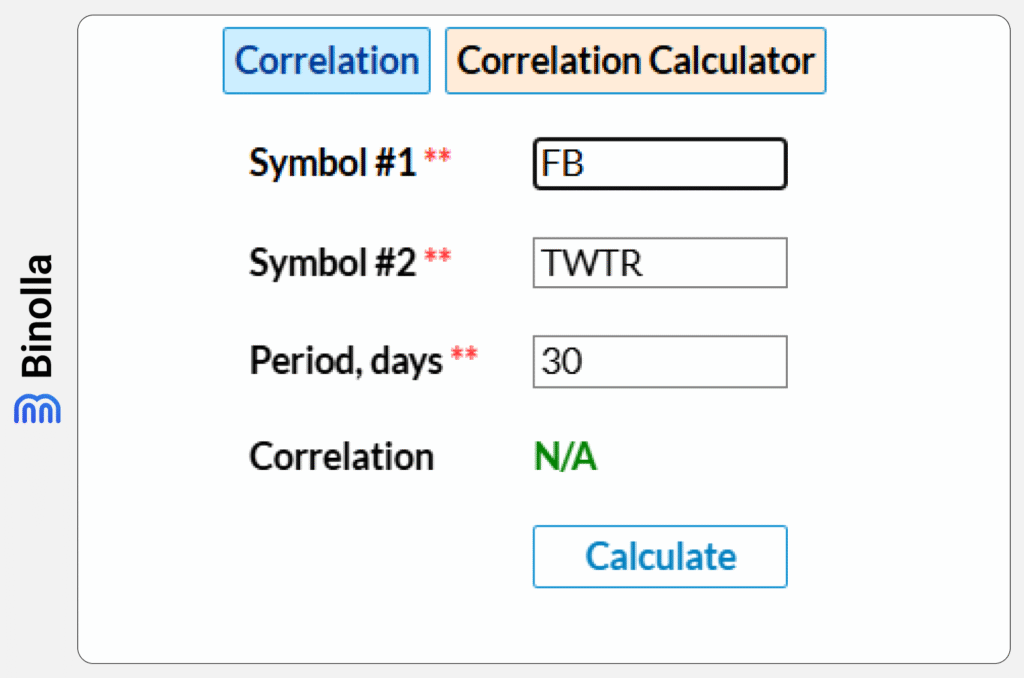

Market In Out correlation service

This is another version of a forex pair correlation where you can check the current relationship between various groups of assets. The system is simple. You enter two symbols and the period, and the system shows you the correlation between the two assets.

Keep in mind that when using these tools, you should watch the dynamics. As it was already mentioned, correlation is not fixed and it may change over time. Therefore, before entering a trade, you should check again the correlation rate and whether it is positive, negative, or there is no correlation at all.

Conclusion

Forex pair correlation is one of the most effective ways to improve your risk and money management by hedging your trades as well as finding entries and exit points. While most beginner traders focus on individual assets and patterns, professionals prefer to see a more global picture.

By learning which pairs move together or in the opposite direction, you will be able to create a stable portfolio with broader diversification. By adding forex pair correlation to your trading strategies, you can reduce eventual risks, find more trading opportunities, and even close positions when trading CFDs. Digital option traders can use correlation to hedge their trading risks by lowering eventual losses, or increase eventual profits by buying two or more contracts.

FAQ

What is forex pair correlation?

Forex pair correlation is a relationship between two or more currency pairs. Positive correlations mean that currencies move in one direction, while negative correlation means that currencies move in the opposite direction. Understanding correlation is important for traders as they can find entry points, manage risks, and diversify their trading portfolio.

How to use correlation to reduce risks?

The easiest way to reduce risks with correlation is to buy at least two contracts in assets that have positive or negative correlation. Moreover, you can use another approach and add pairs with low correlation to mitigate your risks.

How to track the forex pair correlation?

The easiest way to track correlation is to watch charts and see whether both currency pairs move in the same direction. This visualization will allow you to understand whether the assets have positive or negative correlation at a glance. Moreover, there are tools like Myfxbook or investing.com, allowing you to track correlation and even find its coefficient.

Can forex correlation change over time?

Yes, sure. Correlation is not fixed. It can be impacted by various events, including macroeconomic publications, central bank policies, and others. If two currency pairs showed a strong positive correlation last month, they may demonstrate a lower correlation rate the next month. Therefore, you should be aware of this and act accordingly.