FOMO in Trading: How to Recognize and Control It

Whether you are a digital option, CFD, or crypto trader, emotions will play an important role in your trading routine. Greed, fear, and others may negatively impact your trading results. FOMO (fear of missing out) is among those emotions that may cloud your judgment and overshadow logic. Not only your trading decisions but the outcome of the whole trading activities may be at risk if you are unable to tackle them.

By reading this article, you will learn more about FOMO in trading. We will also provide you with some recommendations on how to minimize its impact on your trading decisions and outcomes.

If you are looking for a reliable brokerage company to trade digital options, join Binolla now!

Contents

- 1 FOMO Basics: What is Fear of Missing Out in Trading?

- 2 The Most Frequent FOMO Triggers

- 3 Tackling FOMO is One of the Key Tasks of Every Trader

- 4 Benefit from Outstanding Quality with Binolla

- 5 Famous Traders’ Recommendations on Tackling FOMO and Other Emotional Aspects

- 6 Conclusion

- 7 FAQ

- 8 Ready to Elevate Your Trading Experience?

FOMO Basics: What is Fear of Missing Out in Trading?

The roots of FOMO are deep-seated in our minds. Nowadays, traders have access to a lot of information and success stories that sometimes make the fear of missing out to show itself. For instance, after reading a story of a trader who made a lot of money by buying a low-cap cryptocurrency, many beginner traders start to search for low-liquidity coins in order to become successful too.

How does FOMO reveal itself in trading and why it can be very harmful to a trader? One of the classic examples is when a trader rushes into the market to buy some hot assets that demonstrate outstanding performance. Such a trader thinks that this is a unique opportunity and they can make money on it. However, they forget about the fact that what they see on the chart is already history.

To better understand FOMO in trading, it is worth looking at some examples below. One of the most popular cases to show how FOMO may impact your trading is Bitcoin. The cryptocurrency had several growth stages and a lot of beginner traders opened their positions on the growth exhaustion.

It should be mentioned that the growth stage was short every time and lasted from a couple of hours to a couple of days. However, FOMO stimulated traders to buy Bitcoin even when it reached its new peaks and reversed, which lead traders to losses.

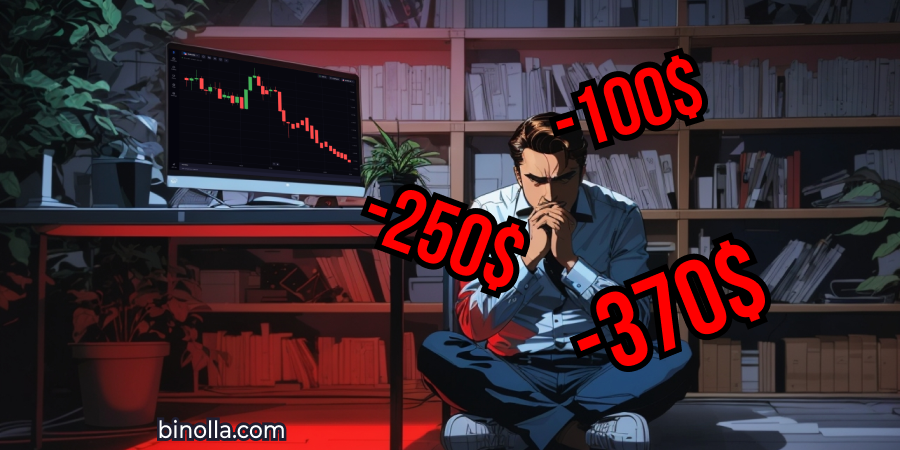

A trader in this review says that he lost a lot of money as he was influenced by both greed and fear. The review ends with a confession that a trader has learned from his mistakes and he admits that he should be more emotionally stable to succeed.

Now let’s look at how FOMO arises. One of the source of the fear of missing out is news from where traders can learn more about the trending assets. The problem is that such news may stimulate you buy a coin when the main movement is over. This may both lead to another leg of growth or to a serious decline as the whales (traders and investors with huge capitals) leave the asset already.

What is important here is that those with low trading or investing experience often buy a coin after reading such news with biting titles. Every time a new buyer appears, whales sell the asset to them and the price is going down gradually leaving novice traders and investors with losses.

In the example above you can see that a trader buys at the top of the market and sells at its bottom. This is a classic situation for most beginner traders or for all those whose decisions are influenced by FOMO. In the first case, a trader buys at the top of the market just because they think that the trend is going to continue. They do not still see this downside part. They see only a lot of green candles moving upwards and they think that they can capitalize on further upside.

In the second case, a trader decides to sell at the bottom of the market. They think that the downtrend will continue and they will miss the opportunity if they do not engage right away. In both cases, the biggest mistake that a trader makes is that they do not conduct proper market analysis. They are seized by emotions and the only thing they are driven by is the wish of making money.

While FOMO is quite a widespread emotion in trading, you can still tackle it similar to greed or fear. Moreover, FOMO is a modification of both, which makes it even more dangerous for a trader. Therefore, being able to control them becomes one of the key challenges for all market participants.

The Most Frequent FOMO Triggers

Before delving deeper into how to deal with the fear of missing out, it is worth looking at the aspects that can trigger these emotions. Here are some of the most frequent ones:

- Market volatility. We have already mentioned that traders do not want to miss good trading opportunities. Volatile markets can create a misconception for those who want to make money. If a market participant sees a strong upside or downside movement, they are likely to engage in order not to miss such an opportunity;

- A series of profitable trades. Having several profitable trades may overshadow a trader’s logic. This may, in turn, lead to situations when a market participant begins to make trading decisions without paying enough attention to market analysis. Simply being sure that you will make money just because you have closed several profitable trades in the past can be harmful. Each next trade may bring you losses if you don’t focus on your trading strategy;

- Losing streaks. Fear of missing out may show up in a series of losing trades. This works the following way: you open a trade that ends with a loss, and then you repeat everything, and the next trade ends with a loss. Finally, you see that the market is trending, and you want to cover your previous losses. You get into the market just to have another loss as you haven’t paid enough attention to analysis;

- Reading too much news. While being aware of the current situation is important, sometimes reading too much news can lead to FOMO. When you read all these stories about success, you may become jealous and try to join these successful traders. It doesn’t mean that reading news and feeds should be excluded from your routine. However, you should never take all these stories at face value. Always keep it real when trading.

Tackling FOMO is One of the Key Tasks of Every Trader

Now that you know more about FOMO and the factors that may trigger it, it is time to see how you can deal with it. Similar to all other emotions that you will face when trading, FOMO can be controlled. However, to do that, you need to take some important steps.

Embrace the FOMO

The fear of missing out is here with you forever similar to other emotions that may influence your trading results. Therefore, first, you should embrace the FOMO. Moreover, when reading all these success stories, you should understand that most of these traders had their bad times too. You can admire Alexander Elder, for instance, for making millions on the financial markets, but you can’t deny that before he even became this famous trader, he had a lot of pitfalls on his way and a lot of failures.

The first and the most evident sign of FOMO is that you deny it. If you are 100% sure of having full control of your trading activities, then you should start thinking about FOMO and how to tackle it. One of the best solutions here is to accept that FOMO affects your trading all the time and you should never make any trading decisions without using your strategy.

Constantly Working on Psychology

While a lot of traders skip this psychological section most times thinking that their success in trading depends solely on their technical analysis abilities, the only way to succeed is to work on psychology.

If you think that you have just missed an opportunity in your life, then you should start working on your emotions. Markets offer a lot of opportunities even throughout the day. The thing is that you should be able to find them. If you pay too much attention to a single trade, then emotions may affect your next trading decisions.

To deal with it, you should never forget that whatever happened on the market, this may repeat in the future. A good trend will occur many times in the future and instead of blaming yourself for losing an opportunity, you should better think about how to be aware of such possibilities in the future.

Don’t Pay Too Much Attention to Social Media

When reading another success story, most beginner traders think that they can do the same way. And that’s partly true. However, the other side of this is that you can lose control and make mistakes just because you want to repeat one’s success.

The example of a coin that made a lot of “x” may bring you back to Earth. When reading a story like that, go to the chart to see how a coin performed and what the current technical situation there. Moreover, go beyond charts and read more about the coin itself. If can be a simple pump&dump scheme and all these posts are nothing more than a way to attract beginners to buy a coin, while those who are behind the scenes sell it to them.

When speaking about controlling your social media activity, it doesn’t mean that you should cut it right away. You can still read all these posts with trading ideas or success stories to find motivation there. However, you should always filter all information to comes from such posts and do not miss your own trading goals.

Create a Trading Journal

Keeping records of your trading is very important. While many novice traders skip this part, it may help you better understand the reasons for making a particular trading decision. It is not necessary to write everything about your trading routine there. However, you can put the essentials into a trading journal so that you can get back at some moment in the future and review your past trading sessions.

Proper Risk Management

One of the ways to make sure that FOMO does not affect your trading is to manage your risks in a proper way. FOMO makes traders break their risk and money management rules as market participants think that this opportunity may bring them life-changing profits. By managing funds properly, you will turn every trade into just another trade in your routine, without bringing too much weight to it.

Famous Traders’ Recommendations on Tackling FOMO and Other Emotional Aspects

Learning from the best will allow you to become the best over time. We have brought together some quotations from famous traders that may help you tackle FOMO and minimize emotional impact as well as reconsider your trading psychology.

Martin Schwartz

The most important change in my trading career occurred when I learned to divorce my ego from the trade. Trading is a Psychological Game.

Martin Schwartz is a famous trader from Wall Street who made millions in trading stocks and other assets. This quotation reflects his personal attitude towards trading and its psychological part. Most traders have an inflated ego, which prevents them from being successful. The author wants to tell us that when making any trading decision, you should stay objective and avoid being overconfident and relying on your ego.

Jesse Livermore

Set your own rules and stick to them; never argue with the market; never make a play you can’t afford; never give way to irrational exuberance. Above all, don’t be a sucker.

Jesse Livermore is another famous traders who made a fortune during the Great Depression in the United states. He suggests traders to use their own trading plan in order to minimize the impact of external factors on trading. Sticking to your rules is the first important thing you should learn to do when trading.

Bill Lipschutz

When you’re in a losing streak, your ability to properly assimilate and analyze information starts to become distorted because of the impairment of the confidence factor, which is a by-product of a losing streak. You have to work very hard to restore that confidence, and cutting back trading size helps achieve that goal.

Bill Lipschutz is the Principal and Director of Portfolio Management for Hathersage. He believes that traders should find the way out the losing streak and to be able to tackle their fears. According to this famous trader, market participants should learn how to restore their confidence in a losing streak and recommends them to cut their trade sizes to believe in themselves again. By the way, this is a good recommendations as it allows traders and investors to minimize the impact of greed and fear on trading and to open a new page in their trading history.

Ed Seykota

If you want to know everything about the market, go to the beach. Push and pull your hands with the waves. Some are bigger waves, some are smaller. But if you try to push the wave out when it’s coming in, it’ll never happen. The market is always right.

The famous trader gives a rather good advice to market participants. Some traders may feel that they can do evertyhing and even reverse the market. They are overconfident about their abilities, which may lead to negative consequences. You can’t push the wave, nor the market.

Alexander Elder

The goal of a successful trader is to make the best trades. Money is secondary.

While this quote of the famous trader may seem a nonsense, Alexander Elder is right. When planning the next trade, a professional trader thinks about their strategy, trading plan, money and risk management, and all other important things. Thinking about making money or about losing them is not the right mindset. If you did everything well, then you will earn, while if your thoughts are focused on money solely, you will suffer from additonal emotional pressure that may prevent you from sticking to your trading system.

Conclusion

FOMO is a frequent aspect in trading that a trader should try to control in order to avoid spontaneous decisions driven by greed of fear. To minimize its impact on your trading results, you should accept and embrace it first. Then, you should follow recommendations that we gave in this article. Keep in mind that FOMO will never make you rich. Even if you have missed an opportunity that you think could bring you life-changing profits, you should focus on analyzing the market and finding other oportunities instead of making emotional decisions.

FAQ

What is FOMO in Trading?

FOMO stands for the fear of missing out, which means that traders who are under the FOMO influence fear of missing a trading opportunity.

How to Fix FOMO in Trading?

One of the most universal advises to fix FOMO in trading is to stick to your trading system and manage your risks and funds properly.

What Makes FOMO Worse?

Spending too much time in your smartphone and social media may worse your FOMO. Try to set limits and keep it real.

Why FOMO is Harmful?

FOMO is a mixture of greed and fear. Therefore, these two emotions together may ruin your trading.