Crypto Scapling in Trading: How to Use the Famous Strategy to Capitalize on Cryptocurrencies

Cryptocurrencies are very popular among short-term traders for their extreme volatility. Bitcoin, for instance, can make significant price movements throughout a day, covering up to $1,000 or even more in either direction within 24 hours. When it comes to crypto scalping, this is one of the most interesting methods allowing market participants to capitalize on smaller price fluctuations.

With crypto scalping, traders can get opportunities 24/7 as the crypto market is open around the clock and works even on weekends. Moreover, if you choose this method when trading with Binolla, you can have access to a variety of OTC assets offering volatility even at the moments when non-OTC assets may fluctuate in tight ranges without volatility bursts. By reading this article, you will discover the basics of crypto scalping and how to apply various strategies to profit from major and minor price movements.

Contents

- 1 Crypto Scalping Basics

- 2 Reasons Behind Applying Scalping in Crypto Trading

- 3 Tools That Traders Use in Scalping

- 4 Crypto Scalping Strategies in Trading

- 5 Start Trading Crypto with Scalping Strategies

- 6 Risk Management in Crypto Scalping

- 7 Benefits and Drawbacks of Crypto Scalping

- 8 Recommendations for Beginners

- 9 What Are the Key Mistakes that Scalpers Make and How to Avoid Them

- 10 Conclusion

- 11 FAQ

Crypto Scalping Basics

Crypto scalping is a type of strategy aiming at making smaller gains across a large number of trades. Scalpers open a lot of positions within 24 hours and profit from even smaller price fluctuations. They do not focus on bigger price movements and hold their positions for several seconds/minutes.

The idea behind crypto scalping trading is very simple and straightforward. You open a lot of trades within a day and collect tiny gains that turn into more significant profits by the end of your trading session.

When speaking about scalping, it is worth mentioning that it is not the same as day trading or swing trading, even though scalping may use day trading strategies. Day trading aims at opening trades within one trading session, but these positions can be held for several hours. The idea behind swing trading is to capitalize on larger price movements that may last even several days and weeks.

All the above make scalping a very attractive strategy, allowing market participants to make significant gains within 24 hours, but it requires skills and fast decision-making.

To understand the difference between scalping, day trading, and swing trading, we have prepared a comparative table.

| Aspect | Scalping | Day Trading | Swing Trading |

| Holding Time | Seconds to minutes | A few minutes to hours, but positions closed before market close | Several days to weeks |

| Number of Trades | Very high (dozens to hundreds per day) | Moderate (a few trades per day) | Low (a few trades per week) |

| Goal | Capture very small price moves | Capture intraday price swings | Capture medium-term trends |

| Risk per Trade | Very small (tight stops) | Moderate | Wider stops, larger moves |

| Capital Requirement | High (due to leverage and frequency of trades) | Moderate | Lower compared to scalping/day trading |

| Stress Level | Very high (fast decisions, constant monitoring) | High (active during market hours) | Lower (more time to analyze and decide) |

| Time Commitment | Full-time, glued to the screen | Full-time or part-time during trading sessions | Part-time, allows holding positions overnight |

| Timeframes and tools | 1-min and 5-min charts, indicators, patterns | 5-min to 1-hr charts, intraday indicators | 4-hr and daily charts, trend analysis, fundamentals |

| Profits | Very high, even with lower deposit amounts | High | Medium |

Reasons Behind Applying Scalping in Crypto Trading

The cryptocurrency market is still evolving, but it is already a very attractive area to apply various scalping strategies. Here are the main reasons why so many traders try such strategies:

- High volatility. Cryptocurrencies are famous for offering high volatility. Even the most liquid ones, like Bitcoin or Ethereum, can make price movements over long distances, like hundreds and even thousands of dollars in several minutes. This provides a lot of opportunities to scalpers.

- Around-the-clock market access. Unlike many other types of assets that are not available throughout the whole week, cryptocurrencies can be traded at any moment, even on weekends.

- Liquidity on major cryptocurrency pairs. Such cryptocurrency trading pairs like BTC/USD or ETH/USD offer higher and deeper liquidity, which means that they are traded with large volumes. This allows market participants to buy digital options or CFD contracts and be sure that they will be executed at a price that is close to the current market quotes in a quick manner.

- Price movements all day. Cryptocurrencies are driven by various factors, including news, social media posts from influencers, investor sentiment, etc. Scalpers can use any single price movement to capitalize on fluctuations.

Tools That Traders Use in Scalping

Successful crypto scalping is impossible without applying various technical analysis indicators. Traders need some indicators, drawing tools, or even Japanese candlestick analysis to find entry points. Find out more about the most popular tools that traders use to perform scalping trades:

- Moving averages of different types. The easiest way to build a reliable scalping strategy is to use a moving average. With this tool, you will be able to find short-term trends on minor timeframes. Some scalpers prefer exponential moving averages as they give more weight to recent price changes. For instance, you can use EMA9 and EMA21 to find entry points when both lines cross.

- RSI. This is definitely one of the best indicators for scalping. It shows overbought and oversold areas from where the price may begin a correction or a full-fledged reversal. Traders can use these situations to open trades in the opposite direction and make money.

- MACD. With this indicator, you can filter signals if you combine it with moving averages to find major trends and align your entries with them.

- Volume analysis. Scalpers sometimes use volume indicators to find entries. If volume rises gradually or spikes, this means that you can enter the market expecting a short-term price momentum.

Crypto Scalping Strategies in Trading

Now that you know the basics of scalping and the main tools that you can use to open trades or filter signals, it is time to delve into strategies. There are several methods that you can use to generate small profits in trading. Here are some of the most popular ones.

Breakout Crypto Scalping Strategies

Breakout strategies are very popular among traders as they allow them to capitalize on sharp one-sided price movements. Along with Forex or stocks, such strategies are widely used by those trading Bitcoin, Ethereum, and other cryptos.

The idea behind this strategy is to open a trade when the price breaks above the resistance level or below the support area. In digital options, you can buy a Higher contract when the price moves above the resistance level exactly at the moment of breakout. Traders buy Lower contracts when the price moves below the support level.

When buying 5s scalping contracts, you can easily profit in such breakouts, as even if the price reverses after the first momentum, the contract will be closed already. When using this simple strategy, you don’t need any indicator at all. However, you should be able to draw support and resistance lines.

Range Scalping

The next strategy that is worth your attention is range trading. Crypto scalping with such strategies can be extremely profitable. The idea is to open trades when the price rejects the boundaries of the range.

To start using this strategy, you should find a range first. The price in the range fluctuates between the support and resistance levels. When it reaches the resistance level and turns down, then a trader can buy a Lower contract or sell if they trade CFDs. On the other hand, when the price hits the support level and reverses there, a trader can buy a Higher contract or purchase Bitcoin/Ethereum or any other cryptocurrency.

Keep in mind that to support your strategy, you can use additional tools like Japanese candlestick patterns. In particular, when the price reverses from the resistance level, you can look for a shooting star, bearish engulfing, evening star, and others.

Indicator-Based Scalping Strategy

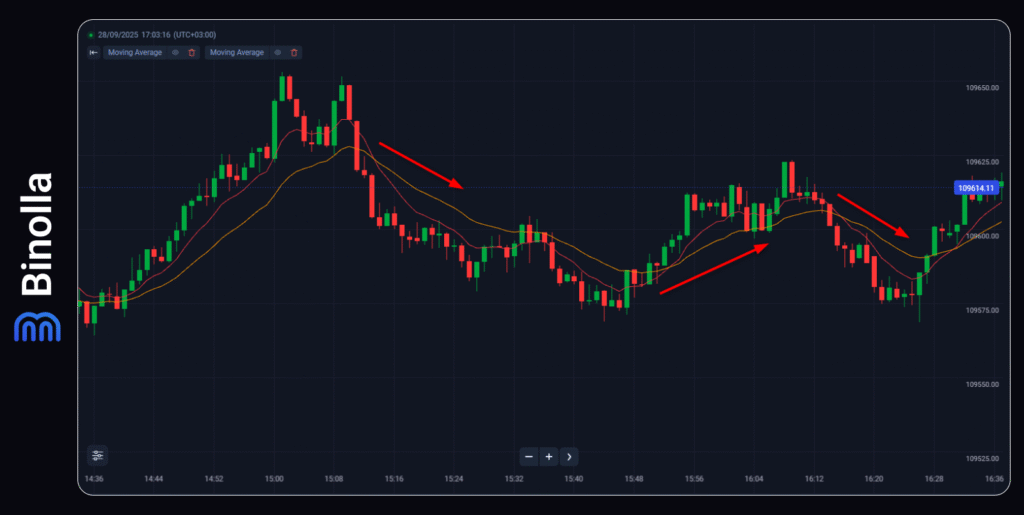

Traders can also use various indicators when they apply crypto scalping strategies. For instance, they can add two exponential moving averages of 9 and 21 to find signals.

This method is quite simple. When both EMAs make a crossover at the top (EMA9 crosses EMA21 from above). If this happens, you can buy a lower contract or sell a cryptocurrency. When the crossover takes place at the bottom, you can buy a Higher contract or purchase cryptocurrency.

As you can see, all these strategies are quite simple. This is what you need when you trade scalping. The fast-paced nature of this method requires quick decisions. The fewer tools you use, the more chances you will have to profit.

Risk Management in Crypto Scalping

Scalping is quite a simple method, but it requires some stricter risk management rules. A series of small trades can both play in your favor or result in losses. Therefore, before moving further, you should learn some rules that will help you maintain a positive balance. Most of the tips that you will learn from there are relevant for CFD trading, as digital options are much easier to grasp and to trade. Here are some important recommendations that you should follow to succeed:

- Use stop losses. When using crypto scalping strategies for CFD trading, use stop losses and plan them accurately. Short-term trades may either be profitable or move in the opposite direction. In case of a sharp and significant move, your position should be protected.

- Position sizing. This recommendation matters for all traders, including those trading digital options. Scalping trading requires small trades with small positions. Therefore, you should plan carefully how much you are going to invest in each trade.

- Avoid overtrading. Scalping can lead to overtrading as you are going to open a lot of trades throughout the trading session. Therefore, you should try to find a way to limit your trading activities. Do not place trades when you are not sure that your strategy gives a clear signal. Better use some additional filters.

Benefits and Drawbacks of Crypto Scalping

Crypto scalping can be very beneficial. However, you should always remember about drawbacks as well. Here are the main pros and cons of using it.

| Advantages of Scalping | Disadvantages of Scalping |

| Fast Profits. A few successful trades in one session can bring noticeable gains without waiting days or weeks. | High Stress and Focus Required. Constant monitoring and quick decisions can be mentally exhausting. |

| Lower Exposure to Market Risk. Short holding times protect traders from overnight news or long-term swings. | High Transaction Costs. Frequent trades increase fees and spreads, reducing overall profit. |

| Many Opportunities. Crypto’s volatility creates multiple setups daily, especially in liquid pairs like BTC/USDT or ETH/USDT. | Small Margins per Trade. One losing trade can wipe out the gains from many small successful ones. |

| Works in Any Market Direction. Scalpers can profit in both bullish and bearish conditions. | Steep Learning Curve. Success requires discipline, speed, and consistent practice. |

Recommendations for Beginners

If you are new to scalping, you can find it a bit difficult. We have prepared some recommendations that will make this process less complex and more straightforward:

- Choose only liquid assets. It is recommended to stick to liquid currencies like Bitcoin, Ethereum, Toncoin, BNB, Bitcoin Cash, and others. If you trade with Binolla, you can select from the most liquid cryptocurrencies in OTC.

- Start with smaller amounts. Before increasing the position size, try crypto scalping with smaller amounts. Once you practice enough, you can gradually increase the sum according to your plans.

- Limit the pool of your strategies. Do not try to use all the strategies that you have learnt at once. Choose one or two and apply them. After grasping them, you can gradually expand your pool of trading methods.

- Stay disciplined. Scalping requires discipline even more than any other strategy, as you are going to work with fast decisions in an ever-changing environment that can change at any moment. Therefore, you need to stay focused all the time.

What Are the Key Mistakes that Scalpers Make and How to Avoid Them

Whether you are new to crypto scalping or have some previous experience, you may make some mistakes that prevent you from succeeding. Here are some of the most commonly spread fails that you should avoid in trading:

- Not having a plan. Scalping requires strict planning of your every trading session. You should have clear entry and exit rules (the latter is relevant for CFD crypto scalpers).

- Getting emotionally unstable. Emotions should be controlled in trading, but when it comes to scalping, you should be especially careful. You will open dozens and even more trades per session, and at some point, you may lose control and try to win back. To trade crypto scalping successfully, you should keep your emotions in control.

- Not sticking to a strategy. Avoid entering a trade when you have doubts about the quality of the signal. The entry should be 100% clear before you place a trade.

Conclusion

Crypto scalping is among the most dynamic trading styles, offering potential for huge gains with smaller trades. Traders focus on the right indicators and other technical analysis methods and maintain discipline to consistently grow their balances.

Yes, scalping is challenging, as it requires focusing on a lot of factors like price movements, timing, careful risk management, and fast decision-making. In some cases, only seconds matter.

Anyway, even if scalping requires more effort and knowledge, it is rewarding as you may have significant profits even by the end of the day. Some scalpers make hundreds and even thousands of percent monthly.

FAQ

What is crypto scalping, and how does it differ from other trading styles?

Crypto scalping is a trading style requiring traders to open a lot of trades within a trading session, aiming at smaller profits. The difference between crypto scalping and other trading styles is that the position is held for seconds or minutes.

Which cryptocurrencies to choose for scalping?

The best choices are cryptocurrencies with higher liquidity, like Bitcoin, Toncoin, Ethereum, Polkadot, and others.

Do I need special tools to scalp effectively?

Yes, if you want to improve your results, you can use various tools, including technical indicators such as RSI, EMA, or MACD. Also, you can add the Japanese candlestick method to predict reversals.

Can Beginners use crypto scalping?

Yes, all categories of traders can use crypto scalping. You should grasp the basics of the strategies and also understand how scalping works before you start trading.