31 Jul, 2025

Expiration (Expiry Time)

Copy link

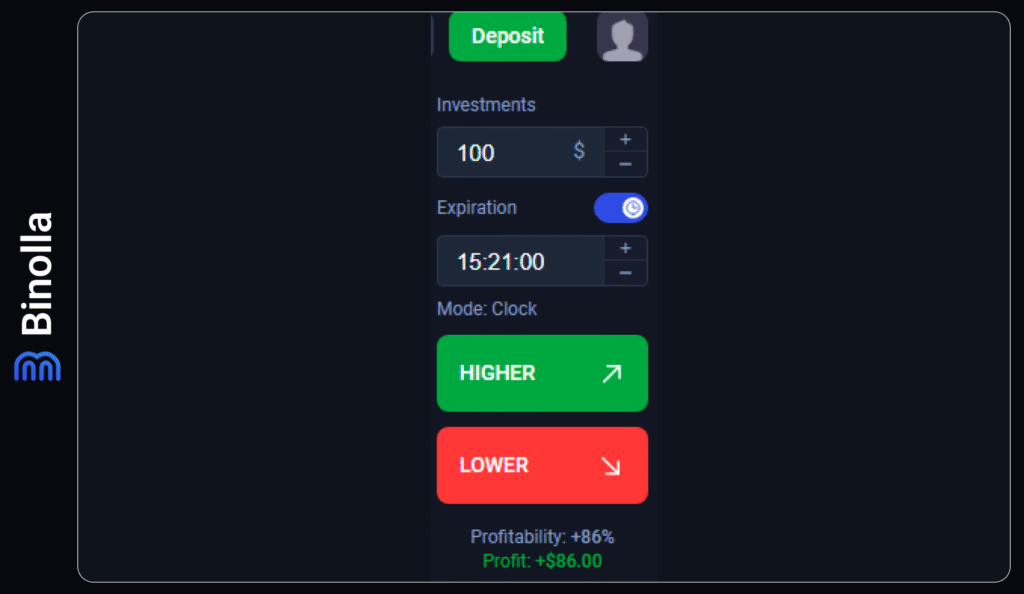

Expiry Time or Expiration stands for the exact moment in the future when the digital options contract ends and the results are calculated. Expiration can be short and even mid-term, allowing market participants to apply different types of strategies. For instance, at Binolla, expiration can be set from 5 seconds to 4 hours, which provides traders and investors with a lot of opportunities, allowing them to use scalping methods or even stick to their swing trading strategies.

Types of Expiration

Digital options traders can have access to a wide range of expiry times with Binolla. Here is a breakdown of the most popular trading styles that you can apply with our brokerage company:

- Ultra-short-term expirations (5 seconds – 30 seconds). These are the fastest contracts available. The idea is to predict the direction within 5 to 30 seconds. This range of expirations is best for scalping strategies.

- Short-term trading (1 minute to 5 minutes). This strategy works best in trending or ranging markets with clean technical patterns. Professional traders often use momentum strategies to trade short-term digital options.

- Medium-Term expiry time (10 minutes to 30 minutes). When choosing such expiration, you have more room for your trade ideas, and you don’t need to engage right away. It is ideal for strategies using technical patterns that react to slower market events.

- Long-term expiration (1 hour to 4 hours). This type of expiration allows market participants to apply a strategic approach. It can be used during trending markets supported by fundamentals. It is best for trend-following strategies.

Recommended

2 min read

Resistance

Resistance refers to the price level of an asset where the quotes tend to stop increasing and reverse in the opposite direction. The resistance level is characterized by increasing selling power while buyers cut their positions gradually or abruptly. It acts like a ceiling, the area where the upward...