CFD Trading: What Are Contracts for Differences and How Do They Compare to Other Financial Instruments

Online trading has become extremely popular recently. It allows people across the world to capitalize on various types of assets and improve their financial situation. There are different forms of trading nowadays, and one of the most popular is known as a Contract for Difference or CFD. By reading this article, you will learn more about CFDs and how to use them. Moreover, we will compare various cash and derivative financial instruments to help you find the most suitable ones.

Looking for a reliable broker for Forex and digital options trading? Join Binolla now, deposit funds, and place your trades with a trustworthy brokerage company!

Contents

- 1 Key Takeaways

- 2 CFD Basics

- 3 CFD Trading: How Contracts for Difference Work

- 4 Give CFD trading a try!

- 5 Types of Assets that You Can Trade with CFDs

- 6 CFD Contract Length

- 7 Advanced Risk Management Techniques for Trading CFDs

- 8 Comparing CFDs to Other Types of Contracts

- 9 How to Trade CFDs: A Detailed Step-by-Step Guide

- 10 Conclusion

- 11 FAQ

Key Takeaways

- CFDs are types of financial contracts allowing you to buy a contract on different types of assets to make money on price fluctuations;

- The main features of CFDs are leverage, margin, spreads, and swaps;

- While CFDs have unlimited risks, you can mitigate them by using limited orders;

- The length of each CFD contract is unlimited until you close it or a Margin call situation occurs;

- CFDs are suitable for advanced traders with some previous experience.

CFD Basics

A contract for difference is a financial contract that pays the difference in the settlement between the open and close trade prices. One of the key features of such contracts is that there is no physical delivery of goods, currencies, shares, etc., which is a great benefit for traders.

By using CFDs, traders can buy and sell various types of assets and capitalize on their price differences. CFD trading is conducted with leverage, which allows market participants to buy higher volumes without adding their own funds. One of the key benefits of using CFDs in trading is that such contracts give you larger exposure to financial markets.

If you buy gold via CFD, for instance, you don’t purchase physical gold. The contract allows you to capitalize on price fluctuations. You don’t need to think about logistics that include transportation and storage. Moreover, you can sell gold CFD at any moment and make a profit from minor price fluctuations.

With CFDs, you don’t need to navigate through a variety of exchanges as all the assets are available under one roof, after you choose your brokerage company and create an account there. By reading further, you will learn about how CFD contracts work.

CFD Trading: How Contracts for Difference Work

Before opening a position when trading with contracts for difference, a market participant selects the number of contracts they are going to buy. This is the position size that is defined by a particular type of asset. The outcome of a trade will depend on the number of points or pips that the price moves in your favor or in the opposite direction. When trading contracts for difference, you have two options.

Buy

This type of contract allows you to buy a specific amount of an asset. When you choose this option, you expect that the price in the future will be higher than the price when you open a trade.

Imagine that you want to trade EUR/USD, which is currently at 1.1300. You expect the price to rise to 1.1350. To capitalize on this situation, you can place a buy order. If the price moves to your target, you will make a profit. If not, you will take a loss.

Let’s EUR/USD hits 1.1350. Therefore, you will make 50 pips. Depending on your position size, this can be 50 cents, 5 dollars, 50 dollars, etc.

Keep in mind that in CFD trading, you can limit your losses by using special pending stop loss orders.

Sell

When choosing this contract, market participants expect that the price in the future will be lower than the current one. If EUR/USD is currently trading at 1.1280 and you expect it to reach 1.1200, then you open a sell order. Let’s it hits the target. Then you can make 80 pips of profit that can be 80 cents, 8 dollars, 80 dollars, and even higher, depending on your position size.

Similar to buy orders, traders can limit their risks by placing a stop loss above the entry price. If the quotes move above the entry price and reach the stop loss level, it will trigger and prevent you from having heavier losses.

Leverage in CFD Trading

One of the key aspects of CFD trading is leverage, which is a kind of loan that you can take when trading with a brokerage company like Binolla. Leverage allows you to open trades of a higher size with lower investments. For instance, by using leverage, you can buy 1 lot in EUR/USD (100,000 units of currency) even without having $100,000 on your balance. Your leverage should be 1:100 if you want to buy a lot with only $1,000 on your balance. As you can see, this is a very important feature that allows you to significantly increase your eventual profits.

When trading CFDs with leverage, you should keep in mind that it has both advantages and drawbacks. If the price goes in your favor, you will make more money by using this kind of loan. However, if the quotes move in the opposite direction, your losses will also be higher. When trading with leverage, you should carefully choose it and be ready to use stop loss orders to mitigate your trading risks.

Spreads and Commissions

Another important thing that you should know about CFD trading are spreads and commissions that you will pay. Spread is the difference between Ask and Bid prices that you will see in your trading terminal. To make it very clear, you can compare spreads with bank spreads that are set by financial organizations when you exchange a particular currency.

Imagine that you want to buy EUR for USD in a bank. There are two exchange rates there. The first one, which is lower, is the rate at which the bank buys currency from you. The second rate is one at which the bank sells the currency. The difference between the two is known as the spread.

When trading CFDs, you will see the same spreads. However, they are normally tighter. Moreover, you should also pay attention to whether the spread is fixed or floating. With fixed spreads, they remain the same throughout the whole period, while floating spreads change all the time. When choosing between the two types, you should check both spreads and understand whether an average fixed spread is better or worse than the average floating one.

Types of Assets that You Can Trade with CFDs

One of the benefits of trading CFDs is that this type of contract gives you a broader exposure to various financial markets. By reading further, you will learn more about the major groups of assets that you can access when using contracts for differences.

Currencies

This is one of the major groups of assets that are available through CFDs. By buying or selling a contract, you can purchase or go short, expecting the price to move in your direction. Currencies in CFD trading are presented in the form of pairs, where the first currency is the one that you buy and the second is the currency that is used to buy the first one.

CFDs allow you to buy and sell not only those currencies that you have at hand. You can also trade pairs with currencies that don’t belong to you. For instance, if your account is nominated in US dollars, you can buy and sell EUR/JPY without acquiring the Japanese yen before placing a trade.

Commodities

CFDs provide you with access to a wide range of commodities that may include oil, metals, and even cereals. Similar to currencies, you don’t buy physical commodities. You purchase contracts for difference instead, which means that your only goal is to capitalize on price fluctuations (you don’t need to think about logistics). Moreover, when you buy a CFD contract, you can dispose of the assets right away, without waiting for them to reach you.

CFDs on Indices

Stock indices major in a particular sector or even combine various sectors and reflect their “health”. You can buy such indices as SP500, DJWI, EU, and other indices directly from your trading platform. Apart from long positions, when trading with leveraged CFDs, you can also sell these indices even if you don’t have them on your balance.

Buying stocks via CFD is another option that you can use when trading with Binolla. The benefit of this type of trading is evident as you have the ownership of the contract right away, which allows you to conduct intraday trades. Keep in mind that when you buy stocks on exchanges, the ownership will be transferred to you in a couple of days.

The procedure includes adding the new ownership to the depositary and some other administrative processes that should be done. Therefore, when trading CFDs, you can sell the contract at any time if you think you don’t need it anymore.

Moreover, CFDs on stocks work on both sides, allowing you to sell shares that you don’t have at hand at the moment, which makes contracts for difference the best solution for traders.

The thing here is that when you trade stocks via CFDs, you can’t claim ownership. Therefore, if you want to get a share of the company and earn dividends, it is better to buy stocks on exchanges with the transfer of ownership.

Crypto CFDs

Last but not least, you can also trade contracts for difference based on cryptocurrencies. Similar to other assets, you don’t buy a cryptocurrency itself, which means that you will not own it (staking is not available, for instance). However, the main benefit is that you can capitalize on price fluctuations by purchasing or selling a particular coin/token. Moreover, leveraged trading allows you to trade higher volumes without investing more money.

CFD Contract Length

Unlike some derivatives like options, digital options, and futures, CFDs don’t have any expiry date. This means that you can hold a contract until you close it (buy or sell an opposite contract) or a margin call occurs (when you don’t have enough funds on your balance to continue holding a CFD contract).

Keep in mind that if you hold your CFD contract overnight, you will pay a special fee known as a swap. The swap can be negative or positive. If the latter occurs, you will earn additional money (no commission is applied in this case).

Advanced Risk Management Techniques for Trading CFDs

All trading risks in contracts for differences can be mitigated by using special tools known as pending stop orders. When you place a trade, you can protect it with a stop loss, which is placed above the entry price when you sell and below it when you buy.

Limit orders are used by professional traders to cut their risks and automate their trading routine. Stop loss is a good solution when you plan to open a trade and do other businesses while the situation in the chart develops. This type of order is also a good solution if you have connection interruptions. The stop loss order is placed directly on the server, which means that it will work in any case, even if you don’t have a connection to the server at a particular moment.

Comparing CFDs to Other Types of Contracts

CFDs are not the only contracts around that may attract your attention. Apart from them, you can trade digital options, classic options, futures, and even buy or sell assets directly on exchanges. Find out more about how they differ from each other from the following table.

| Feature | CFDs | Digital Options | Classic Options | Futures Contracts | Direct Buying at Exchanges |

| Definition | Contract for difference to capitalize on price fluctuations | Fixed-time contracts with all-or-nothing outcomes | Right to buy/sell an asset at a set price | Obligation to buy/sell an asset at a set price on a future date | Purchasing the actual asset on offline and online exchanges |

| Payout Structure | Profits and losses are based on price movements | Fixed outcomes and fixed losses per contract | Profit and loss are calculated based on price movement | Profit and loss are calculated based on the price movement in the future | Profit and loss are calculated based on the current price movements + dividends |

| Expiration Time | No expiration (trader can close a trade at any moment) | Fixed (expiration ranges from seconds to hours) | Fixed (expiration can be weekly, monthly, and quarterly) | Fixed (monthly, quarterly) | No expiration |

| Risk/Reward Ratio | Unlimited/unlimited (until protected by limit orders) | Limited/Limited | Limited/Limited | Unlimited/Unlimited | Unlimited gain/loss based on market moves |

| Leverage | Up to 1:1000 and higher | No | Limited (depending on a broker) | Yes | No leverage |

| Ownership of Asset | No | No | No (unless exercised) | No (contract-based) | The rights to an asset are transferred to the owner |

| Complexity | Moderate | Simple | Advanced | Advanced | Basic to moderate |

| Use Case | Speculation, hedging | Quick profit, low capital trading | Hedging, income, speculation | Hedging, speculation | Long-term investing, swing trading |

| Profit Potential | High (but risky) | Limited and fixed | High (with risk) | High (with risk) | Unlimited (depends on market) |

To conclude this table, it should be mentioned that CFDs are good for traders who have some previous experience. The best tool for newcomers is digital options, which are very simple to understand and offer limited risks. If you have already had several trades behind you, you can switch to CFDs and use these contracts to manage your trading in a better way by controlling your risks and profit levels on your own.

How to Trade CFDs: A Detailed Step-by-Step Guide

Now that you know the basics of CFD trading, it is time to provide you with instructions on how to place your first CFD trade. By reading it, you will learn all the specifics of these contracts and how to buy or sell them:

Step 1: Select an Asset

The first thing that you should do is choose an asset that you are going to trade. This can be currencies, stocks, indices, cryptocurrencies, or any other asset. Learn more about the asset that you are going to trade in advance.

Step 2: Check the Spreads

After selecting an asset, you should check the difference between Bid and Ask prices. The larger the spread is, the less advantageous your trade will be. Keep in mind that floating spreads become larger during major macroeconomic indicators and political events.

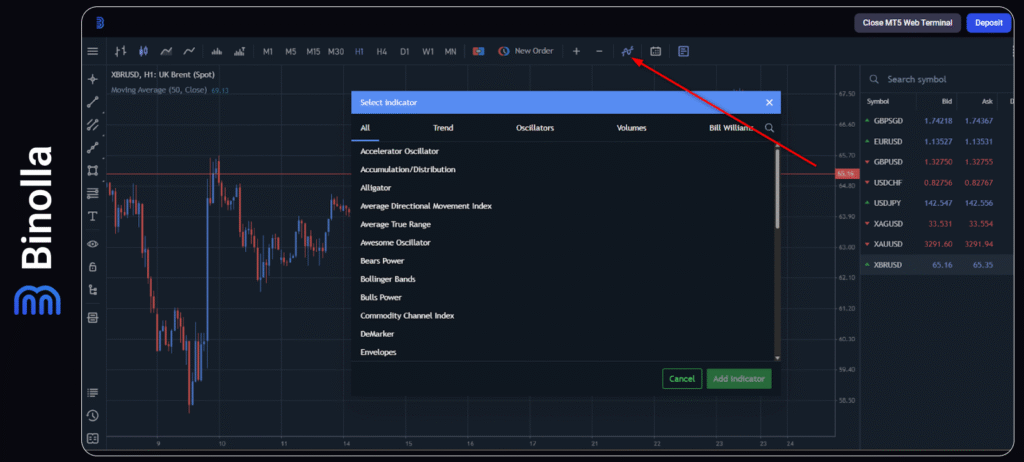

Step 3: Analyze the Market

Now that you have chosen the asset, you can watch the chart and apply various strategies to decide whether to buy or sell it. The most popular indicators and tools to make market forecasts are momentum indicators (RSI, MACD, Stochastic), trend indicators (moving averages, Bollinger Bands, Keltner channels), volatility indicators (Bollinger Bands and ATR), support and resistance levels, trend lines, Fibonacci, and many others.

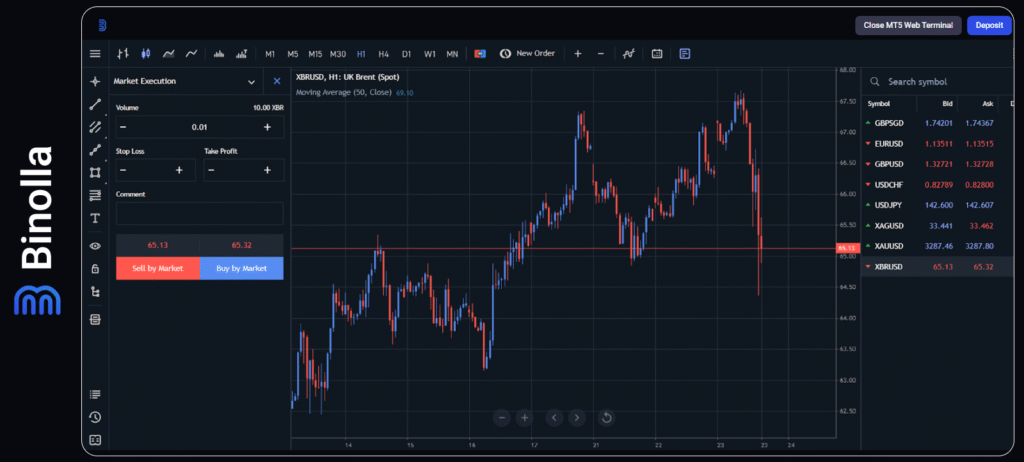

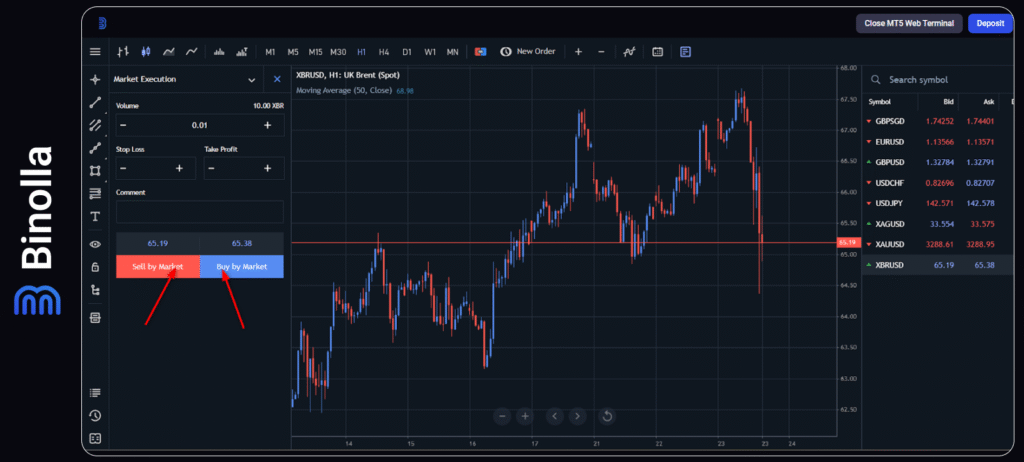

Step 4: Decide Which Order to Place

After making your forecast, you should decide whether to place a market or pending order. The market one is an order that will trigger instantly after you place it. A pending order is a type of order that will trigger if the price reaches a pre-set level.

Step 5: Set the Amount of a Trade

Now you need to decide how much you should put at risk in each trade. Market participants often use the 1-2% rule, which means that they do not put at risk more than 1 or 2% of their current balance.

Step 6: Place a Stop Loss Order

While it is not a mandatory order, it is recommended that a trader use it to mitigate their risks and better control the situation. You can also set a take profit order to automate your trade even more.

Step 7: Open a Position and Monitor Your Trade

When everything is ready, you can open a trade. If stop loss and a take profit order are placed, you don’t even need to monitor them. However, if you prefer manual control, then it is better to watch the chart so as not to miss important changes.

As you can see, placing a trade is not difficult. By reading further, you will learn more about risk management in trading.

Conclusion

CFDs allow market participants to capitalize on price movements of different types of assets. These contracts are designed the way to allow you to catch each minor price fluctuation. These derivatives offer a lot of benefits, including leverage, unlimited length, exposure to broader markets from a single place, and others. Contracts for difference are designed for traders with some previous experience, but even if you are beginning your way in the financial markets, you will definitely grasp their basics in a matter of hours.

FAQ

What is CFD Trading?

CFD trading is buying or selling contracts for difference to profit from price fluctuations. This type of trading is sometimes called “Forex trading”, but nowadays, such contracts can be purchased for a broader range of assets, including stocks, commodities, indices, and even cryptocurrencies.

How Do CFD Traders Make Money?

To make money, a trader should predict (using various analysis tools) whether the price of an asset will grow or fall in the future. If they think that the price will rise, they buy an asset, while if a market participant believes that the price will plunge, they sell it.

Can I Capitalize on Gold Using CFDs?

Yes, you can. Traders can buy CFDs on gold to make money when the precious metal price rises. If they think that gold will plunge, then they can sell it via CFDs.

No, you won’t. You will own a contract that you can sell at any moment. This gives you more flexibility as you don’t need to wait for the ownership transfer. When buying shares directly via exchanges, you can trade them within a day, as you can’t sell them until the ownership is transferred to you (normally 2-3 days).